- Israel

- /

- Hospitality

- /

- TASE:ISRO

Undiscovered Gems In The Middle East To Watch This June 2025

Reviewed by Simply Wall St

As Middle Eastern markets experience a surge, with Gulf shares climbing amid the Israel-Iran ceasefire and Dubai reaching a 17-year high, investors are increasingly turning their attention to potential opportunities in this dynamic region. In such an environment, identifying stocks that demonstrate strong fundamentals and resilience can be key to navigating these promising yet complex markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Vakif Gayrimenkul Yatirim Ortakligi | 0.00% | 50.97% | 56.63% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 6.88% | 51.77% | 67.59% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.80% | 49.41% | 66.89% | ★★★★★☆ |

| Segmen Kardesler Gida Üretim ve Ambalaj Sanayi Anonim Sirketi | 2.02% | -10.23% | 74.54% | ★★★★☆☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 12.49% | -23.32% | 41.51% | ★★★★☆☆ |

| Dogan Burda Dergi Yayincilik Ve Pazarlama | 64.82% | 46.23% | -12.39% | ★★★★☆☆ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 43.01% | 40.80% | -34.83% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Izmir Firça Sanayi ve Ticaret Anonim Sirketi (IBSE:IZFAS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Izmir Firça Sanayi ve Ticaret Anonim Sirketi is engaged in the production and sale of various cleaning materials and painting brushes both in Turkey and internationally, with a market capitalization of TRY10.34 billion.

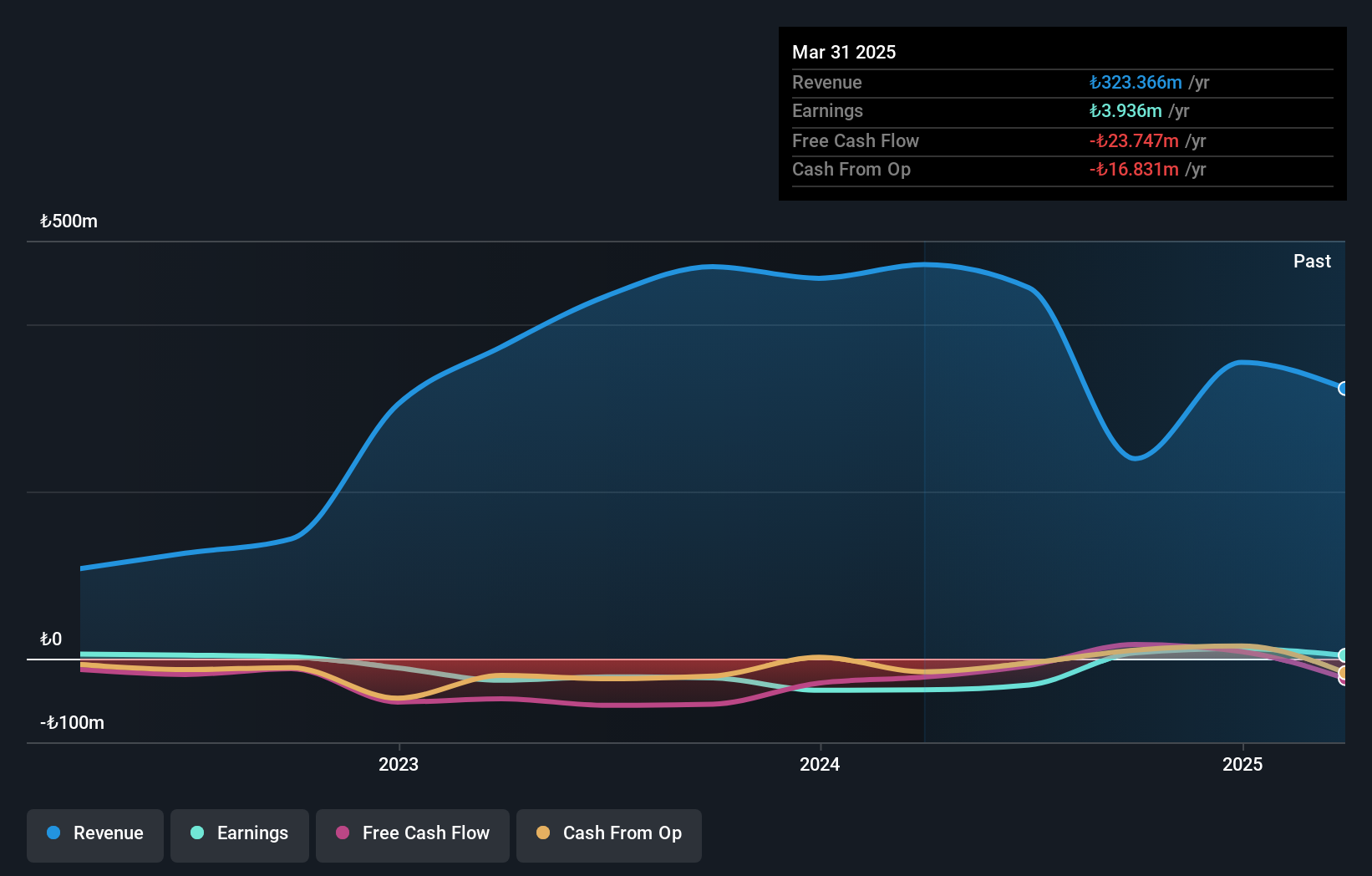

Operations: Izmir Firça generates revenue primarily from its Building Products segment, amounting to TRY323.37 million. The company's financial performance is characterized by its gross profit margin trend, which provides insights into its cost management and pricing strategies.

Izmir Firça Sanayi ve Ticaret Anonim Sirketi has seen its debt to equity ratio improve significantly, dropping from 100.8% to 43% over the past five years. Despite this progress, the company reported a net loss of TRY 21.18 million for Q1 2025, widening from TRY 13.07 million the previous year, with sales falling to TRY 86.52 million from TRY 117.6 million a year ago. Interest payments are well covered by EBIT at five times coverage, indicating financial stability in that area; however, free cash flow remains negative and operating cash flow does not cover debt adequately, highlighting areas for potential improvement moving forward.

- Unlock comprehensive insights into our analysis of Izmir Firça Sanayi ve Ticaret Anonim Sirketi stock in this health report.

Learn about Izmir Firça Sanayi ve Ticaret Anonim Sirketi's historical performance.

Hilan (TASE:HLAN)

Simply Wall St Value Rating: ★★★★★★

Overview: Hilan Ltd. is a software as a service (SaaS) provider that develops solutions for enterprise human capital management in Israel, with a market capitalization of ₪6.51 billion.

Operations: Hilan generates revenue primarily from Business Information Services (₪1.67 billion), Marketing of Software Products (₪391.95 million), Payroll Services, Human Resources and Organizational Systems (₪539.03 million), and Computer Infrastructure (₪322.35 million).

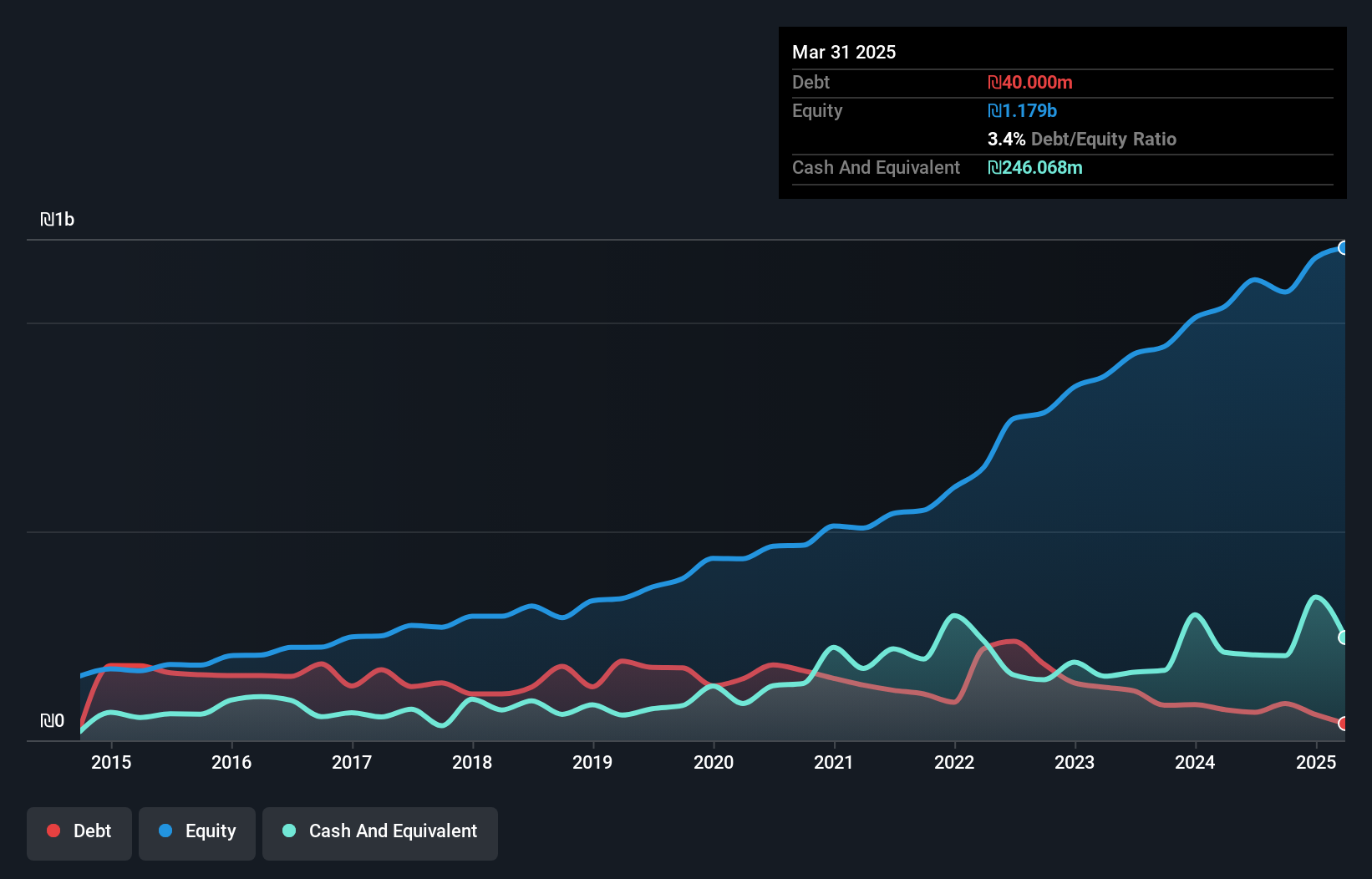

Hilan, a nimble player in the Middle East's professional services sector, has demonstrated robust financial health and growth. Over the past year, earnings surged by 14%, outpacing the industry's 10.9% rise. The company is trading at a significant discount of 42.3% below its estimated fair value, suggesting potential for appreciation. Hilan's debt situation appears strong with more cash than total debt and a reduced debt-to-equity ratio from 33.9% to just 3.4% over five years. Recent results show sales climbing to ILS 782 million from ILS 709 million last year, with net income reaching ILS 66 million up from ILS 58 million previously.

- Take a closer look at Hilan's potential here in our health report.

Gain insights into Hilan's past trends and performance with our Past report.

Isrotel (TASE:ISRO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Isrotel Ltd. operates and manages a chain of hotels in Israel with a market capitalization of ₪5.32 billion.

Operations: The company generates revenue primarily from its Hotels & Motels segment, which reported earnings of ₪1.96 billion.

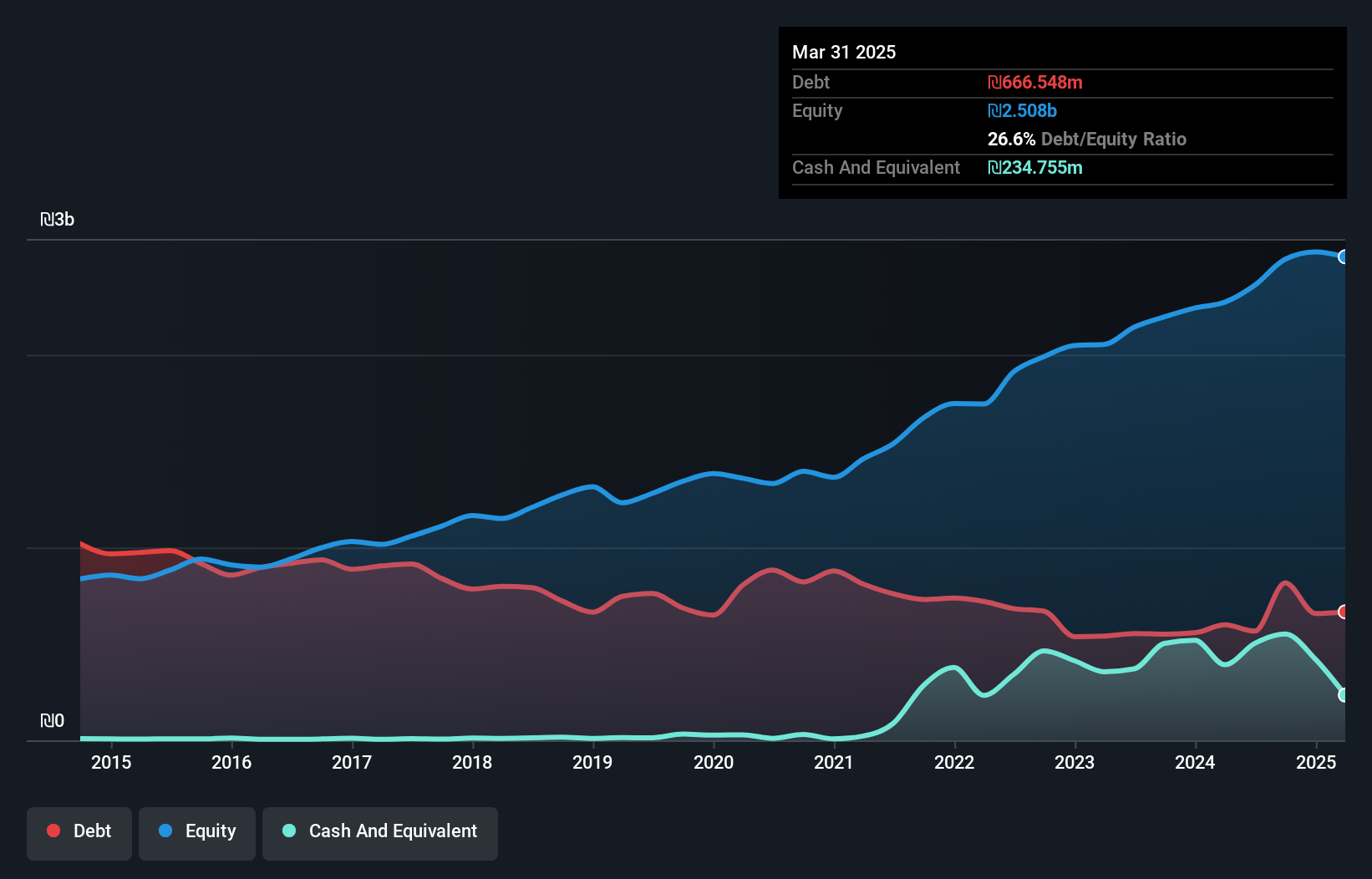

Isrotel, a notable player in the hospitality sector, has demonstrated resilience with its net debt to equity ratio at 17.2%, deemed satisfactory. Over the past year, earnings grew by 6.8%, outpacing the broader hospitality industry's -6.5%. The company's interest payments are well covered by EBIT at a robust 24.1x coverage, indicating financial stability despite recent challenges reflected in a drop in quarterly net income to ILS 2.13 million from ILS 27.76 million last year. With high-quality past earnings and positive free cash flow, Isrotel stands as a promising investment opportunity amidst current market conditions.

- Click here to discover the nuances of Isrotel with our detailed analytical health report.

Review our historical performance report to gain insights into Isrotel's's past performance.

Taking Advantage

- Click through to start exploring the rest of the 215 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISRO

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives