As of late October 2025, Asian markets have shown resilience, with Japan's stock indices rising sharply and China's technology-focused shares gaining ground despite some domestic economic challenges. Penny stocks may be a throwback term, but the opportunities they represent are far from old news. Typically referring to smaller or newer companies, these stocks present an underappreciated chance for growth at lower price points. When combined with strong balance sheets and solid fundamentals, they can offer upside without many of the risks often associated with this corner of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.74 | THB1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.12 | SGD453.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.55 | SGD13.97B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.09 | HK$2.94B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.30 | THB8.69B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 951 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Plan B Media (SET:PLANB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Plan B Media Public Company Limited, along with its subsidiaries, offers advertising media production services in Thailand and has a market cap of THB20.43 billion.

Operations: The company generates revenue from Advertising Media (THB2.22 billion) and Engagement Marketing (THB9.79 billion).

Market Cap: THB20.43B

Plan B Media, with a market cap of THB20.43 billion, presents a mixed picture for investors in the penny stock arena. The company is debt-free and has demonstrated significant earnings growth over the past five years (39.3% annually), although recent growth has slowed to 7.1%. Its Price-to-Earnings ratio of 19.1x is slightly below the media industry average, suggesting potential value. Analysts predict a substantial rise in stock price by 60.1%. Recent earnings reports show steady revenue and profit increases, with net income for Q2 reaching THB270 million compared to THB263 million last year, highlighting stable performance amidst industry challenges.

- Jump into the full analysis health report here for a deeper understanding of Plan B Media.

- Understand Plan B Media's earnings outlook by examining our growth report.

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd., with a market cap of SGD591.72 million, provides semiconductor and electronics test solutions worldwide through its subsidiaries.

Operations: The company's revenue is primarily derived from its Test Cell Solutions segment at SGD249.78 million and Contract Manufacturing at SGD148.65 million, with additional contributions from Instrumentation totaling SGD9.26 million.

Market Cap: SGD591.72M

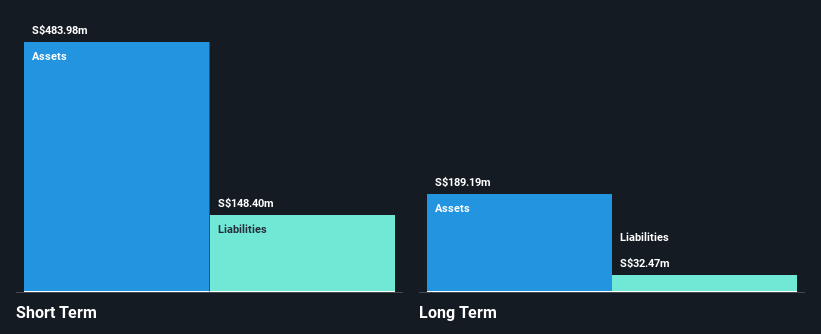

AEM Holdings Ltd., with a market cap of SGD591.72 million, presents a complex scenario for penny stock investors. The company has become profitable recently, reporting net income of SGD3.08 million for the first half of 2025, up from SGD0.895 million the previous year. Its financial health is bolstered by short-term assets exceeding both short and long-term liabilities and cash reserves surpassing total debt. However, AEM faces challenges including a patent infringement lawsuit filed by Advantest Test Solutions Inc., which it strongly contests as lacking merit. Leadership changes also mark its recent history with Samer Kabbani appointed CEO in July 2025.

- Get an in-depth perspective on AEM Holdings' performance by reading our balance sheet health report here.

- Explore AEM Holdings' analyst forecasts in our growth report.

Valuetronics Holdings (SGX:BN2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valuetronics Holdings Limited is an investment holding company that offers integrated electronics manufacturing services across various countries, with a market capitalization of SGD382.93 million.

Operations: The company's revenue is derived from two main segments: Consumer Electronics, contributing HK$367.01 million, and Industrial and Commercial Electronics, which generates HK$1.36 billion.

Market Cap: SGD382.93M

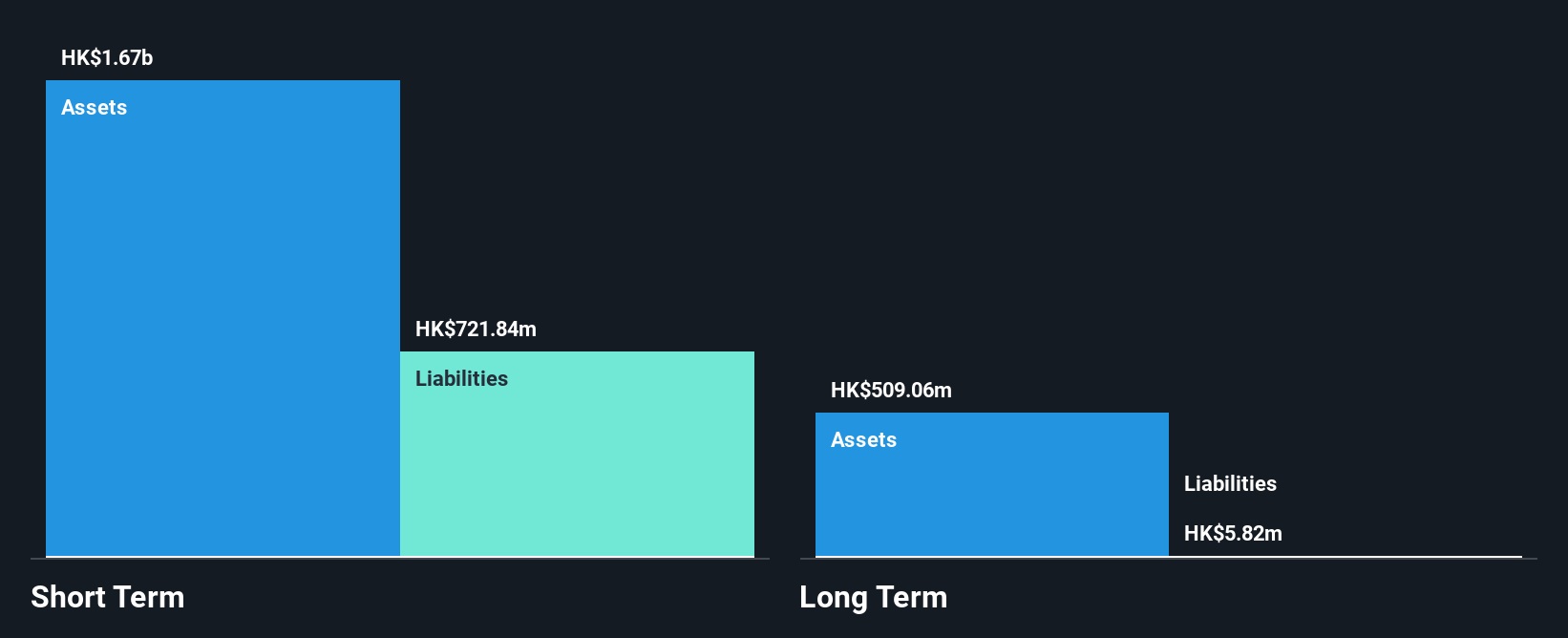

Valuetronics Holdings Limited, with a market cap of SGD382.93 million, offers a mixed picture for penny stock investors. The company is debt-free and its short-term assets of HK$1.7 billion comfortably cover both short and long-term liabilities. Despite experiencing a 1.6% annual decline in earnings over five years, recent growth has been positive at 6.8%. Valuetronics' management is seasoned with an average tenure of 8.3 years, enhancing stability amidst industry challenges. Recent inclusion in the S&P Global BMI Index and dividend increases highlight shareholder value focus, though dividends are not well-covered by free cash flows.

- Click here to discover the nuances of Valuetronics Holdings with our detailed analytical financial health report.

- Evaluate Valuetronics Holdings' prospects by accessing our earnings growth report.

Make It Happen

- Access the full spectrum of 951 Asian Penny Stocks by clicking on this link.

- Ready For A Different Approach? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PLANB

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives