- Thailand

- /

- Metals and Mining

- /

- SET:INOX

January 2025 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence declining and major stock indices experiencing moderate gains, investors are keenly observing opportunities for growth. Penny stocks, often seen as smaller or newer companies with lower price points, continue to attract attention due to their potential for significant returns when backed by strong financials. This article highlights three promising penny stocks that combine solid balance sheets with the possibility of outsized gains, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.78 | HK$41.63B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.425 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,824 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$489.20 million.

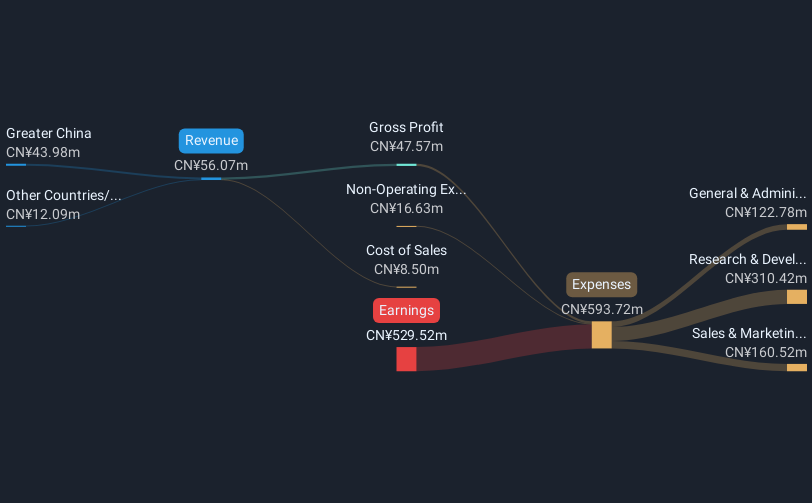

Operations: The company generated CN¥56.07 million from its segment dedicated to the research, development, and commercialization of pharmaceutical products.

Market Cap: HK$489.2M

Antengene Corporation Limited, a biopharmaceutical company, has recently made strides with its drug XPOVIO®, achieving regulatory and reimbursement milestones in China and South Korea. Despite being unprofitable, Antengene has reduced losses by 23% annually over five years and maintains more cash than debt. The company's short-term assets significantly exceed both short- and long-term liabilities, providing a solid financial buffer. With sufficient cash runway for over a year even if free cash flow remains stable, Antengene's revenue is projected to grow substantially at 66.1% annually, driven by expanding indications for XPOVIO® across Asia-Pacific markets.

- Take a closer look at Antengene's potential here in our financial health report.

- Evaluate Antengene's prospects by accessing our earnings growth report.

Advanced Information Technology (SET:AIT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Advanced Information Technology Public Company Limited, with a market cap of THB6.42 billion, operates in Thailand by designing, selling, installing, servicing, repairing, maintaining, and providing training for information and communication technology network systems.

Operations: The company's revenue is primarily derived from sales and service, totaling THB7.29 billion.

Market Cap: THB6.42B

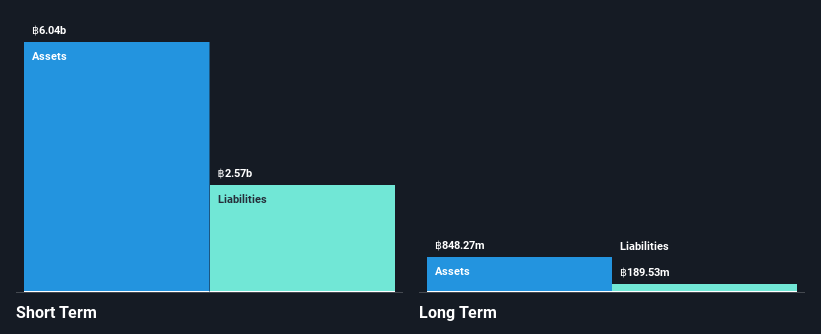

Advanced Information Technology Public Company Limited has shown solid financial performance with a revenue increase to THB5.48 billion for the first nine months of 2024, up from THB4.70 billion the previous year, and net income rising to THB422.87 million. The company is debt-free, with short-term assets exceeding both short- and long-term liabilities significantly, indicating strong financial health. Despite shareholder dilution over the past year, AIT's earnings growth of 29% surpasses its five-year average and industry growth rates. Trading below estimated fair value suggests potential undervaluation in the market despite a low return on equity at 14.2%.

- Unlock comprehensive insights into our analysis of Advanced Information Technology stock in this financial health report.

- Understand Advanced Information Technology's track record by examining our performance history report.

POSCO-Thainox (SET:INOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: POSCO-Thainox Public Company Limited is involved in the production, sale, and export of cold-rolled stainless steel products across various international markets, with a market cap of THB3.66 billion.

Operations: The company's revenue is entirely derived from its stainless steel segment, amounting to THB13.46 billion.

Market Cap: THB3.66B

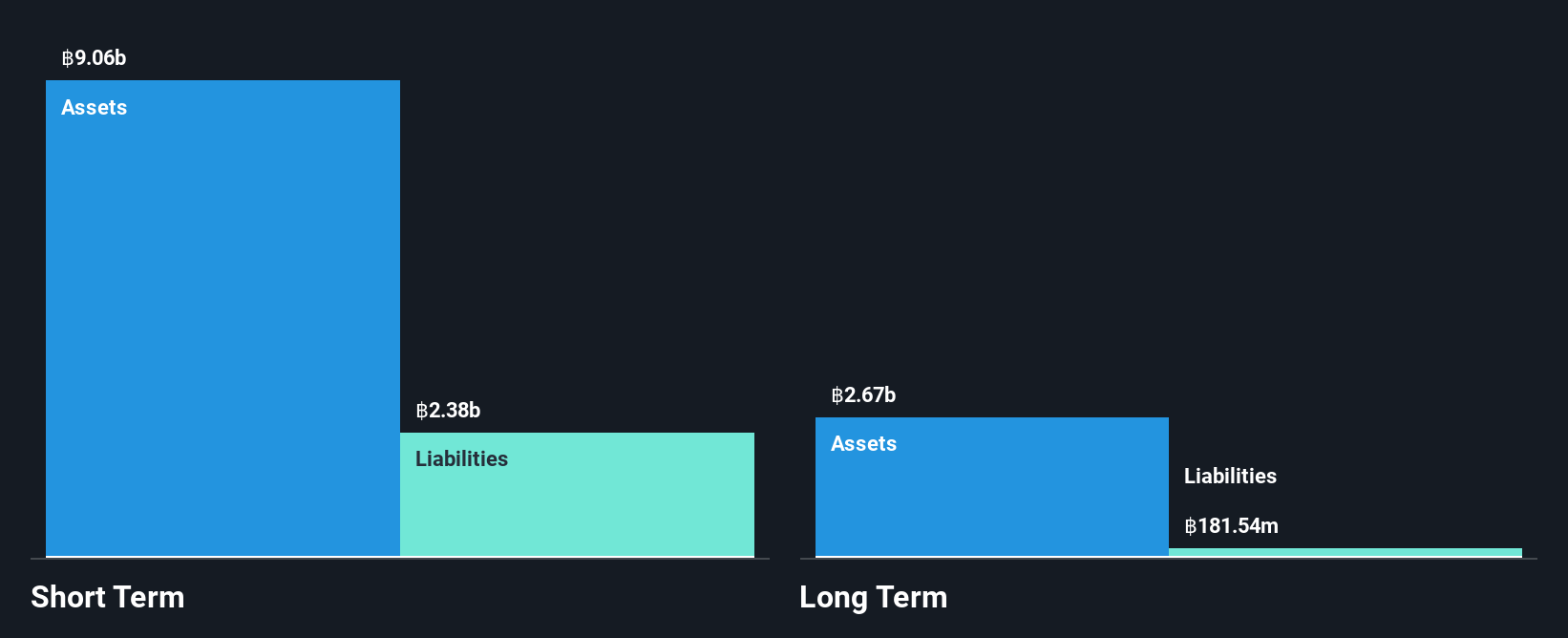

POSCO-Thainox Public Company Limited recently reported a turnaround in profitability, with net income reaching THB256.71 million for the first nine months of 2024 compared to a loss the previous year. The company remains debt-free, and its short-term assets significantly exceed liabilities, highlighting robust financial stability. However, earnings have declined by 4% annually over five years despite becoming profitable this year, and return on equity remains low at 2.3%. Trading at a substantial discount to estimated fair value suggests potential undervaluation, though its dividend coverage is weak due to limited earnings support.

- Dive into the specifics of POSCO-Thainox here with our thorough balance sheet health report.

- Learn about POSCO-Thainox's historical performance here.

Where To Now?

- Unlock more gems! Our Penny Stocks screener has unearthed 5,821 more companies for you to explore.Click here to unveil our expertly curated list of 5,824 Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:INOX

POSCO-Thainox

Engages in the production, sale, and export of cold-rolled stainless steel products in Thailand, South Korea, the United States, Germany, India, Hong Kong, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives