- Japan

- /

- Auto Components

- /

- TSE:5110

Top Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid heightened trade tensions and economic uncertainties, Asian markets have shown resilience, with key indices in China and Japan posting gains as investors anticipate potential policy support. In this environment, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive option for those looking to enhance their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.40% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.74% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.57% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

Click here to see the full list of 1219 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

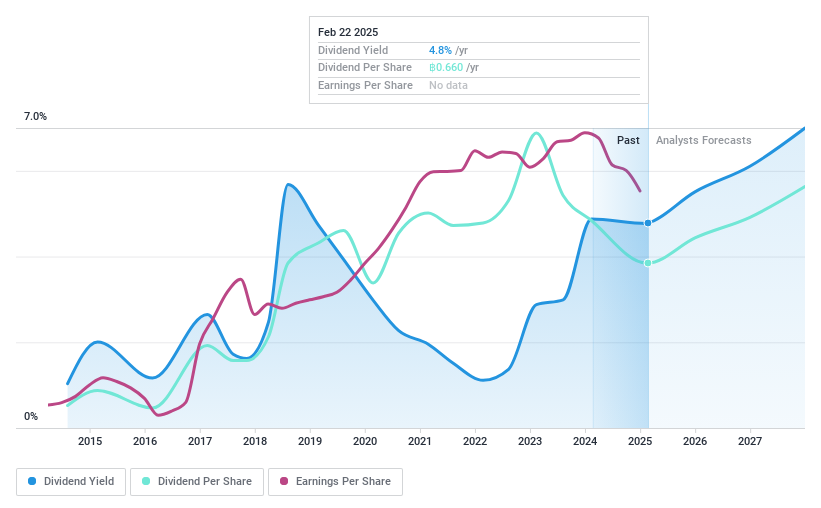

JMT Network Services (SET:JMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JMT Network Services Public Company Limited, along with its subsidiaries, offers debt tracking and collection services to financial institutions and entrepreneurs in Thailand, with a market cap of THB18.83 billion.

Operations: JMT Network Services Public Company Limited generates revenue from its Debt Collection Business (THB263 million), Insurance Business (THB232 million), and Non-Performing Accounts Receivable Management Business (THB4.33 billion).

Dividend Yield: 5.1%

JMT Network Services' dividend payout is sustainable with a 59.6% earnings payout ratio and an 87.6% cash payout ratio, though its dividend track record has been volatile over the past decade. The current yield of 5.12% is below Thailand's top quartile of dividend payers, and while dividends have grown, they remain unreliable due to fluctuations. Recent debt financing initiatives aim to bolster asset acquisition and operations, potentially impacting future cash flows available for dividends.

- Click here to discover the nuances of JMT Network Services with our detailed analytical dividend report.

- The valuation report we've compiled suggests that JMT Network Services' current price could be quite moderate.

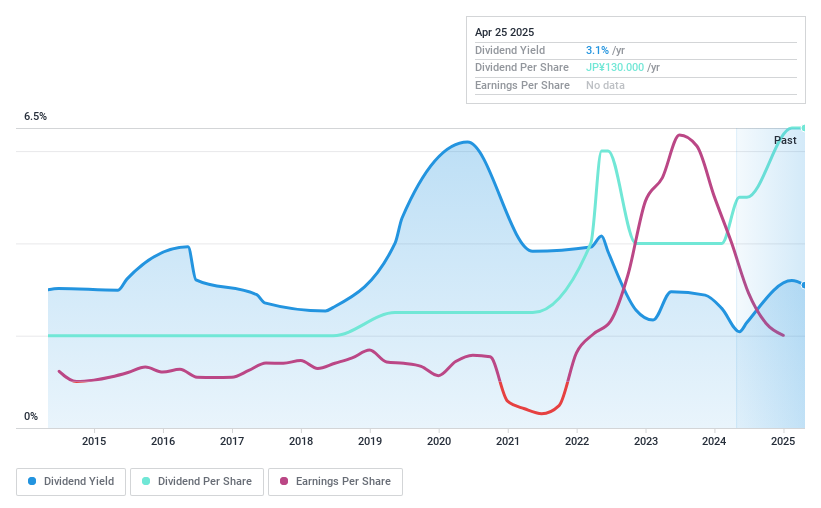

Mitsui Matsushima Holdings (TSE:1518)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui Matsushima Holdings Co., Ltd. operates through its subsidiaries in the production and sale of coal products both in Japan and internationally, with a market cap of ¥45.89 billion.

Operations: Mitsui Matsushima Holdings Co., Ltd. generates revenue primarily from the production and sale of coal products.

Dividend Yield: 3.1%

Mitsui Matsushima Holdings maintains a sustainable dividend with a low earnings payout ratio of 14.9% and cash payout ratio of 19.4%, though its dividend history has been volatile over the past decade. The current yield of 3.12% is below Japan's top quartile, yet recent increases in dividends per share suggest a commitment to enhancing shareholder returns alongside a share buyback program targeting up to ¥1 billion worth of shares, aimed at flexible capital management and potential M&A activities.

- Unlock comprehensive insights into our analysis of Mitsui Matsushima Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Mitsui Matsushima Holdings shares in the market.

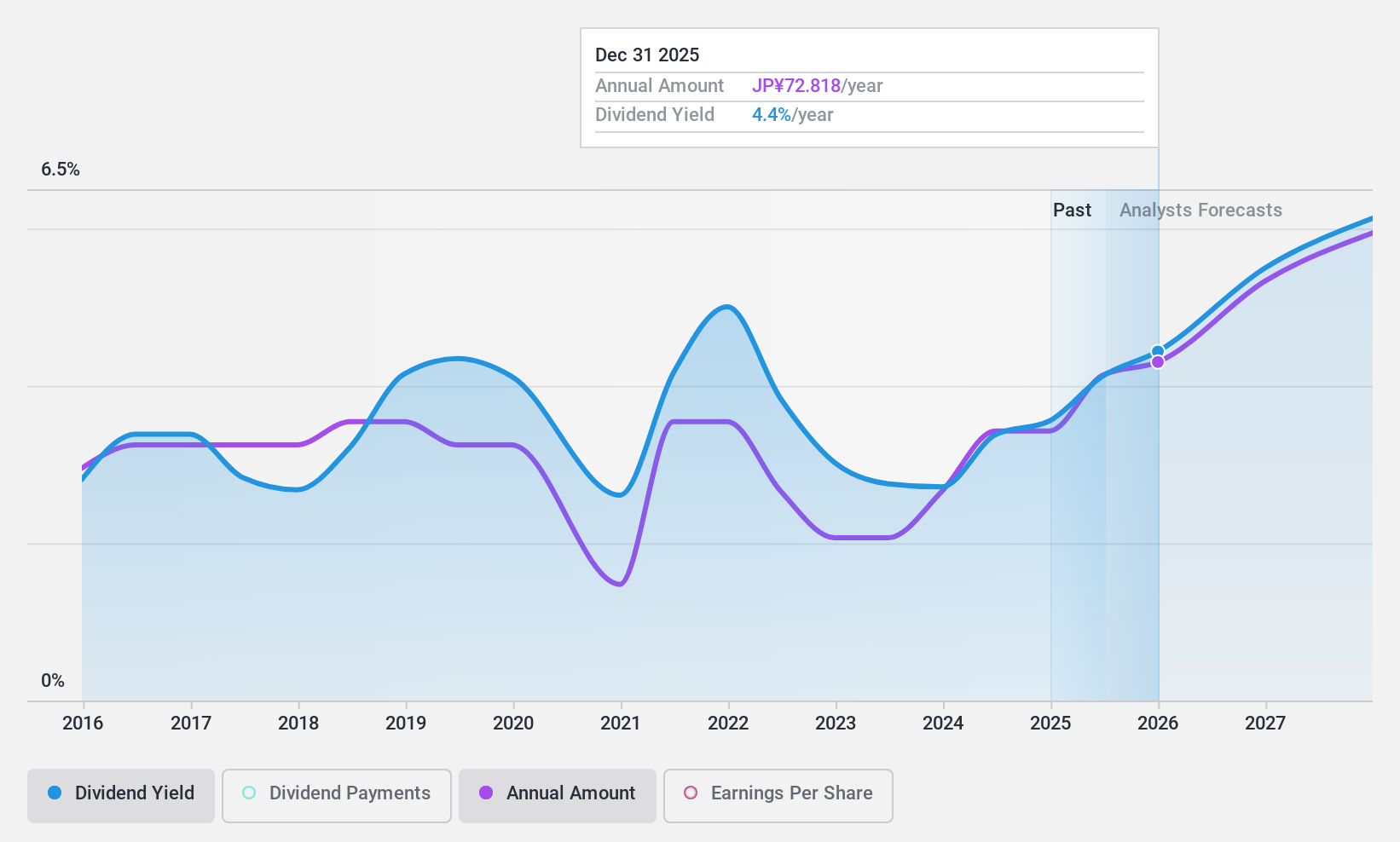

Sumitomo Rubber Industries (TSE:5110)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Rubber Industries, Ltd., along with its subsidiaries, operates in the tire, sports, and industrial products sectors both in Japan and globally, with a market cap of ¥447.15 billion.

Operations: Sumitomo Rubber Industries generates revenue from three main segments: Tires at ¥1.05 trillion, Sports at ¥125.78 billion, and Industrial and Other Products at ¥41.22 billion.

Dividend Yield: 4.1%

Sumitomo Rubber Industries faces challenges with its dividend sustainability, as the high payout ratio of 154.6% is not well covered by earnings, though cash flows cover it at a reasonable 57.4%. Recent dividend increases to ¥35 per share indicate an effort to improve shareholder returns despite past volatility and a decline from ¥53 per share in 2023. The company trades significantly below its estimated fair value, suggesting potential undervaluation amidst these financial dynamics.

- Take a closer look at Sumitomo Rubber Industries' potential here in our dividend report.

- Our valuation report unveils the possibility Sumitomo Rubber Industries' shares may be trading at a premium.

Seize The Opportunity

- Dive into all 1219 of the Top Asian Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5110

Sumitomo Rubber Industries

Provides tires, sports, and industrial and other products in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion