- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:9649

Undiscovered Gems In The Middle East To Watch This October 2025

Reviewed by Simply Wall St

As of October 2025, most Gulf markets have faced downward pressure due to weak oil prices, with concerns over a global supply glut and economic slowdown affecting investor sentiment. Despite these challenges, the Middle East market still holds potential opportunities for investors who focus on companies with strong fundamentals and resilience in volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Marmaris Altinyunus Turistik Tesisler | NA | 49.75% | -49.65% | ★★★★★★ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 16.16% | 34.64% | 61.21% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 7.00% | 41.89% | 59.39% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY16.76 billion.

Operations: Lila Kagit derives its revenue primarily from the sale of paper and paper products, totaling TRY11.22 billion.

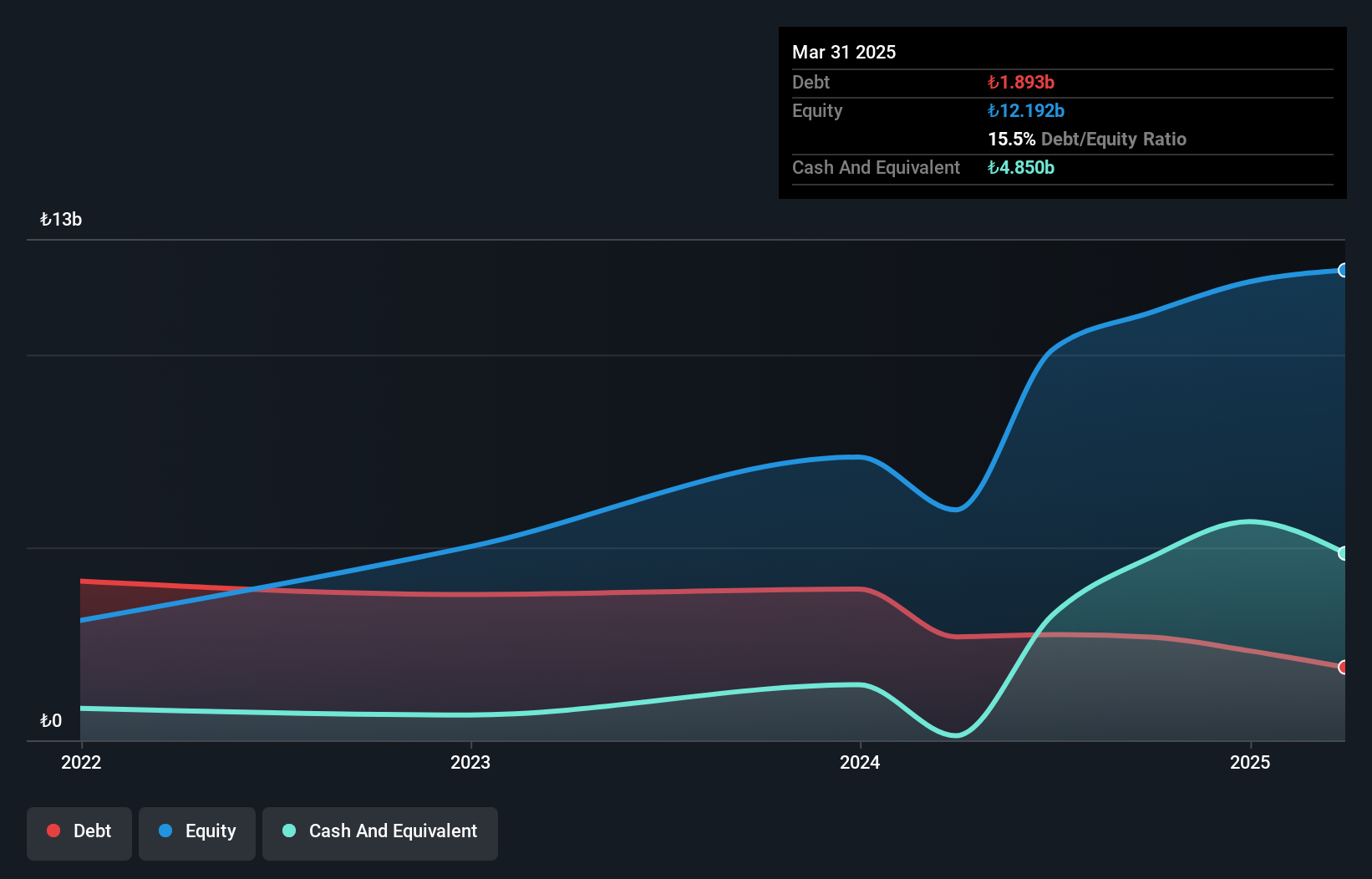

Lila Kagit Sanayi Ve Ticaret, a notable player in the household products sector, showcases impressive financial health. With earnings growth of 37.8% over the past year, it outpaces industry averages. The company trades at 24.5% below its estimated fair value and holds more cash than total debt, indicating robust financial management. Recent reports highlight a net income of TRY 931 million for Q2 2025 compared to TRY 604 million last year, despite sales dipping from TRY 3,923 million to TRY 3,233 million. Basic earnings per share rose from TRY 1.005 to TRY 1.578 during this period.

- Dive into the specifics of Lila Kagit Sanayi Ve Ticaret here with our thorough health report.

Gain insights into Lila Kagit Sanayi Ve Ticaret's past trends and performance with our Past report.

Jamjoom Fashion Trading (SASE:9649)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jamjoom Fashion Trading Company operates in the retail sector, focusing on apparel and fashion products, with a market capitalization of SAR1.06 billion.

Operations: The company generates revenue primarily from its retail apparel segment, amounting to SAR680.04 million.

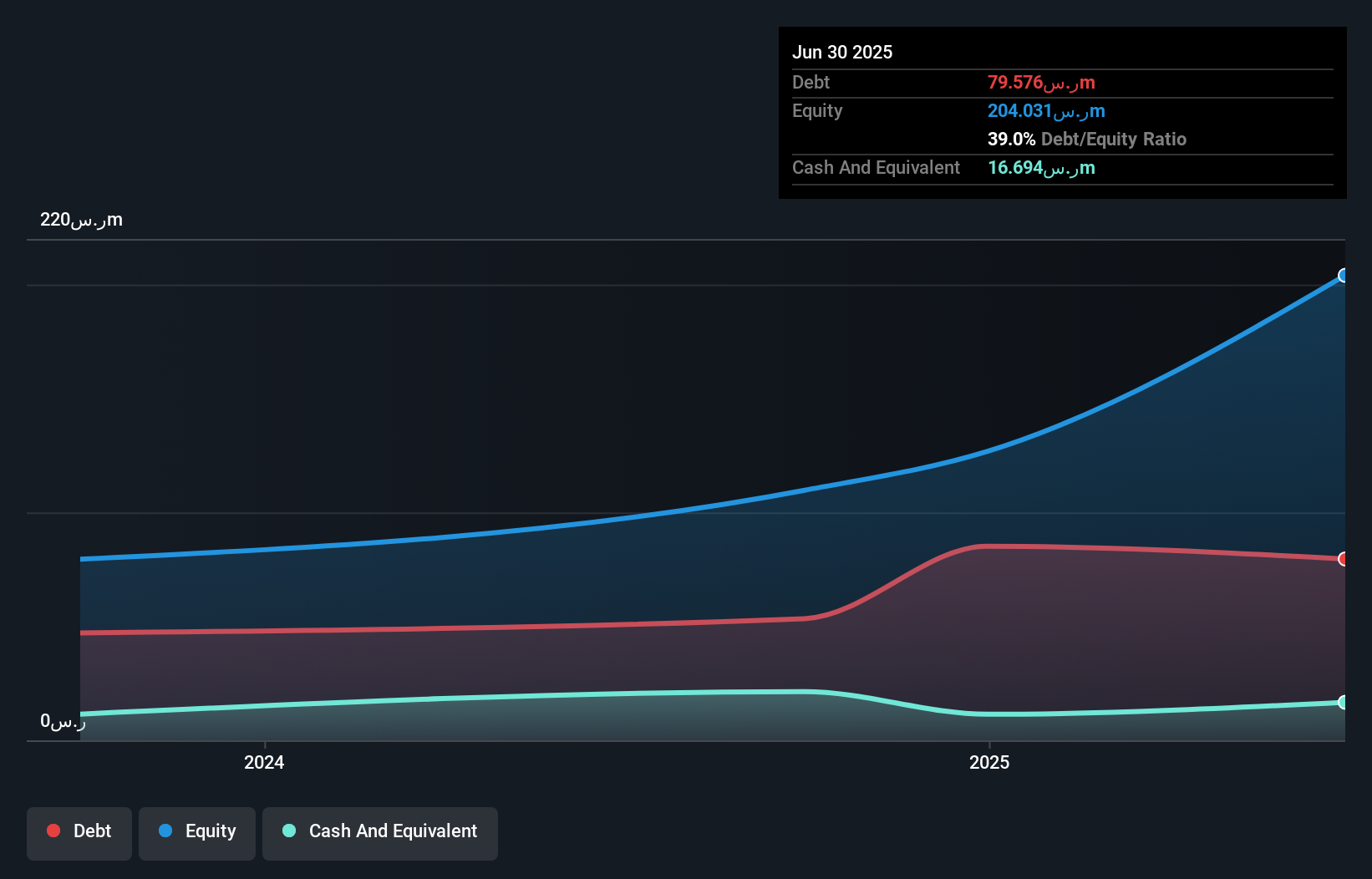

Jamjoom Fashion Trading recently completed a SAR 345.73 million IPO, offering shares at SAR 145 each. Its earnings surged by 23% last year, outpacing the Specialty Retail industry's growth of 1.5%. The company's net debt to equity ratio stands at a satisfactory 30.8%, indicating sound financial health. With EBIT covering interest payments 9.7 times, Jamjoom's debt obligations seem well-managed. Despite its shares being highly illiquid, it trades significantly below estimated fair value by about 71%. These factors suggest potential for value investors seeking opportunities in the Middle East market with an eye on growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Jamjoom Fashion Trading.

Understand Jamjoom Fashion Trading's track record by examining our Past report.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. is a company that designs, develops, markets, and sells various clothing products in Israel with a market capitalization of approximately ₪2.48 billion.

Operations: Delta Israel Brands generates revenue primarily from its Owned Brands segment, contributing ₪1.09 billion, and Franchise Brands segment, adding ₪158.11 million.

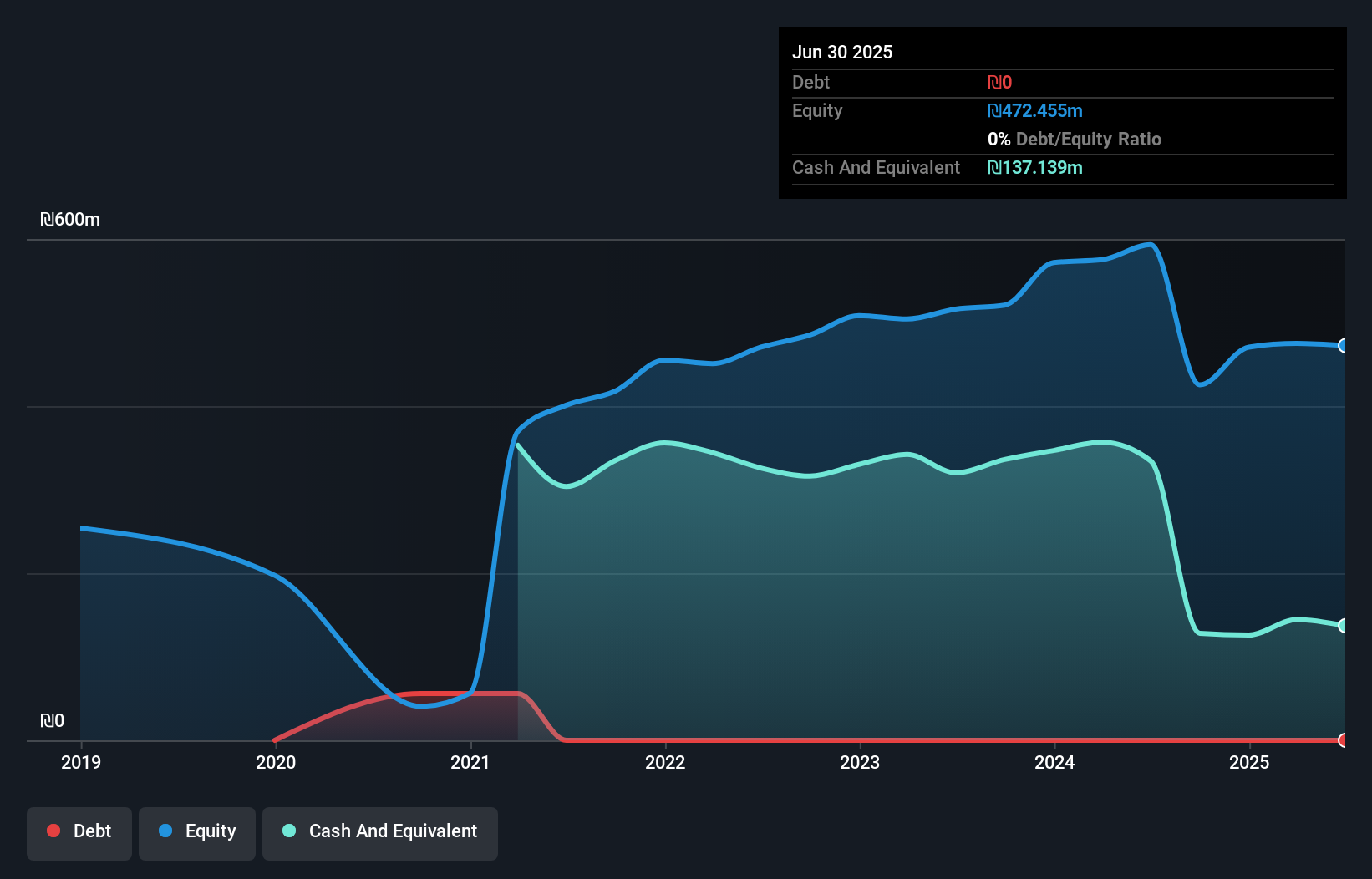

Delta Israel Brands, a nimble player in the specialty retail sector, has demonstrated consistent earnings growth at 8.8% annually over the past five years. Despite its debt-free status, recent earnings show a slight dip with net income for Q2 2025 at ILS 28.95 million compared to ILS 34.4 million last year, and basic EPS from continuing operations down to ILS 1.16 from ILS 1.38. The company's inclusion in the S&P Global BMI Index signals recognition on a larger stage while maintaining positive free cash flow of US$134.57 million as of June 2025 suggests robust operational efficiency amidst market volatility.

Make It Happen

- Delve into our full catalog of 206 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9649

Jamjoom Fashion Trading

Engages in the retail of apparel and fashion products.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives