Asian Penny Stocks: Rongzun International Holdings Group And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

Amidst the backdrop of global market fluctuations, Asia's financial landscape continues to capture investor interest with its diverse opportunities and challenges. Penny stocks, often associated with smaller or less-established companies, remain a focal point for those seeking potential growth and value in under-the-radar investments. While the term may seem dated, these stocks can offer substantial opportunities when backed by strong financials, as we explore through three noteworthy examples in this article.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.89 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD437.71M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.90 | THB2.94B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.42 | SGD13.46B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.99 | HK$2.65B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.86 | NZ$237.89M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 934 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Rongzun International Holdings Group (SEHK:1780)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rongzun International Holdings Group Limited is an investment holding company operating as a contractor specializing in alteration and addition, as well as civil engineering works in Hong Kong, with a market cap of HK$533.20 million.

Operations: The company generates revenue primarily through two segments: Civil Engineering Works, contributing HK$41.03 million, and Alteration and Addition Works, accounting for HK$47.35 million.

Market Cap: HK$533.2M

Rongzun International Holdings Group Limited, with a market cap of HK$533.20 million, operates as a contractor in Hong Kong focusing on civil engineering and alteration works. Despite generating revenues of HK$41.03 million and HK$47.35 million from these segments respectively, the company remains unprofitable with losses increasing at 10.7% annually over five years. The stock is highly volatile, experiencing increased weekly volatility from 14% to 22%. While debt-free and not significantly diluted recently, its dividend yield of 4.65% lacks coverage by earnings or cash flows, raising sustainability concerns amidst an inexperienced board tenure averaging 1.9 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Rongzun International Holdings Group.

- Assess Rongzun International Holdings Group's previous results with our detailed historical performance reports.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China, with a market cap of HK$24.04 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported specific revenue segments.

Market Cap: HK$24.04B

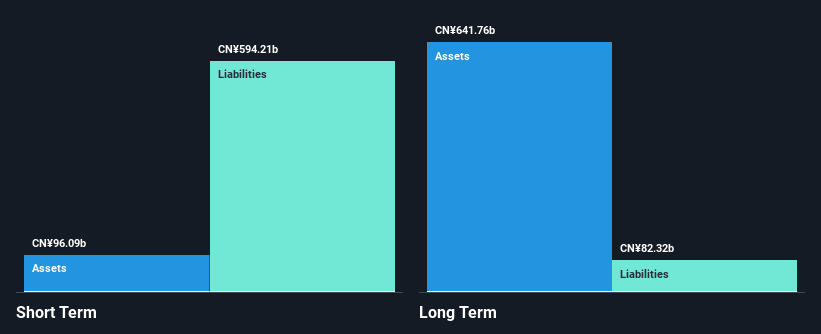

Dongguan Rural Commercial Bank, with a market cap of HK$24.04 billion, has experienced declining earnings with net income dropping from CNY 4,555.46 million to CNY 3,644.61 million over the past year. Despite this, it maintains high-quality earnings and an appropriate level of bad loans at 1.8%. The bank's funding is primarily low-risk through customer deposits, comprising 79% of liabilities. Its board and management are considered experienced with tenures averaging 5.9 and 2.7 years respectively. While its Return on Equity is low at 6.1%, the stock trades significantly below fair value estimates by analysts.

- Take a closer look at Dongguan Rural Commercial Bank's potential here in our financial health report.

- Learn about Dongguan Rural Commercial Bank's historical performance here.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB8.85 billion, manufactures and distributes rubber insulation, automotive, and plastic packing products in Thailand and internationally through its subsidiaries.

Operations: Eastern Polymer Group's revenue segments are not reported.

Market Cap: THB8.85B

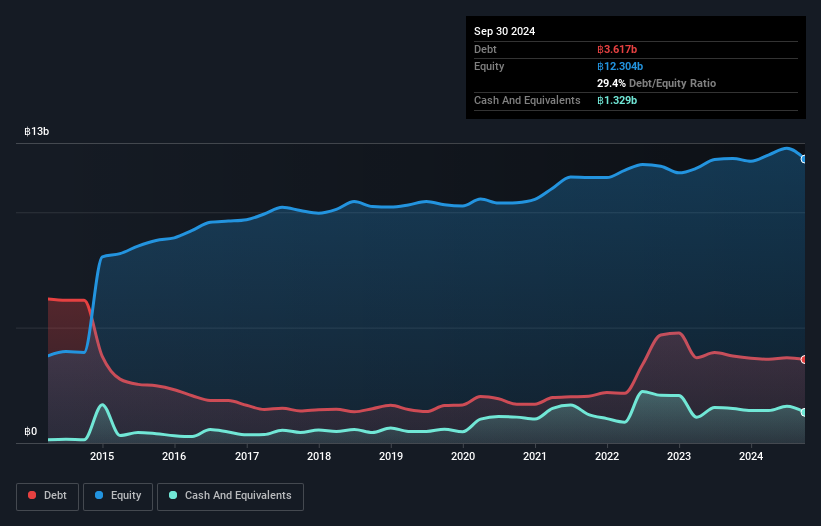

Eastern Polymer Group, with a market cap of THB8.85 billion, has shown robust earnings growth, reporting net income of THB 315.26 million for the second quarter of 2025, up from THB 130.31 million the previous year. The company trades at a discount to its estimated fair value and maintains strong financial health with short-term assets exceeding both short- and long-term liabilities. Its debt is well-covered by operating cash flow, though its Return on Equity remains low at 7.8%. Despite being dropped from the S&P Global BMI Index recently, it benefits from a seasoned management team and stable weekly volatility.

- Navigate through the intricacies of Eastern Polymer Group with our comprehensive balance sheet health report here.

- Evaluate Eastern Polymer Group's prospects by accessing our earnings growth report.

Where To Now?

- Click this link to deep-dive into the 934 companies within our Asian Penny Stocks screener.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives