As global markets navigate a mixed landscape of economic indicators, with U.S. consumer confidence dipping and European stocks edging higher, investors are paying close attention to how these dynamics might influence their portfolios. In this environment, dividend stocks can offer a compelling blend of income and potential stability, making them an attractive option for those looking to navigate uncertain times while benefiting from regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

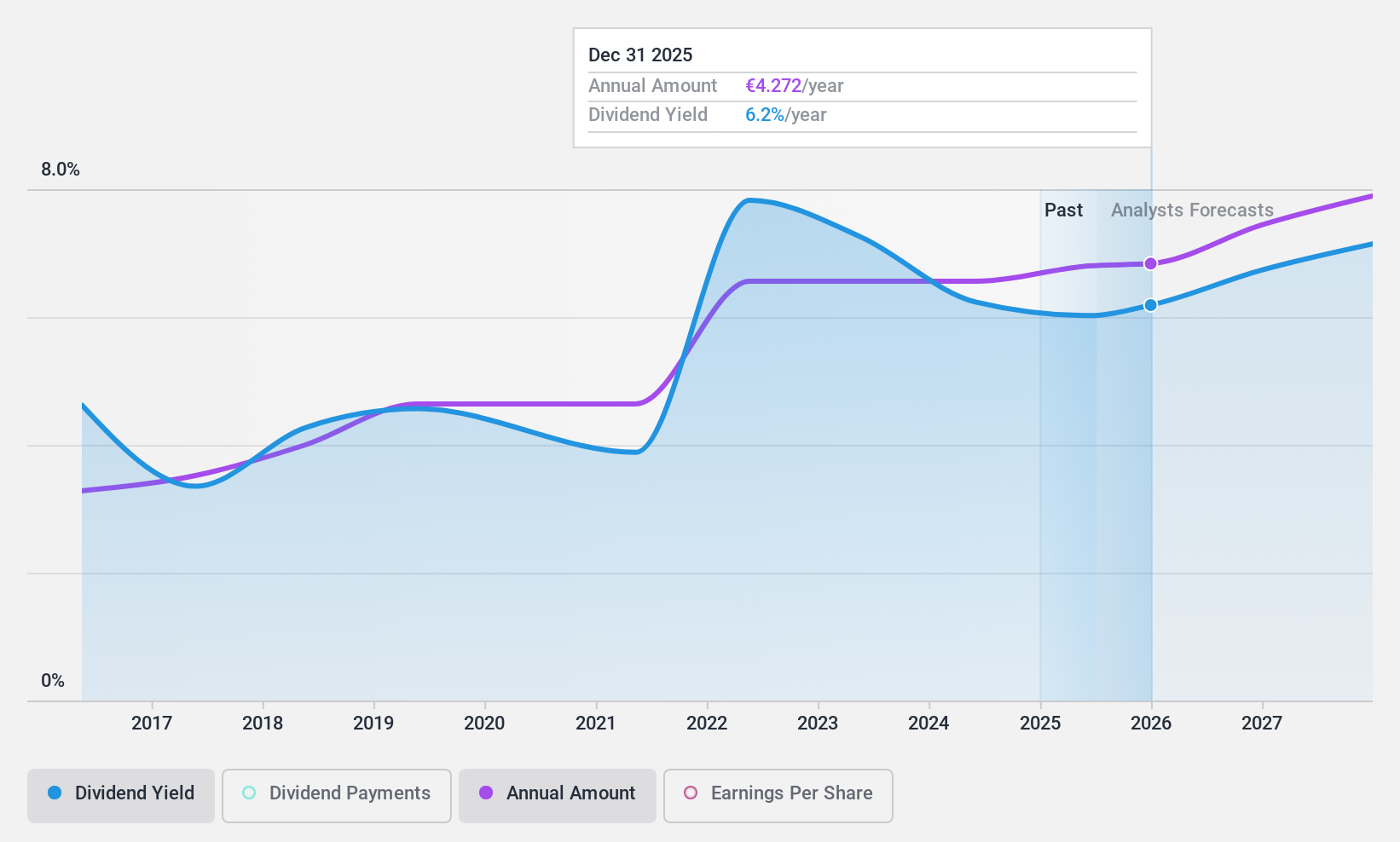

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of €13.17 billion.

Operations: Amundi generates revenue primarily through its Asset Management segment, which accounts for €6.17 billion.

Dividend Yield: 6.4%

Amundi's dividend strategy shows mixed results. While its dividend yield is in the top 25% of French market payers and payments are covered by both earnings (69.3% payout ratio) and cash flows (59.9%), the company's track record is unstable, with less than a decade of volatile payments. Recent executive appointments aim to bolster growth, potentially impacting future dividends. Additionally, Amundi's interest in acquiring Allianz Global Investors could influence its financial strategies moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of Amundi.

- Our comprehensive valuation report raises the possibility that Amundi is priced lower than what may be justified by its financials.

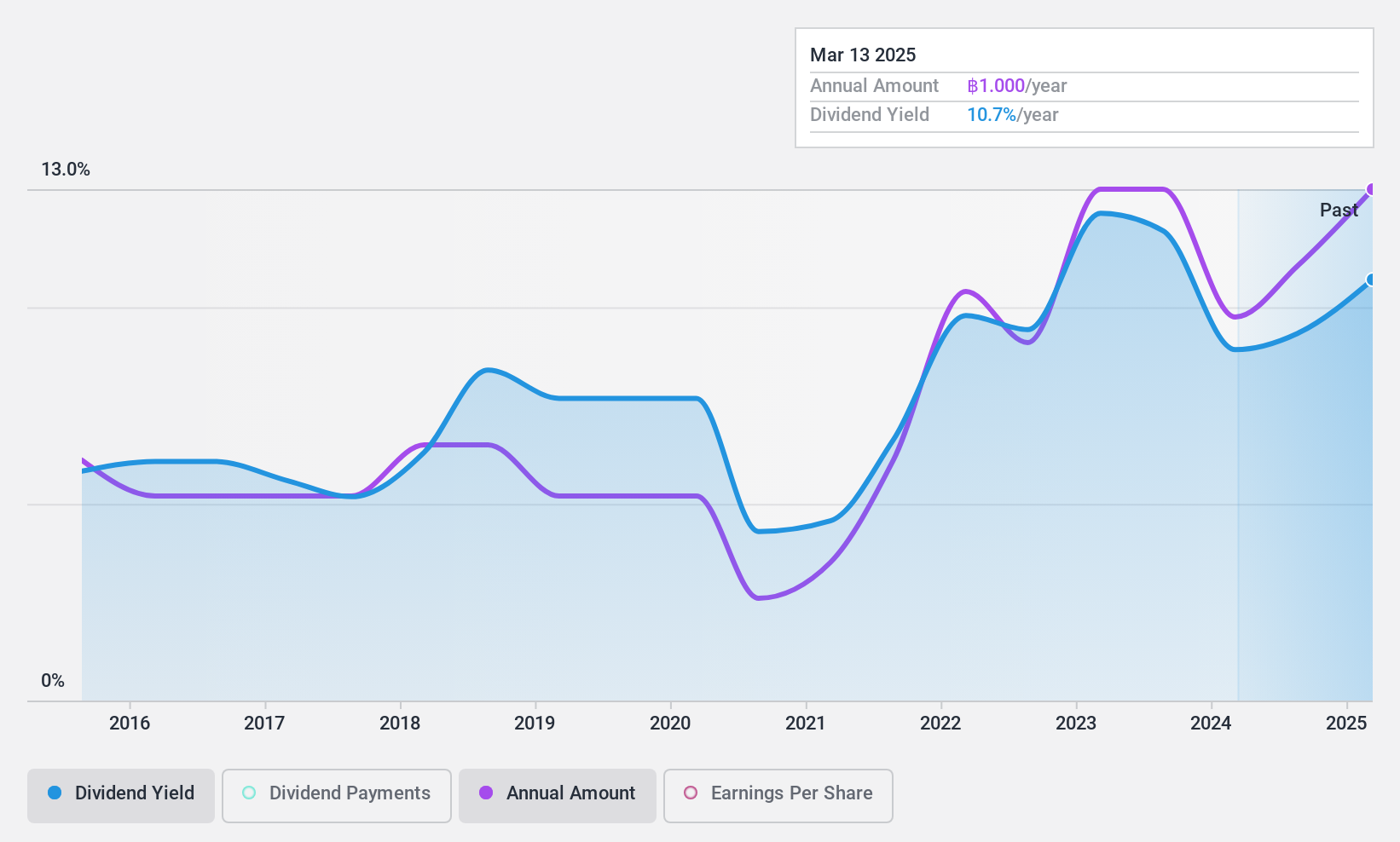

Univanich Palm Oil (SET:UVAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Univanich Palm Oil Public Company Limited operates in Thailand with a focus on oil palm plantations, crushing mills, and oil palm research and seed businesses, and has a market cap of THB8.65 billion.

Operations: Univanich Palm Oil Public Company Limited generates revenue from its operations in oil palm plantations, crushing mills, and oil palm research and seed businesses in Thailand.

Dividend Yield: 8%

Univanich Palm Oil's dividend yield is among the top 25% in Thailand, supported by a reasonable payout ratio of 59.1%. However, its dividend history is unstable, with volatility over the past decade. Despite this, dividends are covered by both earnings and cash flows. Recent earnings reports show significant growth in net income to THB 409.11 million for Q3 2024 from THB 173.19 million a year ago, which may support future payouts.

- Click to explore a detailed breakdown of our findings in Univanich Palm Oil's dividend report.

- The valuation report we've compiled suggests that Univanich Palm Oil's current price could be quite moderate.

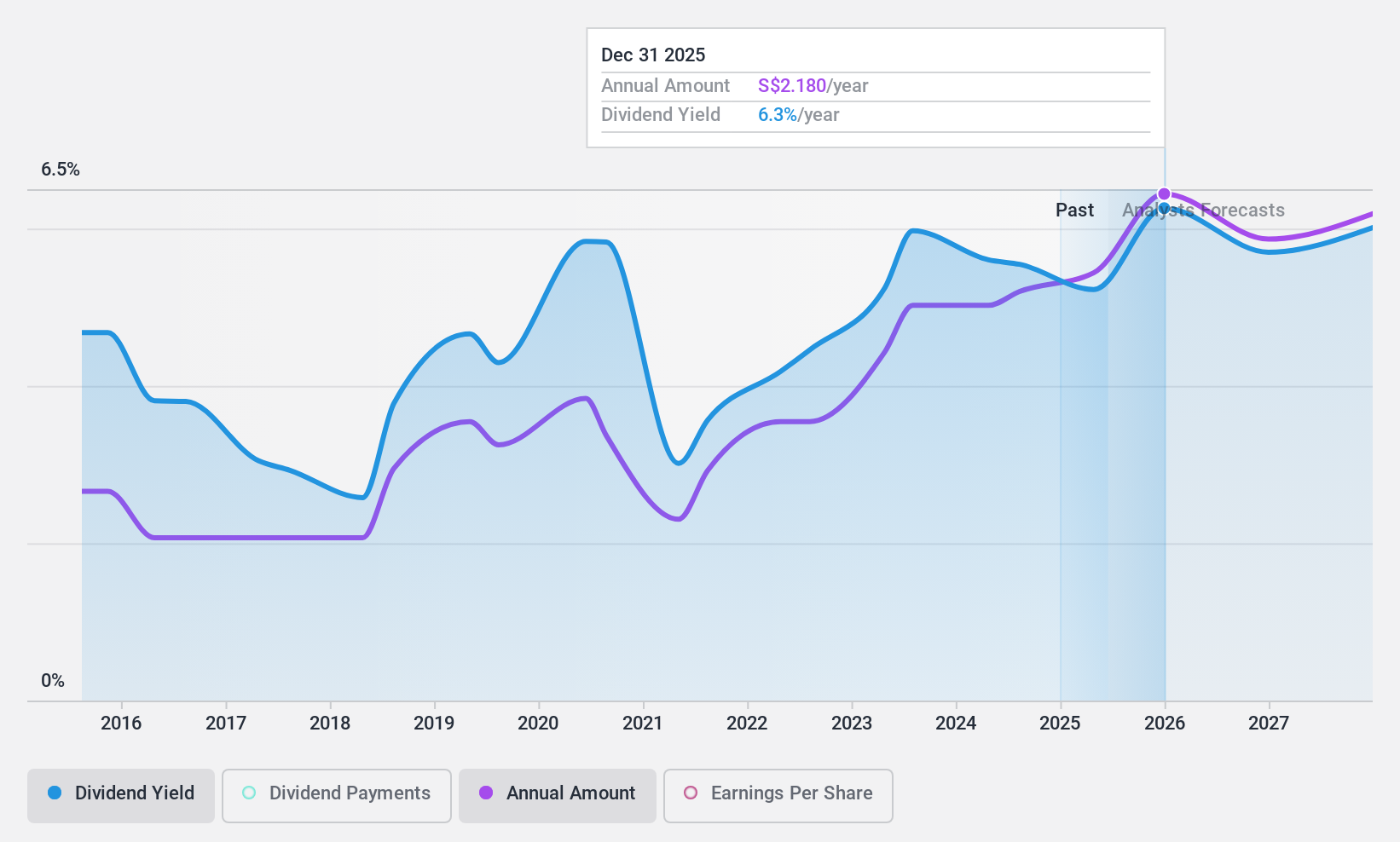

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market capitalization of SGD61.09 billion.

Operations: United Overseas Bank Limited generates revenue through its diverse range of banking products and services offered globally.

Dividend Yield: 4.8%

United Overseas Bank's dividend yield is lower than the top 25% of Singaporean dividend payers, with a current payout ratio of 49.8%, indicating dividends are covered by earnings. However, its dividend history is volatile and unreliable over the past decade despite an increase in payments during this period. Recent earnings have shown growth, with net income rising to S$4.52 billion for Q3 2024 from S$4.31 billion a year ago, potentially supporting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of United Overseas Bank.

- The analysis detailed in our United Overseas Bank valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 1973 Top Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:UVAN

Univanich Palm Oil

Engages in the oil palm plantations, crushing mills, and oil palm research and seed businesses in Thailand and the Philippines.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives