Home Product Center And 2 Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience fluctuations with U.S. stock indexes nearing record highs and inflation data prompting higher-for-longer rate expectations, investors are keenly observing the implications on their portfolios. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate uncertain economic landscapes.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

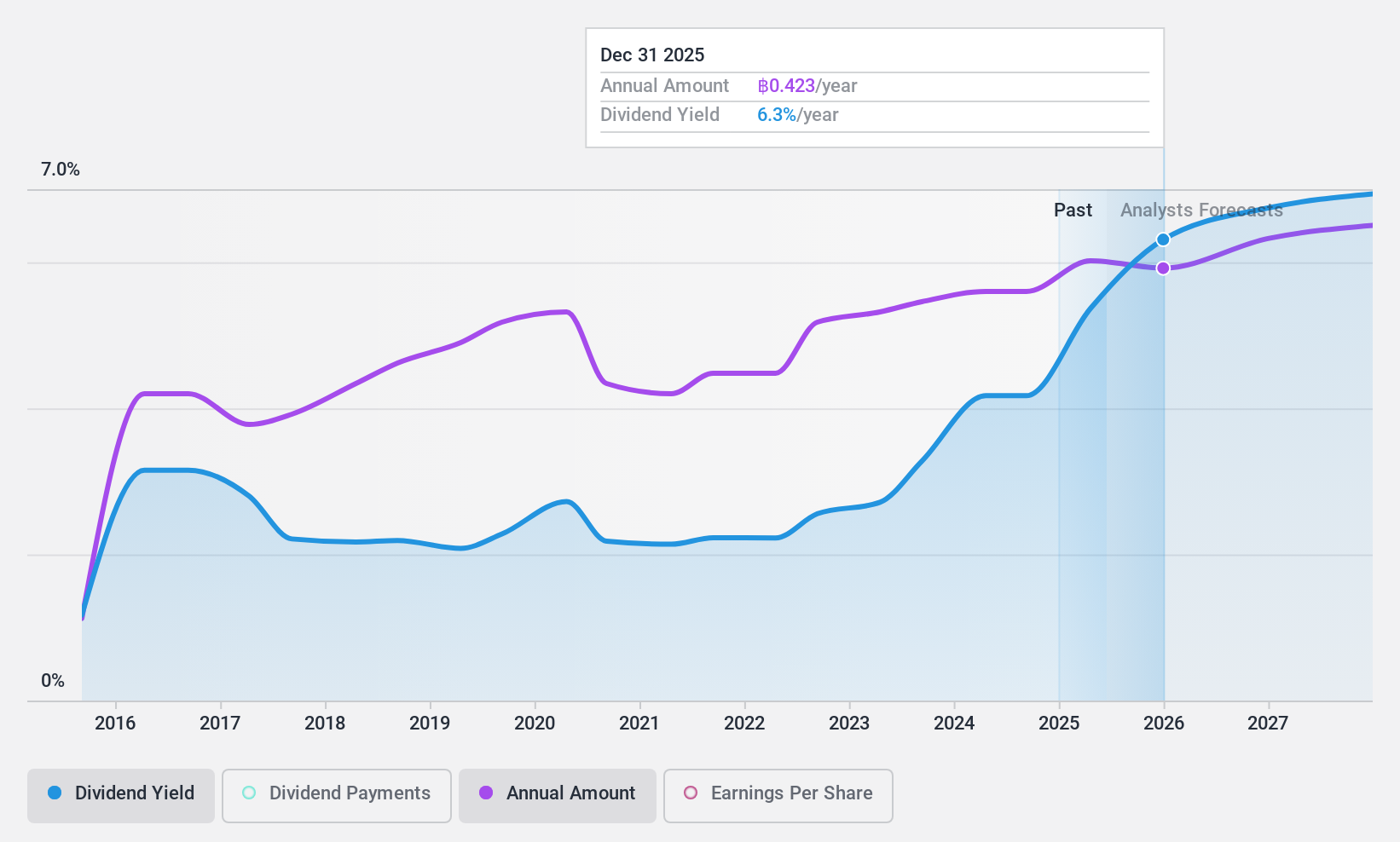

Home Product Center (SET:HMPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Home Product Center Public Company Limited operates as a home improvement retailer in Thailand, Malaysia, and Vietnam with a market cap of THB114.42 billion.

Operations: Home Product Center Public Company Limited generates revenue primarily from its retail segment focused on building products, amounting to THB72.47 billion.

Dividend Yield: 4.6%

Home Product Center's dividend payments have been unreliable and volatile over the past decade, with a history of significant annual drops. Despite this, dividends are currently covered by both earnings and cash flows, with payout ratios of 81.7% and 85.9%, respectively. However, its dividend yield is lower than the top quartile in Thailand's market. Recent delisting from OTC Equity due to inactivity may also impact investor sentiment regarding its stability as a dividend stock.

- Take a closer look at Home Product Center's potential here in our dividend report.

- The valuation report we've compiled suggests that Home Product Center's current price could be quite moderate.

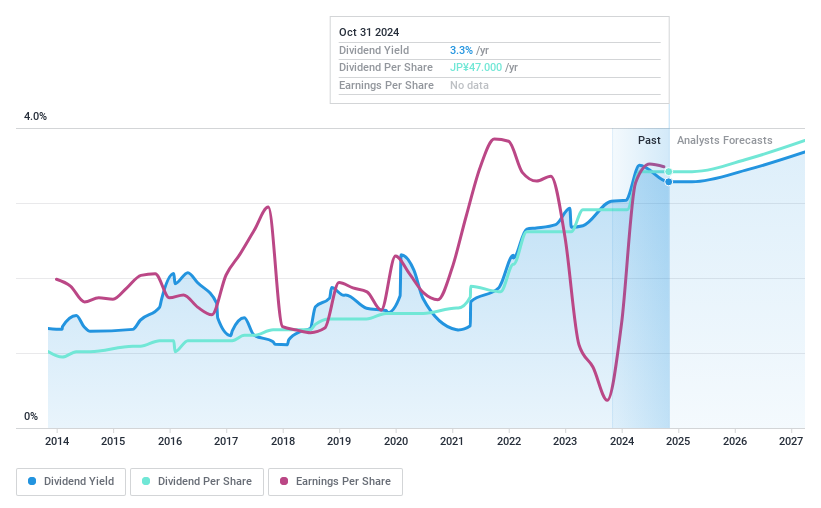

Zeon (TSE:4205)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zeon Corporation operates in the elastomers and specialty materials sectors, with a market cap of ¥301.03 billion.

Operations: Zeon Corporation generates revenue from its Elastomer Materials Business, which accounts for ¥234.06 billion, and its High-Performance Materials Business, contributing ¥118.43 billion.

Dividend Yield: 4.6%

Zeon's dividend yield of 4.6% ranks in the top 25% of Japan's market, with dividends growing steadily over the past decade. However, the dividend is not covered by free cash flows despite a low payout ratio of 41.3%. Recent share buybacks totaling ¥19.99 billion indicate strong capital management but do not address concerns about dividend sustainability due to reliance on earnings rather than cash flows for coverage.

- Get an in-depth perspective on Zeon's performance by reading our dividend report here.

- The analysis detailed in our Zeon valuation report hints at an deflated share price compared to its estimated value.

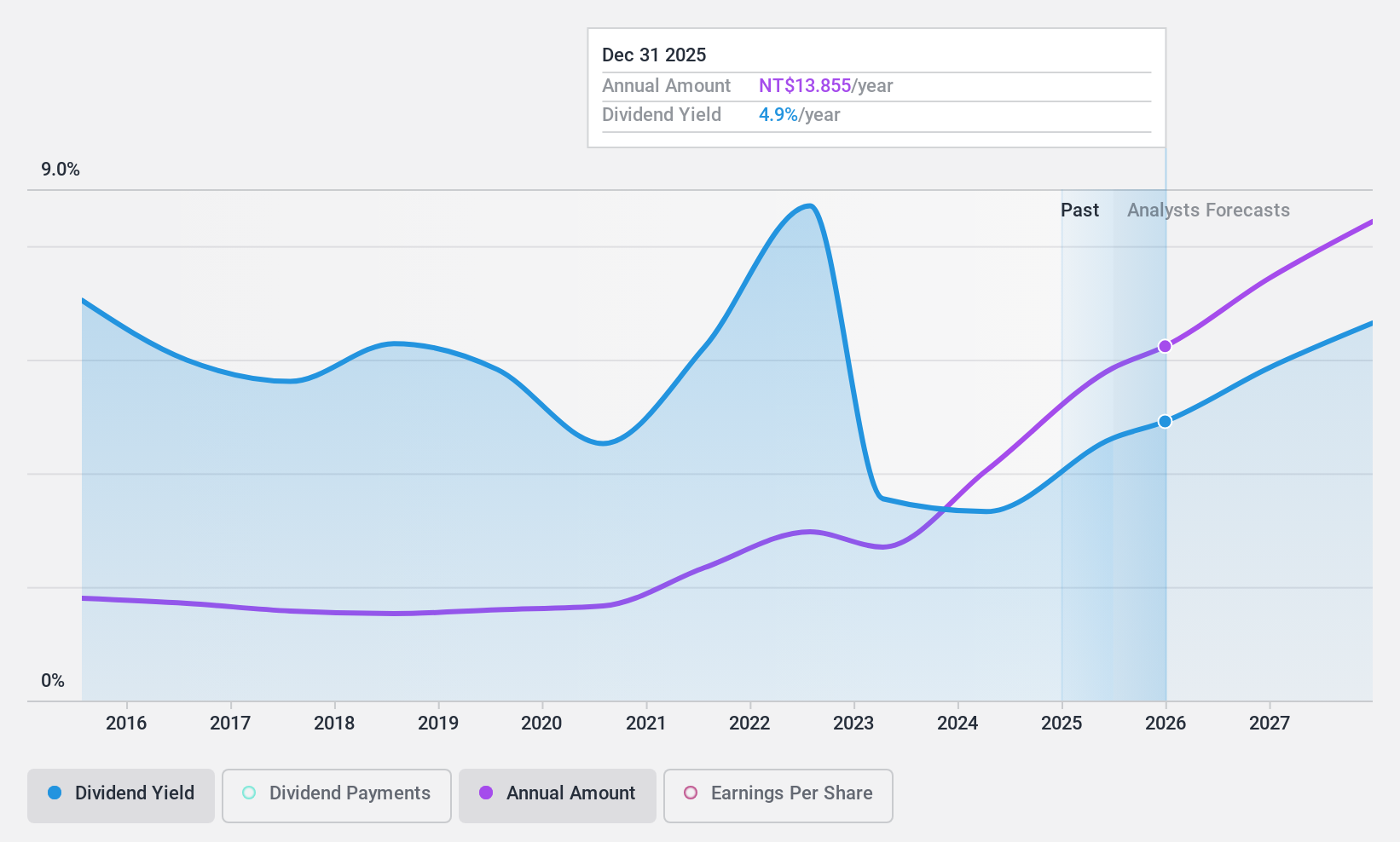

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, and Europe, and has a market cap of NT$1.04 trillion.

Operations: Quanta Computer Inc.'s revenue from the Electronics Sector amounts to NT$2.78 billion.

Dividend Yield: 3.3%

Quanta Computer's dividend yield of 3.34% is below Taiwan's top 25% benchmark, and while dividends have grown steadily over the past decade, they are not well covered by free cash flows. The company trades at a significant discount to fair value and has seen earnings grow by 41% last year, yet its dividend sustainability remains questionable due to reliance on non-cash earnings. Recent private placements raised TWD 482 million, potentially impacting future financial strategies.

- Navigate through the intricacies of Quanta Computer with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Quanta Computer is trading behind its estimated value.

Next Steps

- Discover the full array of 1984 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4205

Zeon

Engages in the elastomers, specialty materials, and other businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives