- Japan

- /

- Diversified Financial

- /

- TSE:8793

Exploring These 3 Undiscovered Gems For Potential Portfolio Growth

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks faced broad losses, with smaller-cap indexes like the S&P 600 particularly affected. Despite strong economic data suggesting resilience in consumer spending and job growth, investor sentiment remained wary due to decreased expectations for rate cuts in 2025 and looming government shutdown fears. In such an environment, identifying undiscovered gems—stocks that may offer potential for portfolio growth despite broader market volatility—requires careful consideration of their fundamentals, market position, and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GRAINTURK Holding (IBSE:GRTHO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grainturk Tarim Anonim Sirketi engages in agricultural commodity trading both domestically and internationally, with a market cap of TRY18.70 billion.

Operations: Grainturk Tarim Anonim Sirketi generates revenue through agricultural commodity trading on both national and international platforms. The company has a market capitalization of TRY18.70 billion.

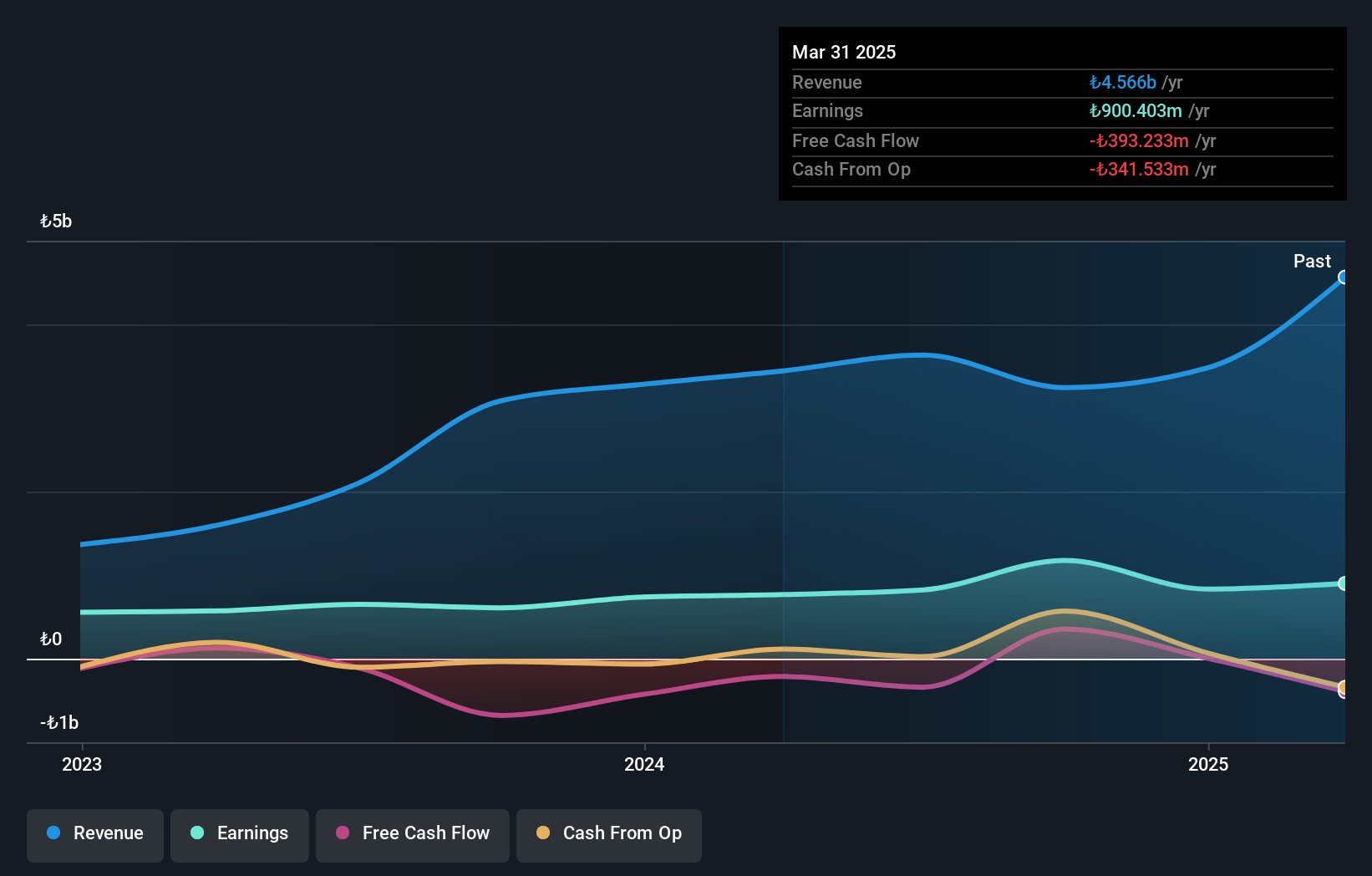

GRAINTURK Holding, a smaller player in the market, has demonstrated robust earnings growth of 51.7% over the past year, surpassing the Consumer Retailing industry's 10.5%. Despite a highly volatile share price recently, its net debt to equity ratio is a satisfactory 0.3%, indicating prudent financial management. The company's recent earnings report highlights significant gains with third-quarter net income soaring to TRY 373.54 million from TRY 21.76 million last year, though sales dipped to TRY 763.91 million from TRY 1,152.62 million previously; this suggests potential impacts from large one-off items such as a TRY251.2M gain affecting results up to September 2024.

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores both in Japan and internationally, with a market capitalization of approximately ¥218.06 billion.

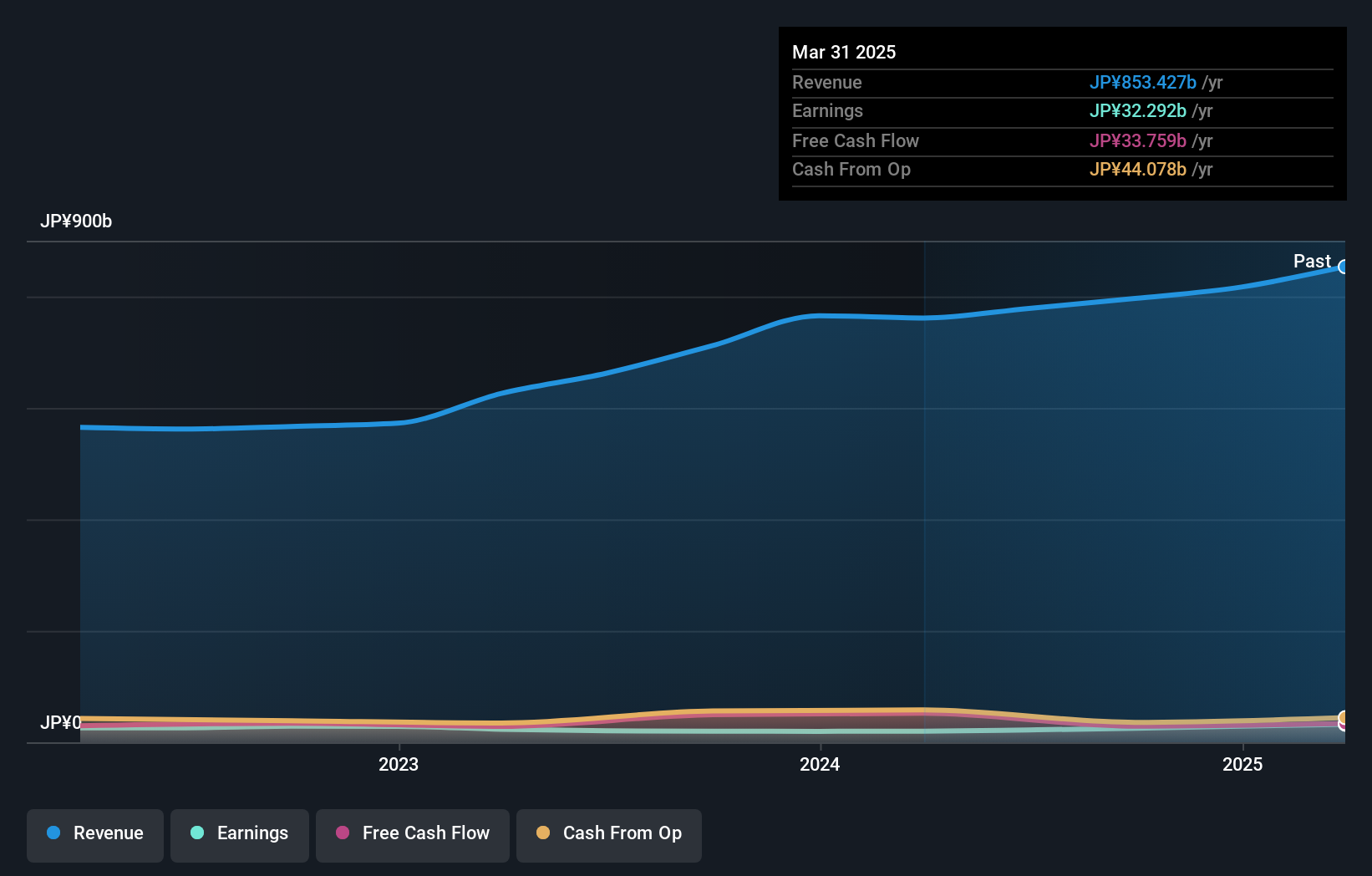

Operations: Nojima Corporation generates revenue primarily from the operation of mobile carrier stores, contributing ¥355.45 billion, and digital consumer electronics specialty shop operations, adding ¥282.52 billion. The overseas segment and internet business also contribute significantly with ¥77.95 billion and ¥67.77 billion respectively to the overall revenue stream.

Nojima, a smaller player in the retail industry, seems to be an intriguing prospect with its recent performance. The company reported a 26.5% earnings growth last year, outpacing the Specialty Retail sector's 8.2%. Its debt-to-equity ratio has significantly improved from 75.3% to 34.2% over five years, indicating prudent financial management. Trading at nearly half its estimated fair value suggests potential undervaluation in the market's eyes. Recent buybacks totaling ¥2,980 million for 1.83% of shares could signal confidence in future prospects as they expect net sales of JPY 765 billion and net income per share of JPY 216 for FY2025.

- Click to explore a detailed breakdown of our findings in Nojima's health report.

Review our historical performance report to gain insights into Nojima's's past performance.

NEC Capital Solutions (TSE:8793)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NEC Capital Solutions Limited offers financial services in Japan and has a market capitalization of approximately ¥84.22 billion.

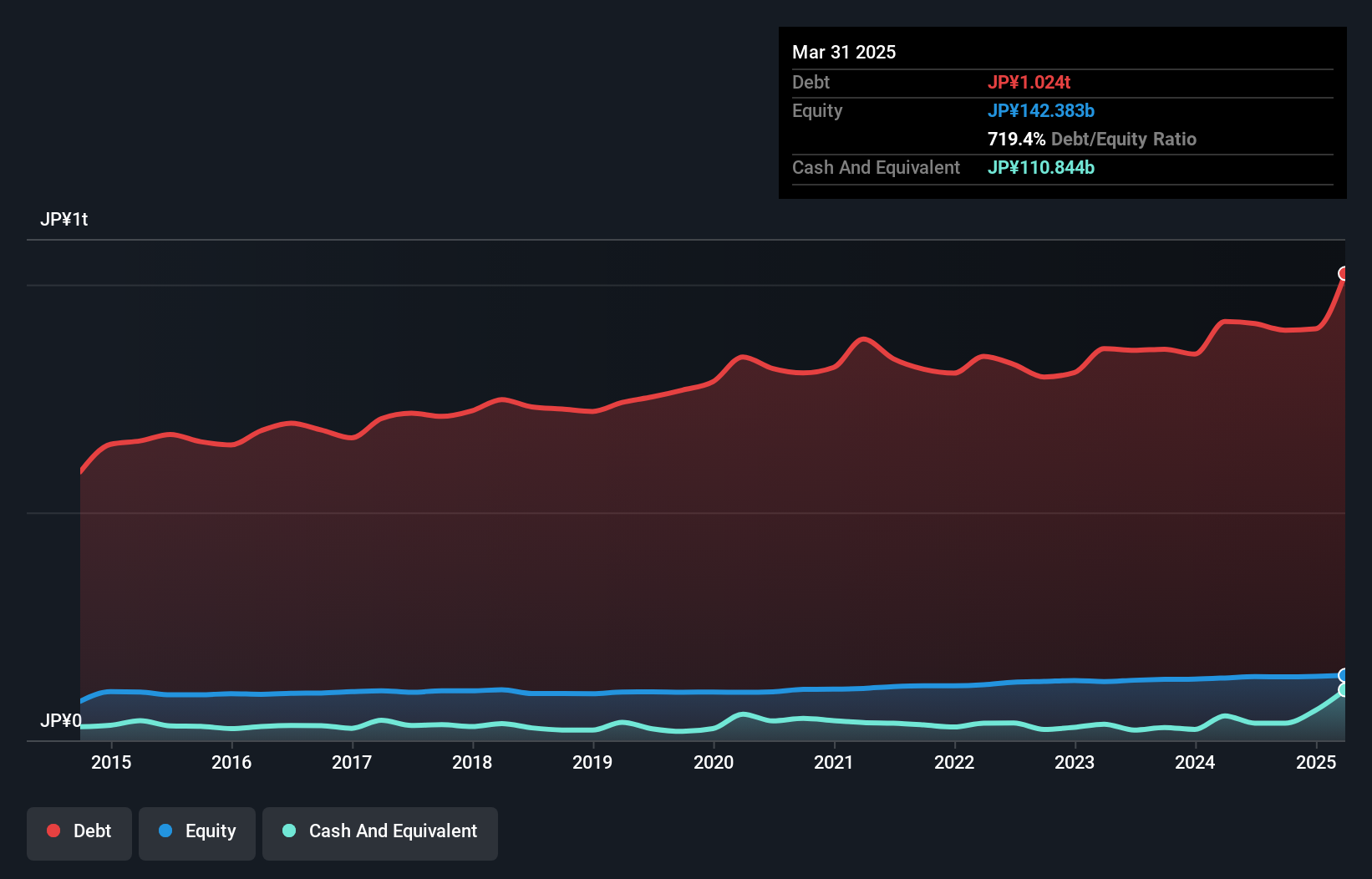

Operations: The company's primary revenue streams include the Lease Business, generating ¥229.64 billion, and the Investment Business, contributing ¥11.99 billion. The Finance Business adds ¥9.15 billion to the revenue mix, while Other Business accounts for ¥4.91 billion in income.

NEC Capital Solutions, a financial entity with a significant industry presence, has shown impressive growth with earnings surging 114.5% in the past year, outpacing the 28.6% industry benchmark. Despite trading at 37% below its estimated fair value, the company's net debt to equity ratio remains high at 619.1%, suggesting some leverage concerns. Recent strategic moves include SBI Shinsei Bank's acquisition of a 33.32% stake and a ¥28 billion fixed-income offering announced in December 2024, reflecting proactive steps to enhance capital structure and market position amidst ongoing industry dynamics.

Key Takeaways

- Click this link to deep-dive into the 4627 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC Capital Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8793

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives