As Gulf markets show signs of recovery with easing trade tensions, the Middle East's stock landscape is gaining renewed attention, despite Saudi Arabia's recent dip due to weak earnings and declining oil prices. In this dynamic environment, identifying promising stocks involves looking for companies that can navigate both regional economic shifts and global market influences effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 17.77% | -1.63% | -0.93% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

GRAINTURK Holding (IBSE:GRTHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GRAINTURK Holding (IBSE:GRTHO) is engaged in the agricultural commodity trade both domestically and internationally, with a market capitalization of TRY36.88 billion.

Operations: Grainturk generates revenue primarily from trade, amounting to TRY4.19 billion, with a smaller contribution from warehousing services at TRY70.63 million. The company's financial performance is influenced by its net profit margin trend, which reflects the efficiency of its operations and cost management strategies over time.

GRAINTURK Holding, a notable player in its sector, has demonstrated robust financial performance with sales reaching TRY 3.48 billion and net income of TRY 833.62 million for the year ending December 2024. The company's earnings growth of 13% outpaced the Consumer Retailing industry, which saw a downturn of over 50%. Despite experiencing high share price volatility recently, GRAINTURK maintains a satisfactory net debt to equity ratio at just 6%, indicating prudent financial management. With high-quality earnings and positive free cash flow, it seems well-positioned for continued stability amidst market fluctuations.

Reysas Tasimacilik ve Lojistik Ticaret (IBSE:RYSAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reysas Tasimacilik ve Lojistik Ticaret A.S. is a diversified logistics and transportation company with operations spanning various sectors, including real estate rental and vehicle inspection services, and it has a market capitalization of TRY30.60 billion.

Operations: RYSAS generates revenue primarily from transportation storage logistics services (TRY5.77 billion) and real estate rental activities (TRY4.43 billion), with additional contributions from vehicle inspection services (TRY1.19 billion) and hotel management (TRY245.84 million).

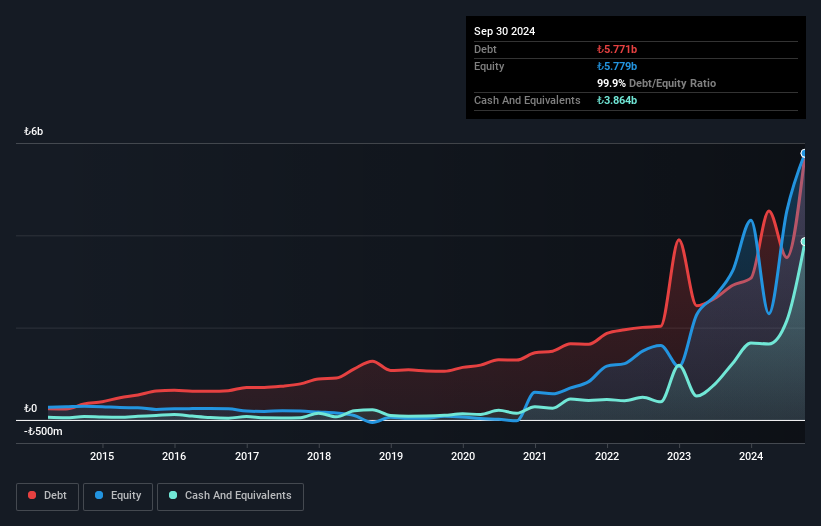

Reysas Tasimacilik ve Lojistik Ticaret, a logistics player in the Middle East, has shown impressive financial resilience. Over the past year, earnings surged by 30%, outpacing the industry’s 11% growth rate. The company reported sales of TRY 11.55 billion for 2024, up from TRY 9.67 billion in the previous year, while net income rose to TRY 1.39 billion from TRY 1.07 billion. With its debt-to-equity ratio significantly reduced from an alarming 1796% to a manageable 56% over five years and interest payments well-covered at four times by EBIT, Reysas seems poised for stable operations despite not yet generating positive free cash flow.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market cap of TRY54.50 billion.

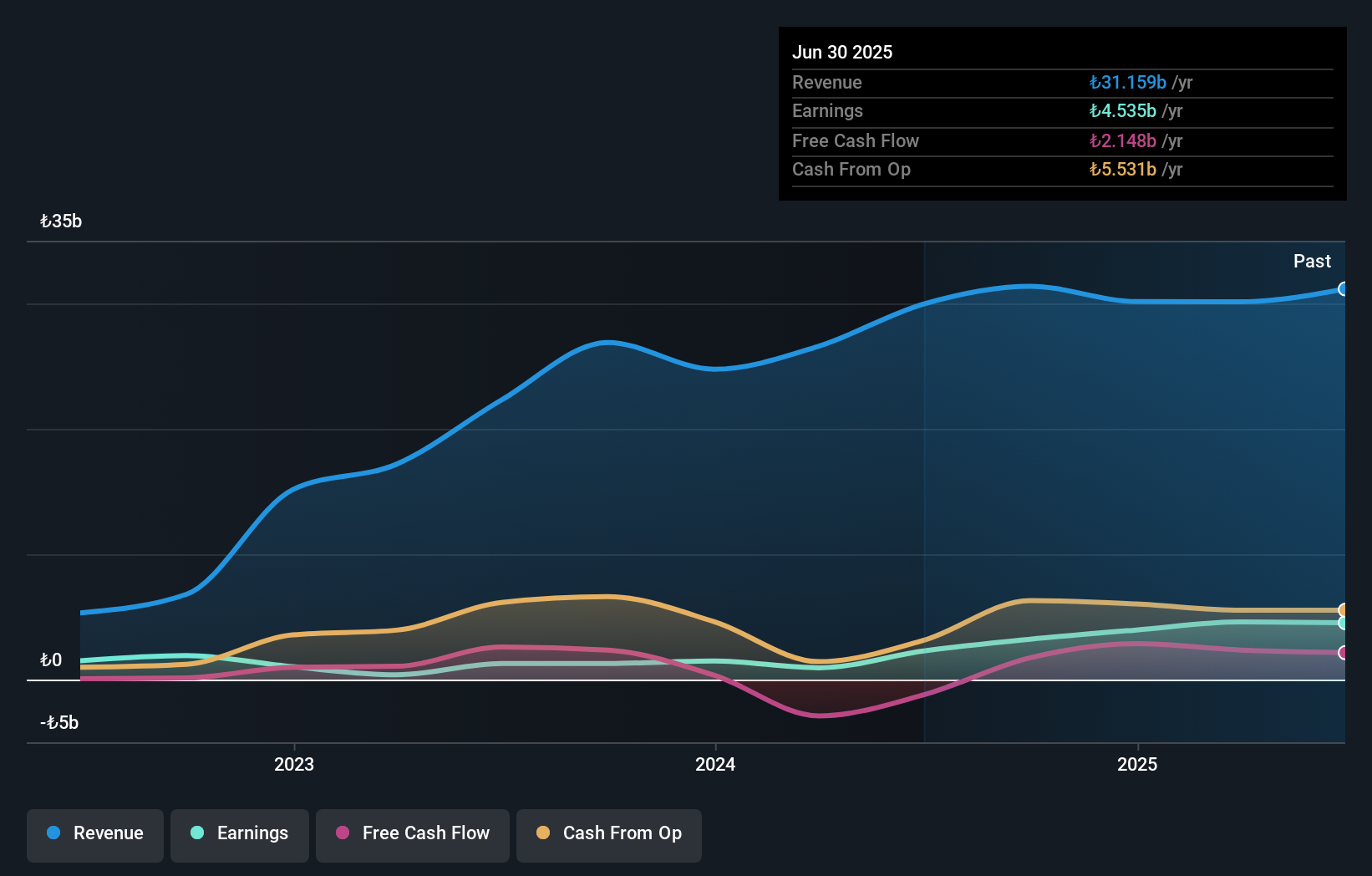

Operations: Türk Tuborg's primary revenue stream is from alcoholic beverages, generating TRY30.15 billion. The company has a market cap of TRY54.50 billion.

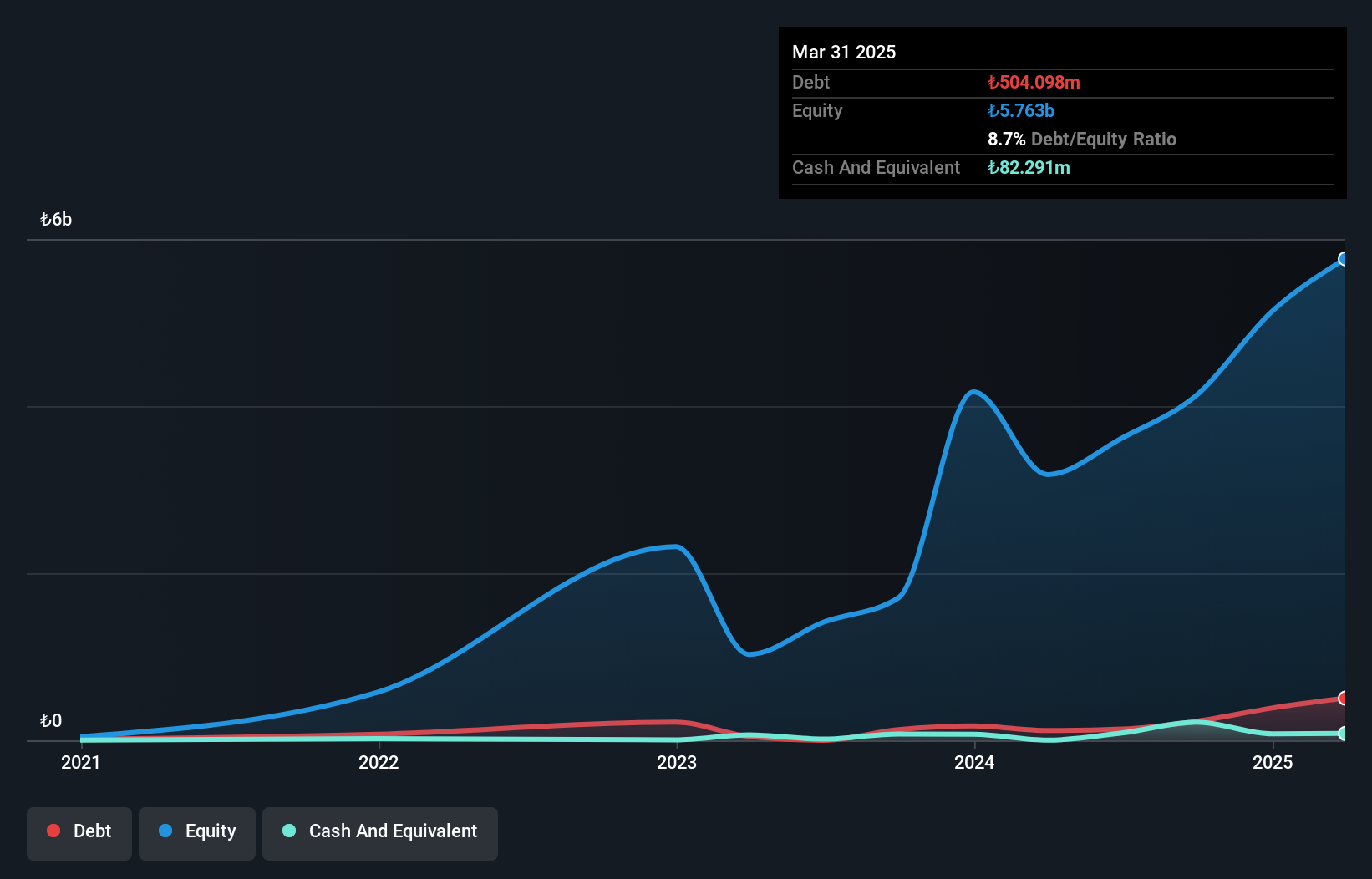

Türk Tuborg, a notable player in the Middle East beverage scene, has shown impressive financial performance. With earnings growth of 165.6% over the past year, it outpaced the industry average of 5%. The company reported sales of TRY 30.15 billion for 2024, up from TRY 24.75 billion in the previous year, while net income jumped to TRY 3.96 billion from TRY 1.49 billion a year ago. Its debt-to-equity ratio improved significantly over five years from 14.4% to just under 5%, reflecting effective debt management and positioning it as an intriguing investment opportunity with high-quality earnings and robust cash flow generation capabilities.

Where To Now?

- Gain an insight into the universe of 246 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türk Tuborg Bira ve Malt Sanayii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TBORG

Türk Tuborg Bira ve Malt Sanayii

Produces, sells, and distributes beer and malt in Turkey and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives