- Turkey

- /

- Metals and Mining

- /

- IBSE:KOZAL

Exploring Three Promising Stocks In The Middle East Market

Reviewed by Simply Wall St

In the current Middle East market landscape, characterized by mixed performances and cautious investor sentiment due to global trade tensions and stable interest rates, identifying promising investment opportunities can be challenging yet rewarding. As investors navigate these complexities, a good stock often stands out through its resilience in subdued markets and potential for growth despite broader uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.53% | 7.56% | 49.01% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Gulermak Aglr Sanayi Insaat ve Taahhut (IBSE:GLRMK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gulermak Aglr Sanayi Insaat ve Taahhut operates in the construction and engineering sector, focusing on large-scale infrastructure projects, with a market cap of TRY43.52 billion.

Operations: Gulermak generates revenue primarily from its operations in the West and Turkey, with contributions of TRY24.48 billion and TRY8.38 billion respectively. The company also earns TRY6.30 billion from the East segment, while eliminations account for a deduction of TRY7.81 billion in its financials.

Gulermak Aglr Sanayi Insaat ve Taahhut, a nimble player in the construction sector, has recently been added to both the S&P Global BMI and FTSE All-World Index. Despite a dip in first-quarter sales to TRY 6.84 billion from TRY 10 billion last year, its earnings growth of 23.7% outpaced the industry average of 16.1%. The company boasts a favorable price-to-earnings ratio of 14.8x compared to the market's 18.3x and maintains more cash than total debt, indicating financial robustness despite not being free cash flow positive recently.

Koza Altin Isletmeleri (IBSE:KOZAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Koza Altin Isletmeleri A.S. is engaged in the exploration and operation of gold mines in Turkey, with a market capitalization of TRY78.53 billion.

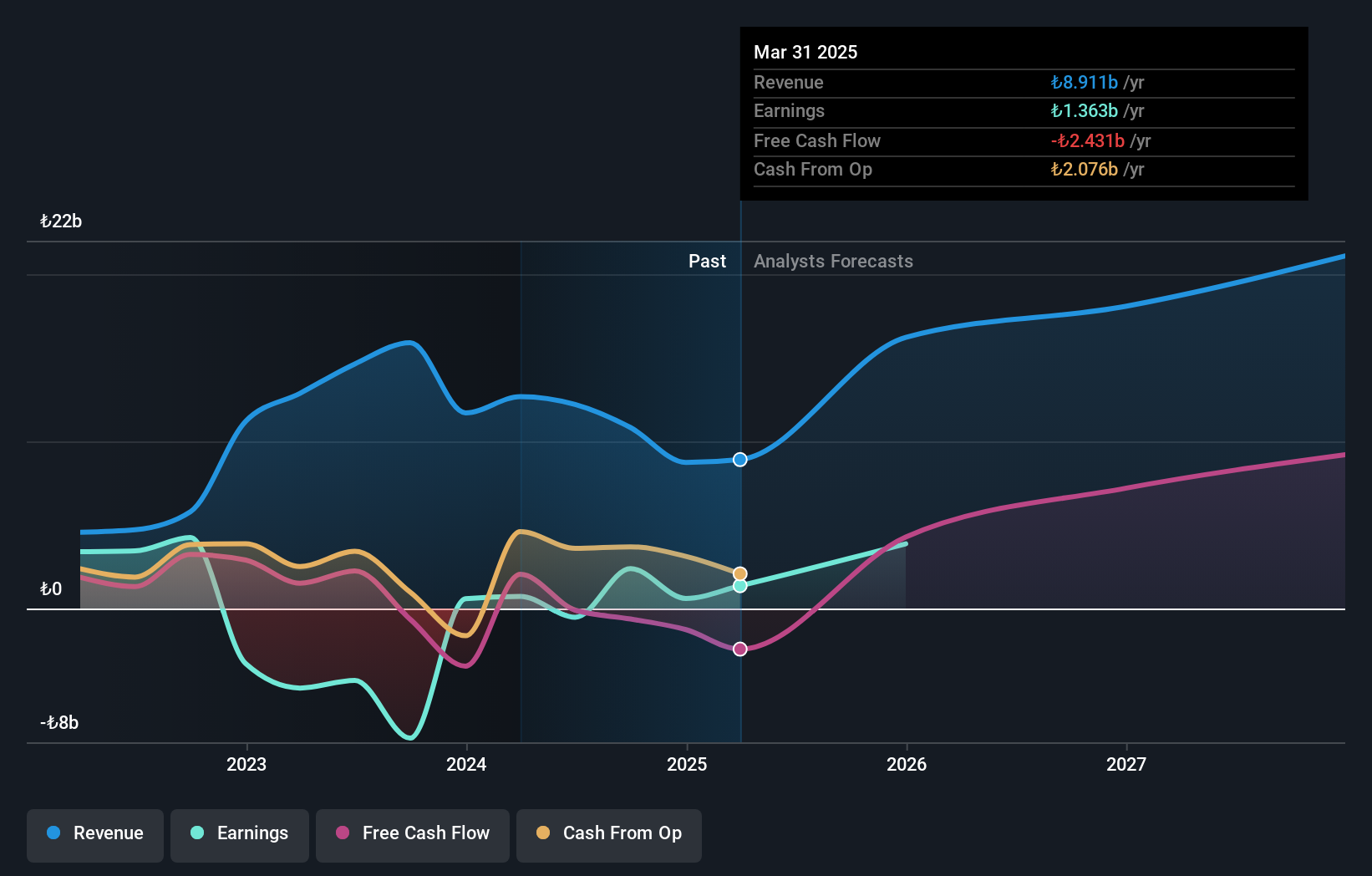

Operations: Koza Altin generates revenue primarily from its gold mining operations, with reported revenues of TRY8.91 billion. The company's financial performance is highlighted by a notable net profit margin trend, reflecting efficient cost management in its operations.

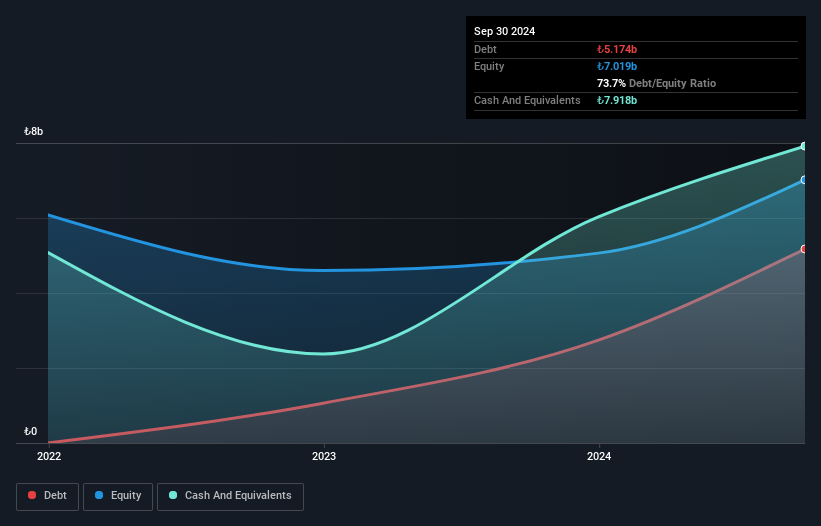

Koza Altin Isletmeleri, a notable player in the metals and mining sector, has shown impressive earnings growth of 87% over the past year, outpacing the industry average of 12%. Despite a challenging five-year period with earnings declining by 26% annually, recent performance paints a brighter picture. In Q1 2025, sales reached TRY 4.22 billion from TRY 4.05 billion last year, while net income swung to TRY 506 million from a loss of TRY 252 million. The company operates debt-free and boasts high-quality non-cash earnings, suggesting resilience amidst industry fluctuations.

- Take a closer look at Koza Altin Isletmeleri's potential here in our health report.

Learn about Koza Altin Isletmeleri's historical performance.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey, with a market capitalization of TRY38.11 billion.

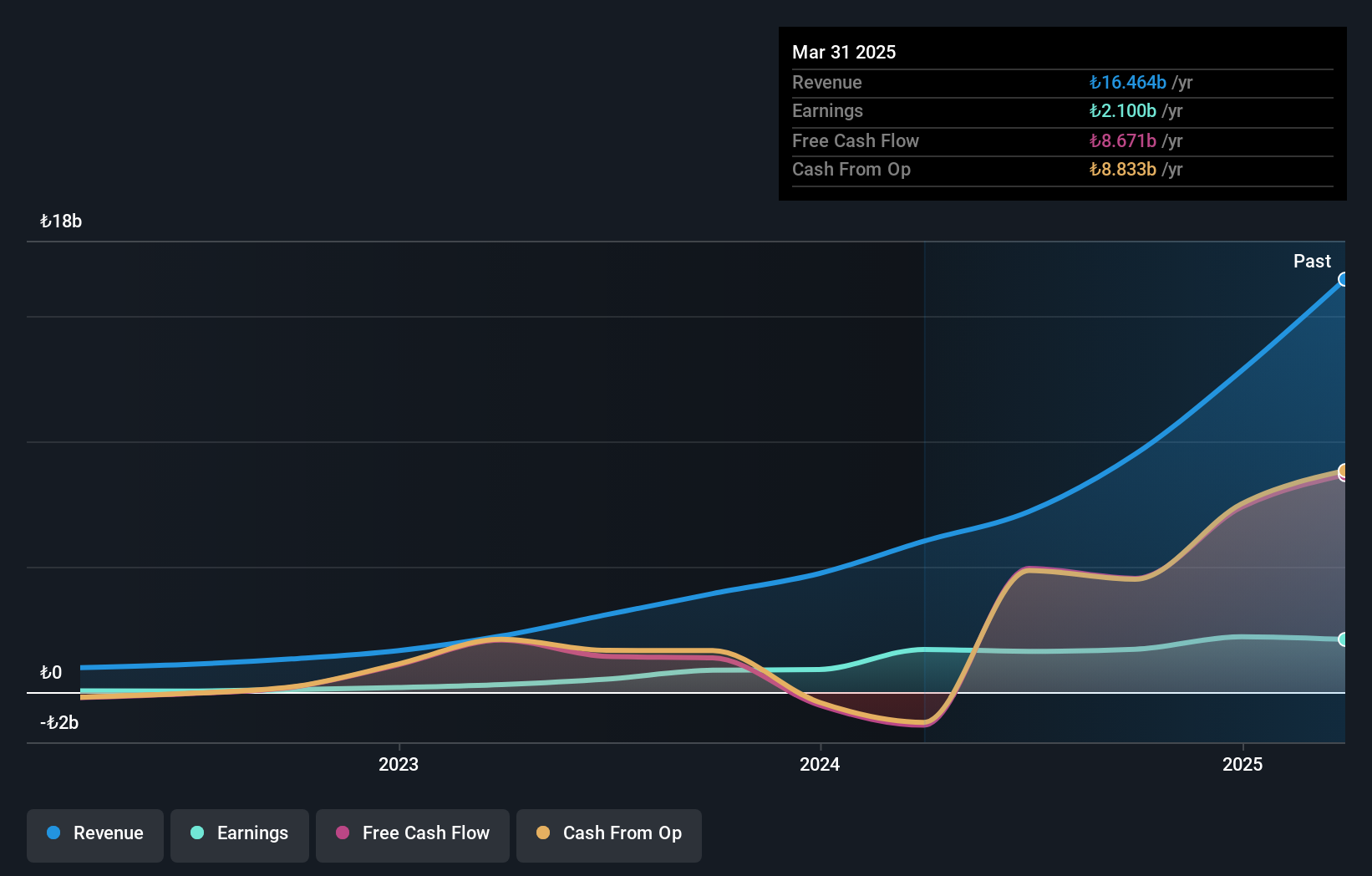

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from accident insurance, which contributes TRY10.46 billion, and fire insurance at TRY1.42 billion. The company also derives income from transportation and engineering segments.

Ray Sigorta, a nimble player in the insurance sector, has demonstrated robust earnings growth of 70.8% annually over the past five years. Despite this impressive track record, recent net profit margins have slipped to 12.8% from last year's 28.3%. The company is debt-free and boasts high-quality earnings with a favorable price-to-earnings ratio of 18.1x compared to the Turkish market's average of 18.3x. In Q1 2025, Ray Sigorta reported net income of TRY 812 million, down from TRY 924 million the previous year, reflecting challenges in maintaining its growth trajectory amidst industry pressures.

Where To Now?

- Click through to start exploring the rest of the 221 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koza Altin Isletmeleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:KOZAL

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives