- Israel

- /

- Real Estate

- /

- TASE:AURA

Undiscovered Gems In The Middle East To Watch This May 2025

Reviewed by Simply Wall St

As the Middle East markets experience a positive shift, buoyed by rising oil prices and anticipation of the Federal Reserve's policy decisions, investors are closely monitoring these developments for their potential impact on regional equities. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for those seeking opportunities in lesser-known sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 17.77% | -1.63% | -0.93% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

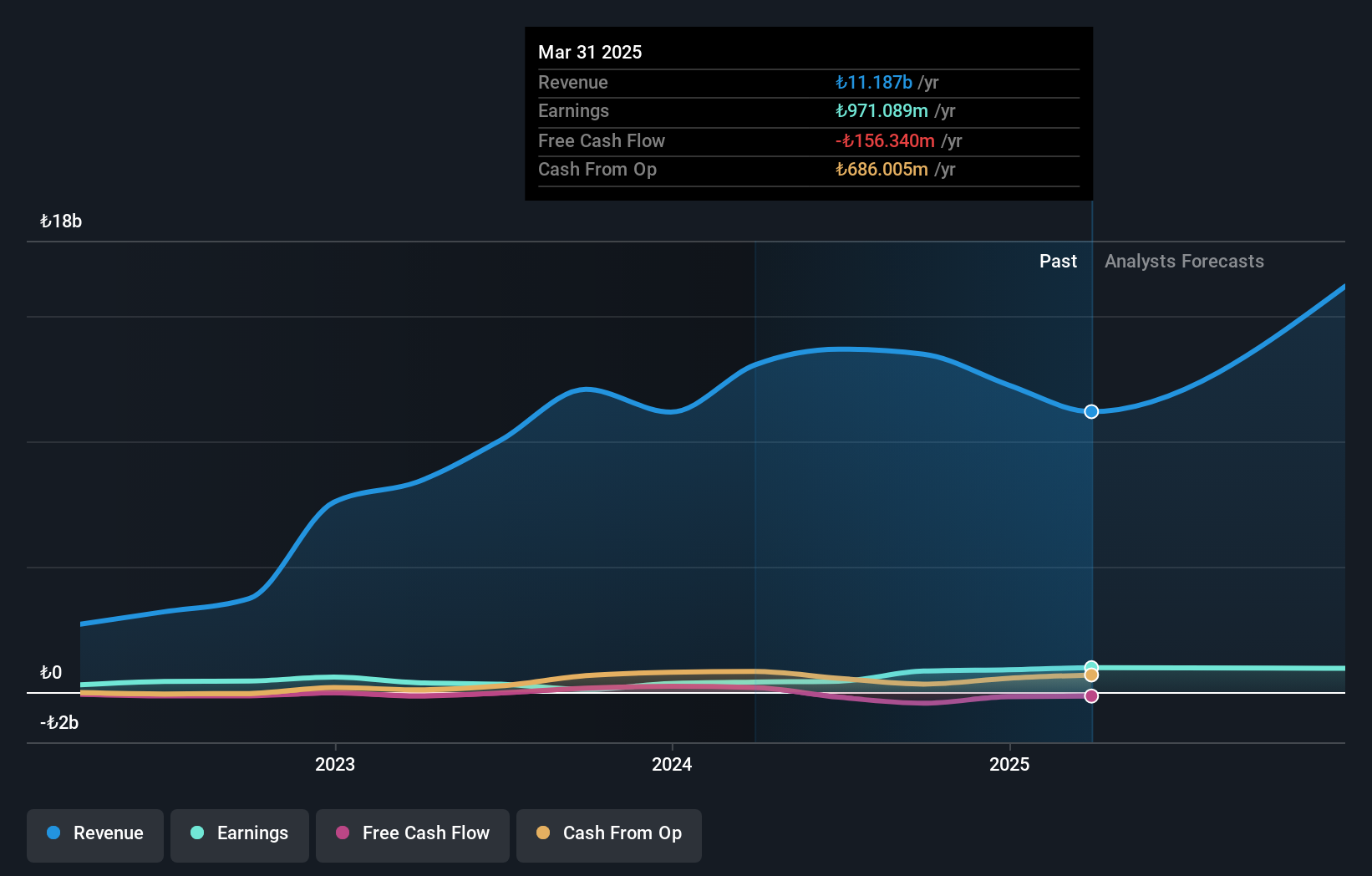

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★★★

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in the design, production, and sale of knit fabrics and ready-made womenswear garments both domestically and internationally, with a market capitalization of TRY18.59 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made womenswear garments, contributing TRY9.27 billion, and fabric production, adding TRY3.09 billion. The company's financial performance is impacted by eliminations amounting to TRY110.48 million.

Sun Tekstil Sanayi ve Ticaret, a noteworthy player in the luxury sector, has shown impressive financial resilience. Its debt-to-equity ratio improved significantly from 107.1% to 23.5% over five years, indicating prudent financial management. With earnings growth of 161.7%, it outpaced the industry's -51.3%. The company reported TRY 893 million in net income for the year ending December 2024, up from TRY 342 million previously, and basic earnings per share rose to TRY 1.88 from TRY 0.72 last year. Despite high volatility in its share price recently, Sun Tekstil remains a compelling prospect with strong non-cash earnings and more cash than total debt.

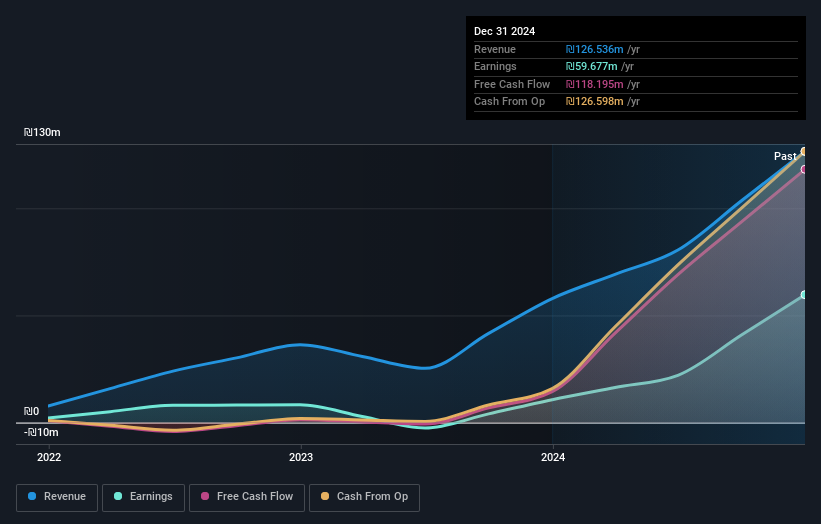

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aryt Industries Ltd. is a company that, through its subsidiaries, focuses on developing, producing, and marketing electronic thunderbolts for the defense sector in Israel with a market capitalization of ₪2.39 billion.

Operations: Aryt Industries generates revenue primarily from its detonators segment, which accounts for ₪126.54 million. The company's financial performance is impacted by various operational costs, with a notable trend observed in its gross profit margin.

Aryt Industries, a player in the Aerospace & Defense sector, has shown impressive financial performance with earnings surging 458% over the past year, significantly outpacing industry growth of 49%. The company reported net income of ILS 59.68 million for 2024, up from ILS 10.69 million in the previous year. Despite a volatile share price recently, Aryt remains a compelling value proposition by trading at roughly 88% below its fair value estimate. With more cash than total debt and positive free cash flow, Aryt seems well-positioned financially despite an increased debt to equity ratio from 0% to 4% over five years.

- Take a closer look at Aryt Industries' potential here in our health report.

Examine Aryt Industries' past performance report to understand how it has performed in the past.

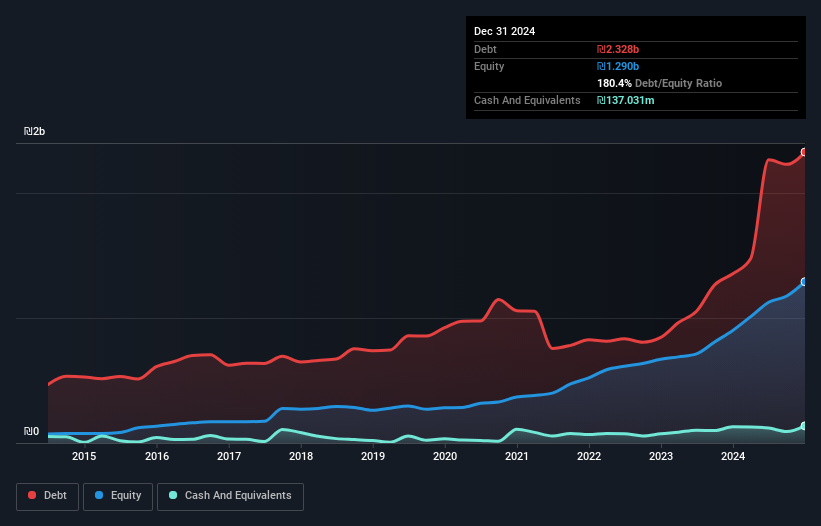

Aura Investments (TASE:AURA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aura Investments Ltd. operates in the residential real estate sector, focusing on project location, initiation, planning, and construction both in Israel and internationally, with a market capitalization of approximately ₪5.47 billion.

Operations: Aura's primary revenue stream is from residential construction, generating approximately ₪1.52 billion.

Aura Investments has shown remarkable growth with earnings increasing by 206% over the past year, outpacing the Real Estate industry's 34.6%. Despite a high net debt to equity ratio of 169.8%, Aura's interest payments are well covered by EBIT at a rate of 7.6 times, indicating strong operational profitability. The company's recent financials were significantly influenced by a ₪159.9M one-off gain, contributing to its net income of ₪360.14M for the year ending December 2024, compared to ₪117.69M previously. While free cash flow remains negative, Aura's profitability suggests that cash runway isn't an immediate concern.

Make It Happen

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 244 more companies for you to explore.Click here to unveil our expertly curated list of 247 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AURA

Aura Investments

Together with its subsidiaries engages in locating, initiating, planning, and construction of residential real estate projects in Israel and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives