As global markets respond to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely watching how policy shifts might impact growth and inflation. Amidst these dynamic conditions, dividend stocks remain a compelling option for those seeking steady income streams and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★☆ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

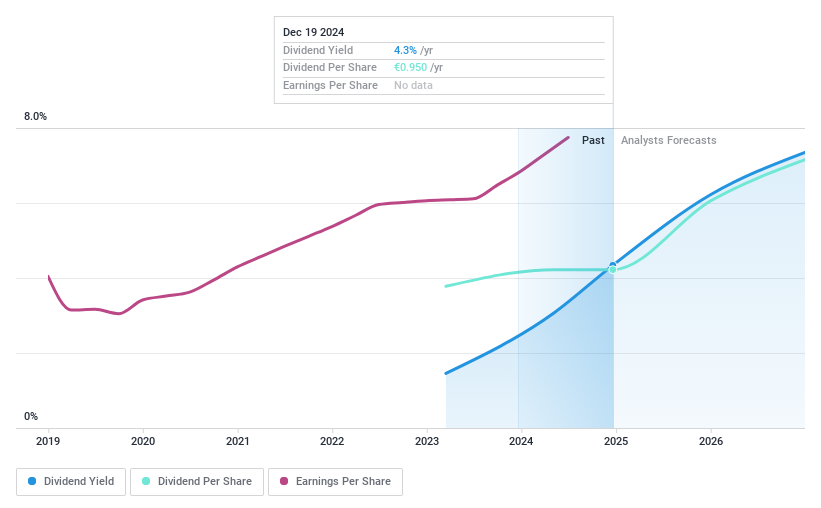

Digital Value (BIT:DGV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Digital Value S.p.A. offers IT solutions and services in Italy with a market cap of €110.74 million.

Operations: Digital Value S.p.A.'s revenue segments are not specified in the provided text.

Dividend Yield: 8.1%

Digital Value S.p.A. has shown promising growth in its dividend payments, despite only a two-year history of distributions. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 21.8% and 20.1%, respectively, indicating sustainability. Recent earnings results reveal strong performance with net income rising to €22.31 million for the half year ended June 30, 2024, supporting its position as a top-tier dividend payer in Italy's market.

- Click here and access our complete dividend analysis report to understand the dynamics of Digital Value.

- Our expertly prepared valuation report Digital Value implies its share price may be lower than expected.

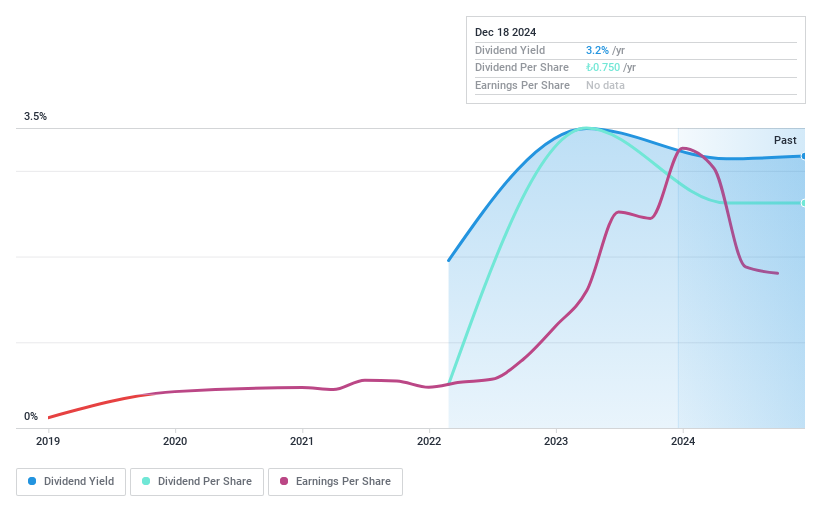

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi (IBSE:BOBET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi operates in Turkey, producing and selling ready-made concrete and aggregates under the Bosphorus Concrete brand, with a market cap of TRY7.35 billion.

Operations: Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi generates revenue through its production and sale of ready-made concrete and aggregates in Turkey.

Dividend Yield: 3.7%

Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi's dividend yield is among the top 25% in Turkey, supported by a payout ratio of 36.4% and a cash payout ratio of 30.3%, indicating sustainability despite recent earnings declines. However, its dividend history is short and volatile, with payments decreasing over 20% annually at times. Recent financials show decreased sales and net income for Q3 2024, potentially impacting future dividends' stability and reliability.

- Navigate through the intricacies of Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Bogazici Beton Sanayi Ve Ticaret Anonim Sirketi's share price might be too optimistic.

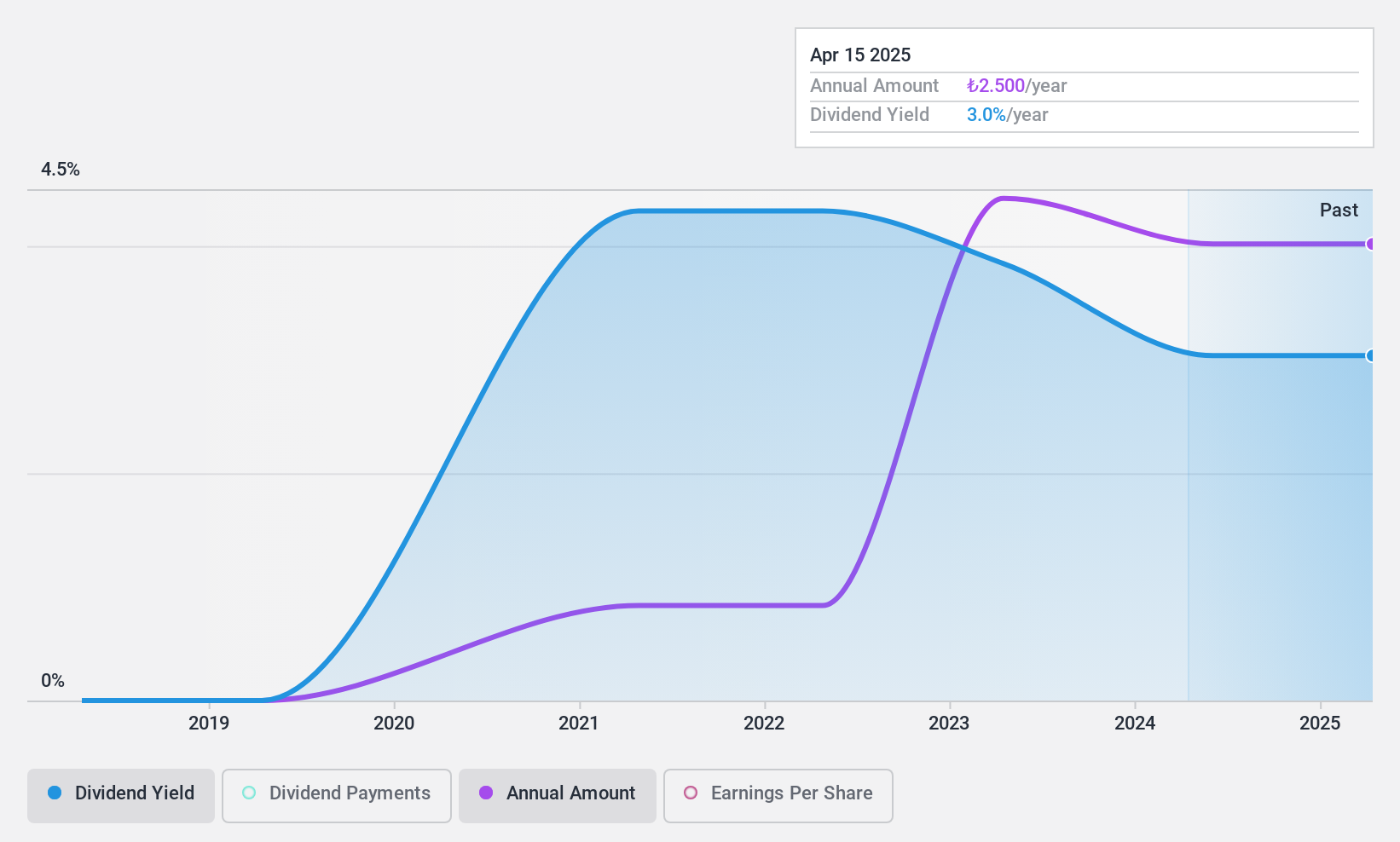

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. is a Turkish company engaged in the production and retail of luxury fashion items, with a market capitalization of TRY13.31 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri generates revenue primarily from its Apparel segment, which amounts to TRY10.44 billion.

Dividend Yield: 2.9%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's dividend yield ranks in the top 25% of Turkish dividend payers, with a low payout ratio of 24% and cash payout ratio of 19.4%, suggesting strong coverage by earnings and cash flows. Despite stable payments, its dividend history is brief at four years. Recent Q2 2024 earnings showed decreased net income to TRY 540.46 million from TRY 635.01 million, which may influence future stability.

- Click to explore a detailed breakdown of our findings in Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri shares in the market.

Seize The Opportunity

- Reveal the 1937 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DGV

Digital Value

Provides information and communication technology (ICT) solutions and services in Italy.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.