- Thailand

- /

- Electronic Equipment and Components

- /

- SET:PLANET

3 Penny Stocks With Market Caps Larger Than US$70M To Watch

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, major indices have shown mixed performances, with the Nasdaq Composite reaching new heights while other indexes faced declines. In this context, penny stocks—often associated with smaller or emerging companies—remain an intriguing area for investors seeking growth opportunities. Despite being considered a niche market segment today, these stocks can offer significant potential when backed by strong financials and clear growth trajectories. Let's explore three penny stocks that stand out for their financial health and promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,670 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: YH Entertainment Group primarily engages in artist management in China and has a market cap of HK$558.60 million.

Operations: The company generates revenue from three main segments: Artist Management (CN¥646.62 million), Pan-Entertainment Business (CN¥15.80 million), and Music IP Production and Operation (CN¥75.71 million).

Market Cap: HK$558.6M

YH Entertainment Group, with a market cap of HK$558.60 million, generates revenue primarily from Artist Management (CN¥646.62 million). Despite negative earnings growth of -95.5% over the past year and a low Return on Equity of 4.5%, the company maintains high-quality earnings and stable weekly volatility at 4%. It has more cash than debt, with short-term assets covering both short and long-term liabilities comfortably. The Price-To-Earnings ratio stands attractively at 8x compared to the Hong Kong market average of 10.2x. Recent changes in auditors suggest proactive management adjustments for future business needs.

- Click to explore a detailed breakdown of our findings in YH Entertainment Group's financial health report.

- Assess YH Entertainment Group's previous results with our detailed historical performance reports.

Asia Network International (SET:ANI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Asia Network International Public Company Limited functions as a cargo general sales and services agent for airlines, with a market cap of THB5.40 billion.

Operations: The company's revenue is primarily derived from its air freight forwarding business, generating THB7.93 billion.

Market Cap: THB5.4B

Asia Network International, with a market cap of THB5.40 billion, has shown robust revenue growth, reporting THB8.45 billion for 2024 compared to THB5.93 billion the previous year. Despite this increase, net income declined to THB664.39 million from THB802.96 million due to reduced profit margins of 8.4%. The company maintains strong financial health with short-term assets exceeding both short and long-term liabilities and more cash than debt, which is well covered by operating cash flow at 122.6%. Trading significantly below its estimated fair value and having experienced management could present opportunities for investors seeking undervalued stocks in the logistics sector.

- Navigate through the intricacies of Asia Network International with our comprehensive balance sheet health report here.

- Learn about Asia Network International's historical performance here.

Planet Communications Asia (SET:PLANET)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Planet Communications Asia Public Company Limited operates in the distribution, installation, maintenance, and servicing of telecommunication equipment in Thailand and Myanmar with a market capitalization of approximately THB1.12 billion.

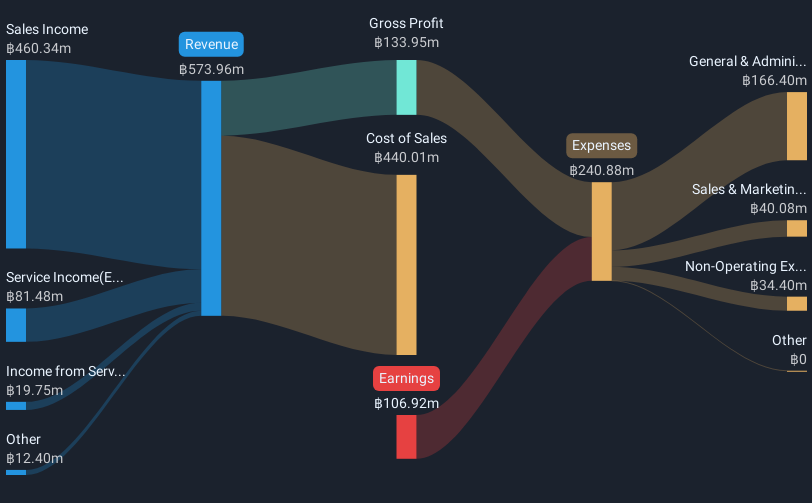

Operations: The company's revenue is derived from sales income of THB460.34 million, service income excluding service providers of THB81.48 million, and income from service providers totaling THB19.75 million.

Market Cap: THB1.12B

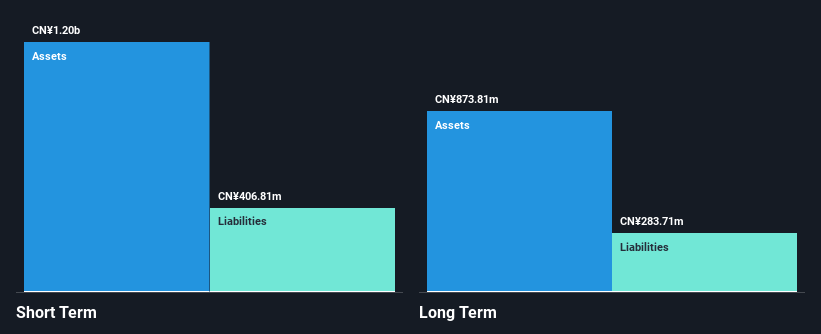

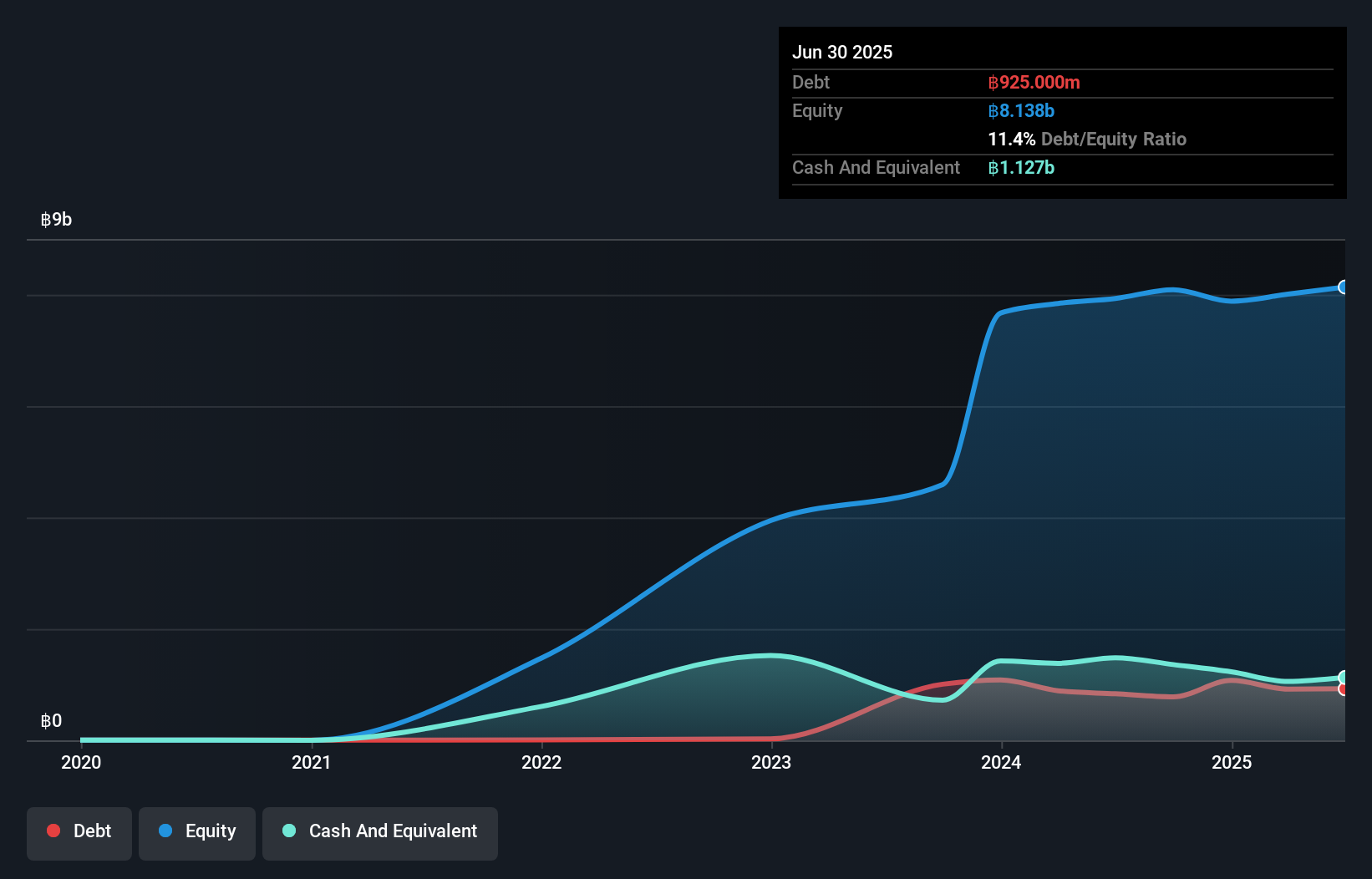

Planet Communications Asia, with a market cap of THB1.12 billion, operates in the telecommunication equipment sector in Thailand and Myanmar. Recently, it completed a follow-on equity offering of THB101.22 million to bolster its cash position amid high volatility and financial challenges. Despite unprofitability and a net debt to equity ratio considered high at 58.3%, the company has made strides in reducing debt over five years and expanding its business objectives into air defense systems and UAVs. Short-term liabilities exceed assets by THB206.3 million, but long-term liabilities are covered by current assets of THB335 million.

- Unlock comprehensive insights into our analysis of Planet Communications Asia stock in this financial health report.

- Gain insights into Planet Communications Asia's past trends and performance with our report on the company's historical track record.

Next Steps

- Get an in-depth perspective on all 5,670 Penny Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PLANET

Planet Communications Asia

Engages in the distribution, installation, maintenance, and servicing of telecommunication equipment in Thailand, the United States, Cambodia, Laos, Malaysia, and Republic of the Union of Myanmar.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.