- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:9649

Middle East's Undiscovered Gems Including Amanat Holdings PJSC and Two Promising Small Caps

Reviewed by Simply Wall St

The Middle East stock markets are currently experiencing mixed performances, with Saudi Arabia's bourse extending its gains due to favorable interest rate adjustments, while Qatar and Egypt have seen declines amid profit-taking activities. In this dynamic environment, identifying promising small-cap stocks becomes crucial as investors seek opportunities that can thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 0.03% | 13.83% | 35.58% | ★★★★★☆ |

| Bulbuloglu Vinc Sanayi ve Ticaret Anonim Sirketi | 21.47% | 16.40% | 50.84% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 1.89% | -4.20% | 70.35% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 54.38% | 44.16% | 40.25% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC operates as an investment company focusing on the education and healthcare sectors in the UAE and internationally, with a market capitalization of AED2.85 billion.

Operations: Amanat Holdings PJSC generates revenue primarily from its investments in the education and healthcare sectors, with AED485.25 million coming from education and AED365.18 million from healthcare.

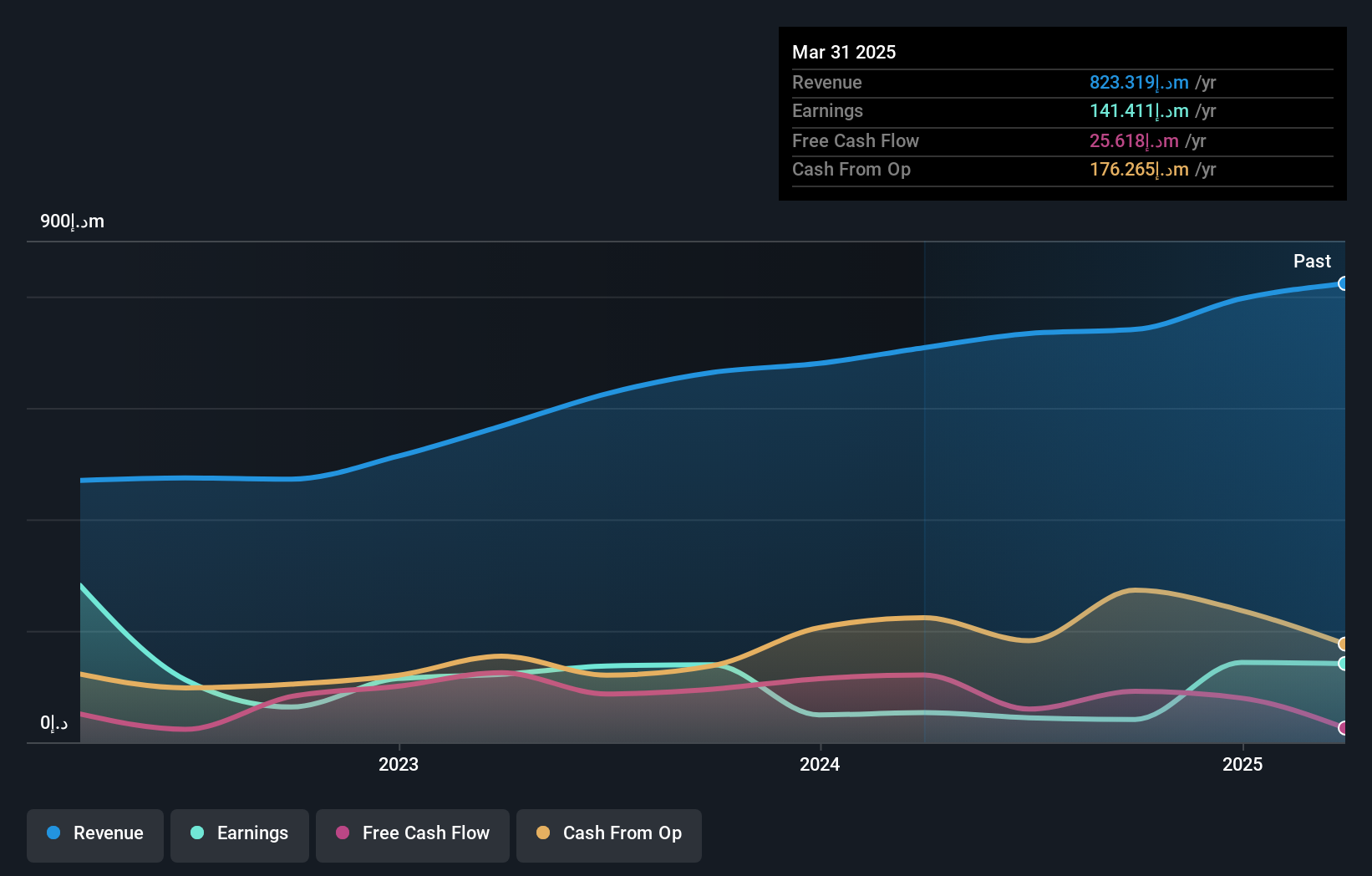

Amanat Holdings PJSC, a small cap player in the Middle East, has shown remarkable earnings growth of 212.5% over the past year, significantly outpacing its industry peers. Despite an increase in its debt to equity ratio from 2.5% to 10.4% over five years, it holds more cash than total debt, indicating financial stability. Recent results reveal net income for Q2 at AED 47 million and sales at AED 228 million, reflecting consistent improvement from last year. The company seems well-positioned with high-quality earnings and positive free cash flow contributing to its robust financial health.

- Take a closer look at Amanat Holdings PJSC's potential here in our health report.

Understand Amanat Holdings PJSC's track record by examining our Past report.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Hayat Emeklilik Anonim Sirketi operates in Turkey, offering individual and group insurance and reinsurance services across life, retirement, and personal accident sectors with a market cap of TRY39.73 billion.

Operations: Anadolu Hayat Emeklilik generates revenue primarily from its life insurance and retirement segments, with TRY23.42 billion and TRY6.85 billion respectively. The non-life segment contributes minimally to the overall revenue at TRY4.71 million.

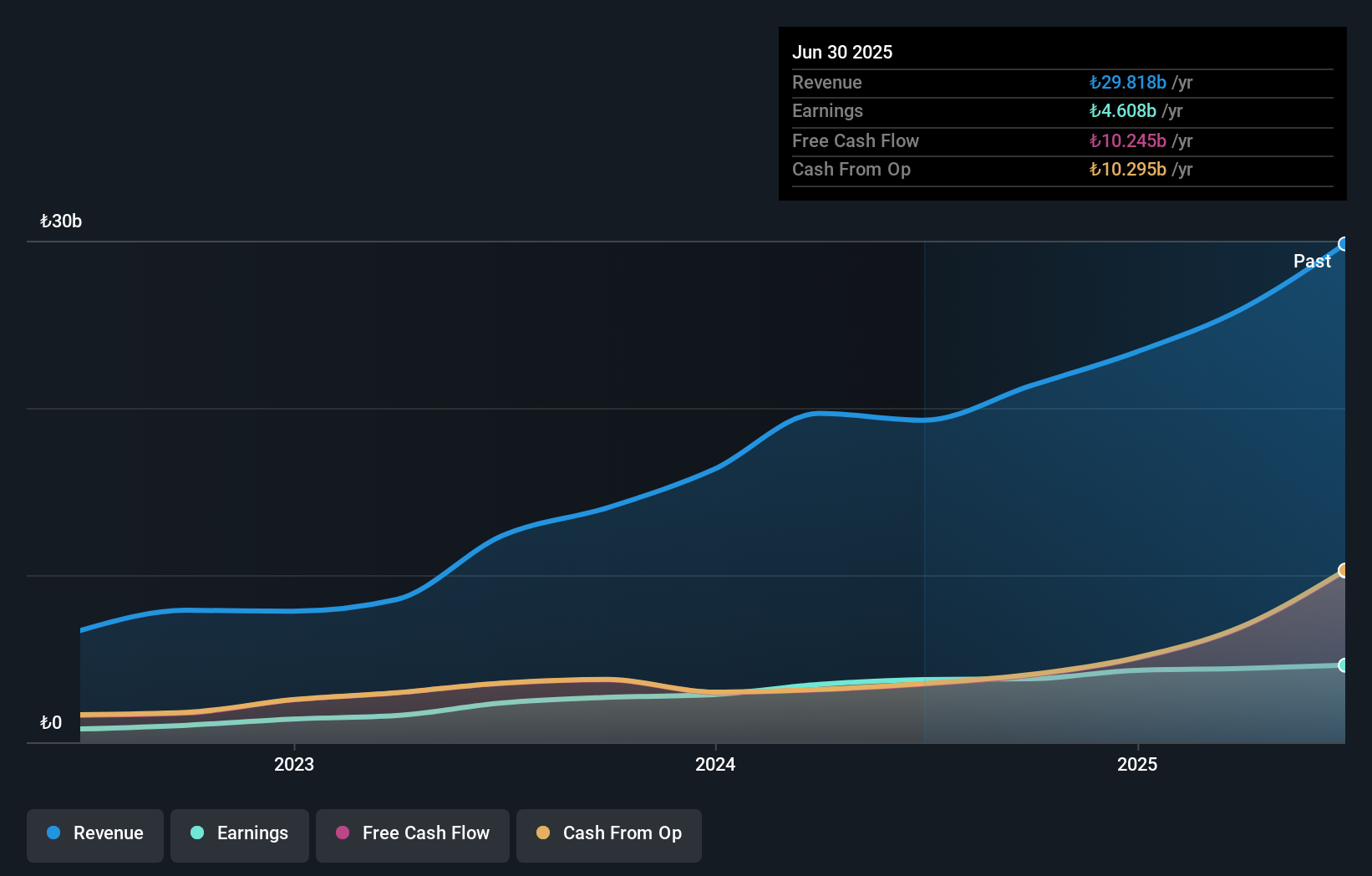

Anadolu Hayat Emeklilik, a notable player in Turkey's insurance sector, shows promising financial health with no debt and a price-to-earnings ratio of 8.6x, significantly below the Turkish market average of 24.2x. Over the past five years, earnings have impressively grown at an annual rate of 47.6%, although recent growth at 22.7% lags behind the industry's 40.6%. The company reported a net income increase for Q2 to TRY 1,416 million from TRY 1,222 million last year and six-month earnings rose to TRY 2,524 million from TRY 2,222 million previously; basic EPS improved to TRY 5.87 from TRY 5.17 year-on-year.

Jamjoom Fashion Trading (SASE:9649)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jamjoom Fashion Trading Company operates in the retail sector, focusing on apparel and fashion products, with a market capitalization of SAR1.15 billion.

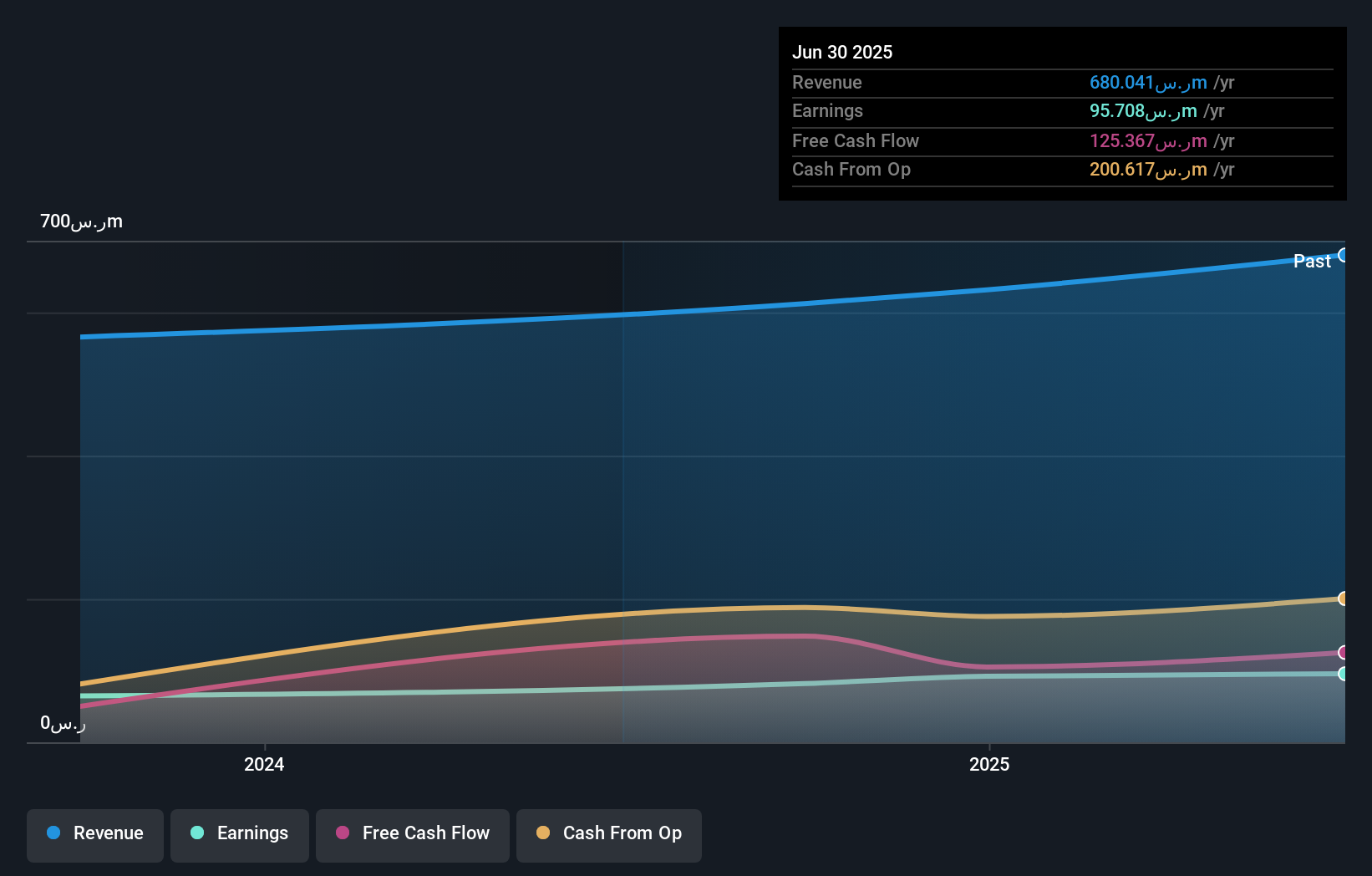

Operations: Jamjoom Fashion Trading generates revenue primarily from its retail apparel segment, amounting to SAR680.04 million. The company's financial performance is influenced by its gross profit margin, which has shown a range between 45% and 50% over the last five reporting periods.

Jamjoom Fashion Trading, a notable player in the Middle East's retail scene, recently completed an IPO raising SAR 346 million by offering over 2.38 million shares at SAR 145 each. The company's earnings surged by 23% last year, outpacing the industry's growth of just 2.6%, showcasing its robust performance. With high-quality past earnings and satisfactory debt levels (net debt to equity ratio at 31%), Jamjoom demonstrates financial resilience. Despite being illiquid, it trades significantly below its estimated fair value, suggesting potential for investors seeking undervalued opportunities in this dynamic sector.

Make It Happen

- Explore the 205 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9649

Jamjoom Fashion Trading

Engages in the retail of apparel and fashion products.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives