- Turkey

- /

- Diversified Financial

- /

- IBSE:INVES

Discovering Undiscovered Gems With Strong Fundamentals February 2025

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and mixed economic signals, global markets have experienced fluctuations, with the S&P 500 showing resilience despite minor declines. As investors navigate these turbulent waters, identifying stocks with strong fundamentals becomes crucial for those seeking potential opportunities in the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 32.74% | 9.08% | 65.05% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY56.10 billion.

Operations: The company generates revenue primarily from non-life insurance premiums. It has a market capitalization of TRY56.10 billion.

Anadolu Sigorta, a notable player in the insurance sector, showcases robust financial health with no debt over the past five years and impressive earnings growth of 67% annually during this period. Despite not outpacing the industry last year, its price-to-earnings ratio of 4.8x suggests it is undervalued compared to the broader TR market at 15x. Recent earnings reports highlight a significant increase in net income to TRY 11.54 billion from TRY 6.38 billion year-on-year, reflecting strong operational performance and high-quality past earnings that bolster investor confidence in its potential value proposition.

- Dive into the specifics of Anadolu Anonim Türk Sigorta Sirketi here with our thorough health report.

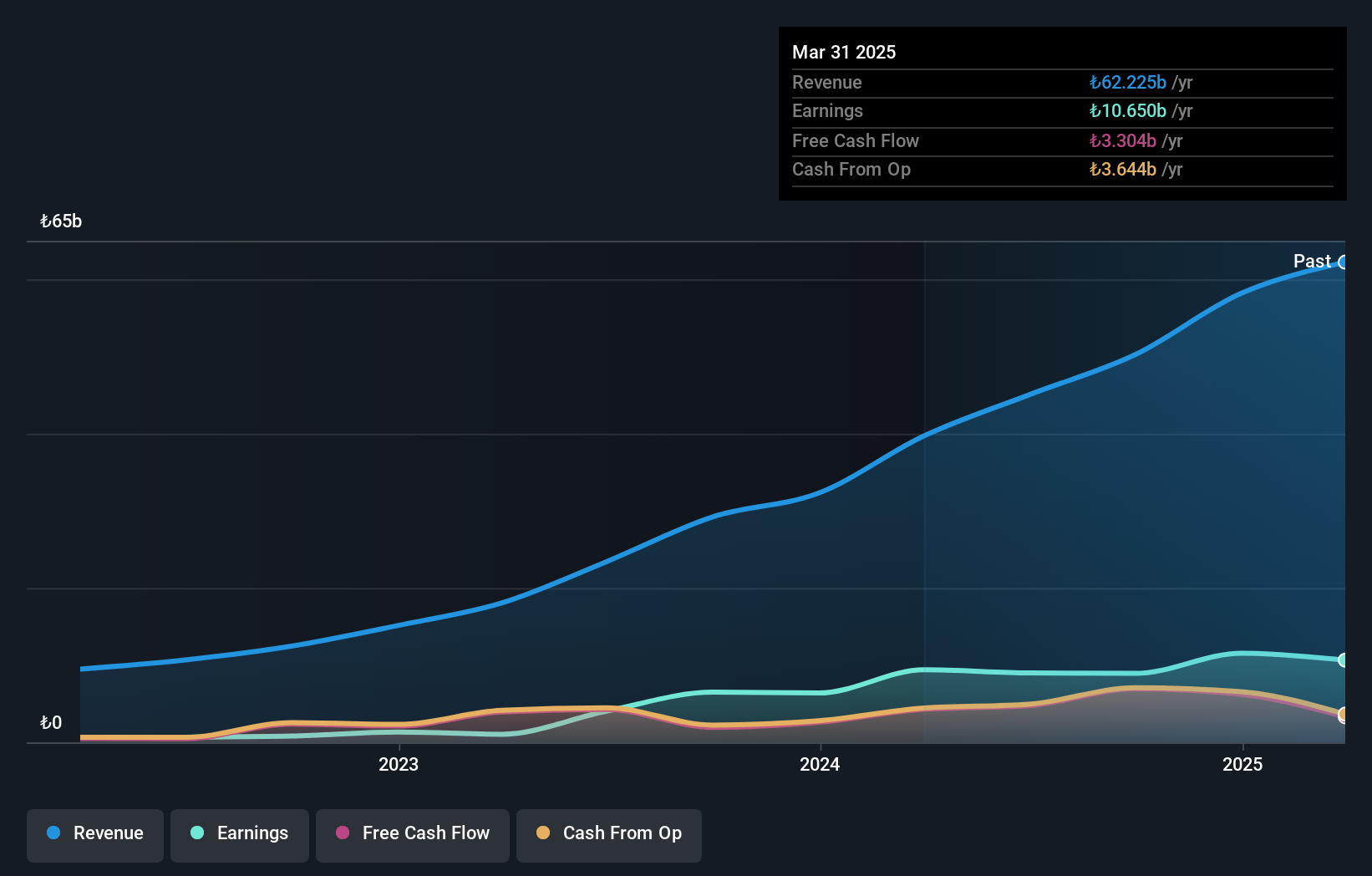

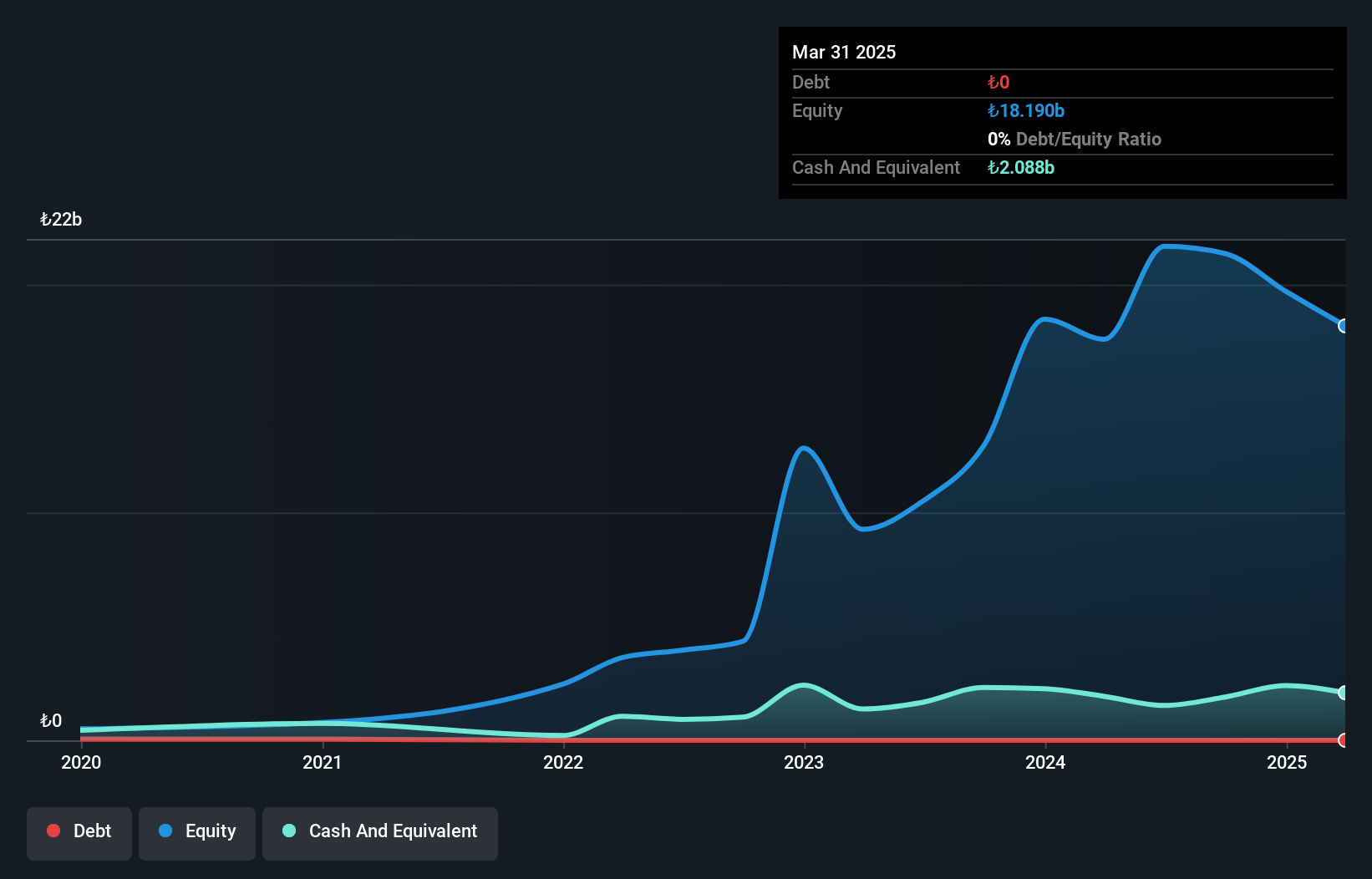

Investco Holding (IBSE:INVES)

Simply Wall St Value Rating: ★★★★★★

Overview: Investco Holding A.S. is an investment company based in Turkey with a market capitalization of TRY36.66 billion.

Operations: Investco generates revenue primarily through its investment activities in Turkey. The company's net profit margin stands at 18%, reflecting its ability to manage costs effectively relative to its income.

Investco Holding, a smaller financial player, stands out with its debt-free status and high-quality earnings. Despite being profitable, the company faced a challenging year with earnings growth at -53.8%, contrasting sharply with the industry average of 46.5%. Levered free cash flow has seen fluctuations, peaking at US$216.31 million in mid-2023 before dropping to negative figures by late 2024. Capital expenditure remained minimal at around US$0.12 million recently, suggesting cautious investment strategies or operational adjustments likely impacting performance dynamics amid evolving market conditions.

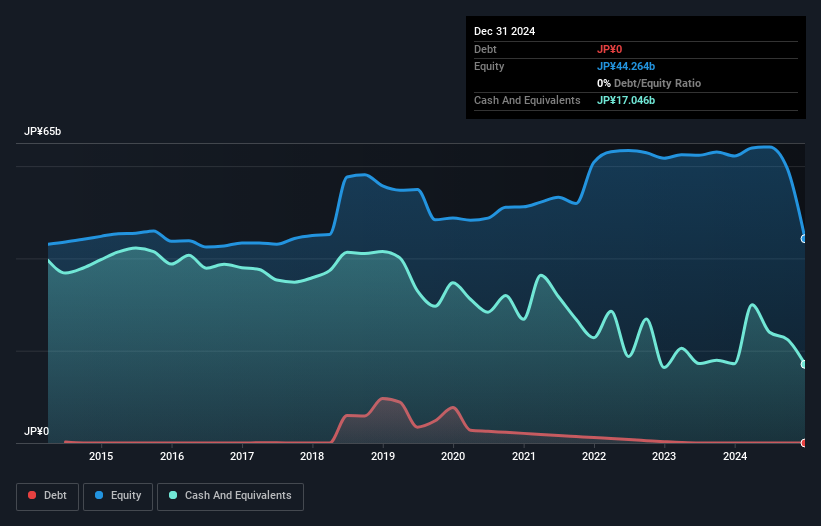

Melco Holdings (TSE:6676)

Simply Wall St Value Rating: ★★★★★★

Overview: Melco Holdings Inc. is a company that, through its subsidiaries, focuses on developing, manufacturing, and selling digital home appliances and PC peripherals both in Japan and internationally, with a market cap of ¥41.13 billion.

Operations: Melco Holdings generates revenue primarily from its IT-related segment, which contributes ¥110.13 billion, and the food segment, which adds ¥39.27 billion.

Melco Holdings, a nimble player in the tech sector, showcases a compelling narrative with its earnings surging 71.8% over the past year, outpacing the industry average of 1.9%. Despite this impressive growth, it's important to note that a ¥1.9 billion one-off gain significantly influenced these results. The firm operates debt-free now compared to five years ago when its debt-to-equity ratio was 9.9%, reflecting prudent financial management. However, future projections suggest an average annual earnings decline of 25.5% over the next three years, which could temper enthusiasm despite its attractive P/E ratio of 11.2x against Japan's market average of 13.3x.

- Get an in-depth perspective on Melco Holdings' performance by reading our health report here.

Examine Melco Holdings' past performance report to understand how it has performed in the past.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4707 more companies for you to explore.Click here to unveil our expertly curated list of 4710 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:INVES

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)