- South Korea

- /

- Food

- /

- KOSE:A005180

Top Asian Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate expectations and technological advancements, Asian markets have shown resilience with notable gains in major indices such as Japan's Nikkei 225 and China's CSI 300. In this context, dividend stocks offer an appealing option for investors seeking steady income streams amidst economic fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.03% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.28% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.70% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.76% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.95% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.97% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.38% | ★★★★★★ |

Click here to see the full list of 1024 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

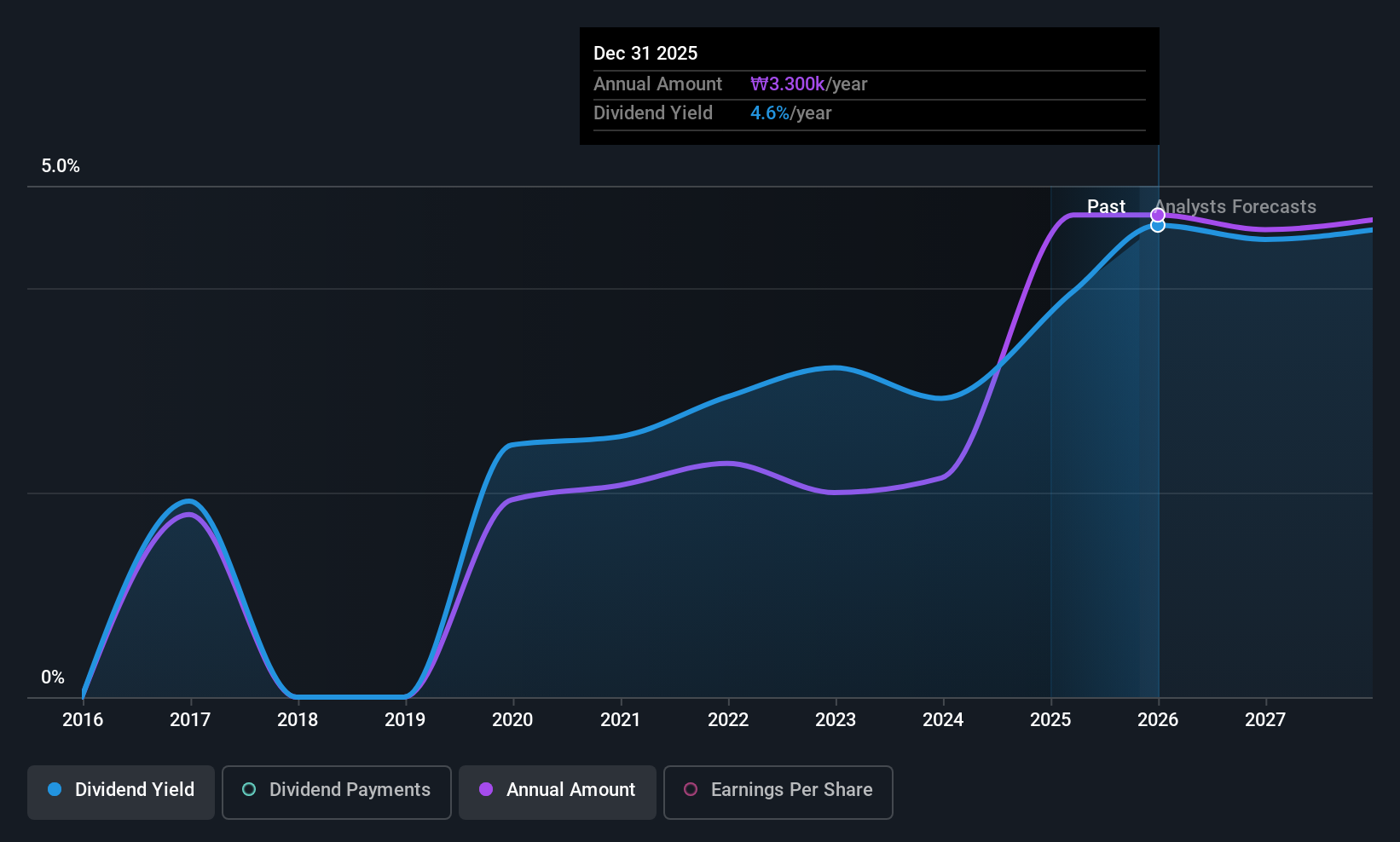

Binggrae (KOSE:A005180)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Binggrae Co., Ltd. is involved in the production and sale of dairy products both in South Korea and internationally, with a market cap of approximately ₩673.75 billion.

Operations: Binggrae Co., Ltd. generates its revenue primarily from the manufacture and sale of dairy products, amounting to approximately ₩1.47 billion.

Dividend Yield: 4.3%

Binggrae offers a compelling dividend profile with a yield of 4.33%, placing it in the top 25% of Korean market payers. Its dividends are reliably covered by earnings (payout ratio: 34.6%) and cash flows (cash payout ratio: 46.3%). Despite recent declines in net income, its dividends have remained stable and growing over the past decade, supported by good relative value compared to peers and industry benchmarks.

- Get an in-depth perspective on Binggrae's performance by reading our dividend report here.

- The analysis detailed in our Binggrae valuation report hints at an deflated share price compared to its estimated value.

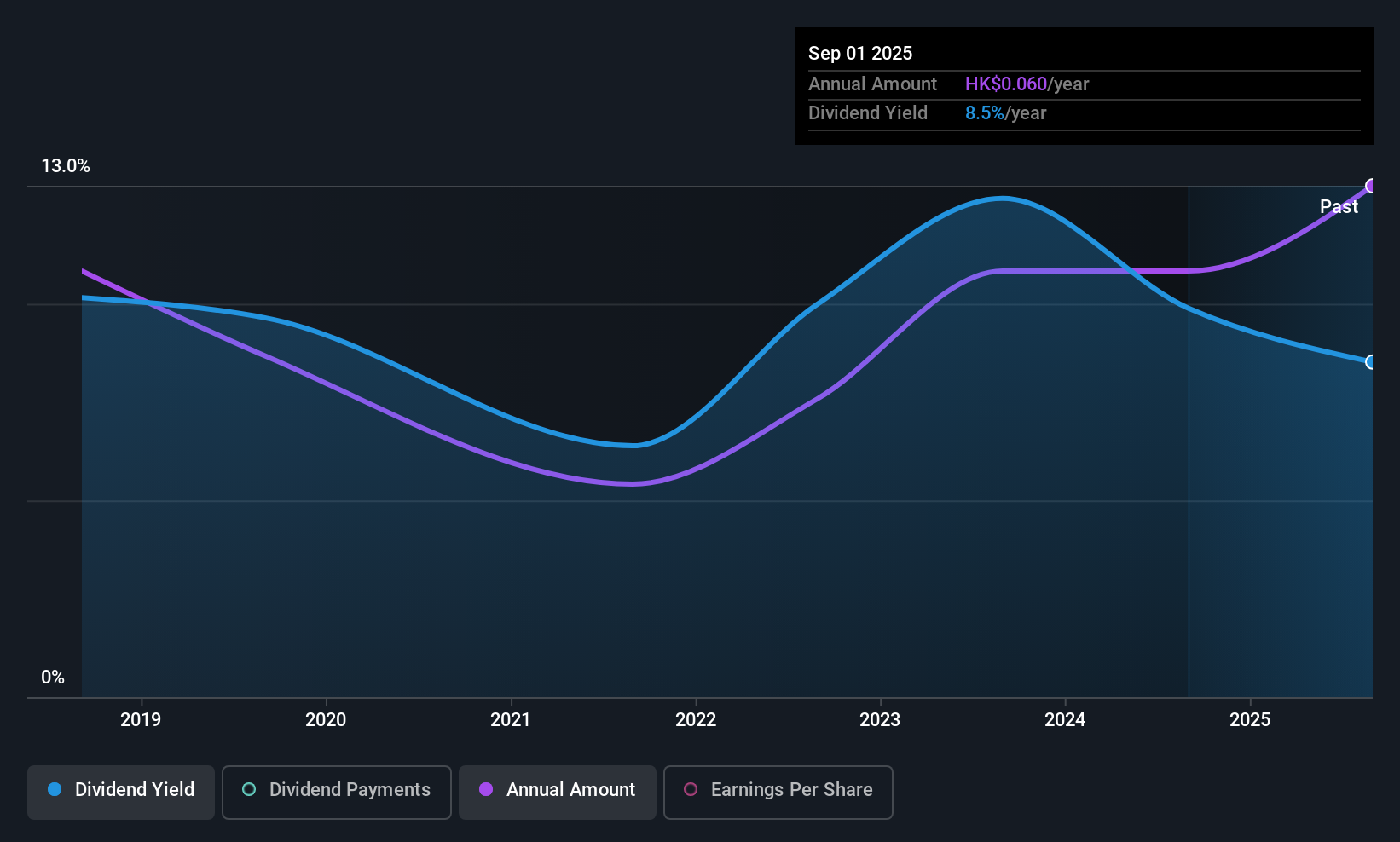

Able Engineering Holdings (SEHK:1627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able Engineering Holdings Limited, with a market cap of HK$1.42 billion, operates in the building construction sector in Hong Kong through its subsidiaries.

Operations: Able Engineering Holdings Limited generates revenue primarily from its construction segment, amounting to HK$7.97 billion.

Dividend Yield: 8.5%

Able Engineering Holdings approved a final dividend of HK$0.06 per share, reflecting its top-tier yield of 8.45% in the Hong Kong market. Despite only seven years of dividend history and volatility with drops over 20%, dividends are well-covered by earnings (payout ratio: 52.5%) and cash flows (cash payout ratio: 40.2%). Recent board changes may impact strategic direction, but current financials show strong revenue growth to HK$7.97 billion, supporting ongoing dividend payments.

- Delve into the full analysis dividend report here for a deeper understanding of Able Engineering Holdings.

- According our valuation report, there's an indication that Able Engineering Holdings' share price might be on the cheaper side.

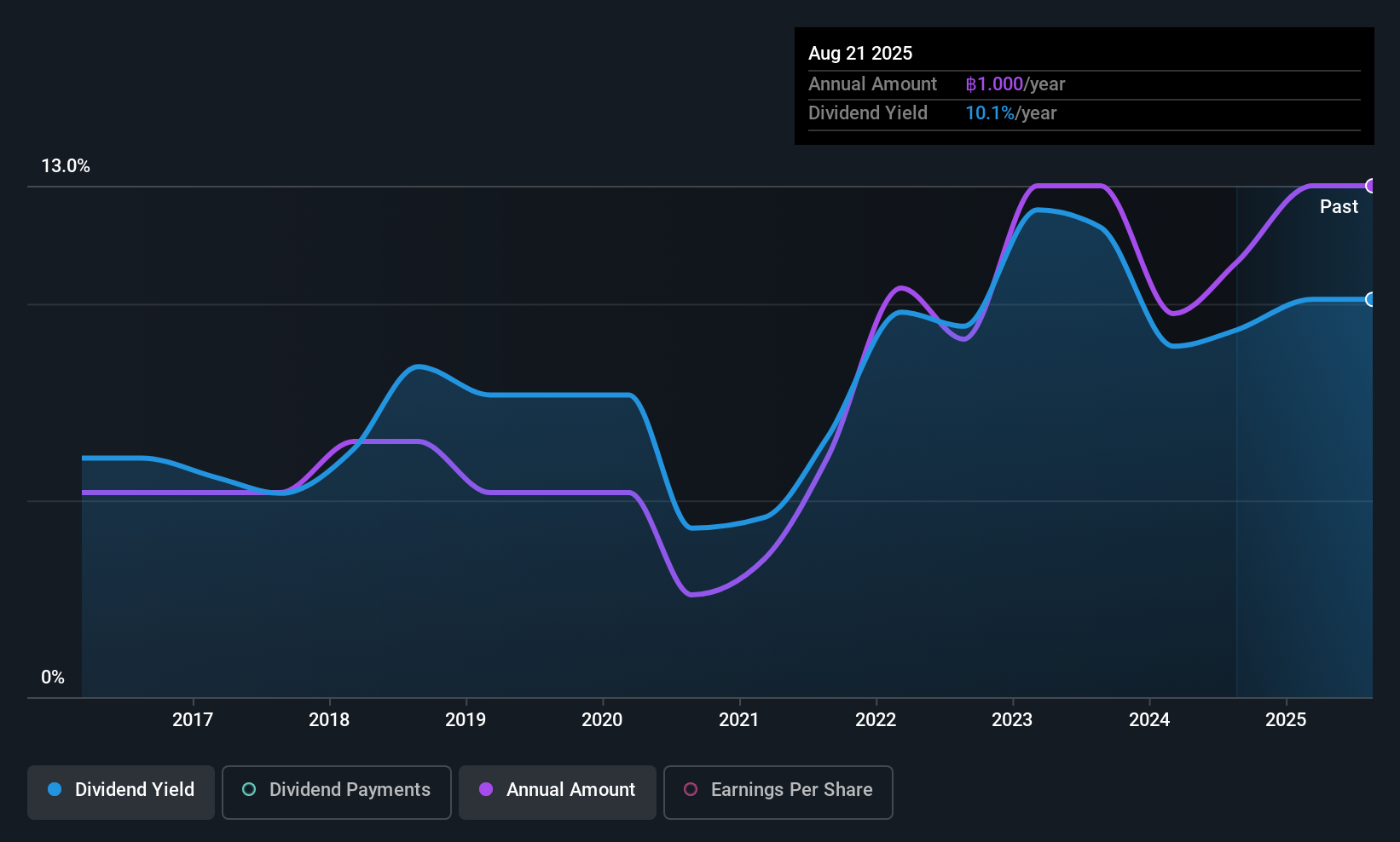

Univanich Palm Oil (SET:UVAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univanich Palm Oil Public Company Limited operates oil palm plantations, crushing mills, and engages in oil palm research and seed businesses in Thailand and the Philippines with a market cap of THB11.09 billion.

Operations: Univanich Palm Oil Public Company Limited generates revenue through its operations in oil palm plantations, crushing mills, and oil palm research and seed businesses across Thailand and the Philippines.

Dividend Yield: 8.5%

Univanich Palm Oil declared an interim dividend of THB 0.40 per share, reflecting a top-tier yield of 8.47% in the Thai market. Despite earnings growth of 32.9% over the past year and a reasonable payout ratio of 63.1%, dividends are not well covered by free cash flows due to a high cash payout ratio of 106.2%. Historically volatile with annual drops over 20%, dividends have increased over the past decade but remain unreliable for stability-focused investors.

- Click here to discover the nuances of Univanich Palm Oil with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Univanich Palm Oil's share price might be too pessimistic.

Make It Happen

- Investigate our full lineup of 1024 Top Asian Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binggrae might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005180

Binggrae

Engages in production and sale of dairy products in South Korea and internationally.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives