As Middle Eastern markets align with global trends, buoyed by positive investor sentiment and tech sector advancements, attention is also focused on the implications of U.S. economic data for regional monetary policies. In this dynamic environment, dividend stocks offering yields above 3.5% can provide a reliable income stream, making them an attractive option for investors seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.22% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.37% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.74% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.76% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.51% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.38% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.88% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.52% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.85% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.99% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

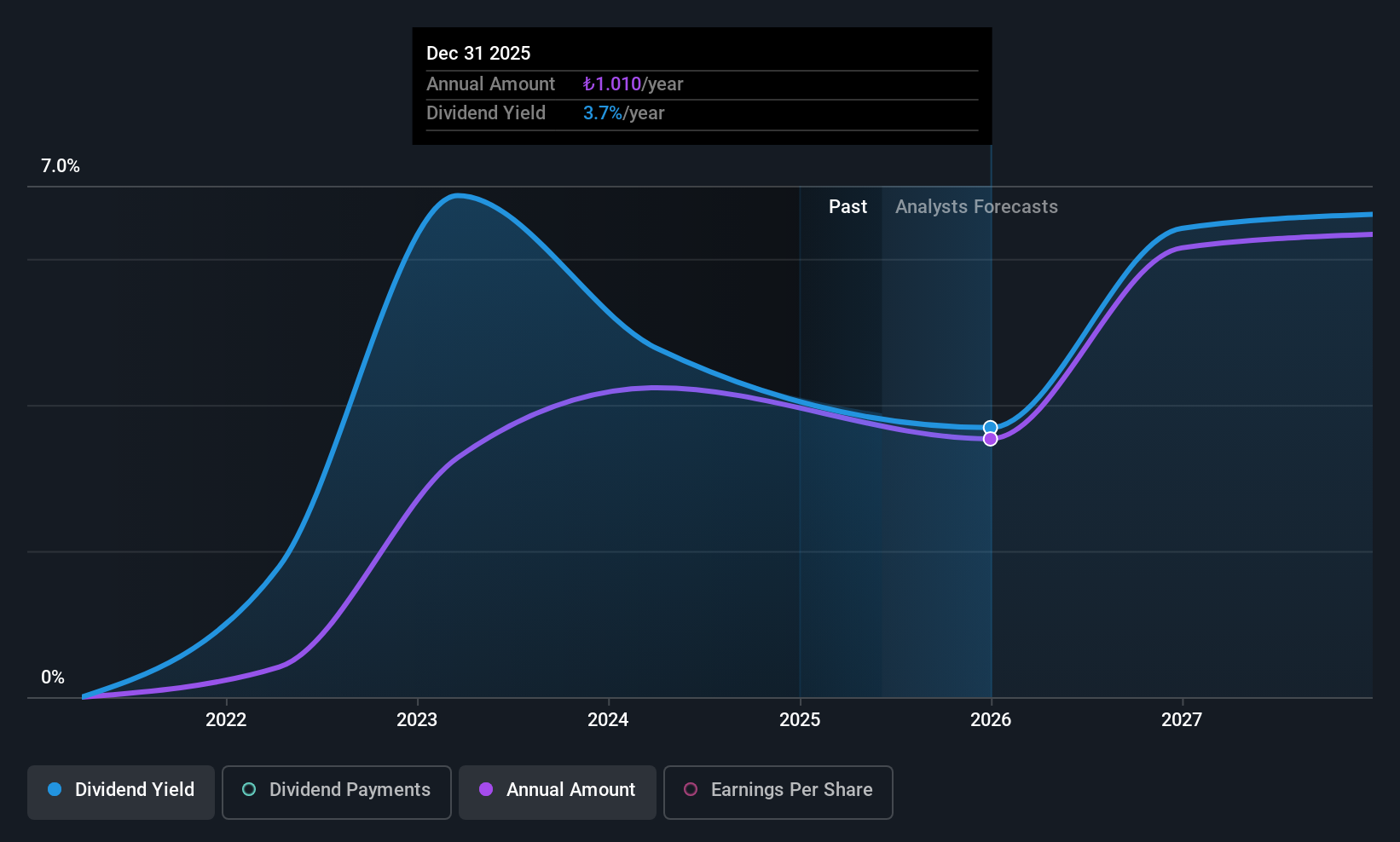

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anadolu Hayat Emeklilik Anonim Sirketi offers private pension and insurance products in Turkey, with a market capitalization of TRY41.71 billion.

Operations: Anadolu Hayat Emeklilik Anonim Sirketi's revenue is primarily derived from its Life segment at TRY26.16 billion, followed by the Retirement segment at TRY7.40 billion and a smaller contribution from the Non-Life segment at TRY7.31 million.

Dividend Yield: 6%

Anadolu Hayat Emeklilik Anonim Sirketi offers a compelling dividend profile with a payout ratio of 40.6%, ensuring dividends are well-covered by earnings. The cash payout ratio is also low at 21.1%, indicating strong cash flow support for dividends. Despite its volatile dividend history, recent earnings growth and a favorable price-to-earnings ratio of 6.8x enhance its attractiveness. However, investors should note the past instability in dividend payments despite their growth over the decade.

- Dive into the specifics of Anadolu Hayat Emeklilik Anonim Sirketi here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Anadolu Hayat Emeklilik Anonim Sirketi is trading behind its estimated value.

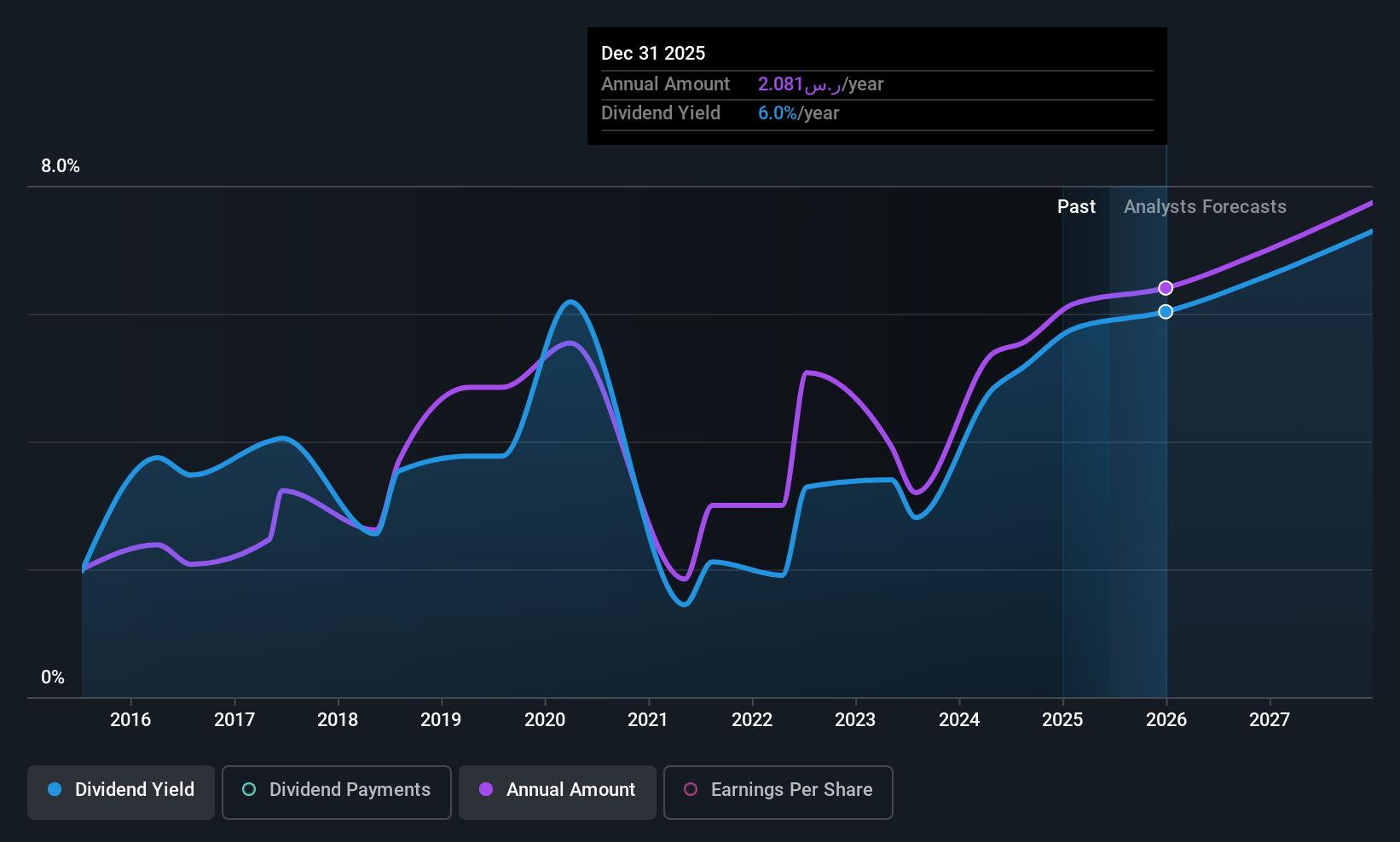

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers commercial banking and financial products and services in Turkey and internationally, with a market cap of TRY289.73 billion.

Operations: Yapi ve Kredi Bankasi's revenue segments include Retail Banking (including Private Banking and Wealth Management) at TRY105.87 billion, Treasury, Asset Liability Management and Other at TRY81.41 billion, Commercial and SME Banking at TRY59.01 billion, Corporate Banking at TRY21.58 billion, Other Domestic Operations at TRY17.59 billion, and Other Foreign Operations at TRY6.07 billion.

Dividend Yield: 3.5%

Yapi ve Kredi Bankasi's dividend profile is supported by a low payout ratio of 24.5%, indicating strong coverage by earnings. Despite its top-tier dividend yield in the Turkish market, the bank's dividend history has been volatile over the past decade. Recent earnings growth and a favorable price-to-earnings ratio of 6.5x suggest value, but investors should be cautious due to its high level of non-performing loans at 3.2%.

- Take a closer look at Yapi ve Kredi Bankasi's potential here in our dividend report.

- The valuation report we've compiled suggests that Yapi ve Kredi Bankasi's current price could be inflated.

Saudi National Bank (SASE:1180)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Saudi National Bank, with a market cap of SAR223.91 billion, operates through its subsidiaries to offer banking and investment management services both within the Kingdom of Saudi Arabia and internationally.

Operations: The Saudi National Bank's revenue is derived from four primary segments: Retail (SAR16 billion), Wholesale (SAR18.06 billion), International (SAR1.75 billion), and Capital Market (SAR2.32 billion).

Dividend Yield: 5.3%

Saudi National Bank's recent earnings report showed a notable increase in net income, reaching SAR 6.47 billion for Q3 2025, which supports its dividend coverage with a payout ratio of 51.3%. However, the bank's dividend history has been unreliable over the past decade. Despite this volatility, its price-to-earnings ratio of 9.7x suggests it is undervalued compared to the broader Saudi market. Legal issues have also been resolved favorably with Thimar Development Holding Company receiving compensation of SAR 6.76 million.

- Unlock comprehensive insights into our analysis of Saudi National Bank stock in this dividend report.

- Our valuation report here indicates Saudi National Bank may be undervalued.

Key Takeaways

- Investigate our full lineup of 62 Top Middle Eastern Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANHYT

Anadolu Hayat Emeklilik Anonim Sirketi

Provides private pension and insurance products in Turkey in Turkey.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives