Three Stocks That May Be Priced Below Their Estimated Value In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and interest rate uncertainties, U.S. stock indexes are climbing toward record highs, buoyed by growth stocks outperforming value shares. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market opportunities; such stocks may offer intrinsic value that is not yet reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Samwha ElectricLtd (KOSE:A009470) | ₩43300.00 | ₩86056.86 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Elin Electronics (NSEI:ELIN) | ₹128.00 | ₹254.83 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.01 | 49.8% |

| Sobha (NSEI:SOBHA) | ₹1196.85 | ₹2376.30 | 49.6% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96048.27 | 49.7% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

LEPU ScienTech Medical Technology (Shanghai) (SEHK:2291)

Overview: LEPU ScienTech Medical Technology (Shanghai) Co., Ltd. is an investment holding company involved in the research, development, manufacture, and commercialization of interventional medical devices globally, with a market cap of approximately HK$5.93 billion.

Operations: The company's revenue is primarily derived from its activities in the research, development, manufacturing, and commercialization of interventional medical devices on a global scale.

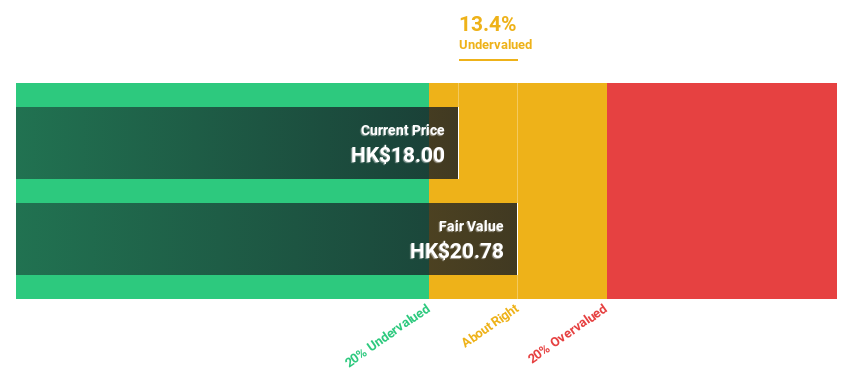

Estimated Discount To Fair Value: 15.9%

LEPU ScienTech Medical Technology (Shanghai) is trading at HK$17.34, below its estimated fair value of HK$20.63, suggesting potential undervaluation based on cash flows. Despite a low forecasted Return on Equity of 16.6%, the company anticipates robust revenue growth at 34.8% annually and earnings growth at 33.3%, outpacing the Hong Kong market averages significantly. However, dividend coverage by earnings or free cash flows remains weak, indicating caution for income-focused investors.

- Our growth report here indicates LEPU ScienTech Medical Technology (Shanghai) may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of LEPU ScienTech Medical Technology (Shanghai) stock in this financial health report.

Thaifoods Group (SET:TFG)

Overview: Thaifoods Group Public Company Limited operates in the production and distribution of chicken and swine products in Thailand, with a market cap of THB19.64 billion.

Operations: The company's revenue segments include Swine (THB26.64 billion), Retail (THB22.79 billion), Poultry (THB44.45 billion), and Feed Mill (THB29.25 billion).

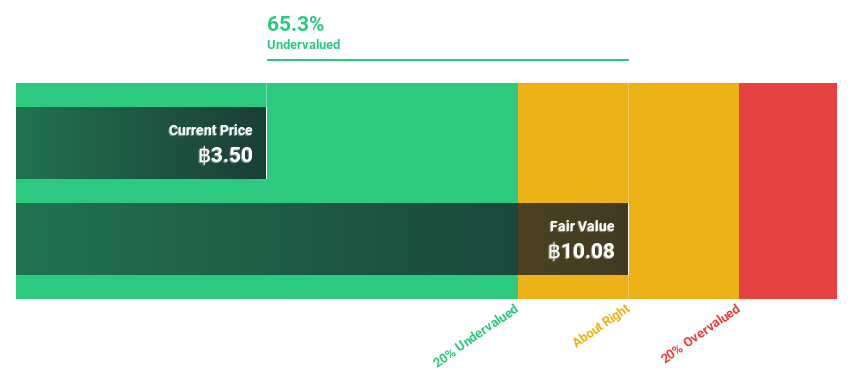

Estimated Discount To Fair Value: 23%

Thaifoods Group, trading at THB3.48, is priced 23% below its fair value estimate of THB4.52, highlighting potential undervaluation based on cash flows. While the forecasted Return on Equity is low at 18.9%, earnings are expected to grow significantly by 24% annually over the next three years, surpassing market averages. Recent fixed-income offerings may impact financial strategy but do not alter its strong growth outlook in revenue and earnings compared to the Thai market.

- Our earnings growth report unveils the potential for significant increases in Thaifoods Group's future results.

- Click here to discover the nuances of Thaifoods Group with our detailed financial health report.

Nuvoton Technology (TWSE:4919)

Overview: Nuvoton Technology Corporation, along with its subsidiaries, operates as a semiconductor company and has a market cap of NT$40.34 billion.

Operations: The company's revenue is primarily derived from General Integrated Circuit Products, totaling NT$30.37 billion, and Wafer Foundry services, contributing NT$2.08 billion.

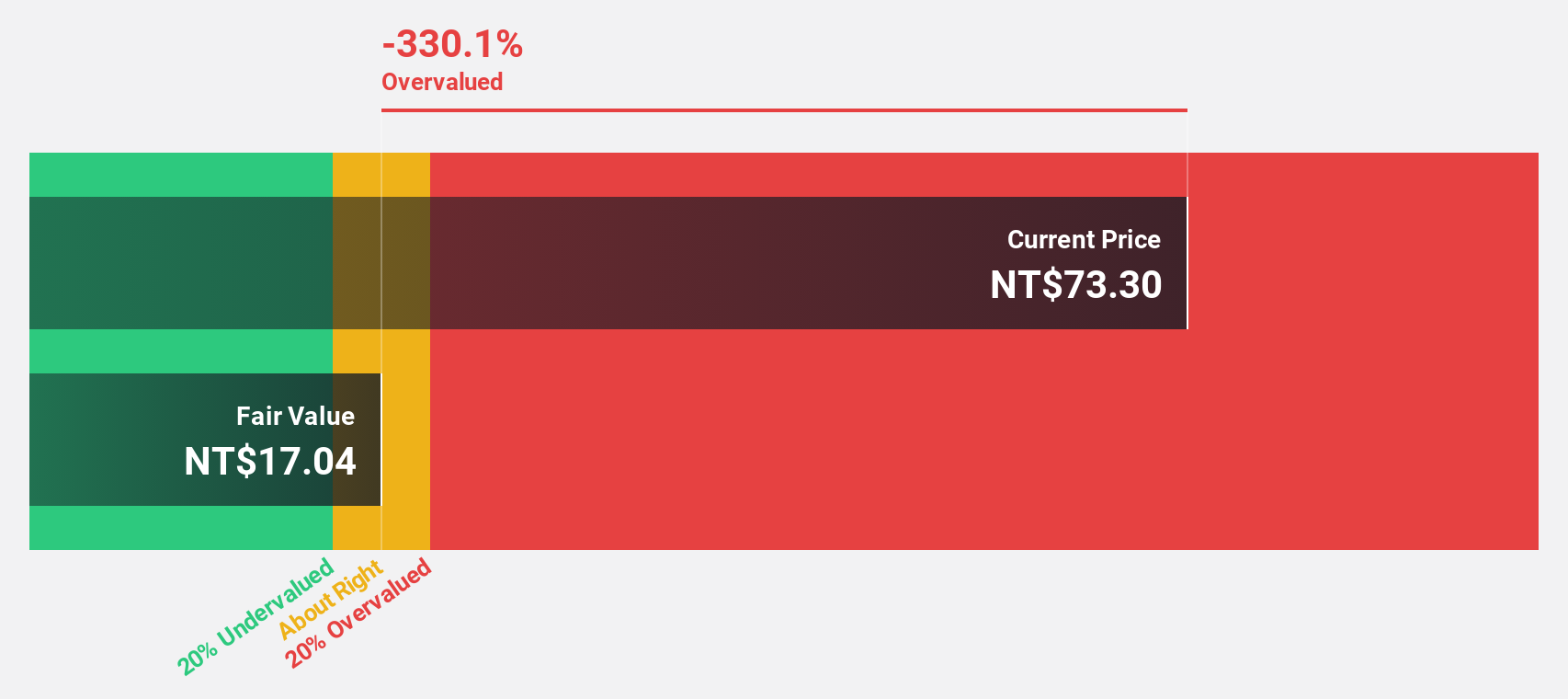

Estimated Discount To Fair Value: 49.2%

Nuvoton Technology, trading at NT$97.2, is significantly undervalued with a fair value estimate of NT$191.21 based on discounted cash flow analysis. Despite a lower profit margin this year (3% vs 6.7%), earnings are projected to grow substantially at 95.8% annually, outpacing the TW market's growth rate of 17.9%. However, its dividend yield of 3.09% is not well supported by earnings or free cash flows, suggesting potential sustainability concerns.

- Insights from our recent growth report point to a promising forecast for Nuvoton Technology's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Nuvoton Technology.

Seize The Opportunity

- Unlock our comprehensive list of 925 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thaifoods Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TFG

Thaifoods Group

Engages in the production and distribution of chicken and swine products in Thailand.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives