- United Arab Emirates

- /

- Industrials

- /

- DFM:DIC

April 2025's Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

Most Gulf markets have recently experienced gains, buoyed by rising oil prices, positive corporate earnings, and optimism surrounding a potential U.S.-China trade agreement. In this context, penny stocks—while an outdated term—remain a relevant investment area for those interested in smaller or newer companies. These stocks can offer surprising value when backed by strong financial health, presenting opportunities for significant returns and long-term potential.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.11 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR4.20 | SAR504M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪1.046 | ₪128.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.735 | ₪191.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.941 | ₪2.93B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.118 | ₪157.46M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.69 | AED413.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Union Insurance Company P.J.S.C (ADX:UNION) | AED0.601 | AED198.89M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.46 | AED10.42B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 98 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED10.42 billion.

Operations: The company's revenue is derived from three main segments: Property at AED2.17 billion, Manufacturing, Contracting and Services at AED1.33 billion, and Investments at AED302.49 million.

Market Cap: AED10.42B

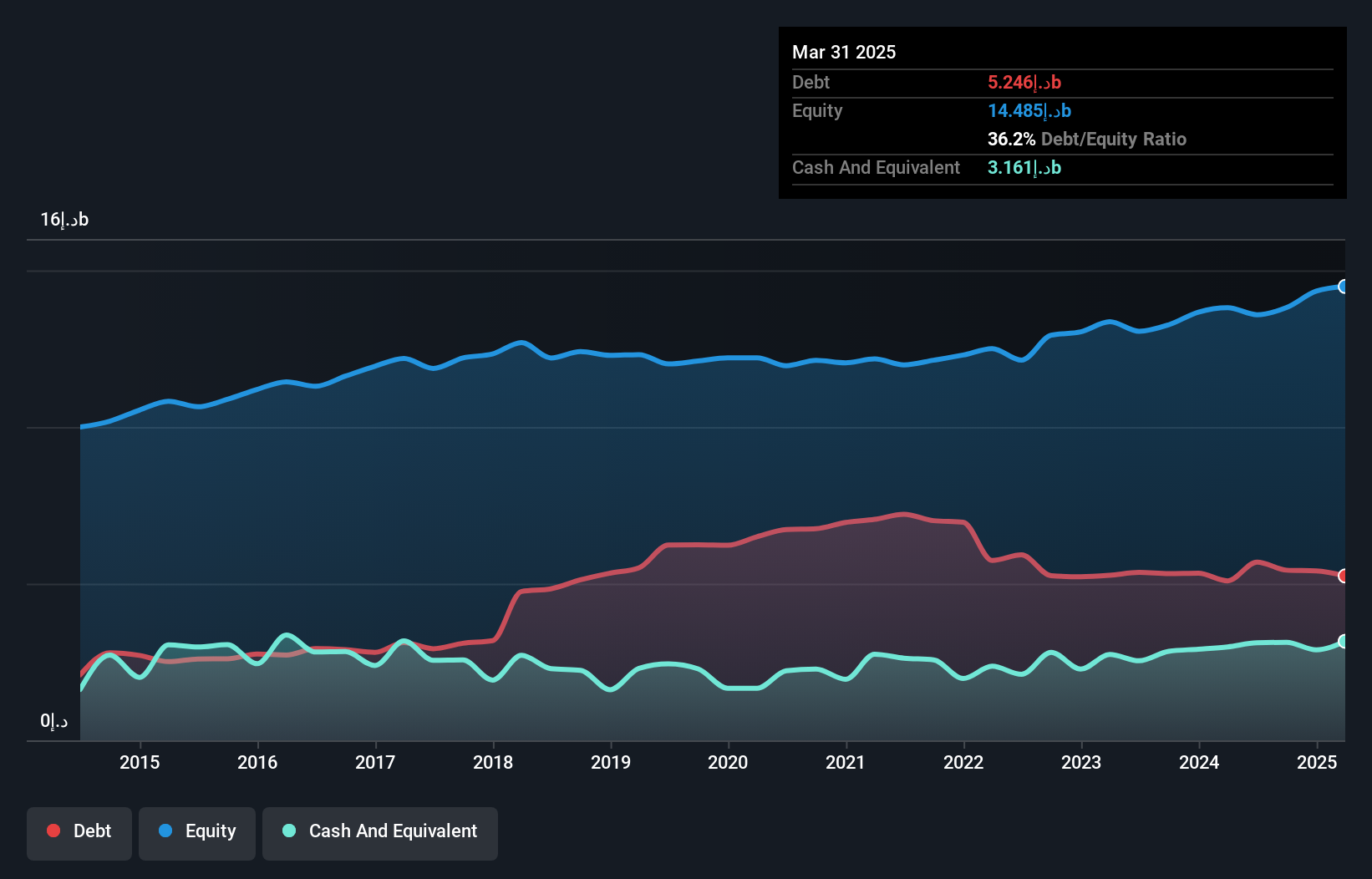

Dubai Investments PJSC, with a market cap of AED10.42 billion, shows mixed performance in its penny stock profile. While the company has seen significant profit growth over five years and maintains a stable weekly volatility, recent earnings growth of 6.6% is below its historical average. The company's net profit margin decreased slightly to 31.7%, and interest coverage remains low at 1.9x EBIT, indicating potential financial strain despite reduced debt levels over time. Its dividend yield of 7.35% is not well covered by free cash flows, yet it trades at a favorable price-to-earnings ratio compared to the AE market average.

- Dive into the specifics of Dubai Investments PJSC here with our thorough balance sheet health report.

- Gain insights into Dubai Investments PJSC's future direction by reviewing our growth report.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. operates in the manufacturing sector, specializing in vehicle-mounted equipment, with a market cap of TRY1.58 billion.

Operations: The company generates revenue of TRY1.34 billion from its vehicle equipment manufacturing segment.

Market Cap: TRY1.58B

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S., with a market cap of TRY1.58 billion, has transitioned to profitability, reporting a net income of TRY547.11 million for the year ended December 31, 2024. Despite a decline in sales from TRY2.19 billion to TRY1.34 billion, the company improved its debt profile significantly over five years and maintains satisfactory net debt levels at 16.6%. While its return on equity is low at 9.9%, Katmerciler's short-term assets comfortably cover both short and long-term liabilities, indicating solid financial health amidst high share price volatility and limited interest coverage by EBIT (1.4x).

- Take a closer look at Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's potential here in our financial health report.

- Examine Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's past performance report to understand how it has performed in prior years.

Dna Group (T.R.) (TASE:DNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dna Group (T.R.) Ltd develops, manufactures, and markets patented ultrasound systems across Israel, North America, East Asia, and internationally with a market cap of ₪128.83 million.

Operations: The company generates revenue from its Laser Systems and Components segment, amounting to ₪0.31 million.

Market Cap: ₪128.83M

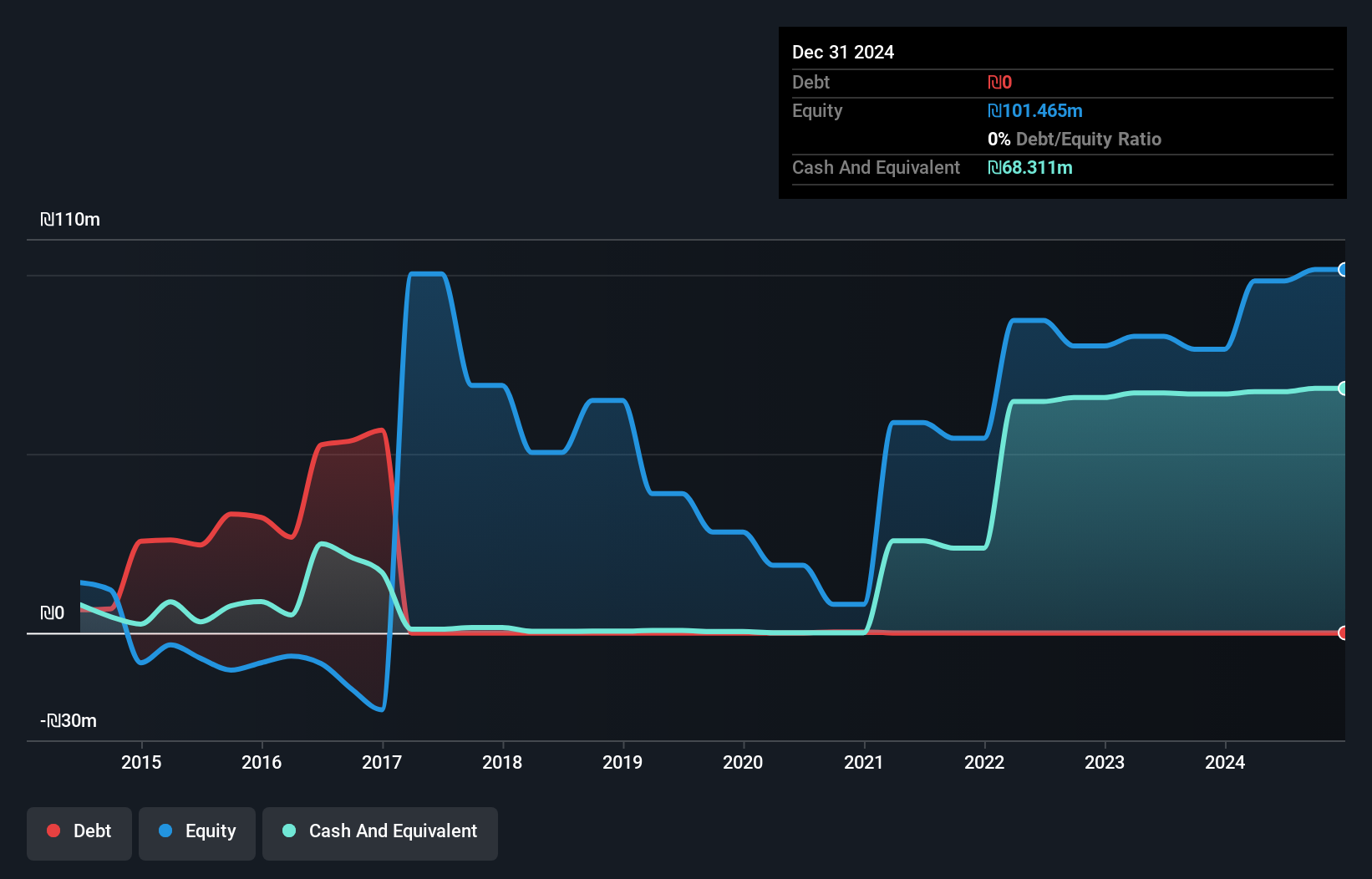

Dna Group (T.R.) Ltd, with a market cap of ₪128.83 million, is pre-revenue with sales under US$1 million. The company has transitioned to profitability, reporting a net income of ₪22.1 million for the year ended December 31, 2024. It operates debt-free and its short-term assets significantly exceed both short and long-term liabilities by wide margins. Trading at 15.5% below estimated fair value, Dna Group's return on equity stands high at 21.8%. Despite high share price volatility over recent months, the board's average tenure reflects experience while shareholders have not faced dilution recently.

- Navigate through the intricacies of Dna Group (T.R.) with our comprehensive balance sheet health report here.

- Understand Dna Group (T.R.)'s track record by examining our performance history report.

Where To Now?

- Embark on your investment journey to our 98 Middle Eastern Penny Stocks selection here.

- Searching for a Fresh Perspective? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:DIC

Dubai Investments PJSC

Engages in property, investment, manufacturing, contracting, and services businesses in the United Arab Emirates and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives