In a week marked by solid gains across major U.S. indices and promising economic indicators, investors are increasingly optimistic about the potential for a "soft landing" in the economy. With inflation showing signs of easing and consumer spending remaining robust, now is an opportune time to consider dividend stocks as a reliable source of steady income. In this favorable market environment, selecting dividend stocks with strong fundamentals can offer both stability and growth potential. Here are three top dividend stocks that stand out for their consistent performance and attractive yields.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.07% | ★★★★★★ |

| Globeride (TSE:7990) | 4.13% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 2098 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

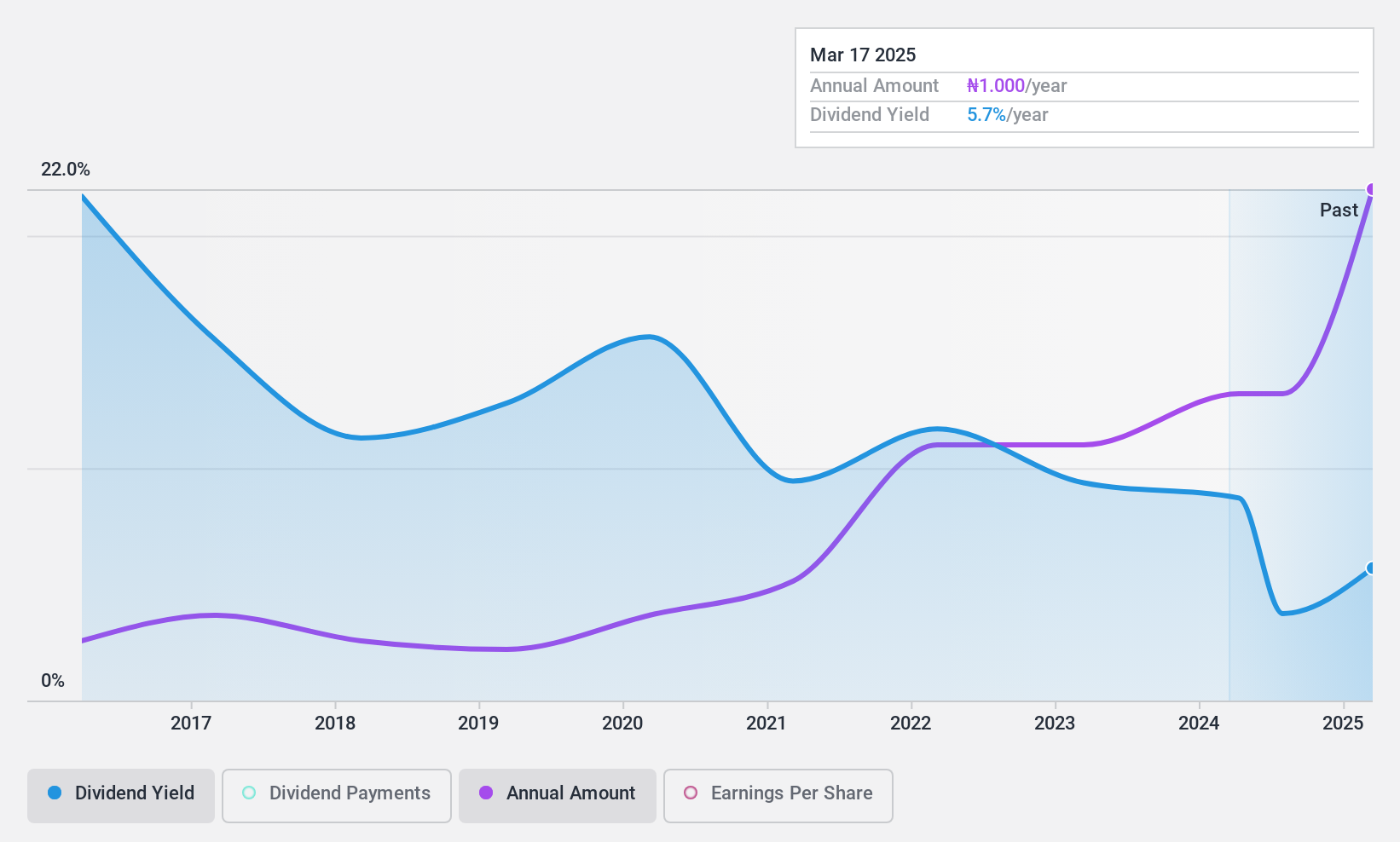

United Capital (NGSE:UCAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Capital Plc, with a market cap of NGN328.50 billion, operates in Nigeria offering investment banking, portfolio management, securities trading, and trusteeship services through its subsidiaries.

Operations: United Capital Plc generates revenue of NGN23.88 billion from its brokerage services in Nigeria.

Dividend Yield: 3.3%

United Capital's dividend payments are well-covered by earnings (payout ratio: 74.7%) and cash flows (cash payout ratio: 5.2%), but they have been volatile over the past decade, with occasional drops exceeding 20%. Despite this instability, dividends have increased overall in the last ten years. The company recently reported strong H1 2024 financials with revenue at NGN 15.15 billion and net income at NGN 7.74 billion, reflecting significant growth from the previous year.

- Dive into the specifics of United Capital here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that United Capital is priced higher than what may be justified by its financials.

Kiatnakin Phatra Bank (SET:KKP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kiatnakin Phatra Bank Public Company Limited, along with its subsidiaries, offers a range of banking products and services to commercial and public customers in Thailand and has a market cap of THB38.10 billion.

Operations: Kiatnakin Phatra Bank Public Company Limited generates revenue from various segments, including commercial banking services at THB12.50 billion, retail banking services at THB8.75 billion, and investment banking services at THB5.60 billion.

Dividend Yield: 6.7%

Kiatnakin Phatra Bank's dividends are well-covered by earnings (35.1% payout ratio) and are forecast to remain sustainable (47.1% in 3 years). However, the bank has a high level of bad loans (4.4%) and its profit margin has decreased from 30.2% last year to 19.4%. Recent news includes a share repurchase program worth THB 950 million and an interim dividend payment of THB 1.25 per share, representing about 46-52% of net profit for H1 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Kiatnakin Phatra Bank.

- According our valuation report, there's an indication that Kiatnakin Phatra Bank's share price might be on the expensive side.

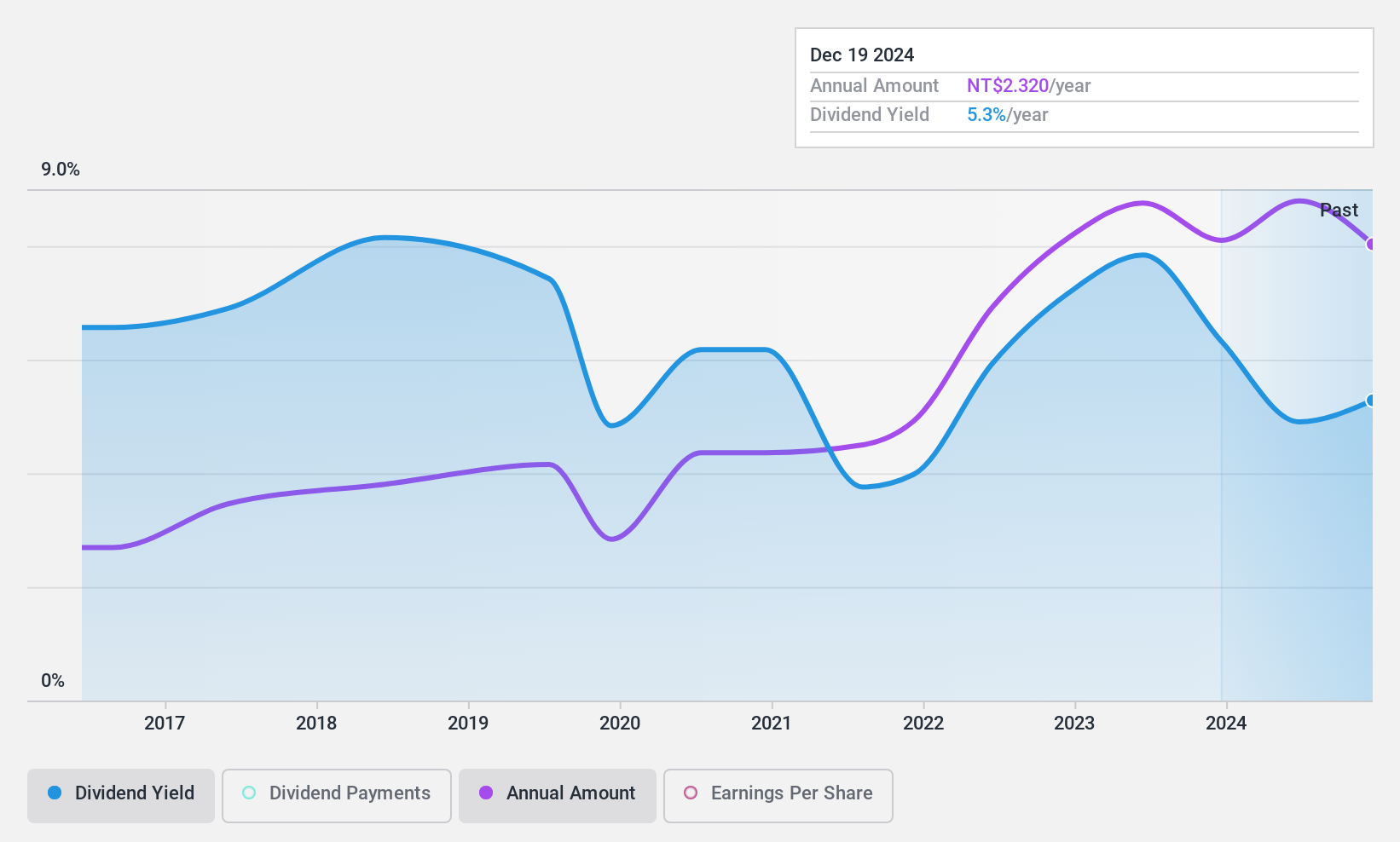

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chang Wah Electromaterials Inc. trades electrical, telecommunication, and semiconductor materials and parts in Taiwan, Asia, and internationally, with a market cap of NT$34.56 billion.

Operations: Chang Wah Electromaterials Inc. generates revenue primarily from its main operations, with Chang Wah Electromaterials Inc. contributing NT$6.75 billion and Chang Wah Technology Co., Ltd. and its subsidiary adding NT$11.45 billion.

Dividend Yield: 4%

Chang Wah Electromaterials' recent earnings report showed a slight increase in sales but a decline in net income for Q2 2024. The company's dividend payments are covered by both earnings (73.1% payout ratio) and cash flows (57.1% cash payout ratio), though its dividend yield is relatively low at 3.99%. While dividends have increased over the past decade, they have been volatile and unreliable, raising concerns about sustainability despite adequate coverage ratios.

- Click to explore a detailed breakdown of our findings in Chang Wah Electromaterials' dividend report.

- Upon reviewing our latest valuation report, Chang Wah Electromaterials' share price might be too optimistic.

Make It Happen

- Discover the full array of 2098 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiatnakin Phatra Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KKP

Kiatnakin Phatra Bank

Engages in the provision of various banking products and services for commercial and public customers in Thailand.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives