As Gulf stocks follow a global rally, buoyed by strong earnings reports and strategic developments in the tech and AI sectors, investor sentiment in the Middle East remains optimistic despite broader economic uncertainties. In this dynamic environment, identifying promising stocks involves looking for companies with solid fundamentals and growth potential that align with current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.46% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 35.76% | 53.34% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: United Arab Bank P.J.S.C. offers a range of commercial banking products and services to both individual and corporate clients in the United Arab Emirates, with a market capitalization of AED3.65 billion.

Operations: United Arab Bank P.J.S.C. generates revenue primarily through its Wholesale Banking segment, which accounts for AED497.67 million, followed by Treasury and Capital Markets at AED225.58 million, and Retail Banking at AED83.69 million.

United Arab Bank, a small cap player in the Middle East, showcases robust financial health with total assets of AED24.5 billion and equity of AED4 billion. Despite a high bad loans ratio at 3.1%, its customer deposit-driven funding structure accounts for 82% of liabilities, reducing risk exposure compared to external borrowing. The bank's earnings surged by 56% over the past year, outpacing the industry average of 15%, while maintaining a favorable price-to-earnings ratio at 9x against the market's 11.6x. However, shareholders experienced significant dilution recently and its allowance for bad loans remains low at 82%.

- Click here to discover the nuances of United Arab Bank P.J.S.C with our detailed analytical health report.

Assess United Arab Bank P.J.S.C's past performance with our detailed historical performance reports.

Aksigorta (IBSE:AKGRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aksigorta A.S. is a Turkish company offering a range of life and non-life insurance products and services to both retail and corporate clients, with a market capitalization of TRY11.04 billion.

Operations: Aksigorta generates revenue primarily through its life and non-life insurance products and services offered to retail and corporate clients in Turkey. The company's financial performance is influenced by its ability to manage underwriting costs, claims expenses, and investment income. Net profit margin trends provide insights into the company's profitability efficiency over time.

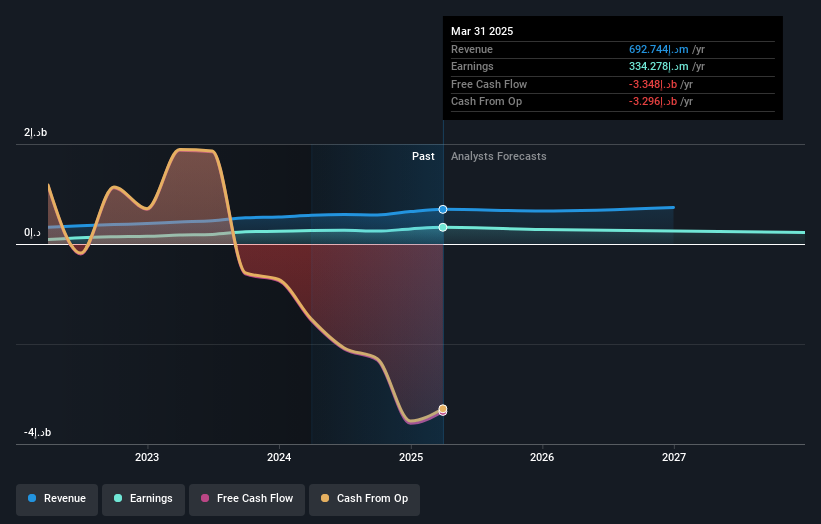

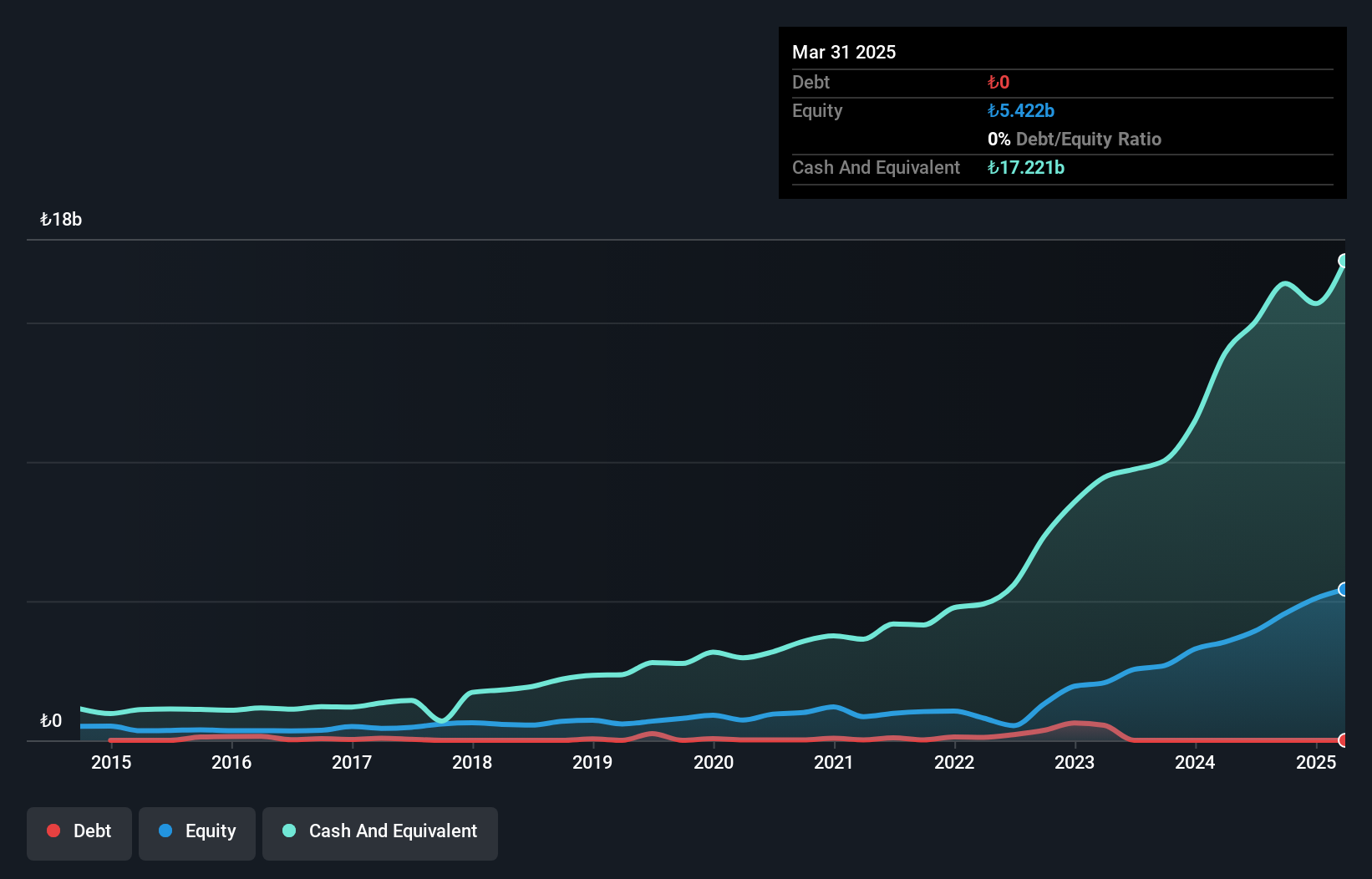

Aksigorta, a notable player in the insurance sector, has demonstrated solid financial health with earnings growing at 49.6% annually over the past five years. The company reported a net income of TRY 824.95 million for Q3 2025, up from TRY 554.97 million the previous year, and TRY 2,034.77 million for nine months compared to TRY 1,163.33 million last year. Aksigorta is debt-free now versus a debt-to-equity ratio of 1.3% five years ago and boasts high-quality earnings alongside positive free cash flow trends, making it an attractive option in its market segment with a price-to-earnings ratio of just 4.2x against the TR market's average of 17.7x.

- Unlock comprehensive insights into our analysis of Aksigorta stock in this health report.

Explore historical data to track Aksigorta's performance over time in our Past section.

Yayla Agro Gida Sanayi ve Ticaret (IBSE:YYLGD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yayla Agro Gida Sanayi ve Ticaret A.S. is engaged in the production and sale of various food and grain products both within Turkey and internationally, with a market capitalization of TRY11.46 billion.

Operations: Yayla Agro's primary revenue stream is its food business, generating TRY15.09 billion.

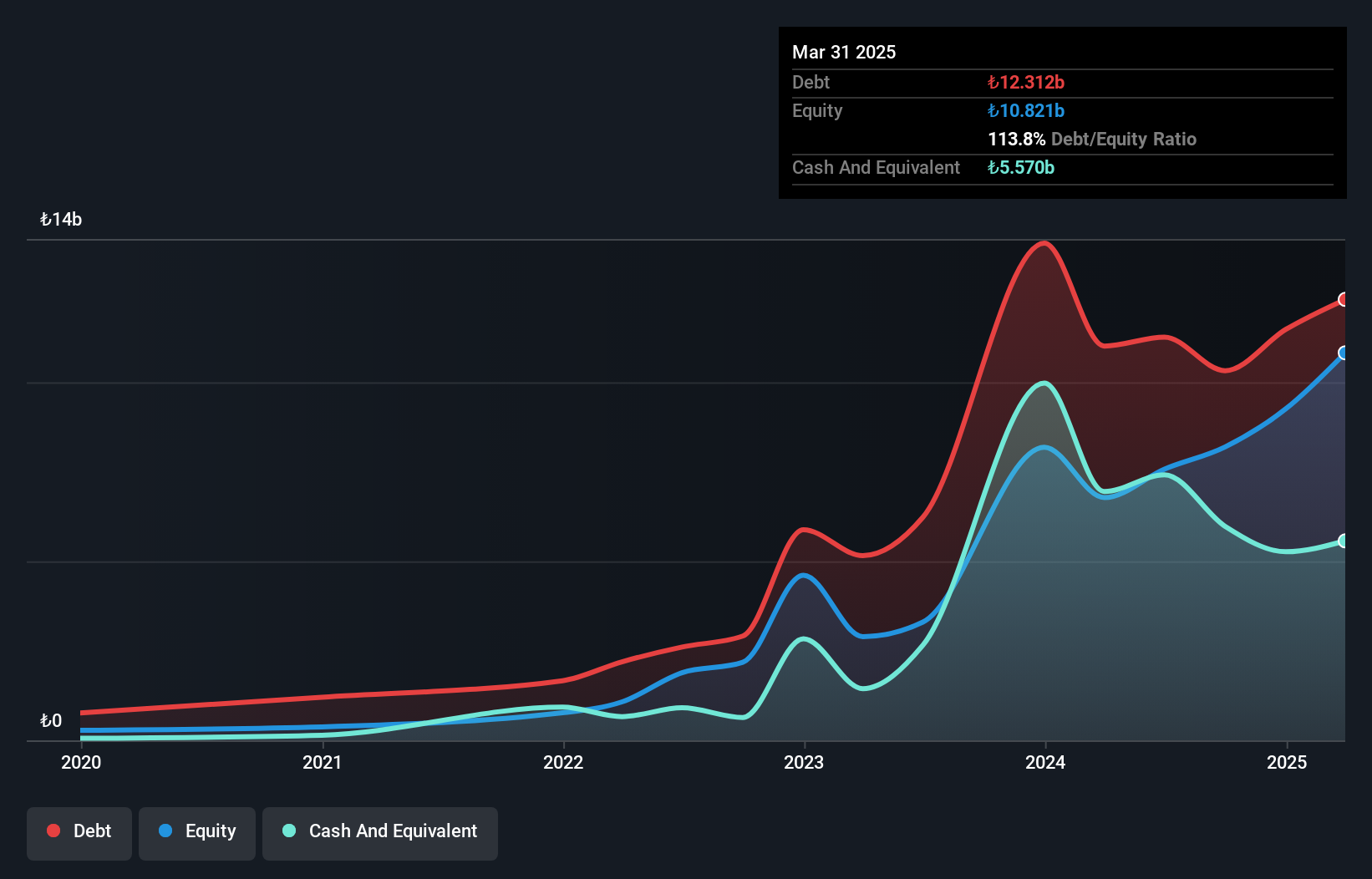

Yayla Agro, a notable player in the food industry, has shown impressive earnings growth of 43.8% over the past year, outpacing the industry's -3.1%. Despite this growth, its net debt to equity ratio remains high at 49.3%, which is above the comfortable threshold of 40%. The company's price-to-earnings ratio stands at 14.9x, lower than the TR market average of 17.7x, suggesting potential undervaluation. Recent earnings announcements revealed a net loss of TRY 84.69 million for Q3 compared to a profit last year; however, nine-month sales rose significantly from TRY 10.79 billion to TRY 14 billion.

Make It Happen

- Click here to access our complete index of 193 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YYLGD

Yayla Agro Gida Sanayi ve Ticaret

Produces and sells various food and grains in Turkey and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives