- Israel

- /

- Electrical

- /

- TASE:GNCL

Promising Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets usher in the new year, U.S. stocks have shown mixed performance, closing out a strong 2024 despite some recent volatility. With the S&P 500 and Nasdaq Composite achieving significant gains last year, investors are exploring diverse opportunities beyond traditional blue-chip stocks. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their potential for growth at lower price points. These stocks offer a unique blend of value and growth potential that can be appealing when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.96M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,810 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Water Oasis Group (SEHK:1161)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Water Oasis Group Limited, with a market cap of HK$564.86 million, operates beauty services centers in Hong Kong, Macau, and the People's Republic of China through its subsidiaries.

Operations: The company's revenue is derived from two main segments: Product sales, contributing HK$151.97 million, and Service offerings, generating HK$853.14 million.

Market Cap: HK$564.86M

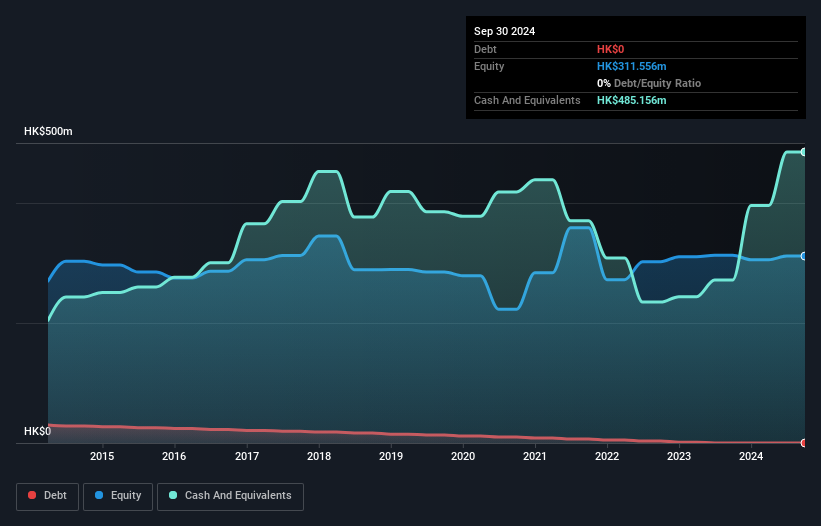

Water Oasis Group Limited, with a market cap of HK$564.86 million, has seen its net income decline to HK$68.29 million for the year ended September 30, 2024, from HK$110.32 million the previous year, impacted by one-off losses and increased expenses. Despite this, the company remains debt-free and boasts a high return on equity of 21.9%. Its short-term assets (HK$620.1M) surpass long-term liabilities but fall short of covering short-term liabilities (HK$830.7M). The board is experienced with an average tenure of 16.8 years; however, dividend sustainability remains unstable amidst declining profit margins and earnings growth challenges.

- Jump into the full analysis health report here for a deeper understanding of Water Oasis Group.

- Review our historical performance report to gain insights into Water Oasis Group's track record.

Asia Network International (SET:ANI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Asia Network International Public Company Limited functions as a cargo general sales and services agent for airlines, with a market cap of THB7.06 billion.

Operations: The company generates revenue of THB7.93 billion from its air freight forwarding business segment.

Market Cap: THB7.06B

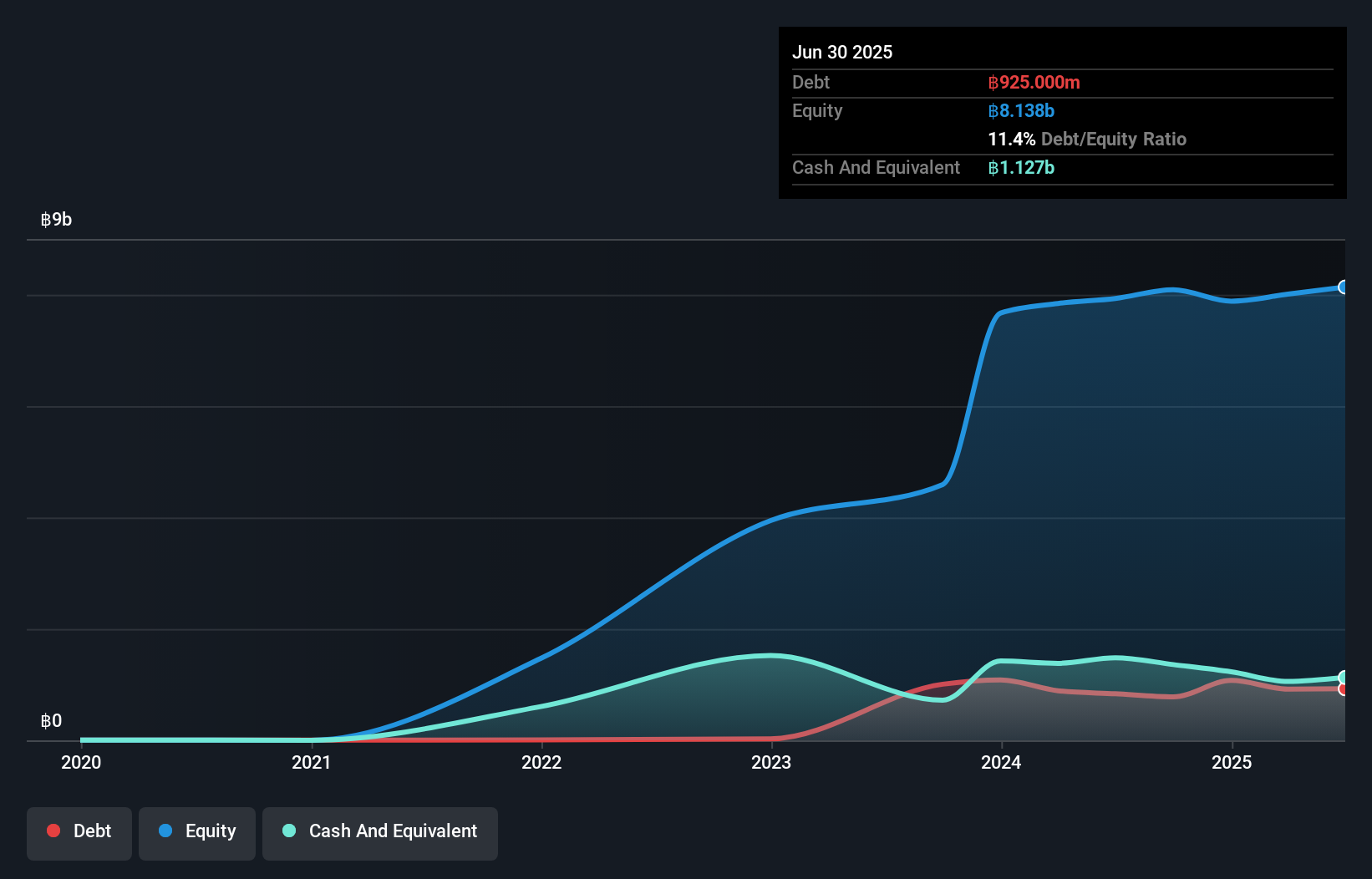

Asia Network International, with a market cap of THB7.06 billion, has experienced a decline in net profit margins to 8.4% from 26.8% last year, despite revenue growth to THB6.03 billion for the first nine months of 2024. The company's short-term assets comfortably cover both short- and long-term liabilities, and it maintains more cash than total debt, indicating strong liquidity management. Although earnings have grown significantly over five years, recent negative growth poses challenges against industry benchmarks. The board and management are seasoned with average tenures of six and four years respectively, supporting stability amidst volatility concerns.

- Click here to discover the nuances of Asia Network International with our detailed analytical financial health report.

- Gain insights into Asia Network International's past trends and performance with our report on the company's historical track record.

Gencell (TASE:GNCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GenCell Ltd. develops and produces fuel cell-based energy systems with a market cap of ₪89.62 million.

Operations: The company's revenue of $4.66 million is derived from the development and production of energy systems based on fuel cell technology.

Market Cap: ₪89.62M

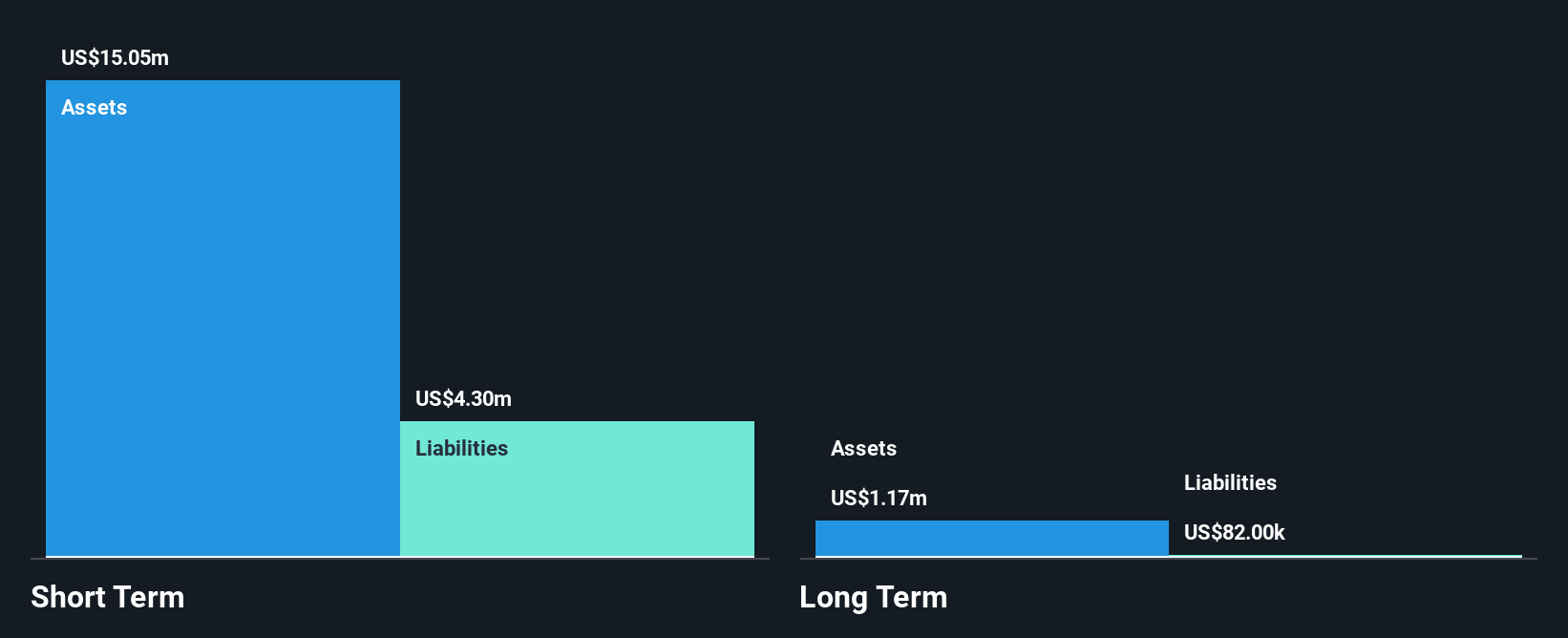

GenCell Ltd., with a market cap of ₪89.62 million, develops fuel cell-based energy systems and reports revenue of US$4.66 million, indicating it is not pre-revenue. The company is debt-free and its short-term assets of $34.0M exceed both short- and long-term liabilities, suggesting a solid financial position despite having less than a year of cash runway if current cash flow trends persist. GenCell's management and board are experienced with average tenures exceeding industry norms, although the company remains unprofitable with increasing losses over the past five years, reflecting challenges in achieving profitability amidst high share price volatility.

- Get an in-depth perspective on Gencell's performance by reading our balance sheet health report here.

- Understand Gencell's track record by examining our performance history report.

Summing It All Up

- Investigate our full lineup of 5,810 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:GNCL

Gencell

GenCell Ltd. engages in the development and production of fuel cell-based energy systems.

Moderate with adequate balance sheet.

Market Insights

Community Narratives