The Middle Eastern stock markets have recently shown robust performance, with Saudi Arabia's bourse leading the way following a temporary pause on U.S. tariffs. For investors looking beyond the well-known giants, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment due to their potential for growth and affordability. Despite being considered an outdated term, penny stocks continue to offer opportunities for those seeking value in lesser-known companies with strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.96 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.86 | SAR463.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.378 | ₪164.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.923 | ₪2.87B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.189 | ₪162.74M | ✅ 1 ⚠️ 2 View Analysis > |

| Union Properties (DFM:UPP) | AED0.522 | AED2.23B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.739 | AED449.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Ansari Financial Services PJSC (DFM:ALANSARI) | AED0.979 | AED7.34B | ✅ 2 ⚠️ 0 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED0.99 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.41 | AED10.25B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

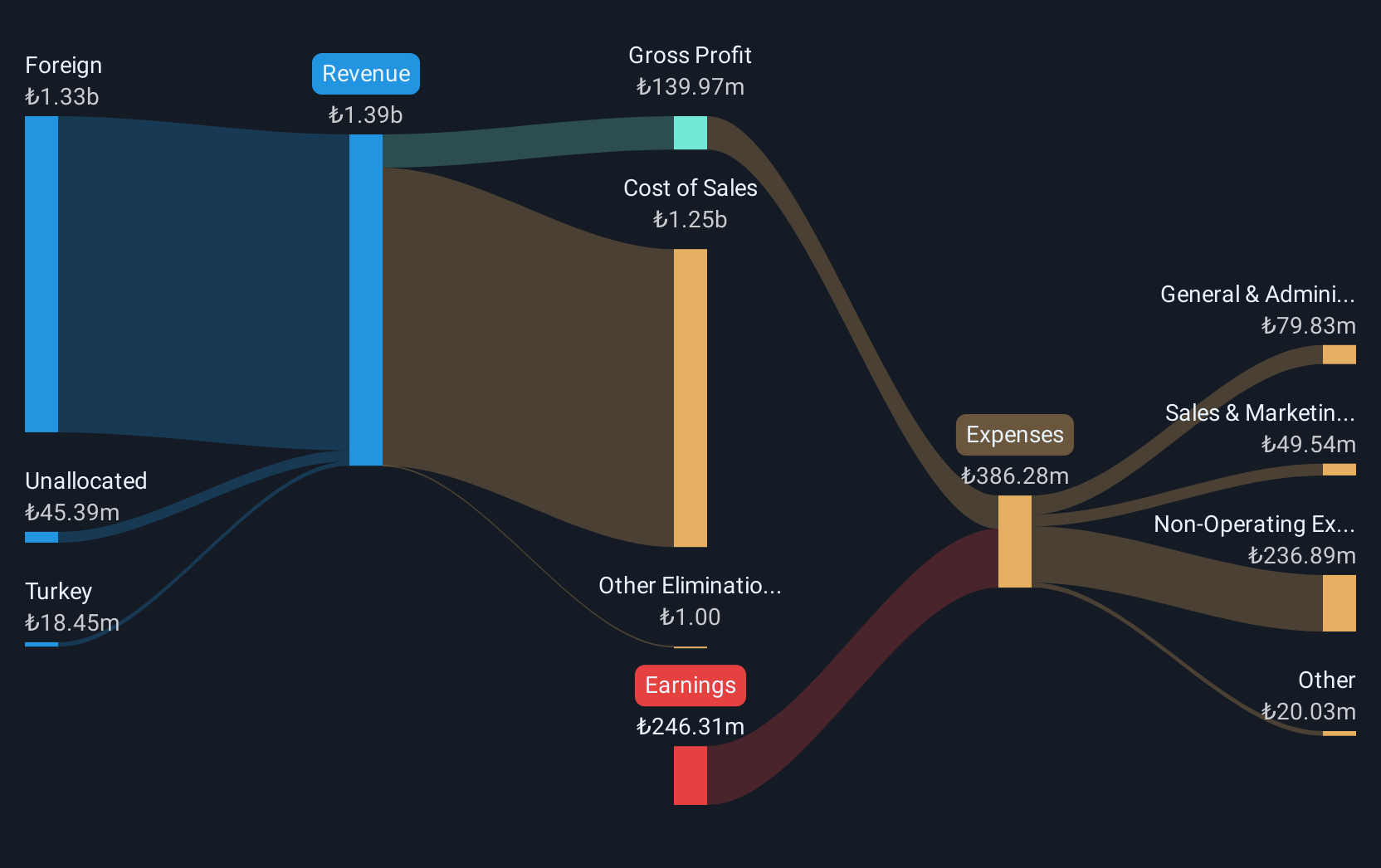

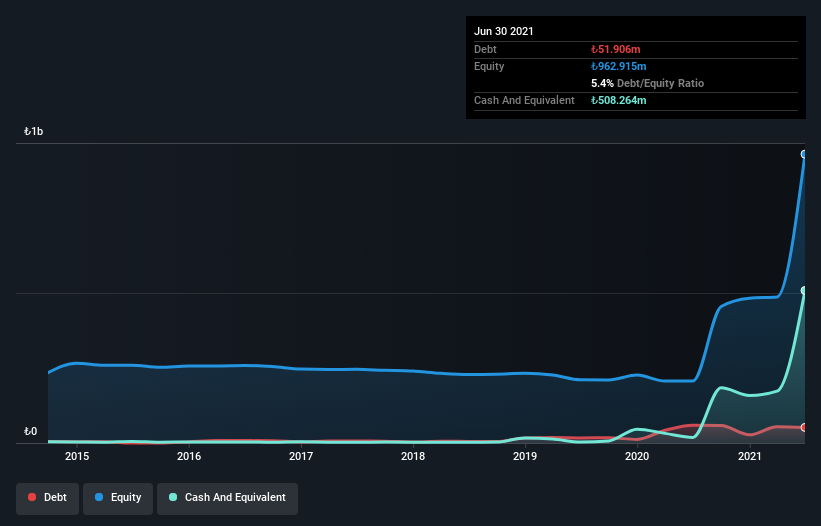

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market cap of TRY696.60 million.

Operations: The company generates revenue of TRY1.41 billion from its food activities segment.

Market Cap: TRY696.6M

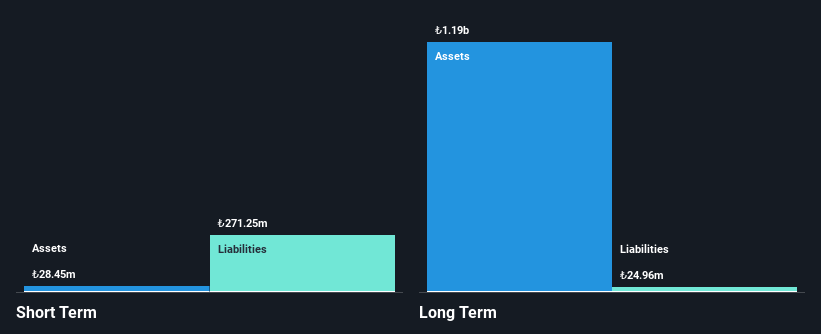

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, operating within Turkey's food sector, reported a revenue of TRY1.41 billion but faced a net loss of TRY289.02 million for 2024. Despite high debt levels with a net debt to equity ratio of 48.5%, the company maintains sufficient short-term assets (TRY1.3 billion) to cover both short and long-term liabilities. While unprofitable, A.V.O.D has not diluted shareholders recently and possesses a cash runway exceeding three years due to positive free cash flow, though earnings have significantly declined over recent years.

- Click to explore a detailed breakdown of our findings in A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's financial health report.

- Evaluate A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's historical performance by accessing our past performance report.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Yayin Holding A.S. operates in the media, publishing, and advertising sectors in Turkey through its subsidiaries, with a market cap of TRY981 million.

Operations: The company's revenue is primarily derived from its Journalism and Printing Works segment, which generated TRY1.77 billion, followed by News Agencies at TRY389.08 million and TV Services and Other at TRY318.35 million.

Market Cap: TRY981M

Ihlas Yayin Holding A.S. operates in the Turkish media sector with significant revenue from its Journalism and Printing Works segment, totaling TRY1.77 billion. Despite a net loss of TRY227.23 million in 2024, this marks an improvement from the previous year's larger loss. The company has managed to reduce its debt to equity ratio significantly over five years, now at 0.9%, and maintains more cash than total debt, suggesting financial prudence despite unprofitability. However, Ihlas Yayin faces challenges with high share price volatility and insufficient short-term assets to cover long-term liabilities fully.

- Unlock comprehensive insights into our analysis of Ihlas Yayin Holding stock in this financial health report.

- Learn about Ihlas Yayin Holding's historical performance here.

Metro Ticari ve Mali Yatirimlar Holding (IBSE:METRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metro Ticari ve Mali Yatirimlar Holding A.S. operates as a holding company with diverse investments in various sectors and has a market cap of TRY1.31 billion.

Operations: The company generates its revenue from the Transportation - Railroads segment, amounting to TRY28.73 million.

Market Cap: TRY1.31B

Metro Ticari ve Mali Yatirimlar Holding A.S. has a market cap of TRY1.31 billion and reported revenue of TRY28.73 million for 2024, indicating it is pre-revenue as its earnings are below US$1 million. The company remains unprofitable with a net loss of TRY1,085.84 million, although this is an improvement from the previous year’s larger loss. While debt-free and possessing sufficient cash runway for over three years at current free cash flow levels, Metro's short-term assets exceed its liabilities but do not cover long-term obligations fully. Its board is experienced with an average tenure of 4.8 years.

- Dive into the specifics of Metro Ticari ve Mali Yatirimlar Holding here with our thorough balance sheet health report.

- Examine Metro Ticari ve Mali Yatirimlar Holding's past performance report to understand how it has performed in prior years.

Where To Now?

- Discover the full array of 98 Middle Eastern Penny Stocks right here.

- Searching for a Fresh Perspective? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AVOD

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi

Provides dried vegetables and derivatives, and vegetable based convenience foods under the Farmer`s Choice brand name in Turkey.

Excellent balance sheet and good value.

Market Insights

Community Narratives