- Turkey

- /

- Renewable Energy

- /

- IBSE:LYDYE

Exploring Three Undiscovered Middle East Gems With Promising Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently shown mixed performances, with Gulf bourses fluctuating ahead of the U.S. Federal Reserve's policy meeting and Egypt's stocks experiencing a rally. In this dynamic environment, identifying promising stocks requires a keen understanding of market trends and economic indicators that can reveal hidden opportunities amidst broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

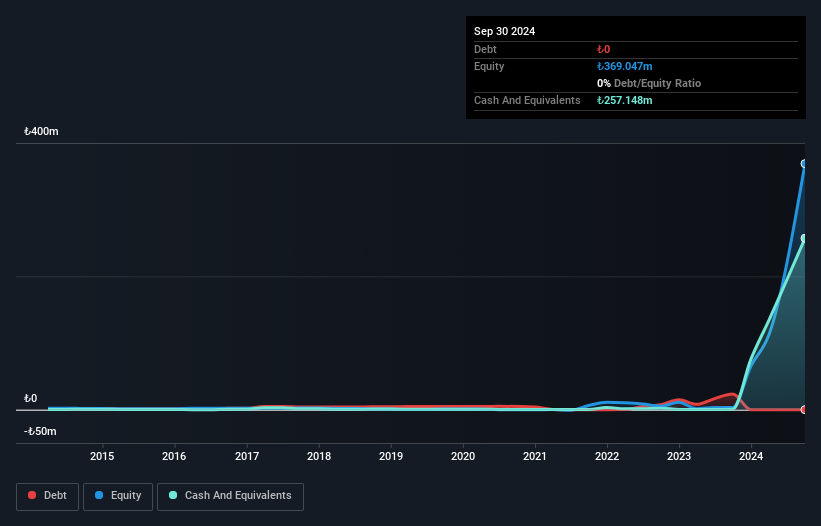

Borusan Yatirim ve Pazarlama (IBSE:BRYAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Borusan Yatirim ve Pazarlama A.S. operates by investing in companies across the industrial, commercial, and service sectors, with a market capitalization of TRY68.77 billion.

Operations: Borusan Yatirim ve Pazarlama generates revenue through its investments in companies within the industrial, commercial, and service sectors. The company focuses on optimizing its investment portfolio to enhance financial performance.

Borusan Yatirim, a nimble player in the financial sector, showcases an intriguing profile. It stands debt-free now, a stark contrast to five years ago when its debt-to-equity ratio was 0.8%. Earnings have been robust, growing at 44.4% annually over the past five years, though last year's growth of 18.2% lagged behind industry peers at 27%. Recent earnings reports highlight a net income of TRY413 million for Q2 and TRY769 million for six months ending June 2025, reflecting steady growth from previous periods. Despite limited revenue (TRY90M), its high-quality earnings and profitability paint a promising picture.

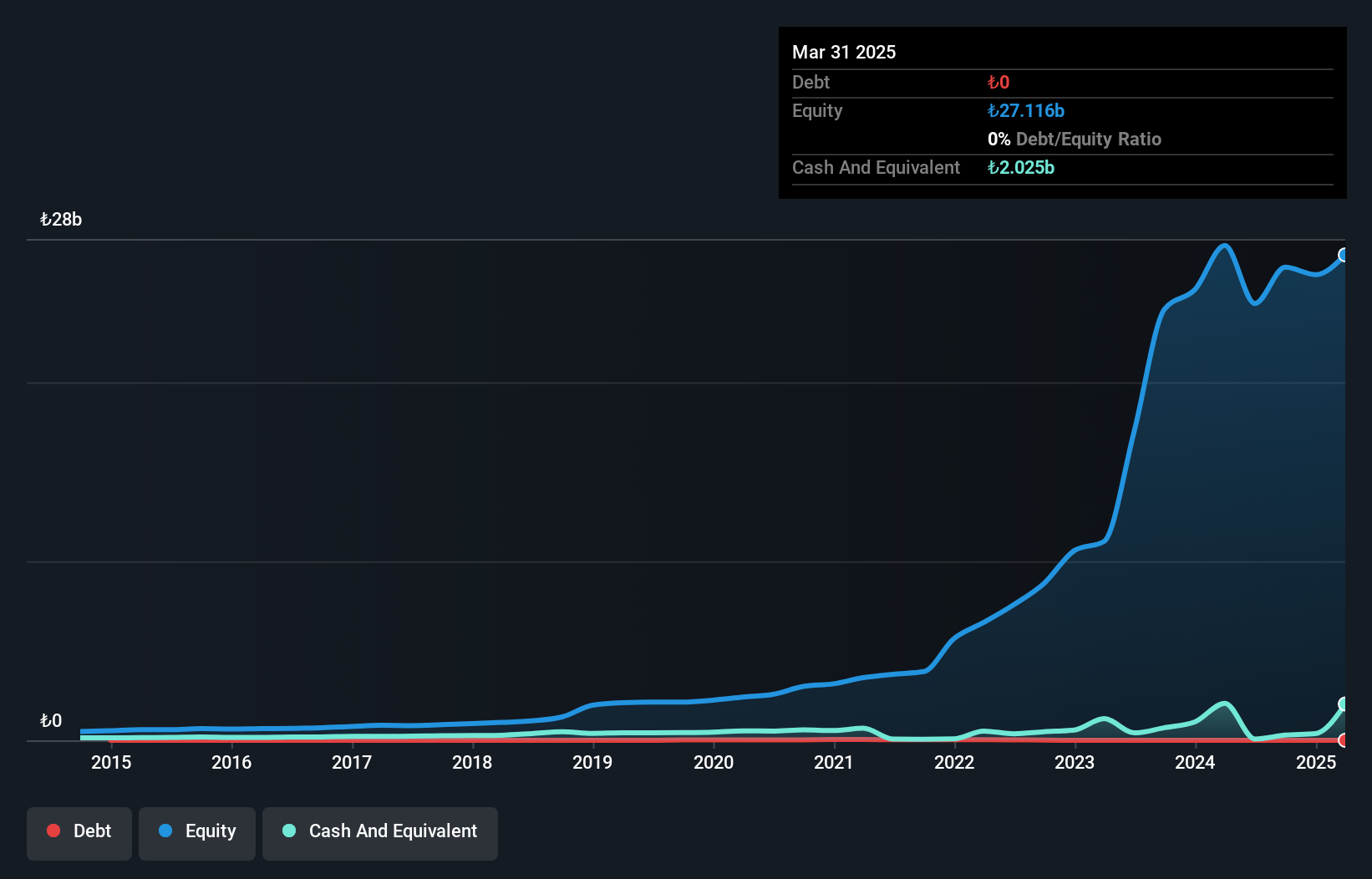

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lydia Yesil Enerji Kaynaklari A.S. operates in Turkey, focusing on the production and sale of electricity and heat energy, with a market capitalization of TRY24.59 billion.

Operations: Lydia Yesil Enerji generates revenue primarily from the production and sale of electricity and heat energy. The company has a market capitalization of TRY24.59 billion.

Lydia Yesil Enerji Kaynaklari, a relatively small player in the energy sector, has shown remarkable financial performance recently. Its earnings skyrocketed by 714% over the past year, significantly outpacing the food industry's -32% performance. The company reported net income of TRY 217 million for Q2 2025, a substantial increase from TRY 76 million in the same period last year. Despite being debt-free and trading at nearly 8% below its estimated fair value, it faces challenges with shareholder dilution over the past year and lacks meaningful revenue at TRY 71 million. Nonetheless, LYDYE remains profitable with positive free cash flow.

- Get an in-depth perspective on Lydia Yesil Enerji Kaynaklari's performance by reading our health report here.

Understand Lydia Yesil Enerji Kaynaklari's track record by examining our Past report.

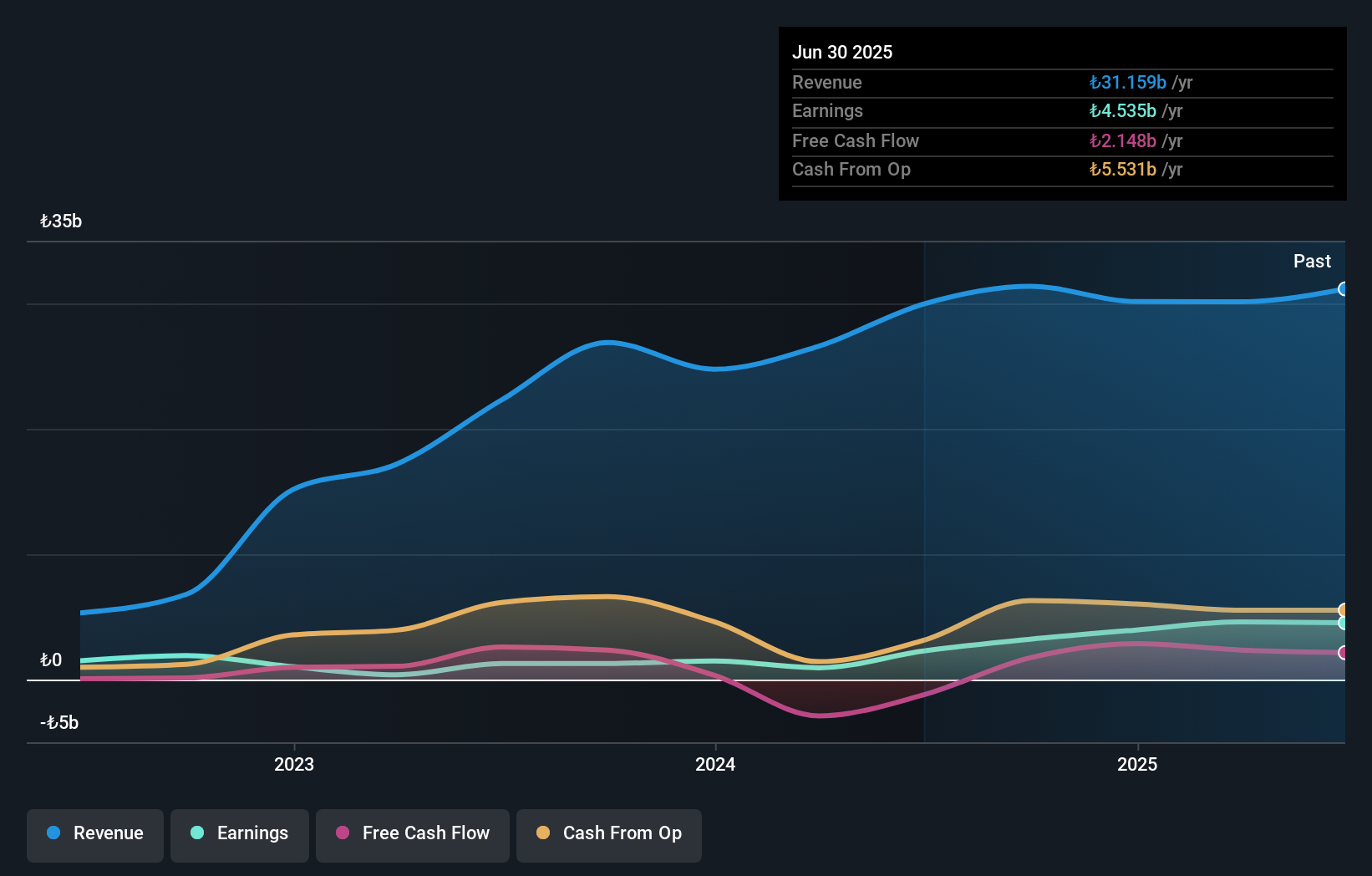

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is involved in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market capitalization of TRY56.92 billion.

Operations: Türk Tuborg derives its revenue primarily from the sale of alcoholic beverages, amounting to TRY31.16 billion. The company's gross profit margin is notable at 60%.

Türk Tuborg, a notable player in the beverage sector, showcases robust financial health with earnings growth of 98.7% over the past year, outpacing industry averages. Its debt-to-equity ratio has improved significantly from 37.3% to 16.6% over five years, indicating prudent financial management. The company reported sales of TRY 11.47 billion for Q2 2025 and net income of TRY 2.53 billion, reflecting stable performance despite a slight dip in net income compared to last year’s same quarter (TRY 2.60 billion). With a price-to-earnings ratio at an attractive level of 12.6x against the market's 22.5x, Türk Tuborg represents an intriguing investment opportunity within its industry context.

- Click here to discover the nuances of Türk Tuborg Bira ve Malt Sanayii with our detailed analytical health report.

Learn about Türk Tuborg Bira ve Malt Sanayii's historical performance.

Where To Now?

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 198 more companies for you to explore.Click here to unveil our expertly curated list of 201 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LYDYE

Lydia Yesil Enerji Kaynaklari

Engages in the production and sale of electricity and heat energy in Turkey.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives