- Slovenia

- /

- Hospitality

- /

- LJSE:TCRG

Terme Catez, d.d. (LJSE:TCRG) Passed Our Checks, And It's About To Pay A €1.01 Dividend

Terme Catez, d.d. (LJSE:TCRG) stock is about to trade ex-dividend in 2 days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Terme Catez d.d investors that purchase the stock on or after the 23rd of December will not receive the dividend, which will be paid on the 29th of December.

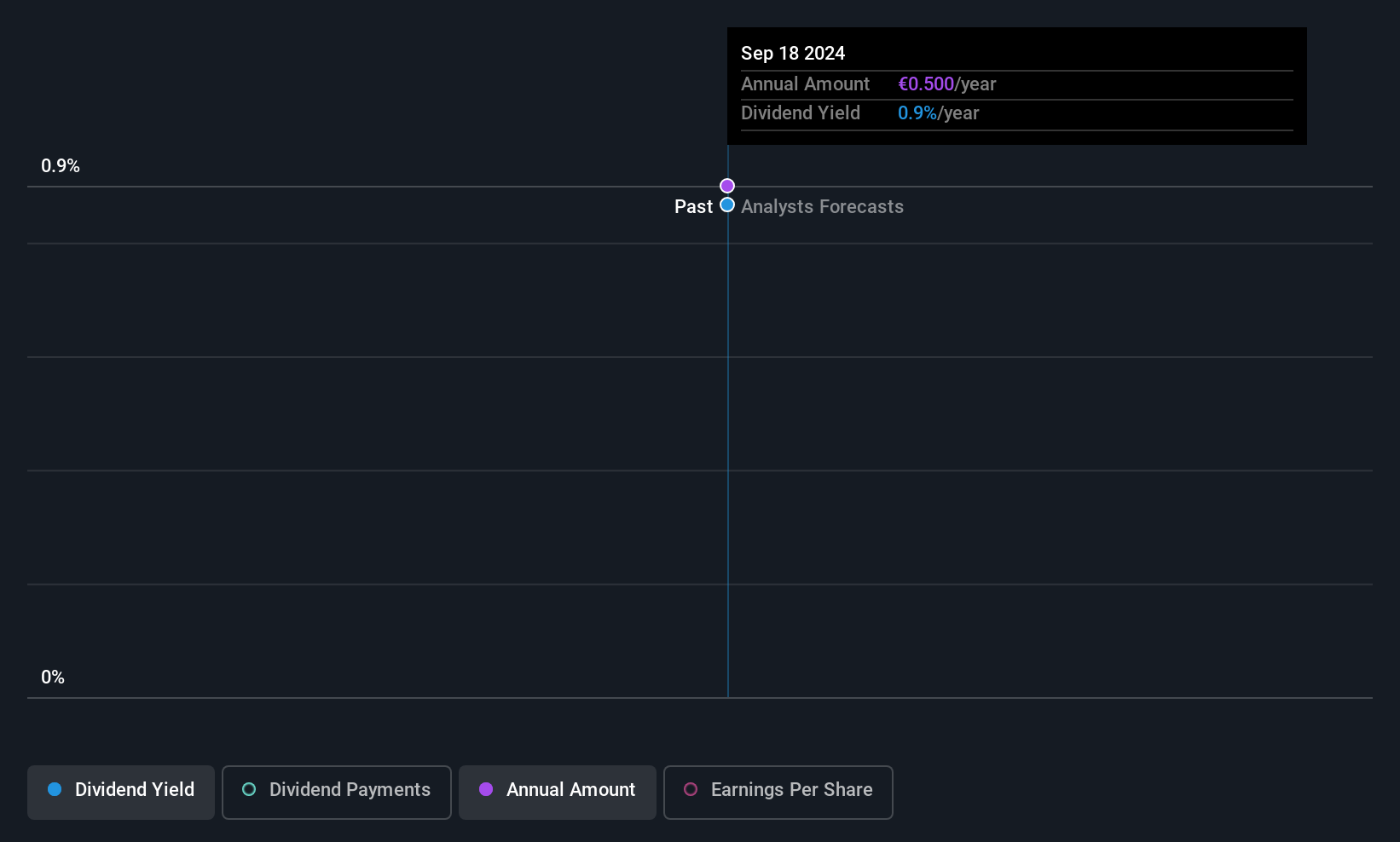

The company's next dividend payment will be €1.01 per share, on the back of last year when the company paid a total of €0.50 to shareholders. Last year's total dividend payments show that Terme Catez d.d has a trailing yield of 1.4% on the current share price of €70.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Terme Catez d.d can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Terme Catez d.d is paying out just 6.3% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Check out our latest analysis for Terme Catez d.d

Click here to see how much of its profit Terme Catez d.d paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For that reason, it's encouraging to see Terme Catez d.d's earnings over the past year have risen 34%. While we'd be remiss not to point out that a year is a very short time in dividend investing, it's an encouraging sign so far.

One year is not very long in the grand scheme of things though, so we wouldn't draw too strong a conclusion based on these results.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. It looks like the Terme Catez d.d dividends are largely the same as they were 10 years ago.

To Sum It Up

Should investors buy Terme Catez d.d for the upcoming dividend? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. Perhaps even more importantly - this can sometimes signal management is focused on the long term future of the business. Overall, Terme Catez d.d looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

In light of that, while Terme Catez d.d has an appealing dividend, it's worth knowing the risks involved with this stock. We've identified 3 warning signs with Terme Catez d.d (at least 1 which is potentially serious), and understanding them should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Terme Catez d.d might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LJSE:TCRG

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion