- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

Three Stocks That May Be Priced Below Their Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of shifting trade policies and technological optimism, major indices like the S&P 500 have reached new heights, driven by hopes for softer tariffs and advancements in AI infrastructure. Amidst this backdrop of economic activity and investor sentiment, identifying stocks that may be undervalued requires careful consideration of their intrinsic value relative to current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.57 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.31 | 49.7% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.89 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37756.10 | 49.8% |

| Dynavox Group (OM:DYVOX) | SEK68.20 | SEK136.07 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.02 | 49.8% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.57 | CN¥51.06 | 49.9% |

| St. James's Place (LSE:STJ) | £9.31 | £18.53 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Let's dive into some prime choices out of the screener.

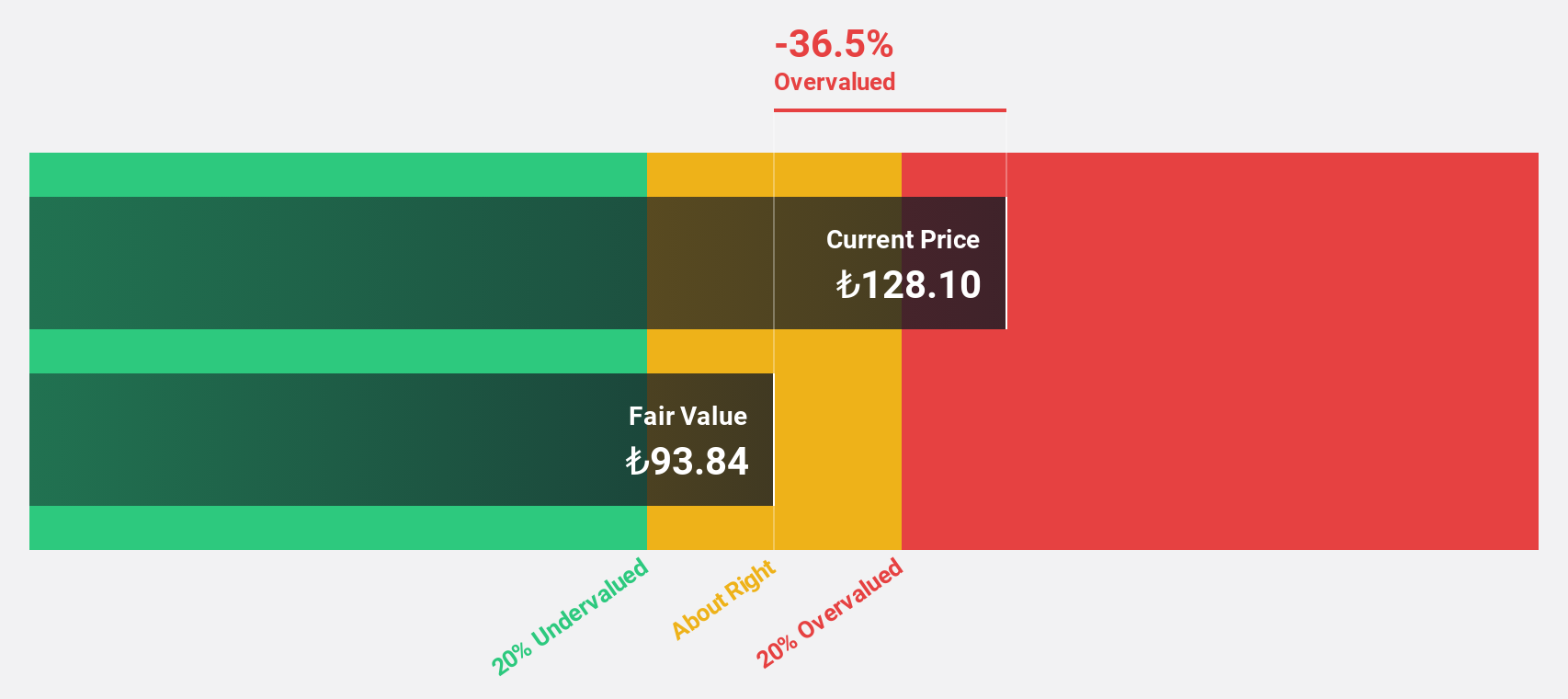

Arçelik Anonim Sirketi (IBSE:ARCLK)

Overview: Arçelik Anonim Sirketi, along with its subsidiaries, is involved in the production, marketing, sales, after-sales services, importation, and exportation of consumer durable goods and electronics across Turkey, Europe, the Asia Pacific, Africa and globally; it has a market cap of TRY79.50 billion.

Operations: The company's revenue is primarily derived from White Goods, amounting to TRY224.10 billion, and Consumer Electronics, contributing TRY16.95 billion.

Estimated Discount To Fair Value: 38.4%

Arçelik Anonim Sirketi is trading at TRY130.7, significantly below its estimated fair value of TRY212.19, indicating it is undervalued based on cash flows. Despite forecasted annual earnings growth of 111.42% and revenue growth of 22.8%, the company's dividend yield of 2.04% isn't well covered by free cash flows, and interest payments aren't well supported by earnings. However, its expected profitability within three years suggests potential for above-average market growth.

- Insights from our recent growth report point to a promising forecast for Arçelik Anonim Sirketi's business outlook.

- Take a closer look at Arçelik Anonim Sirketi's balance sheet health here in our report.

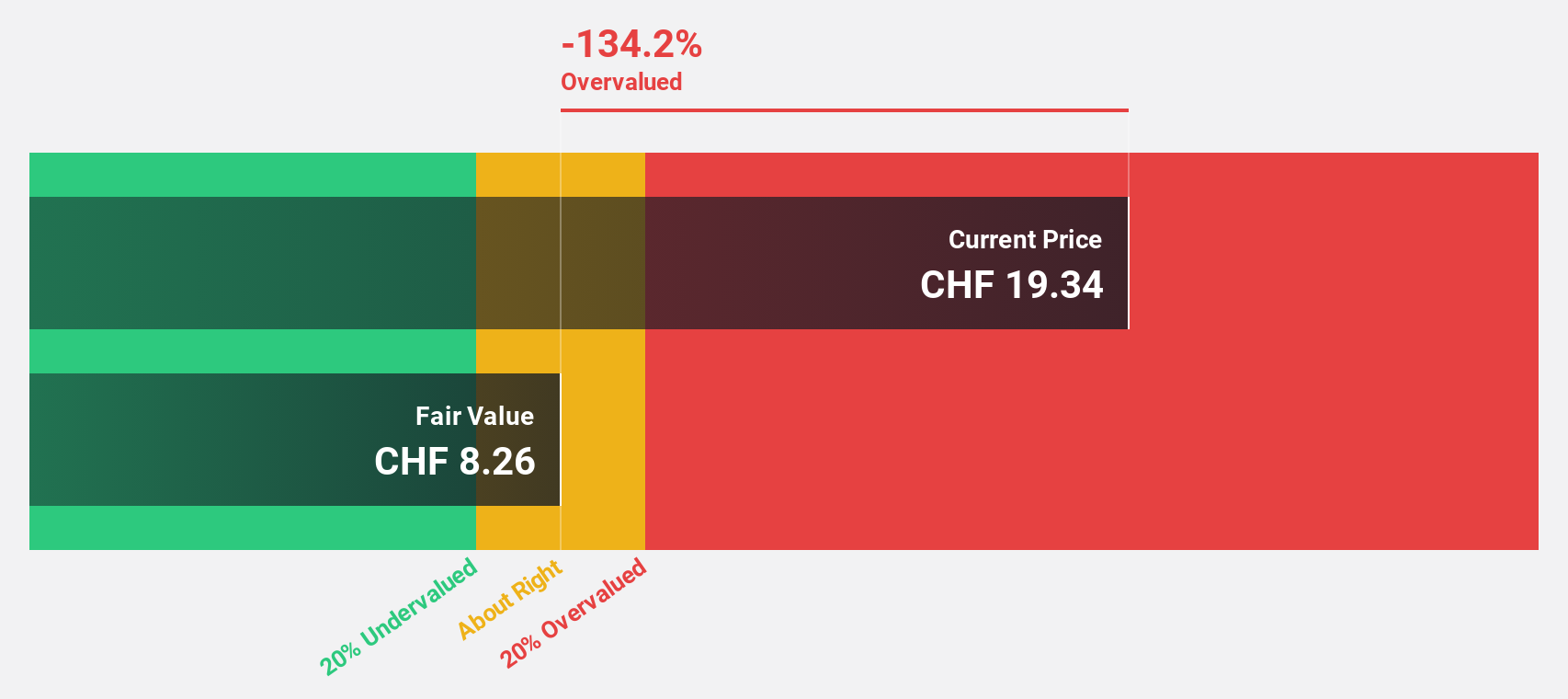

Stadler Rail (SWX:SRAIL)

Overview: Stadler Rail AG, with a market cap of CHF2.03 billion, manufactures and sells trains across Switzerland, Germany, Austria, Europe, the Americas, CIS countries and internationally through its subsidiaries.

Operations: Stadler Rail's revenue is primarily derived from its Rolling Stock segment at CHF3.10 billion, followed by Service & Components at CHF789.41 million, and Signalling at CHF135.68 million.

Estimated Discount To Fair Value: 44.7%

Stadler Rail, trading at CHF20.45, is undervalued with a fair value estimate of CHF37. Its earnings are forecast to grow significantly at 22.9% annually, outpacing the Swiss market's 11.2%. Revenue is expected to increase by 5.7% per year, surpassing the broader market growth rate of 4.4%. However, its dividend yield of 4.4% lacks coverage from free cash flows and return on equity is projected to be low in three years (18.8%).

- Our expertly prepared growth report on Stadler Rail implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Stadler Rail stock in this financial health report.

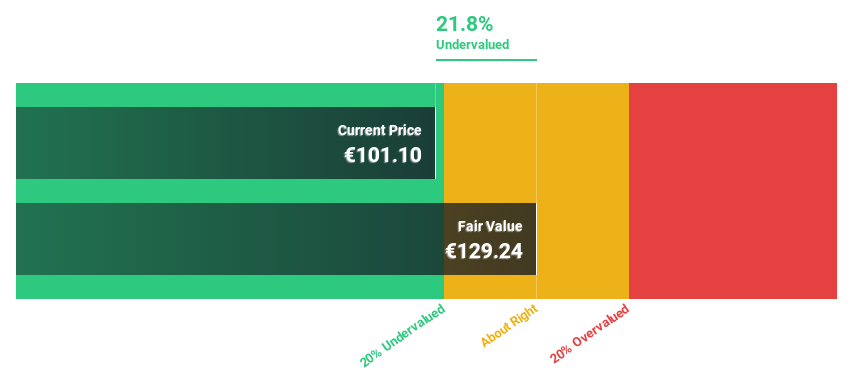

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €2.24 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions both in Germany and internationally.

Operations: The company's revenue is primarily derived from its Plastics & Devices segment, which accounts for €1.13 billion, followed by the Primary Packaging Glass segment at €885.56 million, and a smaller contribution from Advanced Technologies at €5.83 million.

Estimated Discount To Fair Value: 41.6%

Gerresheimer, priced at €66.65, is significantly undervalued with a fair value estimate of €114.15. Its earnings are projected to grow 21.8% annually, exceeding the German market's growth rate of 20.2%. Revenue is expected to rise by 9.4% per year, outpacing the broader market's growth of 5.7%. Despite high debt levels and a low forecasted return on equity (13.4%), its innovative product developments highlight potential future cash flow improvements.

- Our comprehensive growth report raises the possibility that Gerresheimer is poised for substantial financial growth.

- Dive into the specifics of Gerresheimer here with our thorough financial health report.

Make It Happen

- Gain an insight into the universe of 888 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives