Haci Ömer Sabanci Holding And 2 Other Growth Stocks With Significant Insider Stakes

Reviewed by Simply Wall St

As global markets exhibit mixed reactions to recent economic data, with small-cap stocks showing notable strength and inflation trends influencing central bank policies, investors continue to navigate through a complex financial landscape. In such an environment, growth companies with high insider ownership can offer unique advantages, as significant insider stakes often align leadership interests with shareholder goals, potentially leading to more prudent management and robust growth trajectories.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

We're going to check out a few of the best picks from our screener tool.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Haci Ömer Sabanci Holding A.Ş. is a diversified conglomerate operating mainly in finance, manufacturing, and trading sectors globally, with a market capitalization of approximately TRY 227.26 billion.

Operations: The company's primary revenue streams are generated from banking (₺388.31 billion), energy (₺192.32 billion), digital services (₺52.76 billion), industry (₺49.50 billion), financial services (₺44.67 billion), and construction materials (₺41.53 billion).

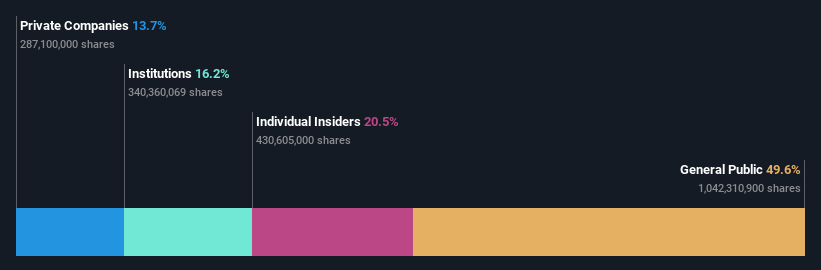

Insider Ownership: 20.5%

Revenue Growth Forecast: 68.4% p.a.

Haci Ömer Sabanci Holding A.S. is experiencing significant growth with earnings forecasted to increase by 79.9% annually, outpacing the Turkish market's expected 25.8%. However, recent financials show a troubling trend with increased net losses from TRY 2.36 billion to TRY 5.37 billion year-over-year and declining profit margins from 11.9% to 6.8%. Despite these challenges, revenue growth projections remain strong at 68.4% annually, also surpassing local market forecasts of 24.4%.

- Navigate through the intricacies of Haci Ömer Sabanci Holding with our comprehensive analyst estimates report here.

- The analysis detailed in our Haci Ömer Sabanci Holding valuation report hints at an inflated share price compared to its estimated value.

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

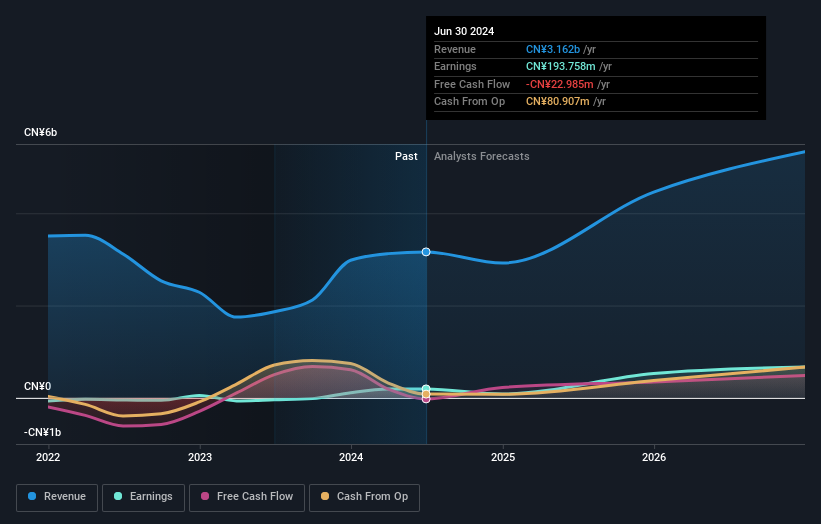

Overview: Vanchip (Tianjin) Technology Co., Ltd. specializes in designing, manufacturing, and selling radio frequency front end and high-end analog chips in China, with a market capitalization of CN¥14.32 billion.

Operations: The company generates CN¥3.12 billion from its electronic components and parts segment.

Insider Ownership: 16.6%

Revenue Growth Forecast: 20.5% p.a.

Vanchip (Tianjin) Technology is poised for substantial growth, with earnings expected to increase by 41.94% annually, significantly outpacing the Chinese market's forecast of 22.1%. Despite a recent net loss reduction from CNY 82.59 million to CNY 5.37 million, concerns remain due to shareholder dilution over the past year and low forecasted Return on Equity at 10.1%. However, revenue growth is robust at an anticipated rate of 20.5% per year, exceeding the market expectation of 13.7%.

- Click here to discover the nuances of Vanchip (Tianjin) Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Vanchip (Tianjin) Technology implies its share price may be too high.

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★★

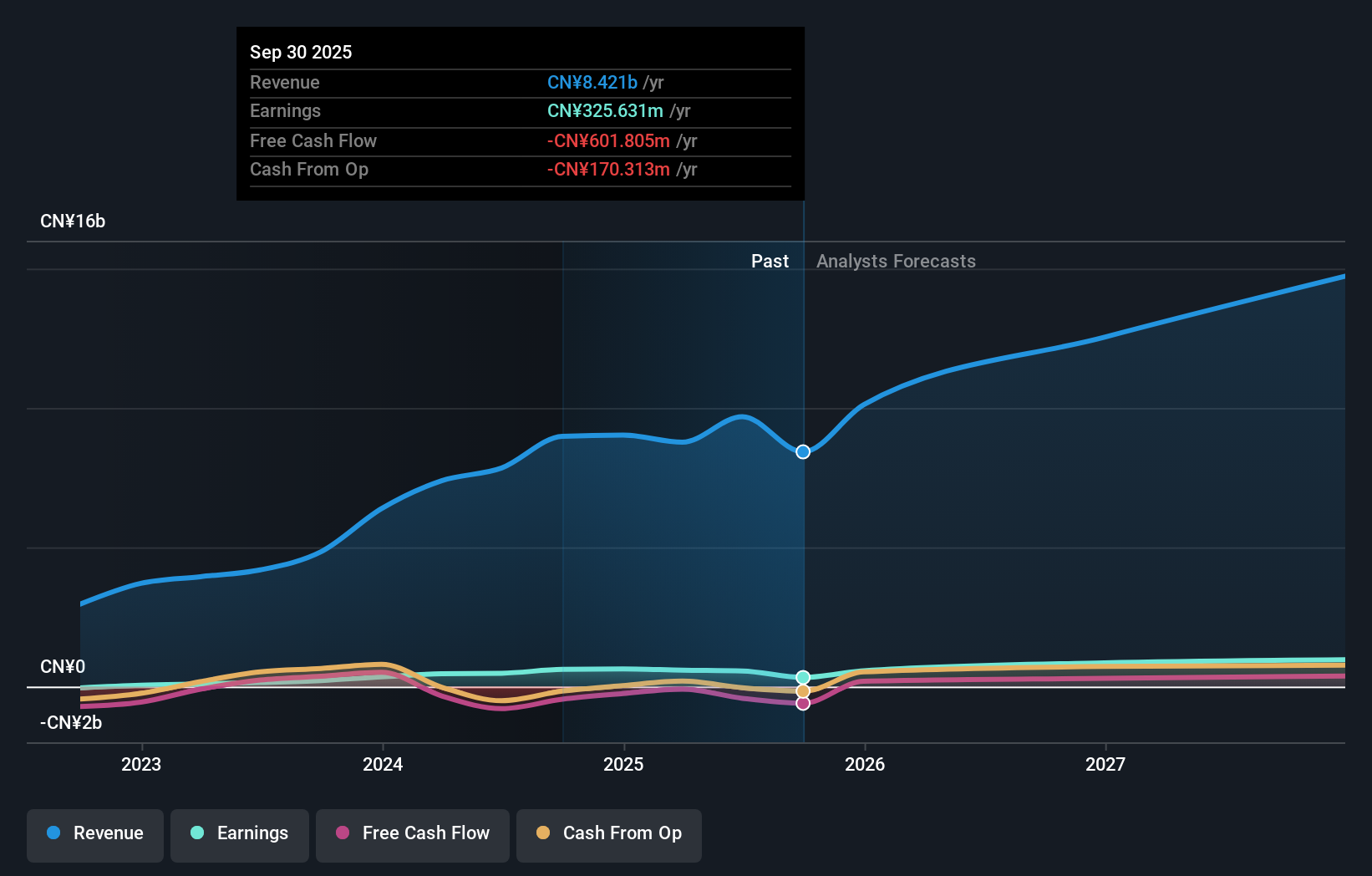

Overview: Arctech Solar Holding Co., Ltd. is a global provider of solar trackers, fixed-tilt structures, and BIPV solutions for utility-scale and commercial projects, with a market capitalization of CN¥12.47 billion.

Operations: Arctech Solar Holding generates revenue primarily from the sale of solar trackers, fixed-tilt structures, and BIPV solutions.

Insider Ownership: 38.7%

Revenue Growth Forecast: 20.8% p.a.

Arctech Solar Holding has demonstrated strong performance with a significant increase in revenue, up from CNY 815.48 million to CNY 1,814.2 million year-over-year, and net income rising to CNY 154 million from CNY 38.77 million. The company's earnings are expected to grow by an impressive 25.8% annually over the next three years, outpacing the Chinese market's forecast of 22.1%. However, its dividend coverage is weak, with payouts not well supported by free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of Arctech Solar Holding.

- Our comprehensive valuation report raises the possibility that Arctech Solar Holding is priced higher than what may be justified by its financials.

Where To Now?

- Embark on your investment journey to our 1438 Fast Growing Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Haci Ömer Sabanci Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SAHOL

Haci Ömer Sabanci Holding

Operates primarily in the finance, manufacturing, and trading sectors worldwide.

High growth potential with excellent balance sheet and pays a dividend.