Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and fluctuating interest rates, small-cap stocks have lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by a notable margin. In this environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and potential to thrive amidst economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Asian Alliance International (SET:AAI)

Simply Wall St Value Rating: ★★★★★★

Overview: Asian Alliance International Public Company Limited, along with its subsidiaries, operates in the production and sale of pet food and ready-to-eat human food products across various international markets including Thailand, the United States, the United Kingdom, Saudi Arabia, Japan, and Italy; it has a market capitalization of THB12.01 billion.

Operations: The company generates revenue primarily from the manufacturing and distribution of shelf-stable foods, amounting to THB6.67 billion.

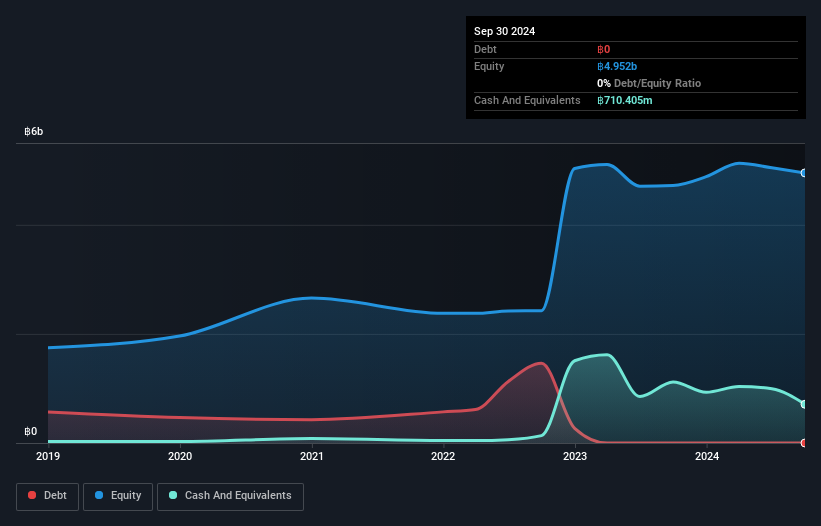

Asian Alliance International stands out with a robust earnings growth of 92.8% over the past year, far surpassing the Food industry's 29.3%. This small company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 25.8%. Its levered free cash flow has shown positive momentum recently, reaching US$1.20 billion as of September 2023, indicating strong operational efficiency. Trading at a substantial discount of 58.2% below its estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks with high-quality earnings and promising growth prospects forecasted at 6.79% annually.

Sichuan Mingxing Electric Power (SHSE:600101)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Mingxing Electric Power Co., Ltd. operates in the electric power industry and has a market capitalization of CN¥5.03 billion.

Operations: The company generates revenue primarily from its electric power operations. It has a market capitalization of CN¥5.03 billion.

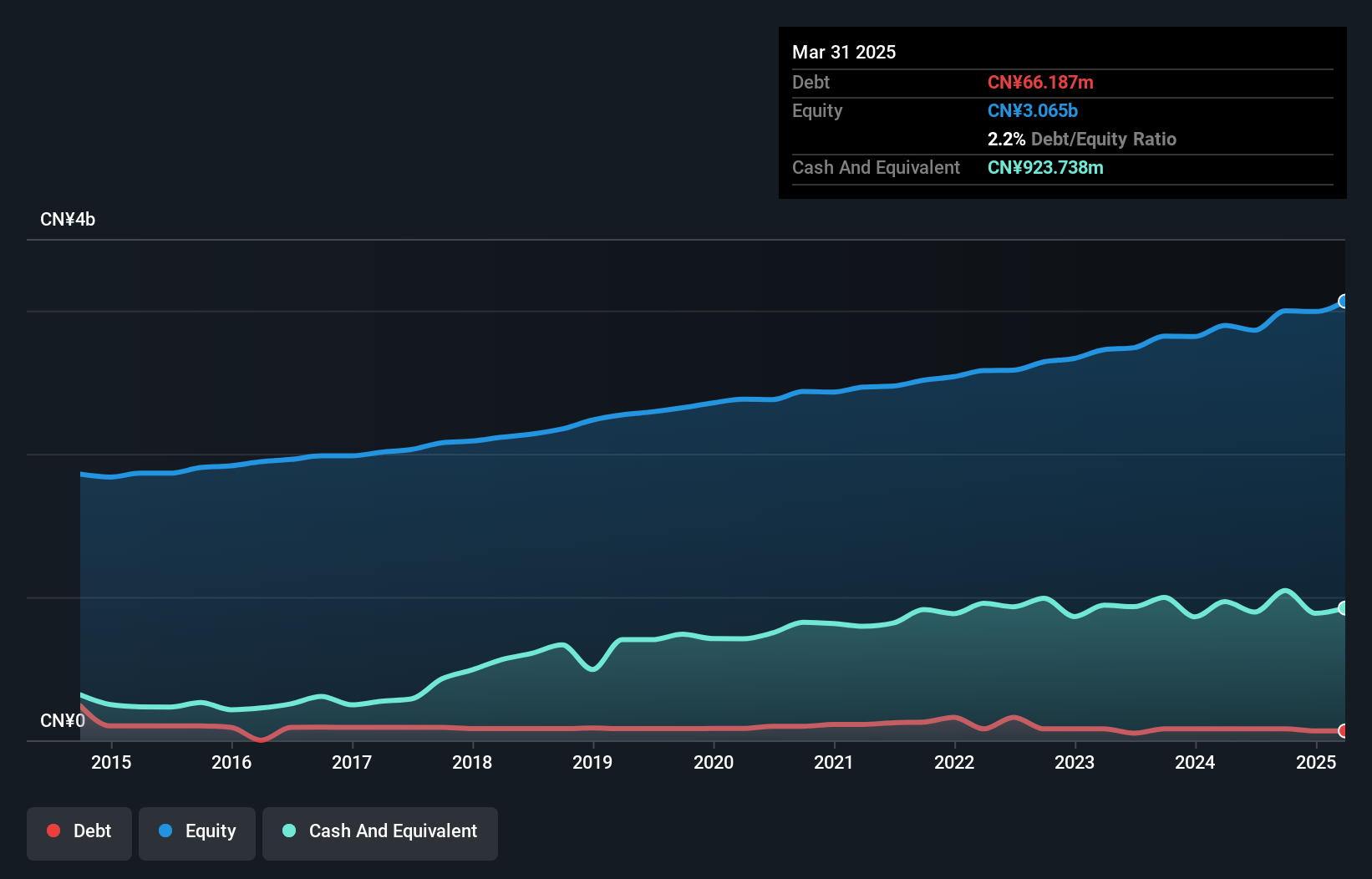

Mingxing Electric Power, a smaller player in the electric utilities sector, showcases strong financial health with cash exceeding total debt and high-quality earnings. Over the past year, its earnings growth of 16.5% outpaced the industry average of 15.2%, indicating robust performance. The company also improved its debt-to-equity ratio from 3.6 to 2.7 over five years, reflecting prudent financial management. With a price-to-earnings ratio of 24x compared to the broader CN market's 37x, it appears undervalued relative to peers, suggesting potential for future appreciation as earnings are expected to grow by nearly 12% annually.

AnyMind Group (TSE:5027)

Simply Wall St Value Rating: ★★★★★★

Overview: AnyMind Group Inc. operates a comprehensive platform offering integrated solutions for brand design, planning, production, e-commerce enablement, marketing, and logistics with a market cap of ¥74.34 billion.

Operations: The company generates revenue through its platform that supports brand design, planning, production, e-commerce enablement, marketing, and logistics. It has a market capitalization of ¥74.34 billion.

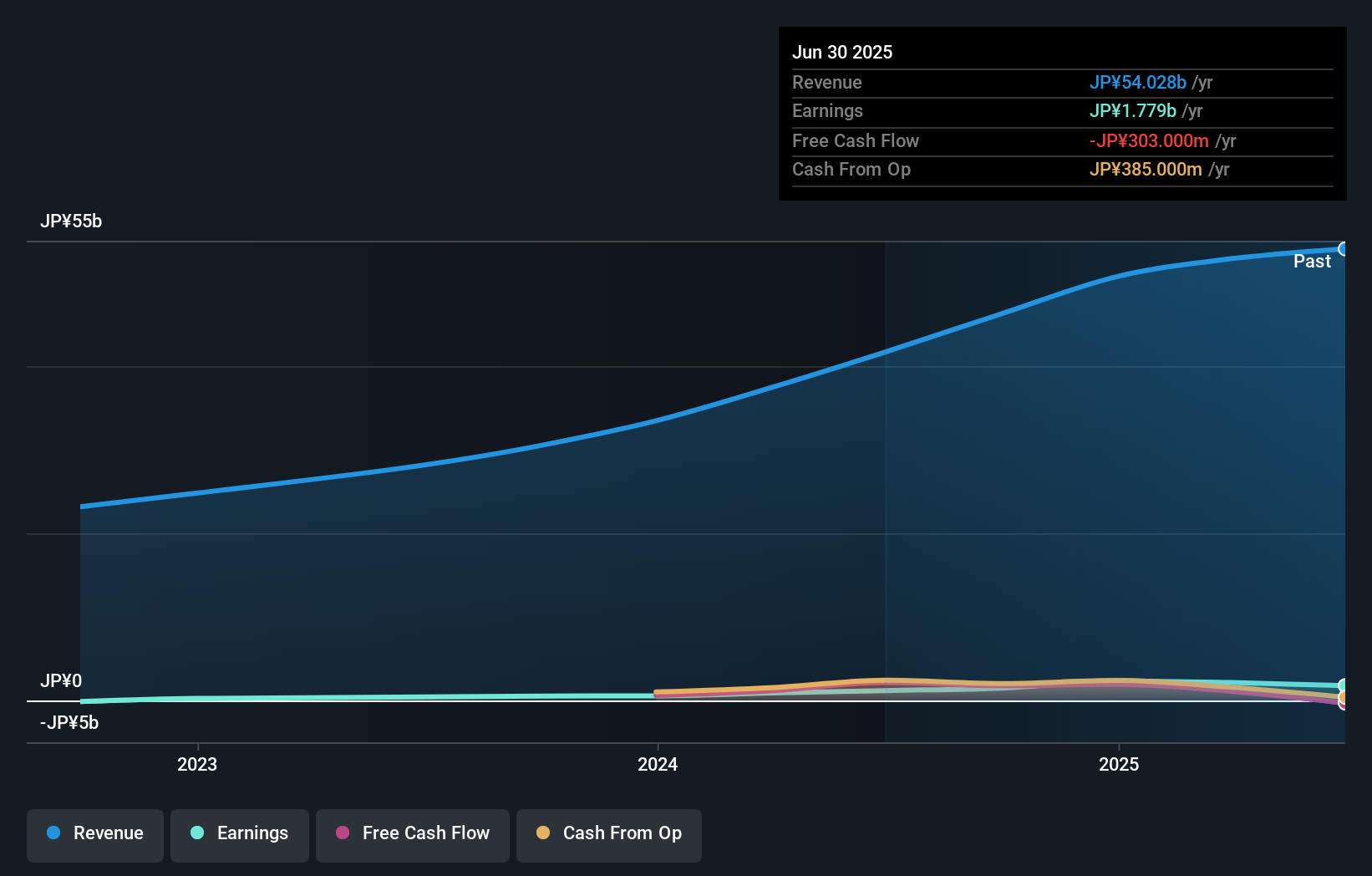

AnyMind Group, a nimble player in the tech space, has been making waves with its impressive 317.7% earnings growth over the past year, significantly outpacing the software industry's 14.2% growth rate. The company is trading at a notable discount of 51.5% below its estimated fair value, suggesting potential upside for investors. With a debt-to-equity ratio reduced from 45.6% to 19.7% over five years and more cash than total debt, AnyMind demonstrates financial prudence and resilience in managing liabilities effectively while expanding its global footprint through strategic partnerships like exclusive distribution rights for BB Laboratories in Vietnam and becoming a Tier 1 Partner for Xiaohongshu in China.

- Unlock comprehensive insights into our analysis of AnyMind Group stock in this health report.

Examine AnyMind Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4724 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5027

AnyMind Group

Engages in the development and the provision of a platform that provides one-stop support for brand building, production management, media operations, e-commerce site development and management, marketing, and logistics management.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives