- Japan

- /

- Construction

- /

- TSE:1770

Top Asian Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As global markets face volatility with concerns over elevated valuations and economic uncertainties, Asian markets present a unique landscape for investors seeking stability through dividend stocks. In the current environment, where strategic competition and evolving trade dynamics shape opportunities, identifying companies with strong fundamentals and consistent dividend payouts can provide a measure of resilience and income potential.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.78% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| NCD (TSE:4783) | 4.62% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.87% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.39% | ★★★★★★ |

Click here to see the full list of 1040 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

JNBY Design (SEHK:3306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JNBY Design Limited, with a market cap of HK$9.71 billion, operates in the design, marketing, retail, and sale of fashion apparel, accessory products, and household goods both in China and internationally.

Operations: JNBY Design Limited's revenue segments consist of Mature Brand generating CN¥3.01 billion, Younger Brands contributing CN¥2.17 billion, and Emerging Brands adding CN¥361.31 million.

Dividend Yield: 7.4%

JNBY Design's dividend yield is among the top 25% in Hong Kong, offering a payout ratio of 74% covered by earnings and cash flows. Despite an unstable eight-year dividend history with volatility, recent approval of a HK$0.93 per share final dividend reflects ongoing commitment to shareholder returns. Earnings growth and trading below estimated fair value may appeal to investors seeking potential capital appreciation alongside dividends. Recent board changes include appointing Deloitte as auditors, enhancing governance oversight.

- Unlock comprehensive insights into our analysis of JNBY Design stock in this dividend report.

- Our expertly prepared valuation report JNBY Design implies its share price may be lower than expected.

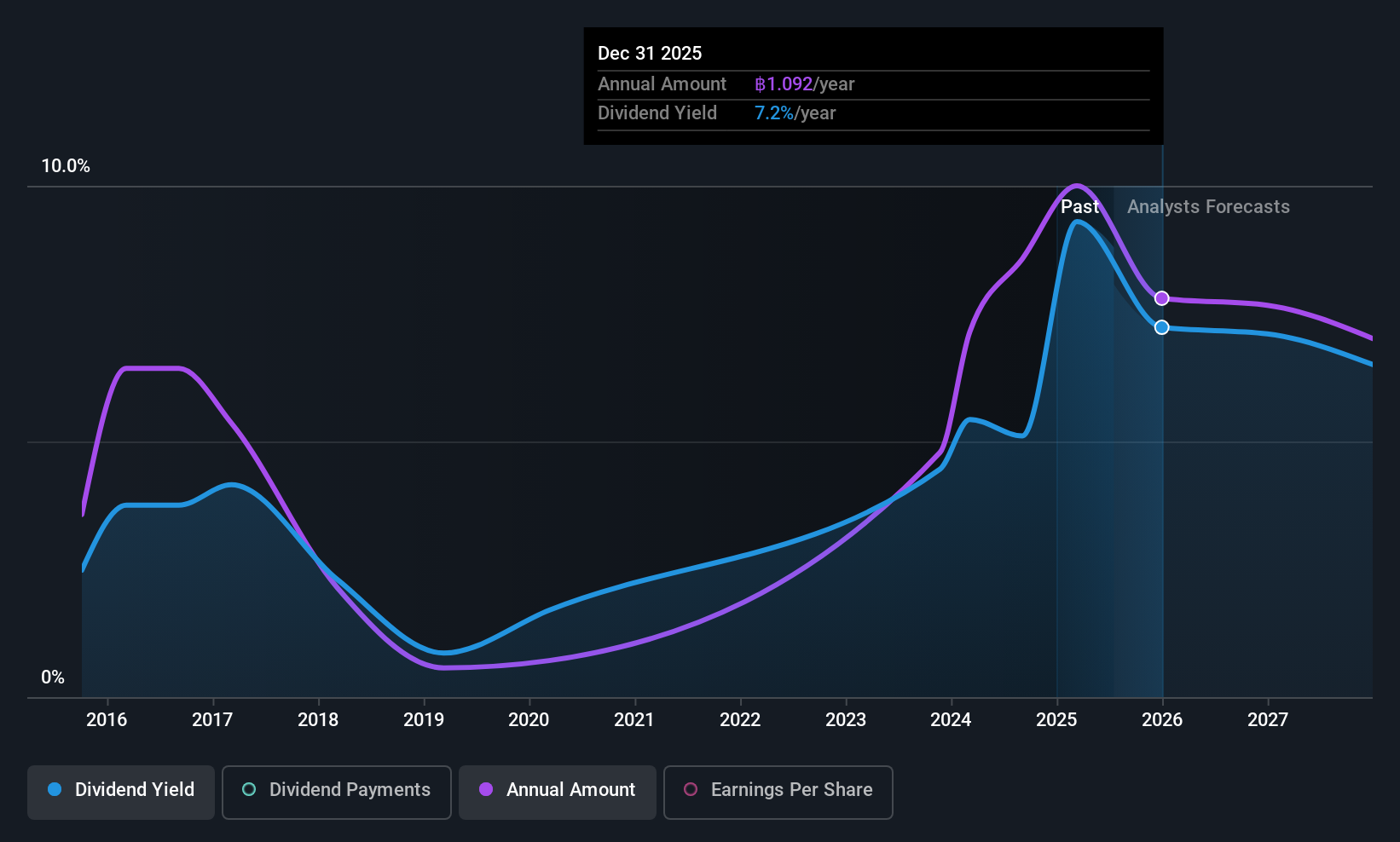

Bangkok Airways (SET:BA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bangkok Airways Public Company Limited, along with its subsidiaries, offers air transportation and airport services, with a market cap of THB29.55 billion.

Operations: Bangkok Airways generates revenue primarily from its Airlines segment at THB17.95 billion and Supporting Airlines Business at THB5.61 billion, with additional income from Airports services totaling THB629 million.

Dividend Yield: 9.9%

Bangkok Airways offers a dividend yield in the top 25% of Thailand's market, with dividends covered by earnings (44.8% payout ratio) and cash flows (62.4% cash payout ratio). Despite a history of volatility and recent dividend decreases, its long-term growth trend remains positive. Recent earnings showed improved net income for Q3 2025 at THB 1.04 billion compared to THB 671.22 million last year, indicating potential stability in future payouts amidst fluctuating revenue figures.

- Delve into the full analysis dividend report here for a deeper understanding of Bangkok Airways.

- Insights from our recent valuation report point to the potential undervaluation of Bangkok Airways shares in the market.

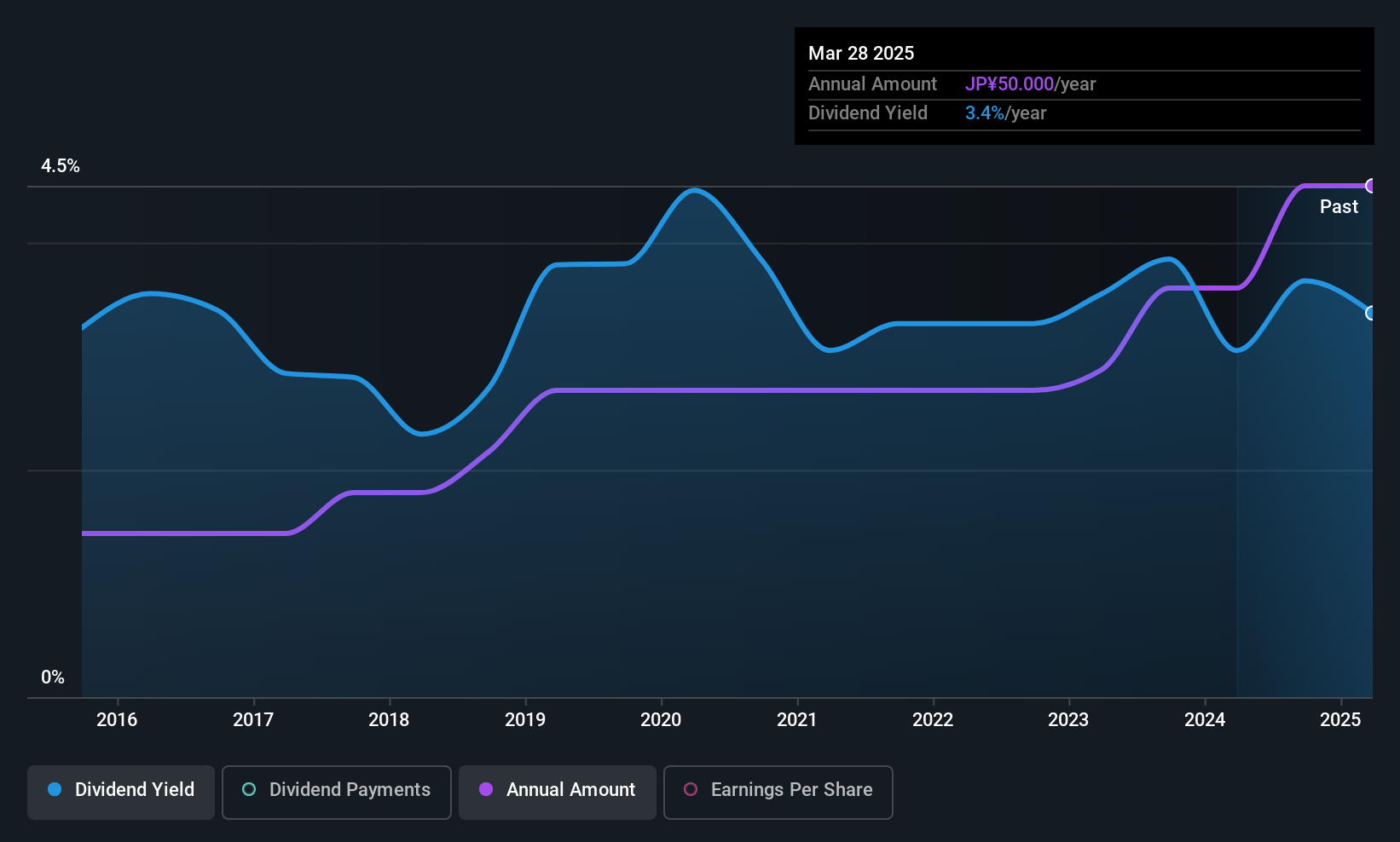

Fujita Engineering (TSE:1770)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujita Engineering Co., Ltd. operates in the facilities construction sector both in Japan and internationally, with a market cap of ¥16.19 billion.

Operations: Fujita Engineering Co., Ltd.'s revenue is primarily derived from its Construction Business at ¥15.79 billion, followed by the Equipment Maintenance Business at ¥7.63 billion, the Equipment Sales and Information System Business at ¥7.38 billion, and the Electronic Parts Manufacturing Business contributing ¥1.70 billion.

Dividend Yield: 3.4%

Fujita Engineering provides a stable dividend yield of 3.4%, though it falls short of the top 25% in Japan's market. Its dividends are reliably covered by earnings (40.6% payout ratio) and cash flows (79.2% cash payout ratio), reflecting sustainability. Over the past decade, dividends have grown steadily without volatility, indicating strong reliability for investors seeking consistent income streams. The stock's price-to-earnings ratio is attractively below the market average at 12x, suggesting potential value.

- Dive into the specifics of Fujita Engineering here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Fujita Engineering is priced higher than what may be justified by its financials.

Summing It All Up

- Click through to start exploring the rest of the 1037 Top Asian Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1770

Fujita Engineering

Engages in the facilities construction business in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives