Undiscovered Gems Highlight These 3 Small Caps with Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience with U.S. indexes nearing record highs, driven by broad-based gains and a strong labor market, while smaller-cap indexes outperformed their larger counterparts. Amidst this backdrop of positive sentiment and economic stability, small-cap stocks often present unique opportunities for investors seeking growth potential in less-explored areas of the market. Identifying promising small caps involves looking for companies with solid fundamentals and potential to thrive even as broader economic conditions fluctuate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

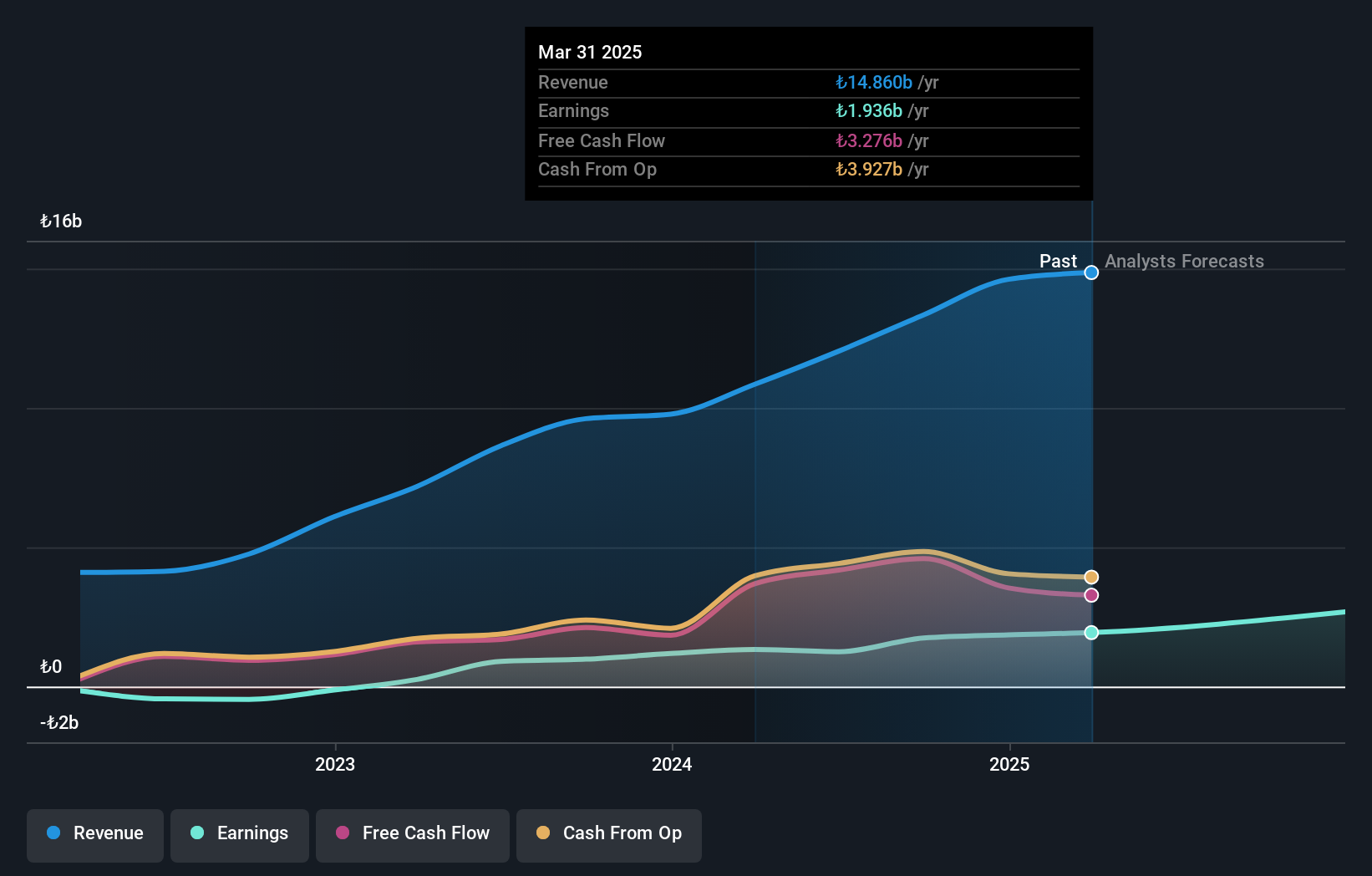

Overview: Aksigorta A.S. offers a range of life and non-life insurance products and services to both retail and business customers in Turkey, with a market capitalization of TRY9.74 billion.

Operations: Aksigorta's primary revenue streams are derived from motor vehicles and motor vehicle liability insurance, generating TRY5.81 billion and TRY3.38 billion respectively. The company also earns significant income from fire and other accident insurance segments. Segment adjustments impact the overall revenue figures by TRY5.47 billion, reflecting internal financial reconciliations within the business model.

Aksigorta, a nimble player in the insurance sector, has shown impressive financial resilience with no debt over the past five years. Its earnings have grown at an annual rate of 29.7%, although recent growth of 70.2% lagged behind the industry average of 79.1%. The company's price-to-earnings ratio stands at a favorable 6.2x compared to the TR market's 15.6x, suggesting it might be undervalued. Recent results highlight robust performance with net income for Q3 reaching TRY 625 million, up from TRY 132 million last year, and nine-month earnings totaling TRY 1,234 million versus TRY 714 million previously.

- Take a closer look at Aksigorta's potential here in our health report.

Review our historical performance report to gain insights into Aksigorta's's past performance.

Investco Holding (IBSE:INVES)

Simply Wall St Value Rating: ★★★★★★

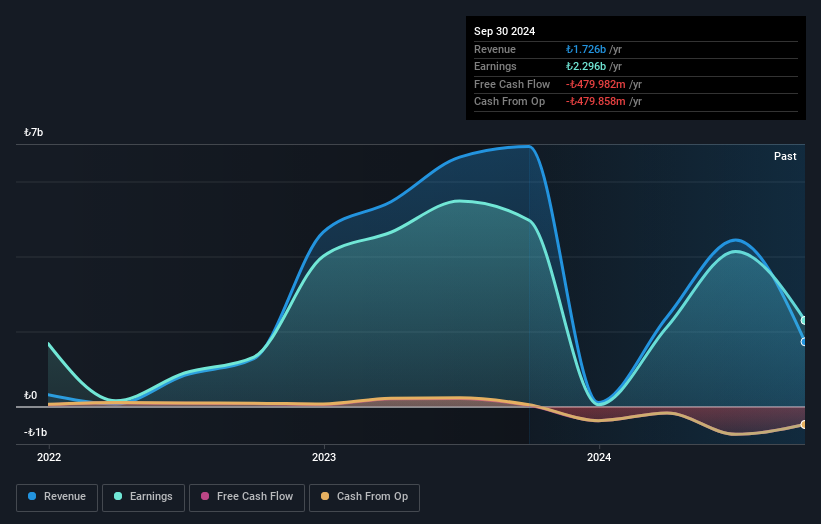

Overview: Investco Holding A.S. is an investment company based in Turkey with a market capitalization of TRY59.11 billion.

Operations: Investco generates revenue primarily through its investment activities in Turkey. The company's net profit margin has shown a notable trend, fluctuating between 12% and 18% over recent periods.

Investco Holding, a nimble player in the financial sector, presents a mixed bag with its recent performance. Despite being debt-free and boasting high-quality earnings, it faced negative earnings growth of 53.8% over the past year compared to a 42.2% industry average. The company reported third-quarter sales of TRY 2,030 million but suffered a net loss of TRY 1,959 million, significantly up from TRY 124 million last year. However, for the nine months ending September 2024, Investco achieved net income of TRY 4,179 million against TRY 1,930 million previously. This suggests potential volatility but also opportunities for future gains.

- Dive into the specifics of Investco Holding here with our thorough health report.

Assess Investco Holding's past performance with our detailed historical performance reports.

Kerur Holdings (TASE:KRUR)

Simply Wall St Value Rating: ★★★★★☆

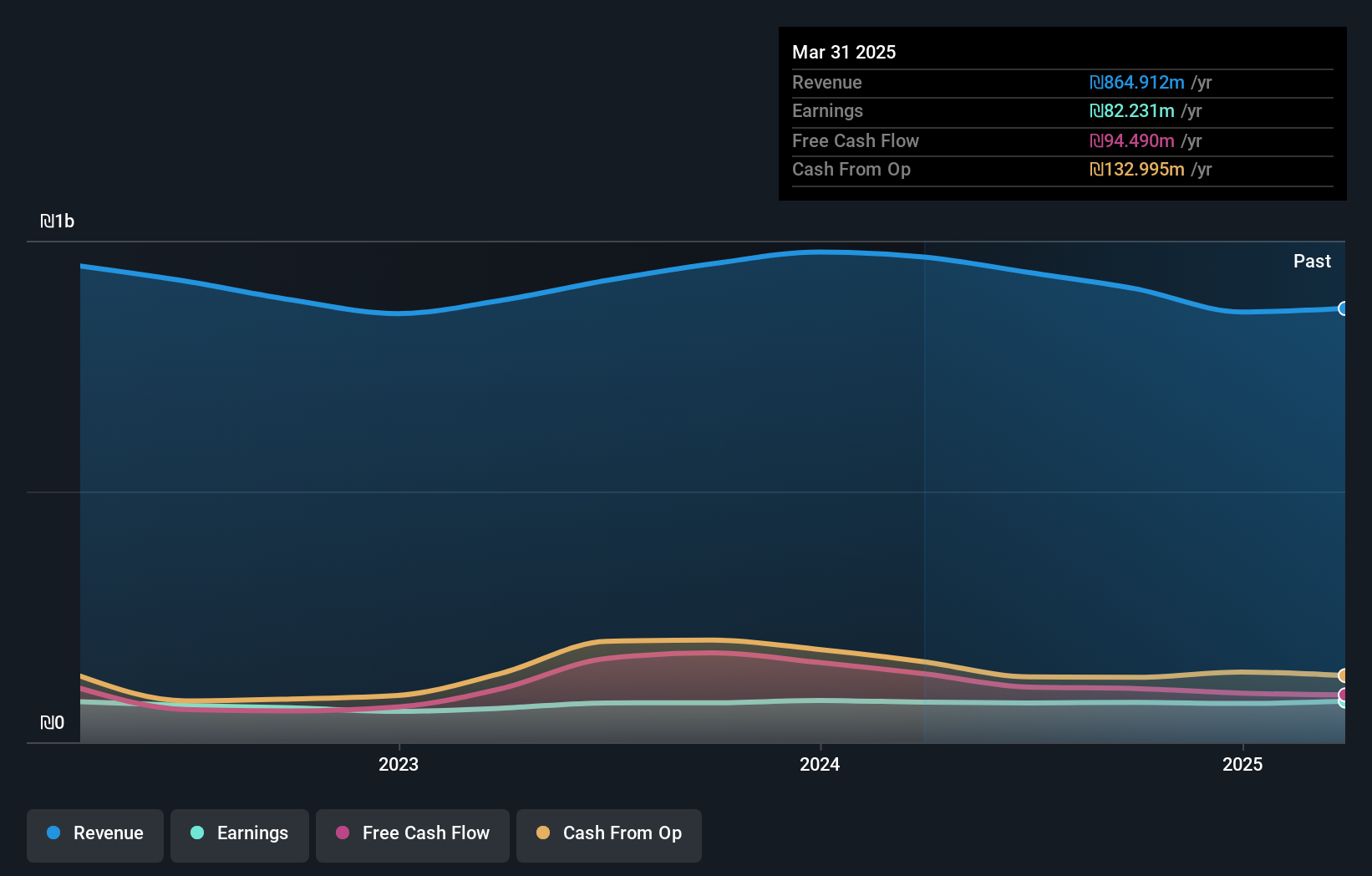

Overview: Kerur Holdings Ltd., with a market cap of ₪977.69 million, operates in the food sector in Israel through its subsidiaries.

Operations: Kerur Holdings generates revenue primarily from its operations in the food sector. The company reported a gross profit margin of 22% in the most recent period.

Kerur Holdings, a dynamic player with a market presence in the beverage sector, showcases some intriguing financial metrics. Despite earnings growth of 1.2% lagging behind the industry average of 12.4%, the company remains profitable with positive free cash flow and more cash than total debt, indicating solid financial health. Its price-to-earnings ratio at 12.3x suggests potential undervaluation compared to the IL market's 14.2x, offering an attractive entry point for investors seeking value opportunities. Recent earnings reveal net income rose slightly to ILS 29.97 million from ILS 28.91 million year-over-year despite sales dipping to ILS 258.35 million from ILS 290.63 million, reflecting resilience amidst challenges.

- Click here to discover the nuances of Kerur Holdings with our detailed analytical health report.

Gain insights into Kerur Holdings' historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4640 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kerur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KRUR

Kerur Holdings

Through its subsidiaries, operates in the food sector in Israel.

Excellent balance sheet with acceptable track record.