- China

- /

- Professional Services

- /

- SZSE:002620

Top Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the Dow Jones and S&P 500 Indexes leading the charge, investor sentiment remains buoyant despite geopolitical tensions and domestic policy shifts. In such a vibrant market landscape, penny stocks—often representing smaller or newer companies—offer unique opportunities for those seeking growth potential at lower price points. While the term "penny stocks" might seem outdated, these investments can still provide significant value when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, is engaged in the research, design, development, production, and sale of automotive steering systems and accessories in China with a market cap of HK$8.84 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: HK$8.84B

Zhejiang Shibao has demonstrated significant financial improvement, reporting earnings growth of 195.4% over the past year, with revenues reaching CNY 1.82 billion for the nine months ending September 2024. The company's debt management is strong, with more cash than total debt and short-term assets exceeding liabilities by a substantial margin. However, shareholder dilution occurred over the past year. Despite its volatile share price recently, Zhejiang Shibao's seasoned management and board contribute to its operational stability. The company’s net profit margins have improved to 6%, reflecting enhanced profitability compared to last year's performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Shibao.

- Explore historical data to track Zhejiang Shibao's performance over time in our past results report.

Thai Eastern Group Holdings (SET:TEGH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thai Eastern Group Holdings Public Company Limited operates in the rubber, palm oil, renewable energy and organic waste management, and logistics sectors both in Thailand and internationally, with a market capitalization of THB4.04 billion.

Operations: The company's revenue is primarily derived from the Block Rubber and Concentrated Latex Segment at THB12.41 billion, followed by the Crude Palm Oil Segment at THB1.92 billion, and the Energy Segment contributing THB264 million.

Market Cap: THB4.04B

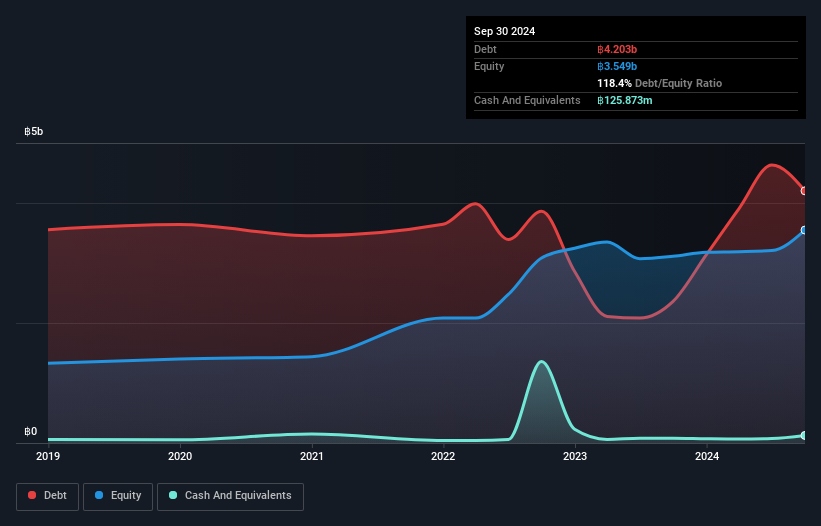

Thai Eastern Group Holdings has shown substantial revenue growth, with third-quarter earnings rising to THB 4.75 billion from THB 3.01 billion a year ago, and net income increasing significantly to THB 219.31 million. Despite this growth, the company's high net debt to equity ratio of 114.9% suggests financial leverage concerns, compounded by negative operating cash flow which inadequately covers its debt obligations. The firm trades at a good value relative to peers but faces challenges with dividend sustainability due to insufficient free cash flows and continues experiencing share price volatility amid an unstable market environment.

- Unlock comprehensive insights into our analysis of Thai Eastern Group Holdings stock in this financial health report.

- Evaluate Thai Eastern Group Holdings' prospects by accessing our earnings growth report.

Shenzhen Ruihe Construction Decoration (SZSE:002620)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Ruihe Construction Decoration Co., Ltd. operates in the construction and decoration industry, with a market cap of CN¥1.52 billion.

Operations: The company generates its revenue primarily from the Chinese market, amounting to CN¥950.31 million.

Market Cap: CN¥1.52B

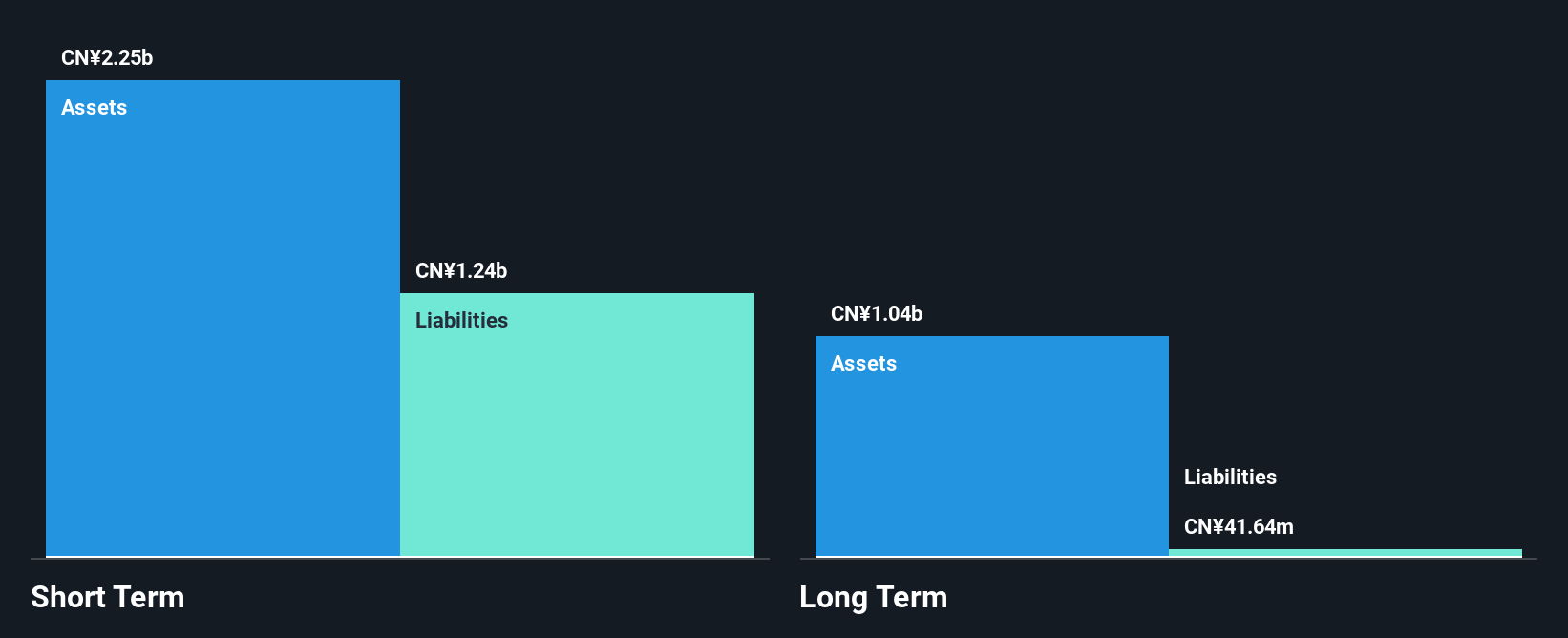

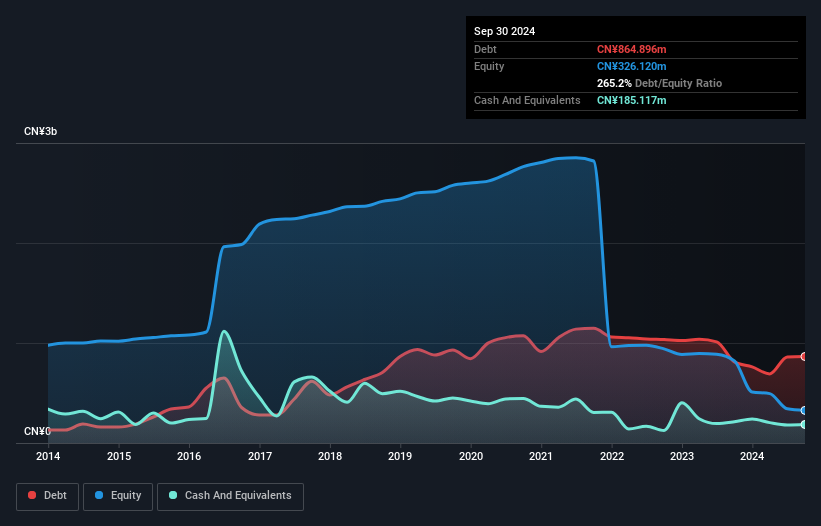

Shenzhen Ruihe Construction Decoration faces financial challenges, with a significant decline in revenue to CN¥588.22 million for the first nine months of 2024 from CN¥1.19 billion the previous year, resulting in a net loss of CN¥108.34 million. Despite having short-term assets exceeding both short and long-term liabilities, the company struggles with high debt levels, as evidenced by a net debt to equity ratio of 162.3%. The board's average tenure is relatively low at 2.9 years, indicating limited experience. However, its positive free cash flow provides a cash runway exceeding three years despite ongoing unprofitability concerns.

- Click to explore a detailed breakdown of our findings in Shenzhen Ruihe Construction Decoration's financial health report.

- Learn about Shenzhen Ruihe Construction Decoration's historical performance here.

Where To Now?

- Jump into our full catalog of 5,690 Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002620

Shenzhen Ruihe Construction Decoration

Shenzhen Ruihe Construction Decoration Co., Ltd.

Adequate balance sheet and slightly overvalued.