- Turkey

- /

- Personal Products

- /

- IBSE:ECILC

Middle Eastern Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As the Middle East navigates the complexities of falling oil prices and cautious investor sentiment amid global trade tensions, Gulf markets have shown mixed performance with Dubai's main share index advancing while others eased. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.45% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.43% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.07% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.35% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.16% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.77% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.00% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 9.09% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.68% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.67% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Akmerkez Gayrimenkul Yatirim Ortakligi (IBSE:AKMGY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Akmerkez Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate sector, focusing on property investment and management, with a market cap of TRY7.75 billion.

Operations: Akmerkez Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from its real estate investment property segment, amounting to TRY783.50 million.

Dividend Yield: 6.1%

Akmerkez Gayrimenkul Yatirim Ortakligi has shown a growing dividend trend over the past three years, with its recent annual dividend set at TRY 12.64 per share. Despite a lower net profit margin and earnings decline in 2024, the company maintains a competitive dividend yield of 6.08%, placing it in the top quartile of Turkish dividend payers. The payout ratio is sustainable at 76.8% from earnings and nearly fully covered by cash flows (99.6%).

- Click to explore a detailed breakdown of our findings in Akmerkez Gayrimenkul Yatirim Ortakligi's dividend report.

- Our valuation report unveils the possibility Akmerkez Gayrimenkul Yatirim Ortakligi's shares may be trading at a premium.

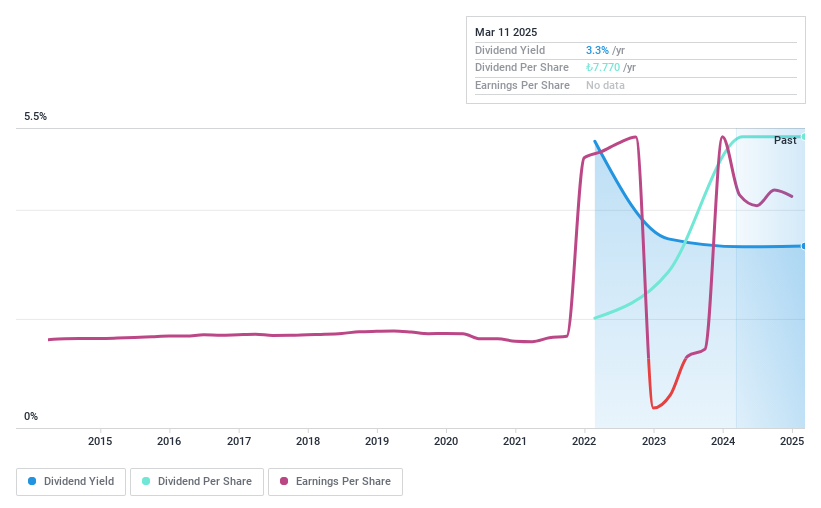

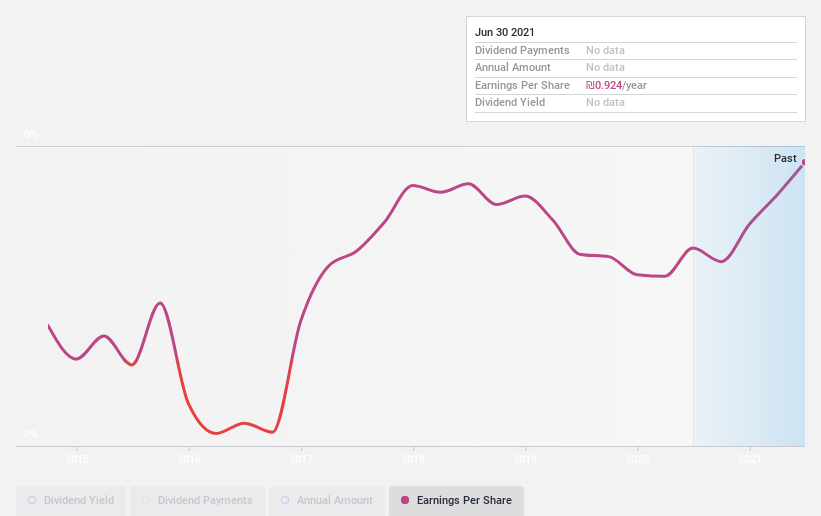

EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret (IBSE:ECILC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EIS Eczacibasi Ilaç, Sinai ve Finansal Yatirimlar Sanayi ve Ticaret A.S. operates in the health and real estate development sectors both in Turkey and internationally, with a market cap of TRY31.52 billion.

Operations: EIS Eczacibasi Ilaç, Sinai ve Finansal Yatirimlar Sanayi ve Ticaret A.S. generates revenue primarily from its health segment, which accounts for TRY9.47 billion, and its real estate development segment, contributing TRY670.77 million.

Dividend Yield: 3.8%

EIS Eczacibasi Ilaç's dividend yield of 3.81% ranks in the top 25% of Turkish dividend payers, but its sustainability is questionable due to a high payout ratio of 117.2%. While dividends have increased over the past decade, they remain volatile and not well-covered by earnings. Recent financials show a significant drop in net income to TRY 1.02 billion from TRY 3.96 billion last year, impacting dividend reliability despite a cash payout ratio of 74.3%.

- Click here to discover the nuances of EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret's share price might be too optimistic.

Mendelson Infrastructures & Industries (TASE:MNIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mendelson Infrastructures & Industries Ltd. (TASE:MNIN) operates in the infrastructure and industrial sectors, with a market cap of ₪586.38 million.

Operations: Mendelson Infrastructures & Industries Ltd. generates revenue from various segments, including Infrastructure (₪278.02 million), Construction and Plumbing (₪477.02 million), and Elevators and Air Conditioning (₪270.23 million).

Dividend Yield: 4.1%

Mendelson Infrastructures & Industries offers a dividend yield of 4.09%, below the IL market's top quartile, with recent increases to ILS 0.6058 per share. Despite a volatile dividend history, payouts are supported by earnings and cash flows with payout ratios of 50.1% and 18.8%, respectively. Recent financials show net income growth to ILS 47.93 million from ILS 37.44 million, though sales declined slightly to ILS 1,023.9 million from the previous year.

- Get an in-depth perspective on Mendelson Infrastructures & Industries' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Mendelson Infrastructures & Industries is trading behind its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 70 Top Middle Eastern Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ECILC

EIS Eczacibasi Ilaç Sinai ve Finansal Yatirimlar Sanayi ve Ticaret

Together with subsidiaries, engages in health and real estate development businesses in Turkey and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives