3 Global Stocks Estimated To Be Up To 47.7% Below Intrinsic Value

Reviewed by Simply Wall St

Amid fluctuating global markets, with U.S. stocks showing mixed results and European indices reflecting concerns over Middle Eastern tensions, investors are navigating an environment marked by steady interest rates and economic uncertainty. In such a scenario, identifying undervalued stocks—those trading below their intrinsic value—can present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.20 | CN¥76.03 | 49.8% |

| Shenzhen Techwinsemi Technology (SZSE:001309) | CN¥127.30 | CN¥251.73 | 49.4% |

| Selvita (WSE:SLV) | PLN28.70 | PLN56.89 | 49.6% |

| PixArt Imaging (TPEX:3227) | NT$220.50 | NT$436.57 | 49.5% |

| Peijia Medical (SEHK:9996) | HK$6.36 | HK$12.71 | 49.9% |

| Lingotes Especiales (BME:LGT) | €6.00 | €11.87 | 49.4% |

| Galderma Group (SWX:GALD) | CHF111.30 | CHF221.71 | 49.8% |

| Everest Medicines (SEHK:1952) | HK$54.20 | HK$107.07 | 49.4% |

| Claranova (ENXTPA:CLA) | €2.68 | €5.30 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK209.00 | SEK415.74 | 49.7% |

Let's uncover some gems from our specialized screener.

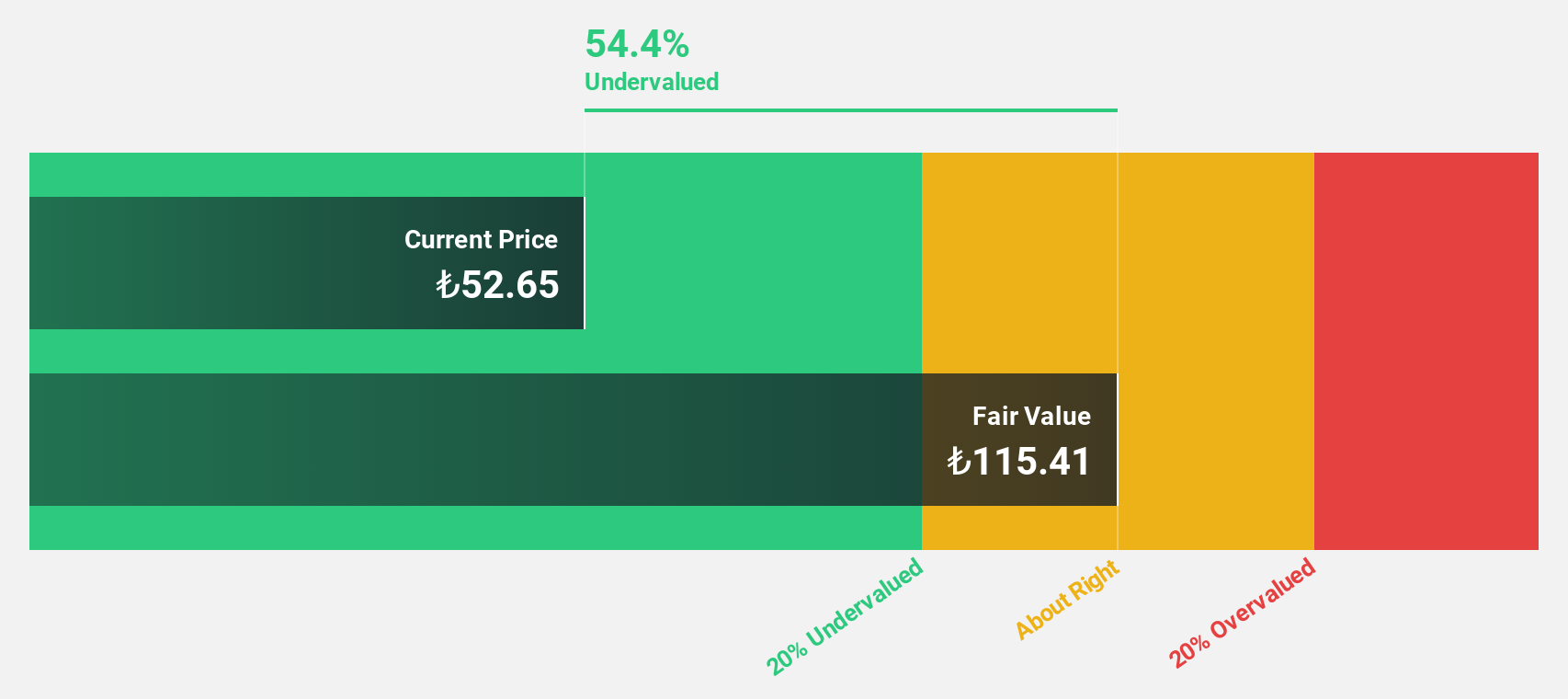

Coca-Cola Içecek Anonim Sirketi (IBSE:CCOLA)

Overview: Coca-Cola Içecek Anonim Sirketi, along with its subsidiaries, is involved in the production, sales, and distribution of both sparkling and still beverages across Turkey, Pakistan, Central Asia, and the Middle East with a market cap of TRY137.39 billion.

Operations: The company's revenue from non-alcoholic beverages amounts to TRY136.24 billion.

Estimated Discount To Fair Value: 47.6%

Coca-Cola Içecek Anonim Sirketi, trading at TRY49.1, is significantly undervalued with a fair value estimate of TRY93.72. Despite challenges like lower profit margins and interest coverage issues, its revenue growth forecast of 24.6% annually outpaces the Turkish market average. Analysts anticipate a 63.2% stock price increase, though earnings are expected to grow slower than the market at 26.5%. Recent Q1 results showed decreased net income and sales compared to last year.

- The growth report we've compiled suggests that Coca-Cola Içecek Anonim Sirketi's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Coca-Cola Içecek Anonim Sirketi.

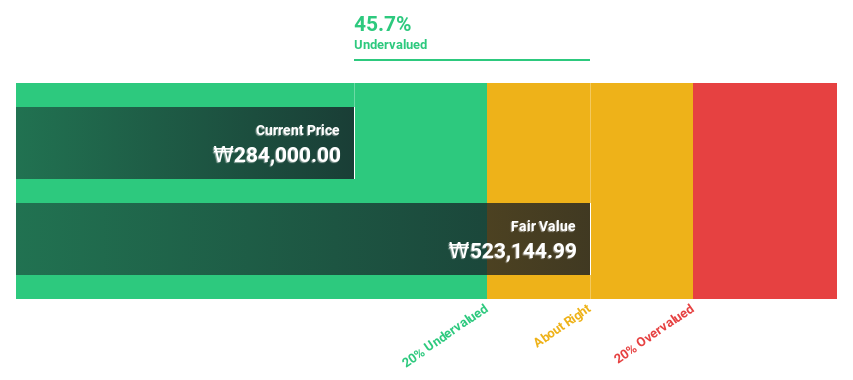

Doosan (KOSE:A000150)

Overview: Doosan Corporation operates in power generation facilities, industrial facilities, construction machinery, engines, and construction sectors across Korea and internationally, with a market cap of ₩10.84 billion.

Operations: Doosan Corporation's revenue is derived from its operations in power generation facilities, industrial facilities, construction machinery, engines, and construction sectors across various regions including Korea, the United States, Asia, the Middle East, and Europe.

Estimated Discount To Fair Value: 43.2%

Doosan Corporation is trading at ₩672,000, significantly undervalued with a fair value estimate of ₩1,182,623.73. Recent Q1 results showed net income surged to ₩23.65 billion from the previous year's ₩4.98 billion despite slightly lower sales. Earnings are projected to grow rapidly at 69.31% annually over the next few years while revenue growth is expected to outpace the Korean market average of 4.9%. However, share price volatility remains high.

- The analysis detailed in our Doosan growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Doosan stock in this financial health report.

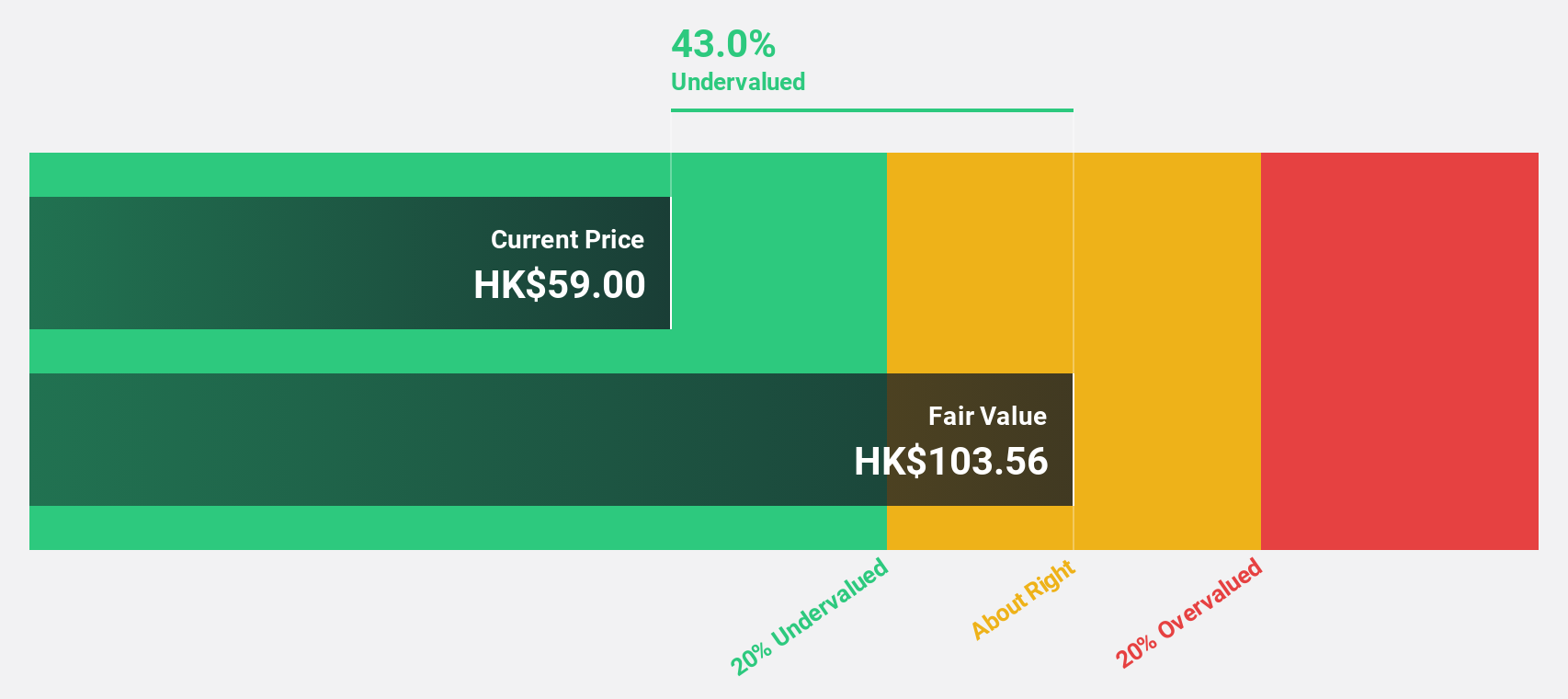

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that designs, develops, and manufactures skin treatment products featuring recombinant collagen in the People’s Republic of China, with a market cap of HK$57.06 billion.

Operations: The company's revenue primarily stems from the research, development, manufacture, and sale of bioactive material-based beauty and health products, generating CN¥5.54 billion.

Estimated Discount To Fair Value: 47.7%

Giant Biogene Holding is trading at HK$53.9, significantly below its estimated fair value of HK$103.01, suggesting substantial undervaluation based on discounted cash flow analysis. Recent earnings reported a robust increase in net income to CNY 2.06 billion from CNY 1.45 billion year-over-year, with revenue growth forecasted to outpace the Hong Kong market at 18.7% annually. The company also announced special and final dividends for shareholders, enhancing its appeal despite insider selling concerns earlier this year.

- Our comprehensive growth report raises the possibility that Giant Biogene Holding is poised for substantial financial growth.

- Get an in-depth perspective on Giant Biogene Holding's balance sheet by reading our health report here.

Key Takeaways

- Dive into all 498 of the Undervalued Global Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:CCOLA

Coca-Cola Içecek Anonim Sirketi

Engages in the production, sales, and distribution sparkling and still beverages in Turkey, Pakistan, Central Asia, and the Middle East.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives