A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi And 2 Other Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently shown mixed performance, influenced by global geopolitical developments and economic policies. For investors looking to explore beyond the well-known giants, penny stocks can offer intriguing possibilities. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to present opportunities for growth and financial resilience.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.544 | ₪176.4M | ★★★★★★ |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.705 | AED407.53M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.043 | ₪3.24B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR3.94 | SAR1.58B | ★★★★★★ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.665 | ₪17.67M | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.141 | ₪159.17M | ★★★★★☆ |

| Loras Holding (IBSE:LRSHO) | TRY2.39 | TRY1.83B | ★★★★★★ |

| Tectona (TASE:TECT) | ₪3.403 | ₪78.9M | ★★★★★★ |

| Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC) | TRY1.83 | TRY512.4M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.27 | AED9.65B | ★★★★★☆ |

Click here to see the full list of 97 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market cap of TRY710.10 million.

Operations: There are no reported revenue segments for A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi.

Market Cap: TRY710.1M

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, with a market cap of TRY710.10 million, has seen its financial performance decline recently. Despite TRY1.3 billion in short-term assets exceeding both short and long-term liabilities, the company reported a net loss of TRY289.02 million for 2024 compared to a profit the previous year. While its debt-to-equity ratio has improved over five years, it remains high at 50%. The company's shares trade significantly below estimated fair value and have not been diluted recently, but profitability challenges persist amidst stable weekly volatility and an adequate cash runway exceeding three years.

- Jump into the full analysis health report here for a deeper understanding of A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi.

- Gain insights into A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's historical outcomes by reviewing our past performance report.

Metro Ticari ve Mali Yatirimlar Holding (IBSE:METRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metro Ticari ve Mali Yatirimlar Holding operates as a diversified investment company with interests in various sectors and has a market cap of TRY1.43 billion.

Operations: Metro Ticari ve Mali Yatirimlar Holding has not reported any specific revenue segments.

Market Cap: TRY1.43B

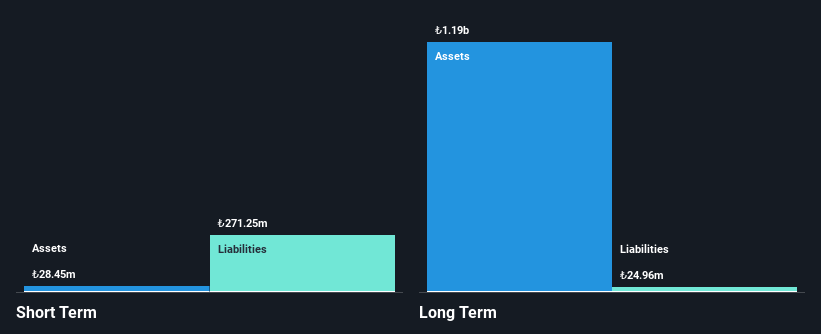

Metro Ticari ve Mali Yatirimlar Holding, with a market cap of TRY1.43 billion, reported TRY28.73 million in sales for 2024 but remains pre-revenue by international standards, given its earnings below US$1 million. Despite being debt-free and having sufficient cash runway for over three years based on current free cash flow, the company faces significant financial challenges with a net loss of TRY1,085.84 million for the year. Short-term assets cover short-term liabilities but fall short against long-term obligations. The board is experienced with an average tenure of 4.7 years, yet profitability issues persist amidst stable weekly volatility.

- Take a closer look at Metro Ticari ve Mali Yatirimlar Holding's potential here in our financial health report.

- Explore historical data to track Metro Ticari ve Mali Yatirimlar Holding's performance over time in our past results report.

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret (IBSE:QUAGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret operates in the manufacturing and sale of granite products, with a market capitalization of TRY10.22 billion.

Operations: QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret has not reported any specific revenue segments.

Market Cap: TRY10.22B

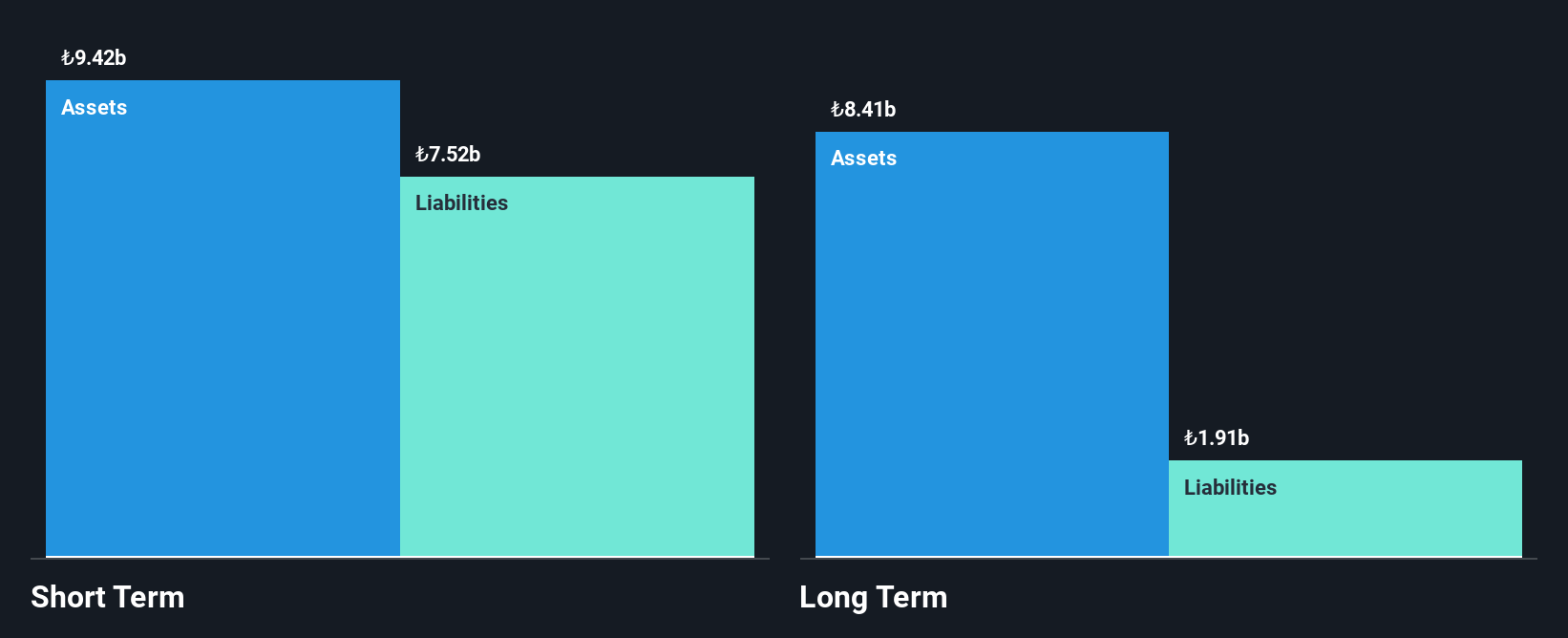

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret, with a market cap of TRY10.22 billion, reported TRY8.14 billion in sales for 2024 but faced a net loss of TRY2.99 billion, highlighting profitability challenges despite stable weekly volatility. The company has a high net debt to equity ratio of 40.2%, and its interest payments are not well covered by EBIT, though operating cash flow covers debt adequately at 21.1%. Short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst increasing losses over the past five years at an annual rate of 28.7%.

- Navigate through the intricacies of QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret with our comprehensive balance sheet health report here.

- Examine QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret's past performance report to understand how it has performed in prior years.

Taking Advantage

- Unlock our comprehensive list of 97 Middle Eastern Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:QUAGR

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret

QUA Granite Hayal Yapi ve Ürünleri Sanayi Ticaret A.S.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives