- Turkey

- /

- Capital Markets

- /

- IBSE:SMRVA

Uncovering Middle East Gems Featuring 3 Promising Stocks

Reviewed by Simply Wall St

The Middle East stock markets have recently shown resilience, with most Gulf shares gaining on the back of a temporary US-China tariff deal and positive investor sentiment from high-profile economic discussions. As regional indices such as Saudi Arabia's benchmark rise, uncovering promising stocks in this dynamic environment involves identifying companies with solid fundamentals and growth potential amid these shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Çelebi Hava Servisi A.S. is a Turkish company offering ground handling, cargo, and warehouse services to both domestic and international airlines, with a market cap of TRY65.91 billion.

Operations: Çelebi Hava Servisi generates revenue primarily from airport ground services, including ground handling, which accounted for TRY12.85 billion, and cargo and warehouse services contributing TRY6.42 billion. The company's net profit margin trends can provide insight into its profitability dynamics over time.

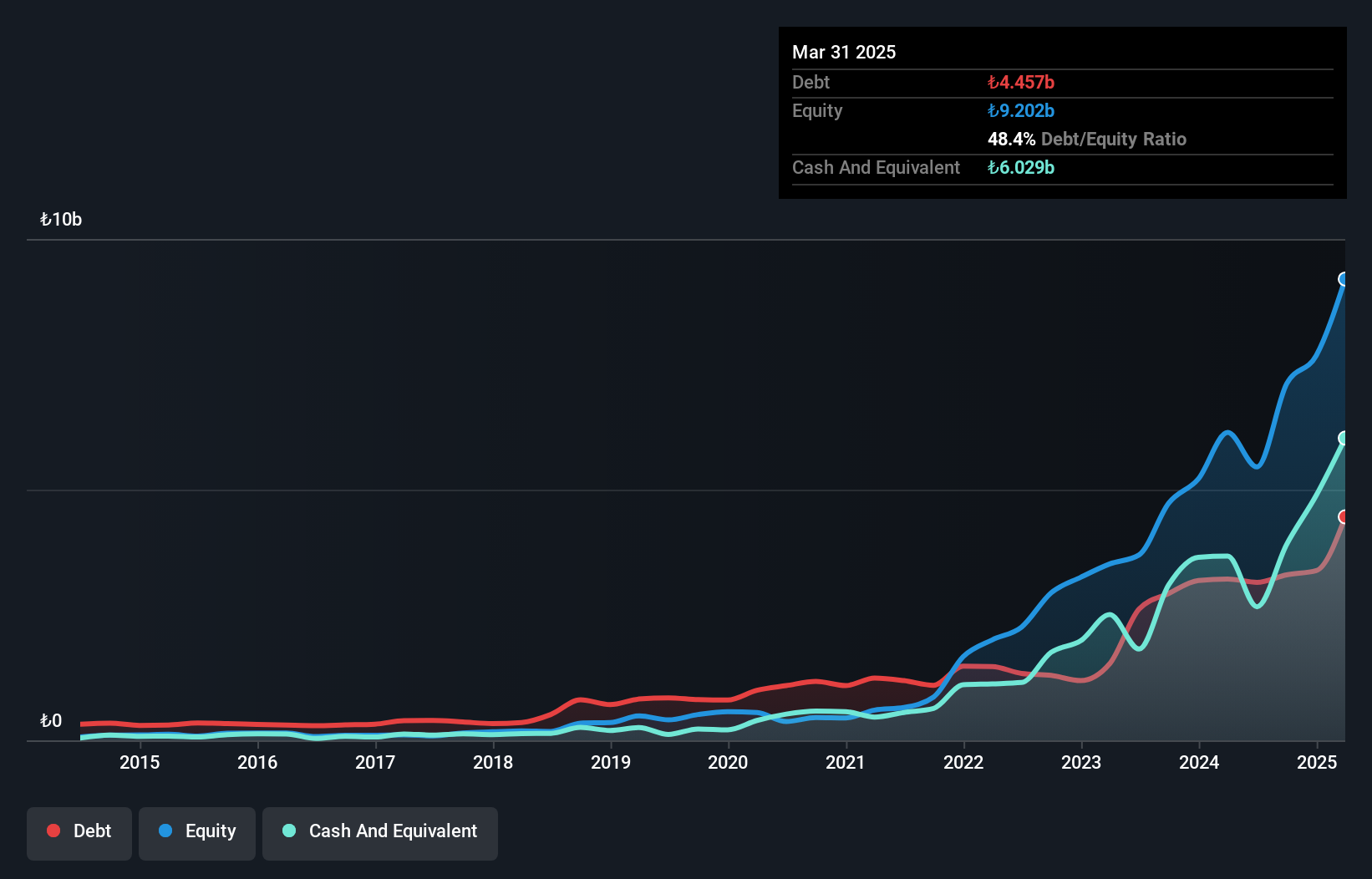

Çelebi Hava Servisi, a notable player in the infrastructure sector, has demonstrated impressive growth with earnings surging 114.2% over the past year, outpacing the industry’s 4.9%. The company's debt management appears robust, as its debt to equity ratio improved from 140.1% to 44.1% in five years and interest payments are well-covered by EBIT at a multiple of 32.8x. Financially sound with high-quality earnings and positive free cash flow, Çelebi reported TRY 19 billion in sales for the last fiscal year and net income of TRY 3.57 billion, showcasing significant profitability improvements compared to previous figures.

Girisim Elektrik Sanayi Taahhüt ve Ticaret (IBSE:GESAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Girisim Elektrik Sanayi Taahhüt ve Ticaret A.S. is a company with a market cap of TRY19.67 billion, engaged in the electrical contracting industry, providing services and solutions across various segments.

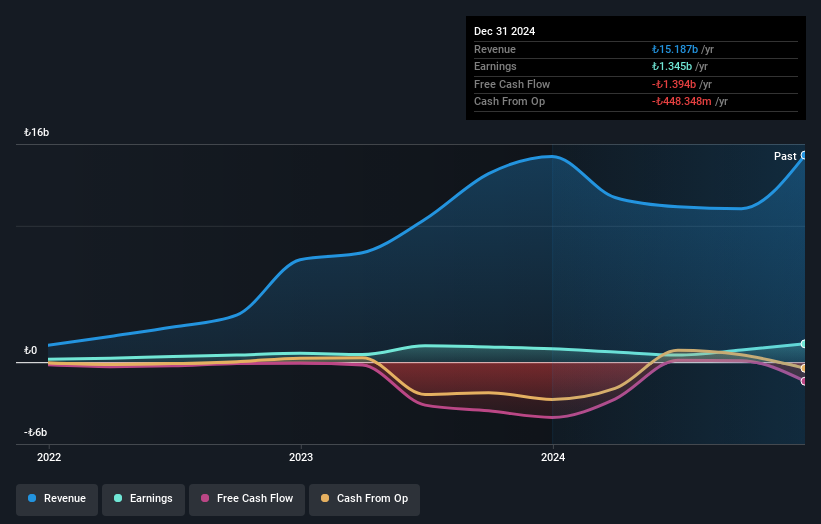

Operations: Girisim Elektrik's revenue streams are primarily derived from its segments: Venture (TRY10.44 billion), Euro Power (TRY6.83 billion), and Peak PV (TRY1.90 billion). The company experiences consolidation adjustments amounting to TRY-3.98 billion, impacting overall financial results.

Girisim Elektrik Sanayi Taahhüt ve Ticaret, a nimble player in the construction sector, has been making waves with its robust performance. Over the past year, earnings surged by 35.6%, outpacing the industry's 24.1%. This growth is supported by a satisfactory net debt to equity ratio of just 1.6%, down from 115.7% five years ago, indicating sound financial management. The company's price-to-earnings ratio stands at an attractive 14.6x compared to the TR market's 18.3x, suggesting potential value for investors seeking opportunities in this region's dynamic market landscape.

Sumer Varlik Yonetim (IBSE:SMRVA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sumer Varlik Yonetim A.S. operates as an asset management company with a market cap of TRY19.12 billion.

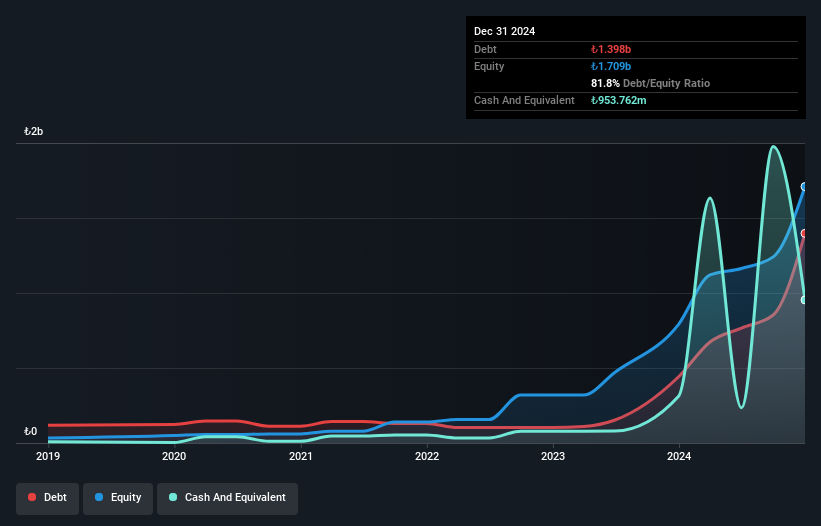

Operations: Sumer Varlik Yonetim generates revenue primarily from its asset management services, with reported earnings of TRY1.68 billion.

Sumer Varlik Yonetim, a financial entity in the Middle East, has demonstrated robust earnings growth of 9.1% over the past year, outpacing the industry average of 5%. Despite a reduction in its debt to equity ratio from 250% to 81.8% over five years, profit margins have seen a dip from last year's 46.5% to 32.2%. The company recently announced an annual dividend of TRY 0.31 per share, reflecting its profitability despite not being free cash flow positive and having interest payments that are not well covered by EBIT at only 2.9 times coverage.

Next Steps

- Get an in-depth perspective on all 244 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sumer Varlik Yonetim, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SMRVA

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives