3 Asian Dividend Stocks With Up To 5.5% Yield For Your Portfolio

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, Asian economies are navigating these changes with cautious optimism, supported by strategic government policies and potential stimulus measures. In this evolving landscape, dividend stocks in Asia present an attractive opportunity for investors seeking steady income streams; selecting those with strong fundamentals and resilient business models can be particularly beneficial in the current climate.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.57% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.43% | ★★★★★★ |

Click here to see the full list of 1219 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

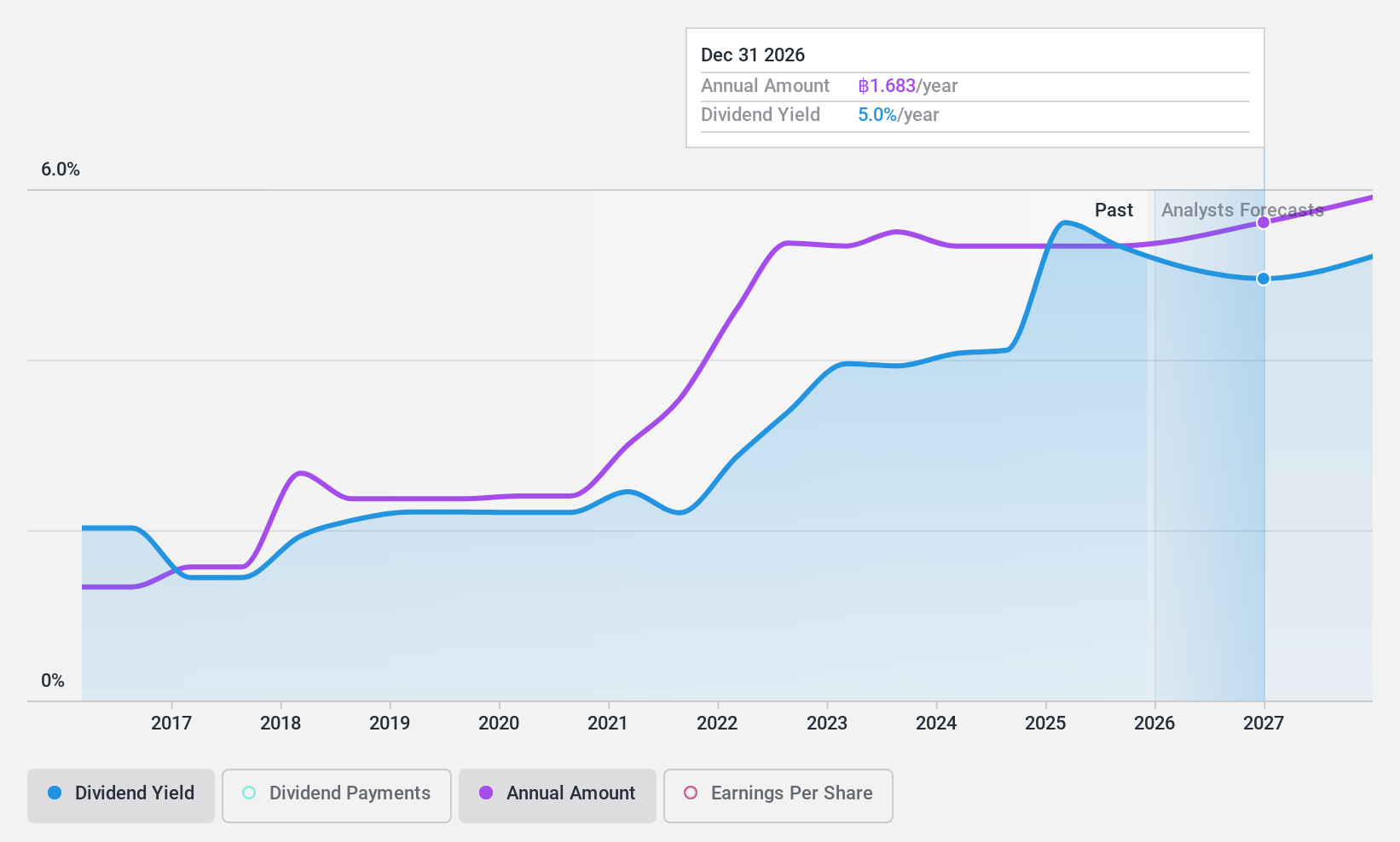

Mega Lifesciences (SET:MEGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mega Lifesciences Public Company Limited, with a market cap of THB26.37 billion, operates in Southeast Asia and Sub-Saharan Africa manufacturing and selling health food supplements, prescription pharmaceuticals, over-the-counter products, herbal products, vitamins, and fast-moving consumer goods.

Operations: Mega Lifesciences generates revenue through its Brands segment with THB8.38 billion, Distribution segment with THB6.68 billion, and Original Equipment Manufacture (OEM) segment with THB306.21 million.

Dividend Yield: 5.3%

Mega Lifesciences has approved a final dividend of THB 0.80 per share, payable on April 24, 2025, reflecting its commitment to returning value to shareholders. Despite a volatile dividend history over the past decade, recent dividends are supported by earnings and cash flows with payout ratios of 69.3% and 65.1%, respectively. The company's stock trades at a significant discount to estimated fair value but offers a lower yield compared to top-tier Thai dividend payers.

- Unlock comprehensive insights into our analysis of Mega Lifesciences stock in this dividend report.

- The analysis detailed in our Mega Lifesciences valuation report hints at an deflated share price compared to its estimated value.

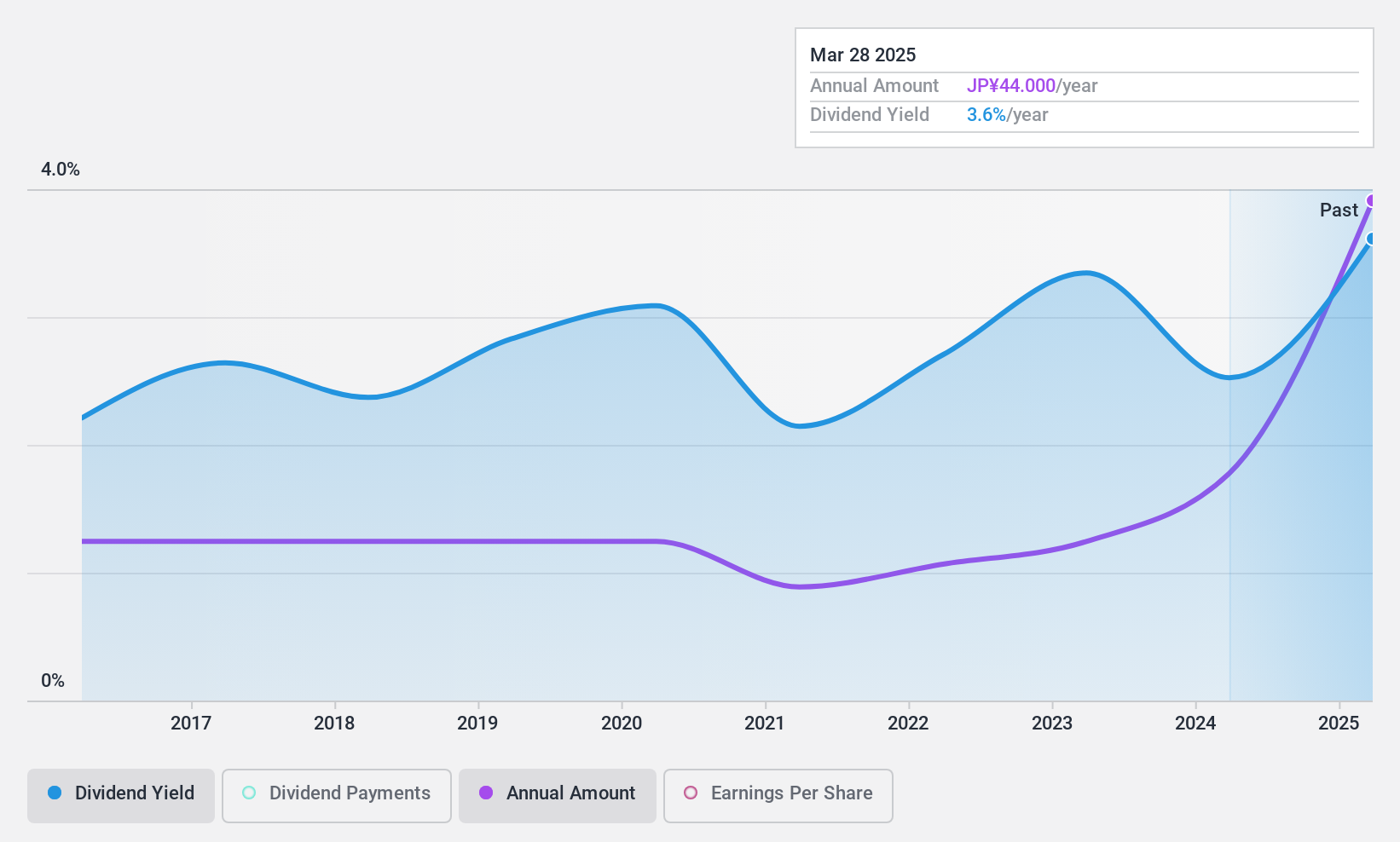

Koike Sanso KogyoLtd (TSE:6137)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koike Sanso Kogyo Co., Ltd. develops, manufactures, and sells gases, welding and cutting machines, and related products for industries processing steel plates, aluminum, and stainless steel in Japan and internationally with a market cap of ¥25.34 billion.

Operations: Koike Sanso Kogyo Ltd.'s revenue is primarily derived from its Machinery and Equipment segment at ¥24.68 billion, followed by High-Pressure Gas at ¥20.49 billion, and Welding Equipment at ¥8.27 billion.

Dividend Yield: 3.7%

Koike Sanso Kogyo's dividend payments are well-supported by earnings and cash flows, with payout ratios of 22.7% and 19.7%, respectively, despite a history of volatility over the past decade. The company's stock is trading significantly below its estimated fair value, offering potential for value investors. However, its current dividend yield of 3.66% falls short compared to leading Japanese dividend payers. A recent 5-for-1 stock split may impact future investor perception and liquidity.

- Navigate through the intricacies of Koike Sanso KogyoLtd with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Koike Sanso KogyoLtd is priced lower than what may be justified by its financials.

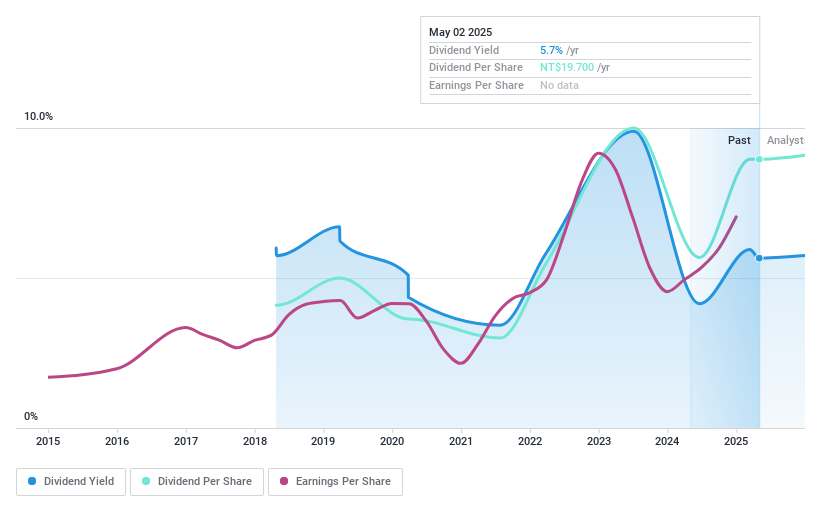

FuSheng Precision (TWSE:6670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally with a market cap of NT$48.72 billion.

Operations: FuSheng Precision Co., Ltd.'s revenue is primarily derived from its Golf Division, contributing NT$24.43 billion, and its Sports Assembly Division, which adds NT$2.60 billion.

Dividend Yield: 5.5%

FuSheng Precision's dividends are covered by earnings and cash flows, with payout ratios of 69.9% and 73.4%. Despite being in the top 25% for yield in Taiwan at 5.53%, its dividend history is volatile, having been paid for only seven years. The stock trades at a substantial discount to fair value, suggesting potential appeal for value investors. Recent earnings show significant growth, with net income rising to NT$3.80 billion from NT$2.40 billion year-over-year.

- Click to explore a detailed breakdown of our findings in FuSheng Precision's dividend report.

- In light of our recent valuation report, it seems possible that FuSheng Precision is trading behind its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1219 Top Asian Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:MEGA

Mega Lifesciences

Manufactures and sells health food supplements, prescription pharmaceutical products, over-the-counter products, herbal products, vitamins, and fast-moving consumer goods in Southeast Asia and Sub-Saharan Africa.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives