Asian Sea Corporation Leads These 3 Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets react to political developments and economic shifts, with U.S. stocks reaching record highs amid hopes for softer tariffs and AI enthusiasm, investors are increasingly looking toward stable income-generating options like dividend stocks. In this environment, companies that consistently offer reliable dividends can be attractive for those seeking steady returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

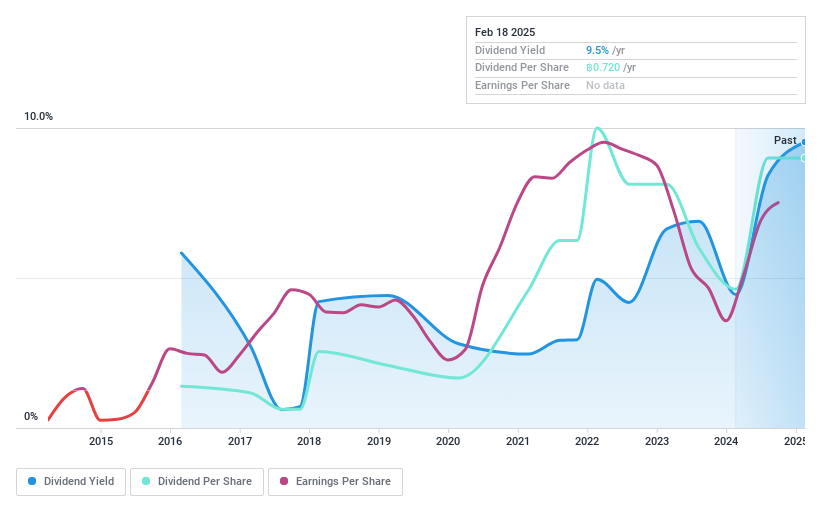

Asian Sea Corporation (SET:ASIAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asian Sea Corporation Public Company Limited operates in the production and distribution of processed frozen seafood and offers cold storage services both in Thailand and internationally, with a market cap of THB6.39 billion.

Operations: Asian Sea Corporation's revenue segments include Feed stuff, generating THB6.57 billion, and Frozen and packaged Food Products, contributing THB4.15 billion.

Dividend Yield: 9.2%

Asian Sea Corporation's recent earnings report shows strong growth, with net income rising significantly year-over-year. The company maintains a reasonable payout ratio of 71.8%, indicating dividends are covered by both earnings and cash flows, with a low cash payout ratio of 38.1%. However, its dividend history is less reliable due to volatility over the past nine years. Despite this, its dividend yield remains competitive in the Thai market at 9.17%.

- Click here and access our complete dividend analysis report to understand the dynamics of Asian Sea Corporation.

- The valuation report we've compiled suggests that Asian Sea Corporation's current price could be quite moderate.

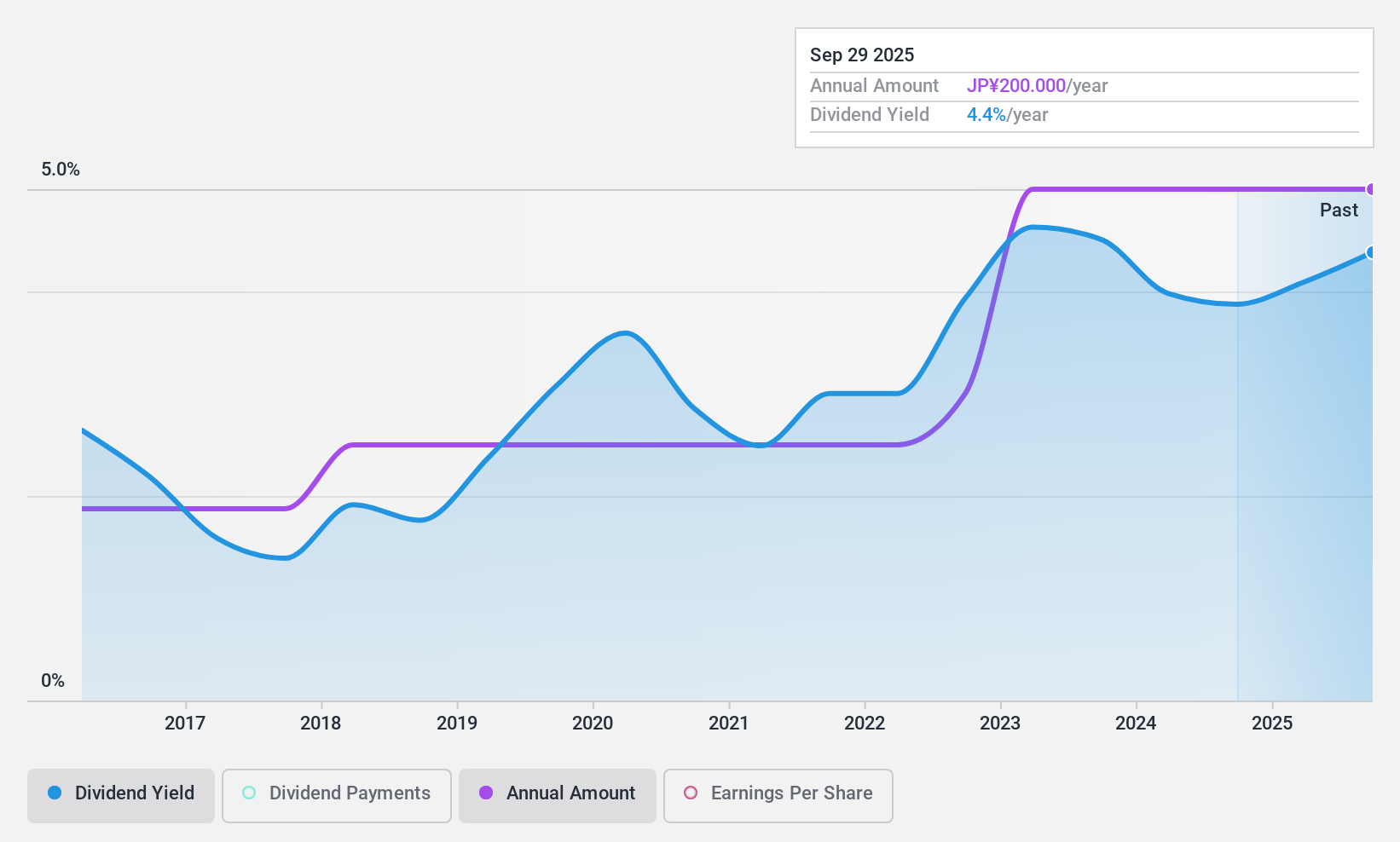

Sumitomo Seika Chemicals Company (TSE:4008)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sumitomo Seika Chemicals Company, Limited operates in the chemical industry, focusing on manufacturing and selling gases and chemical products, with a market cap of ¥61.27 billion.

Operations: Sumitomo Seika Chemicals Company generates revenue from its Function Material segment, amounting to ¥35.43 million, and Water Absorption Resin segment, totaling ¥111.67 million.

Dividend Yield: 4.3%

Sumitomo Seika Chemicals Company offers a dividend yield of 4.28%, placing it in the top 25% of JP market payers, but its dividends are not well covered by free cash flows. The payout ratio is relatively low at 40.2%, suggesting earnings coverage, yet sustainability concerns persist due to lack of free cash flow coverage. Dividends have been stable and growing over the past decade. A recent share buyback aims to enhance shareholder returns and capital efficiency.

- Take a closer look at Sumitomo Seika Chemicals Company's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Sumitomo Seika Chemicals Company is trading behind its estimated value.

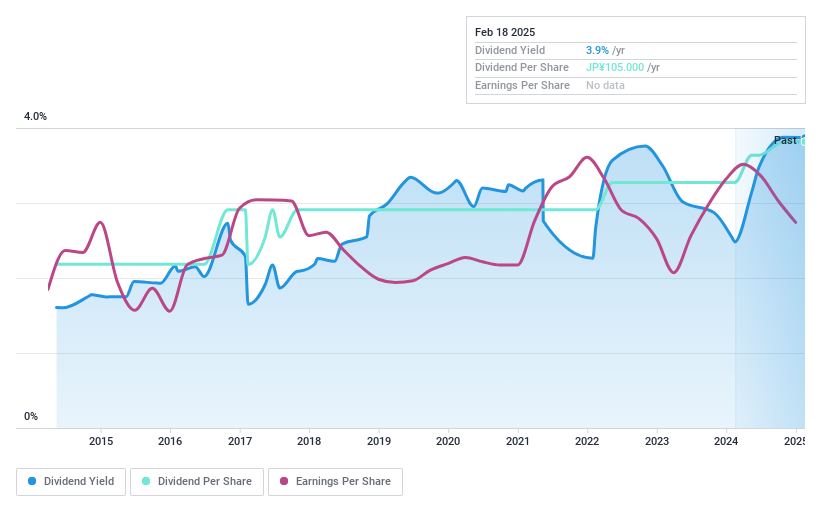

Gun Ei Chemical Industry (TSE:4229)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gun Ei Chemical Industry Co., Ltd. and its subsidiaries manufacture and sell synthetic resins and fibers both in Japan and internationally, with a market cap of ¥18.40 billion.

Operations: Gun Ei Chemical Industry Co., Ltd.'s revenue segments include Foods at ¥5.05 billion, Chemical Business at ¥24.58 billion, and Real Estate Utilization Industry at ¥246 million.

Dividend Yield: 3.8%

Gun Ei Chemical Industry provides a reliable dividend yield of 3.79%, though slightly below the top 25% in the JP market. The company's dividends have been stable and growing over the past decade, supported by a low payout ratio of 39.6%. This suggests strong earnings coverage, with cash flows also covering dividends comfortably at a cash payout ratio of 41.7%. Currently trading significantly below estimated fair value, it offers potential value for investors seeking dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Gun Ei Chemical Industry.

- Insights from our recent valuation report point to the potential undervaluation of Gun Ei Chemical Industry shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1964 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sumitomo Seika Chemicals Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4008

Sumitomo Seika Chemicals Company

Sumitomo Seika Chemicals Company, Limited.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives