Undiscovered Gems These 3 Stocks Stand Out with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, resilient labor market data and cautious optimism about future economic policies provide a backdrop where discerning investors might find opportunities in lesser-known stocks that stand out due to their strong fundamentals and growth potential. In such an environment, identifying stocks with robust financial health and unique market positioning can be key to uncovering undiscovered gems in the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

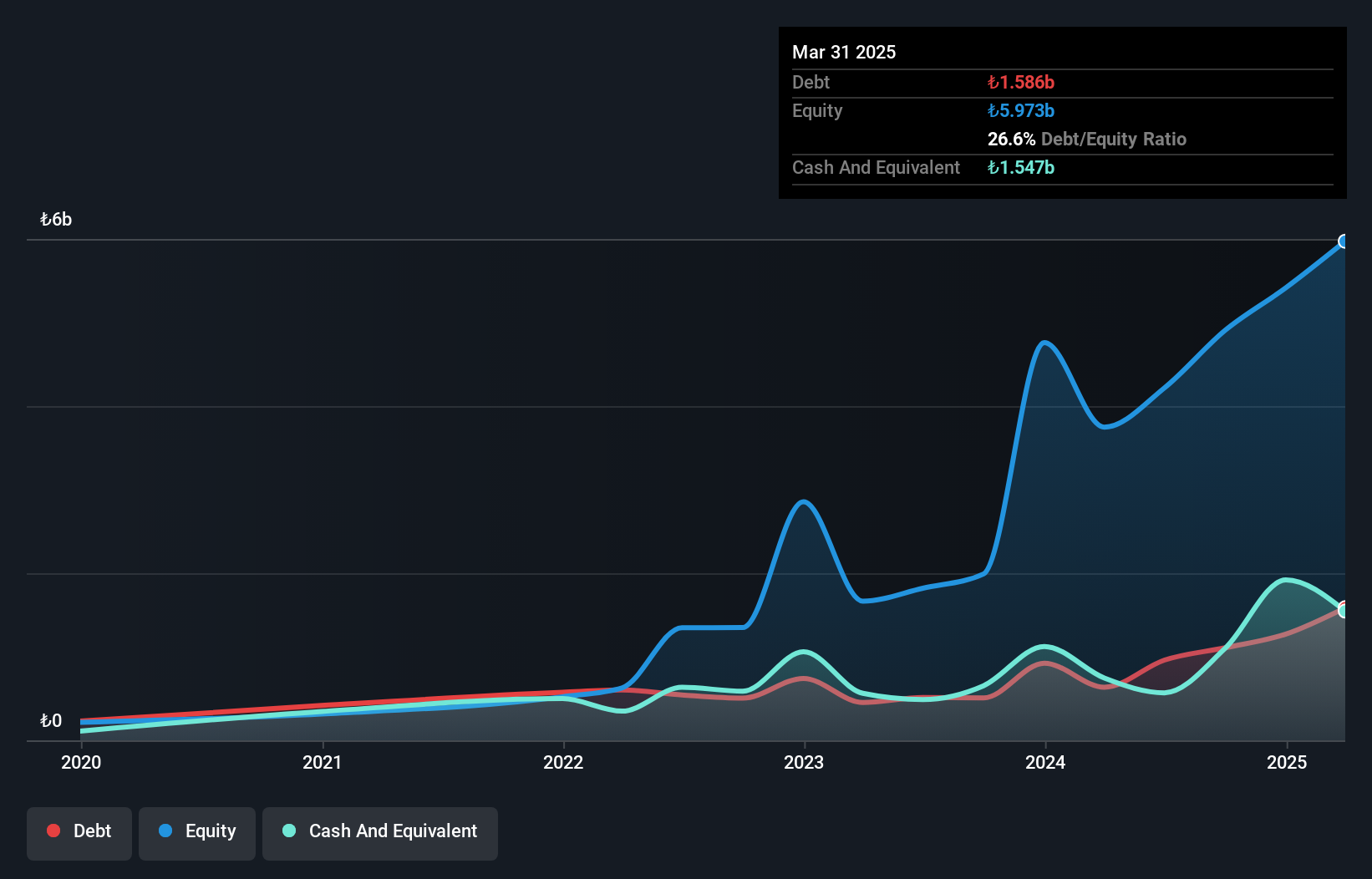

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in the design, production, and sale of knit fabrics and ready-made womenswear garments both domestically and internationally, with a market capitalization of TRY17.37 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made womenswear garments, amounting to TRY7.26 billion, and fabric production, contributing TRY2.09 billion.

Sun Tekstil stands out with a remarkable earnings growth of 601.5% over the past year, significantly outpacing the Luxury industry's -22.1%. Despite its highly volatile share price recently, the company showcases a satisfactory net debt to equity ratio at 0.1%, indicating prudent financial management. Recent earnings announcements highlight impressive recovery, with third-quarter sales reaching TRY 2.94 billion and net income turning positive at TRY 310 million from a previous loss of TRY 93 million. This turnaround is underscored by basic earnings per share rising to TRY 0.65 from a loss of TRY 0.1971 last year, reflecting robust operational improvements amidst industry challenges.

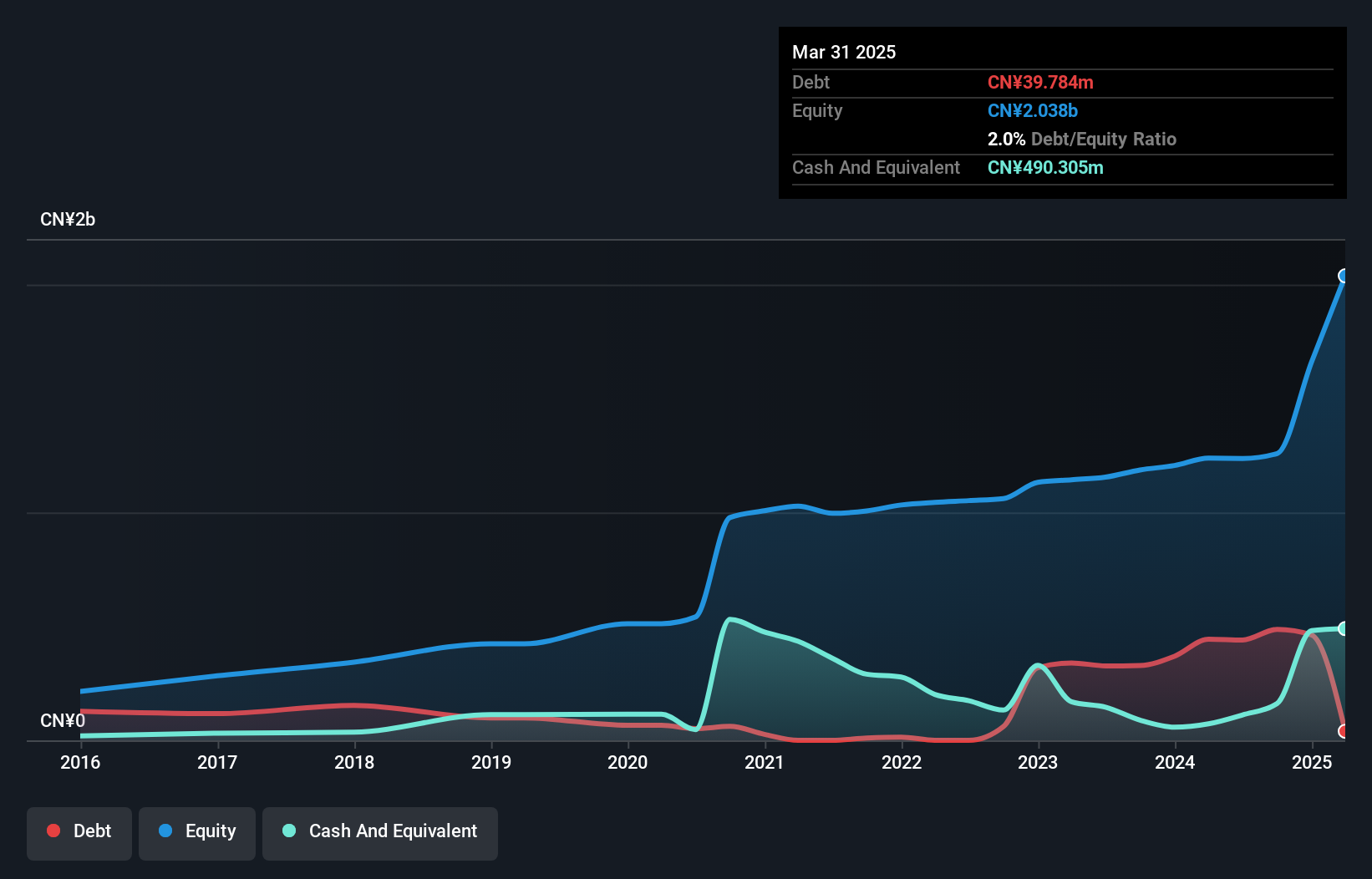

Shanghai Yanpu Metal ProductsLtd (SHSE:605128)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Yanpu Metal Products Co., Ltd engages in the design, manufacture, and sale of stamping parts, assembly and welding parts, and stamping dies in China with a market capitalization of approximately CN¥4.41 billion.

Operations: Shanghai Yanpu Metal Products Co., Ltd primarily generates revenue from the automotive parts segment, totaling approximately CN¥1.99 billion. The company's financial performance includes a focus on managing its cost structure to impact profitability effectively.

Shanghai Yanpu Metal Products Ltd. showcases promising growth, with earnings surging by 85% over the past year, significantly outpacing the Auto Components industry's 10.1%. The company's net income for the first nine months of 2024 reached CNY108.49 million, compared to CNY63.62 million in the previous year, reflecting robust financial health and high-quality earnings. Despite an increase in its debt-to-equity ratio from 13.3% to 38.7% over five years, interest payments remain well-covered at 8.1 times by EBIT, indicating manageable debt levels and a satisfactory net debt-to-equity ratio of 25.9%.

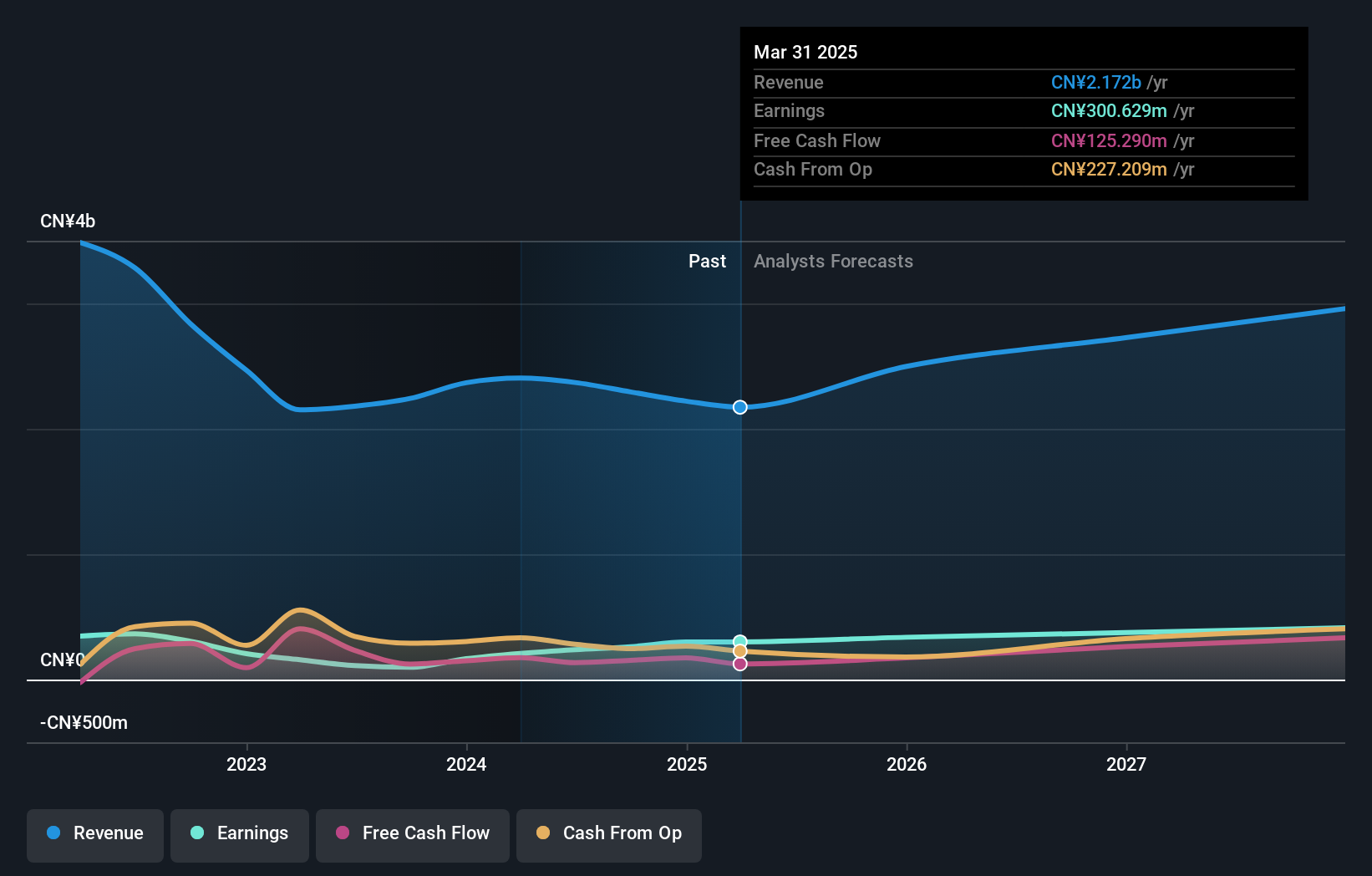

Shandong Weida Machinery (SZSE:002026)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shandong Weida Machinery Co., Ltd. is involved in the manufacturing and sale of drill chucks both within China and internationally, with a market cap of CN¥4.20 billion.

Operations: The company generates revenue primarily from the manufacturing and sale of drill chucks. It operates both domestically in China and internationally, contributing to its market cap of CN¥4.20 billion.

Shandong Weida Machinery, a relatively small player in the machinery sector, has shown impressive financial performance with earnings surging by 167% over the past year. This growth outpaces the industry average significantly. The company's net income for nine months ending September 2024 was CNY 199 million, a notable jump from CNY 104 million in the previous year. Trading at a price-to-earnings ratio of 16x, it is considered good value against peers and market averages. Despite an increase in its debt-to-equity ratio to 15.6% over five years, it remains financially sound with more cash than total debt.

Taking Advantage

- Click here to access our complete index of 4551 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002026

Shandong Weida Machinery

Engages in the manufacture and sale of drill chucks in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives