- Saudi Arabia

- /

- Machinery

- /

- SASE:9568

3 Promising Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

The global markets have been experiencing a surge, with U.S. stocks reaching record highs following a Republican electoral victory that has sparked hopes for growth and tax reforms. Amidst these developments, the concept of penny stocks remains relevant as they offer unique opportunities in smaller or newer companies. With strong financial foundations, these stocks can provide significant growth potential and uncover hidden value for investors seeking to capitalize on market dynamics.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.865 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

Click here to see the full list of 5,755 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Mayar Holding (SASE:9568)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mayar Holding Company operates in Saudi Arabia, focusing on the manufacturing, selling, trading, installing, and maintaining of elevators and escalators along with their spare parts, with a market cap of SAR443.89 million.

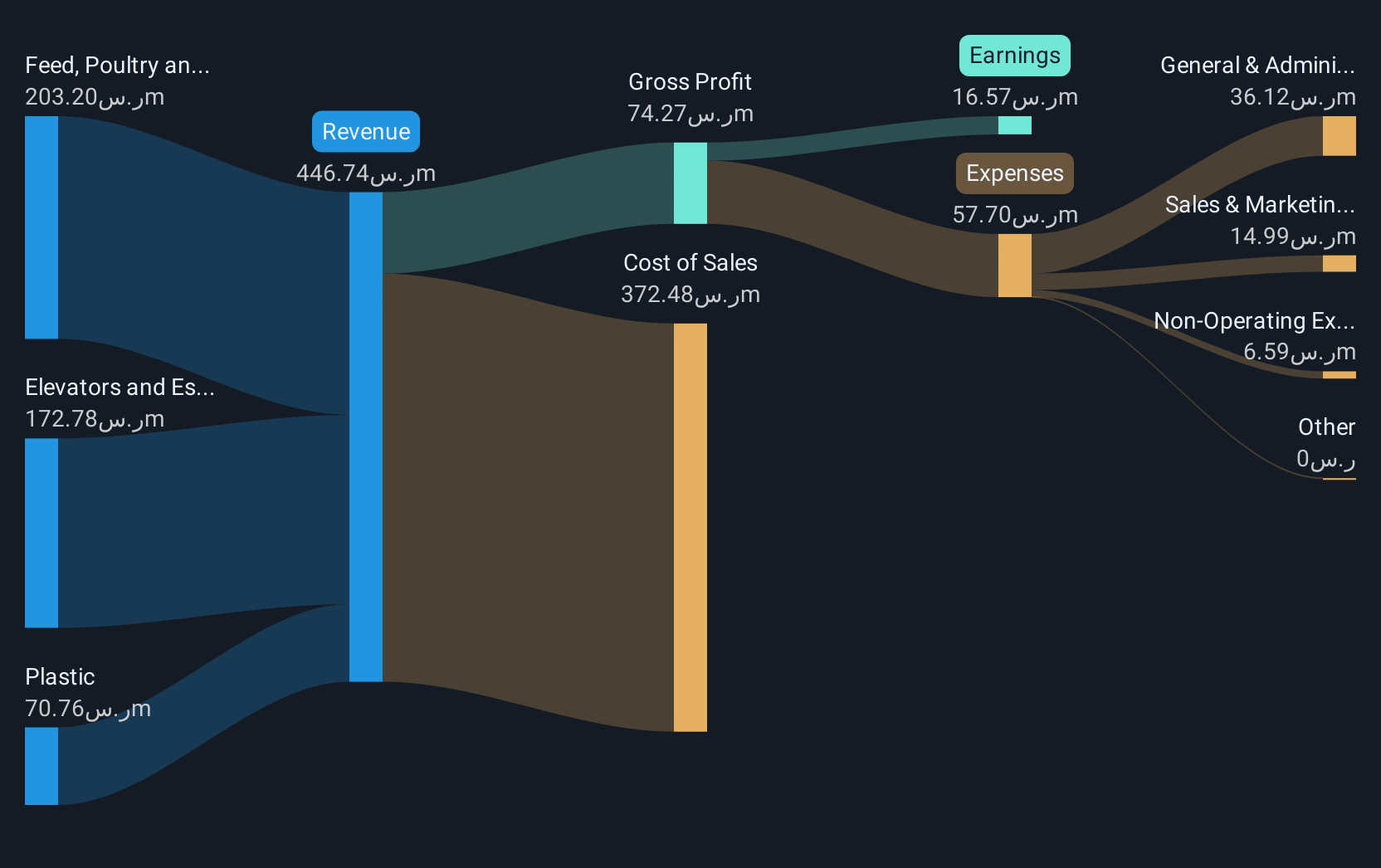

Operations: The company's revenue is primarily derived from its Elevators and Escalators segment, generating SAR186.62 million, followed by the Feed and Agriculture sector at SAR170.84 million and the Plastic division contributing SAR81.06 million.

Market Cap: SAR443.89M

Mayar Holding, with a market cap of SAR443.89 million, operates primarily in the Elevators and Escalators sector. Despite generating revenues from multiple segments, the company remains unprofitable with a negative return on equity of -129.7%. Short-term liabilities exceed short-term assets by SAR145.9 million, although long-term liabilities are covered by current assets. The company has faced increasing losses over the past five years at 54.6% annually but benefits from a positive and growing cash flow that provides a cash runway exceeding three years. However, its net debt to equity ratio is very high at 1046.8%, indicating significant leverage concerns.

- Unlock comprehensive insights into our analysis of Mayar Holding stock in this financial health report.

- Gain insights into Mayar Holding's past trends and performance with our report on the company's historical track record.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB12.94 billion, operates in the manufacture and distribution of rubber insulation, automotive products, and plastic packing both in Thailand and internationally.

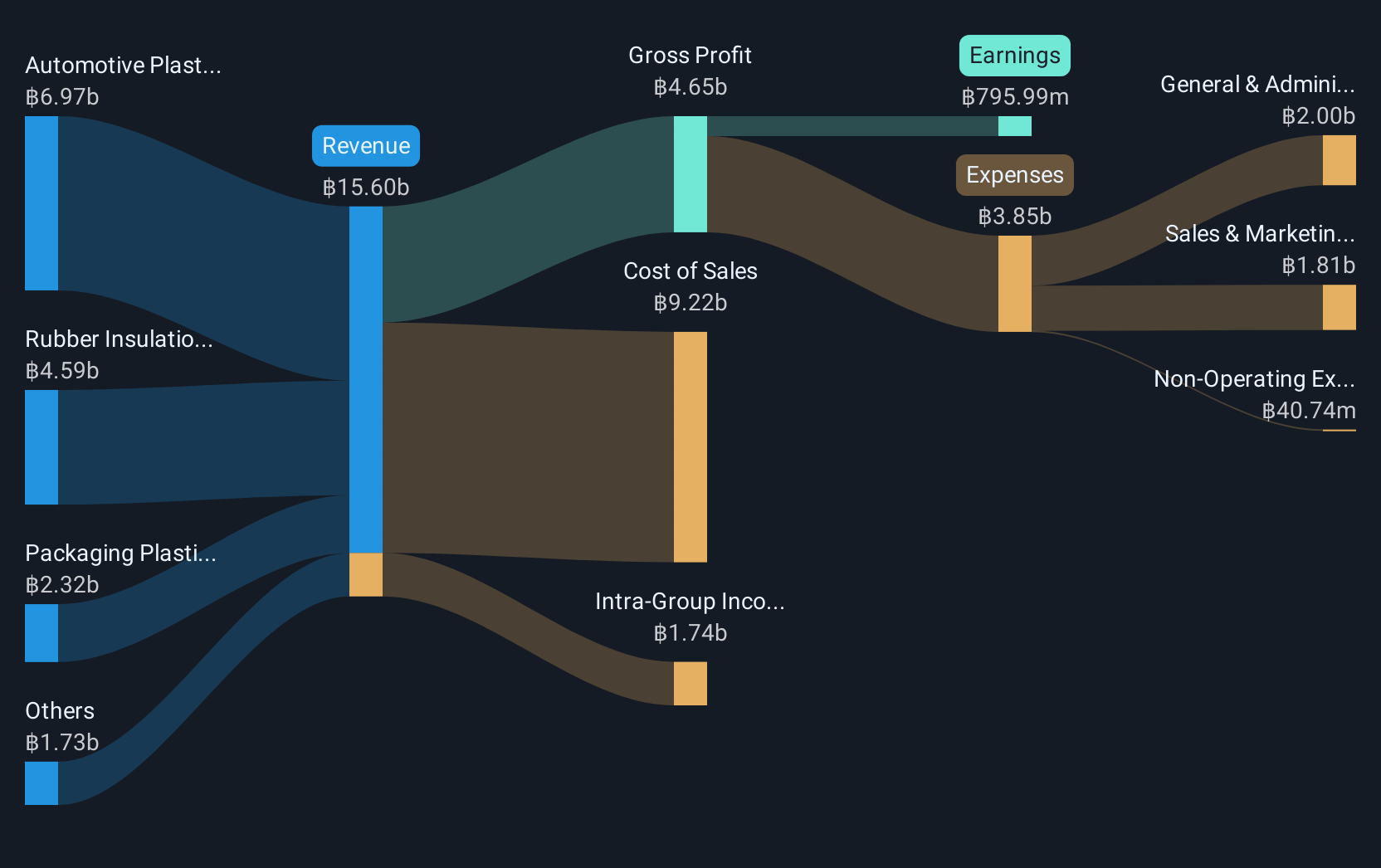

Operations: The company's revenue is primarily derived from three segments: Rubber Insulation (THB4.21 billion), Automotive Plastics (THB7.02 billion), and Packaging Plastics (THB2.38 billion).

Market Cap: THB12.94B

Eastern Polymer Group's market cap of THB12.94 billion reflects its established presence in rubber insulation, automotive plastics, and packaging plastics. The company recently approved a strategic expansion into South Africa to boost automotive parts production, aiming for increased future revenue. Despite a slight decline in net income to THB253.61 million for the first quarter of 2024, EPG maintains high-quality earnings and stable weekly volatility at 6%. While its debt-to-equity ratio has risen over five years, operating cash flow sufficiently covers debt obligations. However, return on equity remains low at 9.1%, with profit margins decreasing year-over-year.

- Jump into the full analysis health report here for a deeper understanding of Eastern Polymer Group.

- Learn about Eastern Polymer Group's future growth trajectory here.

Rojukiss International (SET:KISS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rojukiss International Public Company Limited distributes skincare, cosmetics, food supplements, pharmaceutical, and medical products in Thailand and several other countries with a market cap of THB2.82 billion.

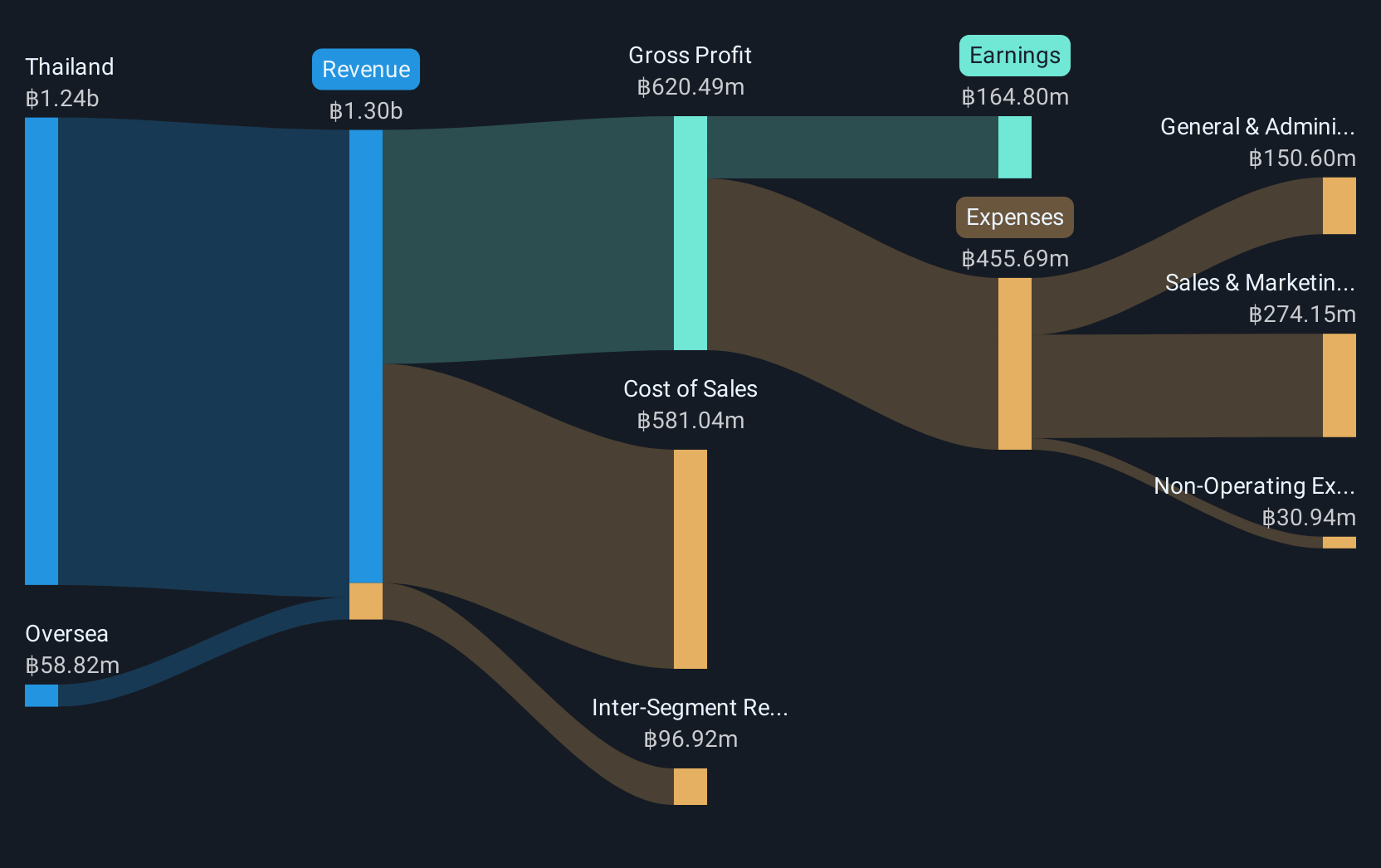

Operations: The company generates revenue from its Personal Products segment, amounting to THB1.04 billion.

Market Cap: THB2.82B

Rojukiss International, with a market cap of THB2.82 billion, shows strong financial health in the Personal Products sector. Its operating cash flow covers 70.6% of its debt, and short-term assets of THB1.3 billion surpass both short- and long-term liabilities significantly. The company's earnings growth of 15.5% over the past year outpaces industry averages, though its Return on Equity is considered low at 14%. Recent executive changes include the appointment of Miss Saranthorn Chantakulchai as CFO in September 2024. Despite high-quality earnings and stable weekly volatility at 5%, dividend sustainability remains a concern due to inadequate free cash flow coverage.

- Take a closer look at Rojukiss International's potential here in our financial health report.

- Gain insights into Rojukiss International's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Take a closer look at our Penny Stocks list of 5,755 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9568

Mayar Holding

Engages in the manufacturing, selling, trading, installing, and maintaining of elevators and escalators, and their spare parts in Saudi Arabia.

Fair value with acceptable track record.

Market Insights

Community Narratives