As global markets wrap up the year with moderate gains, attention is drawn to shifts in consumer confidence and economic indicators that have created a mixed backdrop for investors. Amidst these dynamics, small-cap stocks present intriguing opportunities, particularly those that demonstrate resilience and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

MLP Saglik Hizmetleri (IBSE:MPARK)

Simply Wall St Value Rating: ★★★★★☆

Overview: MLP Saglik Hizmetleri A.S. operates healthcare services in Turkey, Azerbaijan, and Hungary with a market capitalization of TRY68.67 billion.

Operations: MPARK's primary revenue stream is from its healthcare facilities and services, generating TRY28.14 billion.

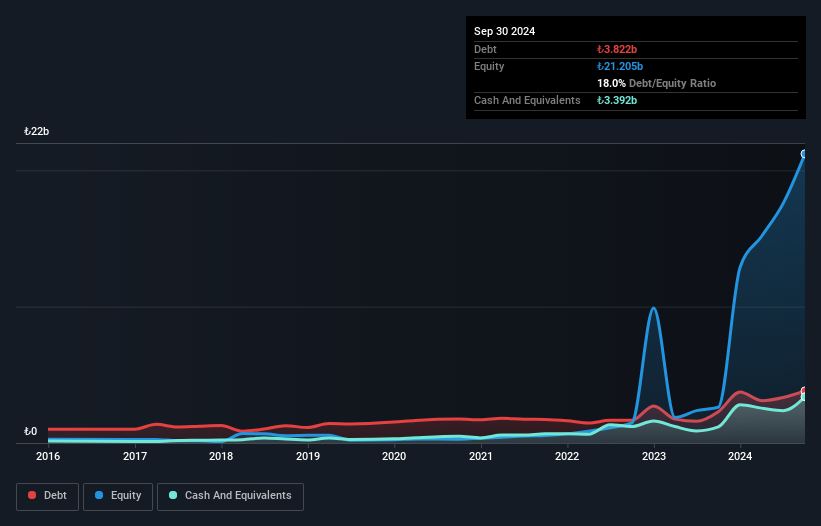

MLP Saglik Hizmetleri, a healthcare player with a modest market cap, is showing promising signs. Recent earnings report reveals sales of TRY 9.78 billion in Q3 2024, up from TRY 7.71 billion the previous year, while net income increased to TRY 2.09 billion from TRY 1.18 billion. The company's debt management appears robust with interest payments well covered by EBIT at a ratio of 58 times and a net debt to equity ratio now at just 2%, down significantly from five years ago when it was over sixfold higher. Despite negative earnings growth last year, future prospects are bolstered by an anticipated annual earnings growth rate of nearly 28%.

- Unlock comprehensive insights into our analysis of MLP Saglik Hizmetleri stock in this health report.

Explore historical data to track MLP Saglik Hizmetleri's performance over time in our Past section.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. is a global manufacturer and seller of electric wires, cables, and related products with a market capitalization of ₩2.17 trillion.

Operations: The primary revenue stream for Taihan Cable & Solution comes from its wire segment, which generated ₩3.62 billion. The company has a market capitalization of approximately ₩2.17 trillion.

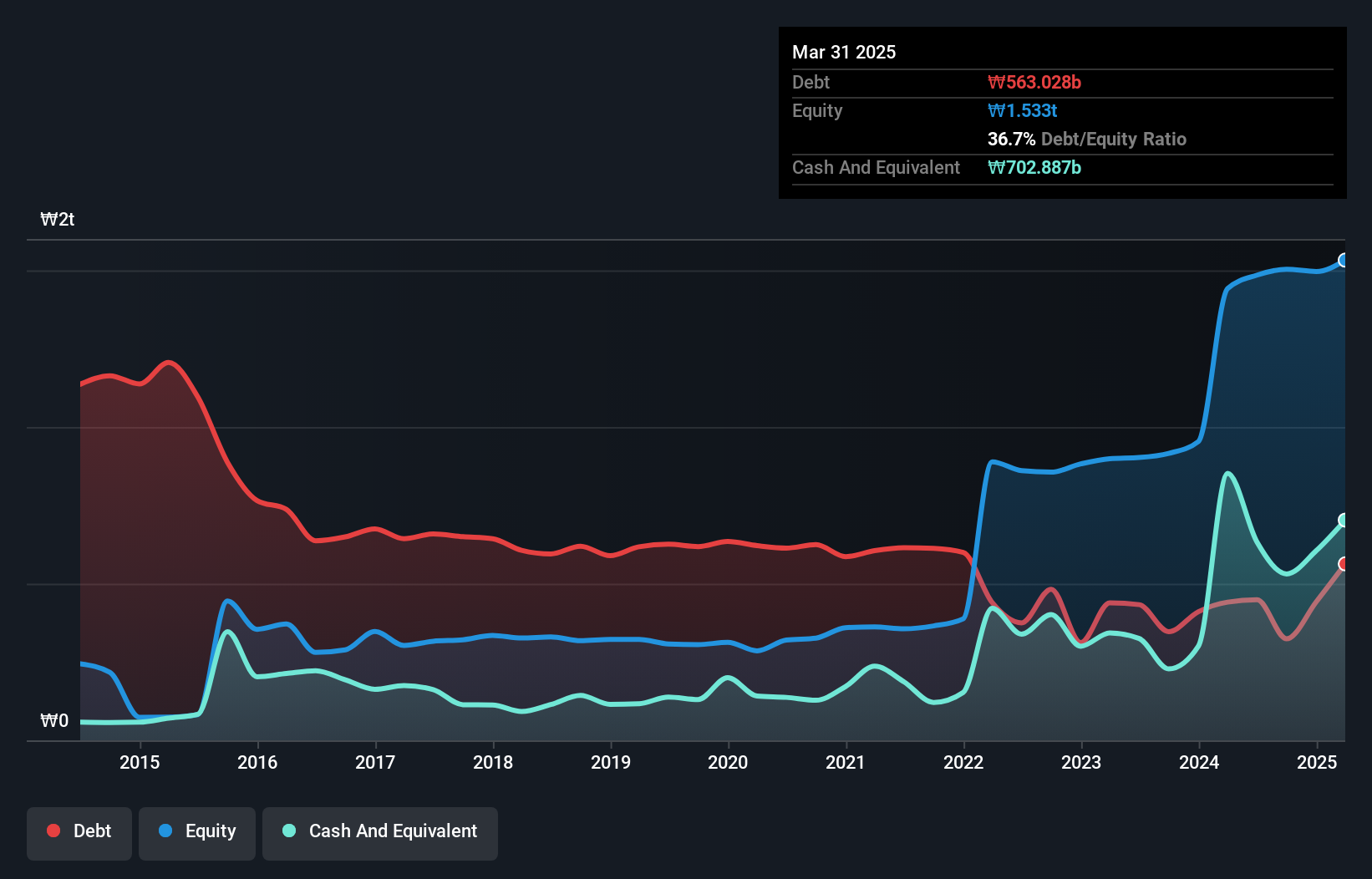

Taihan Cable & Solution has seen its earnings soar by 134% over the past year, outpacing the Electrical industry's 14% growth. This company, with a debt-to-equity ratio now at 21.5%, has significantly improved from five years ago when it stood at 202%. Despite recent shareholder dilution, Taihan's interest payments are well-covered with EBIT covering them 7.7 times over. Recent private placements have raised KRW110 billion in convertible bonds, indicating strategic financial maneuvers to bolster future growth prospects. The company's net income for Q3 was KRW24 billion compared to last year's KRW11 billion, reflecting robust profitability improvements.

- Take a closer look at Taihan Cable & Solution's potential here in our health report.

Learn about Taihan Cable & Solution's historical performance.

BRC Asia (SGX:BEC)

Simply Wall St Value Rating: ★★★★★★

Overview: BRC Asia Limited, with a market cap of approximately SGD699.59 million, is involved in the prefabrication of steel reinforcement for concrete across various international markets including Singapore, Australia, and several other countries in Asia.

Operations: The company's revenue primarily comes from two segments: Trading, contributing SGD217.69 million, and Fabrication and Manufacturing, generating SGD1.26 billion.

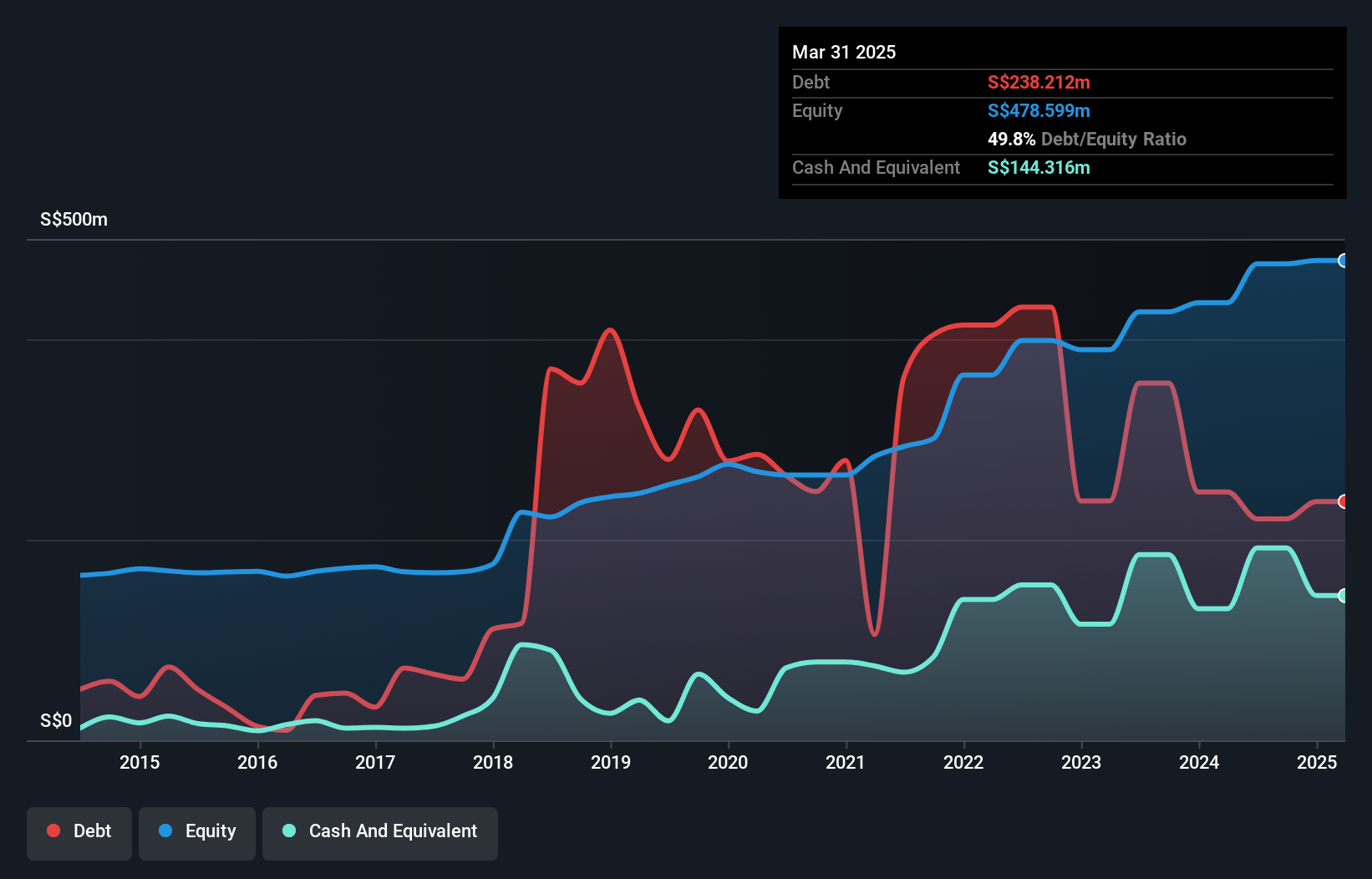

BRC Asia seems to be an attractive prospect, trading at 53% below its estimated fair value. The company's earnings grew by 23.5% over the past year, surpassing the building industry's -2.7%, indicating robust performance in a challenging sector. Net income for the year ended September 2024 reached SGD 93.54 million, up from SGD 75.75 million previously, with basic earnings per share rising to SGD 0.341 from SGD 0.2761. Despite a dip in sales to SGD 1,481 million from SGD 1,627 million last year, BRC Asia's debt reduction strategy has improved its debt-to-equity ratio significantly over five years from 125% to just under half that figure at approximately 47%.

- Click here to discover the nuances of BRC Asia with our detailed analytical health report.

Gain insights into BRC Asia's historical performance by reviewing our past performance report.

Seize The Opportunity

- Explore the 4645 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRC Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEC

BRC Asia

Engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives