- Singapore

- /

- Water Utilities

- /

- SGX:U9E

China Everbright Water (SGX:U9E) Has Announced That It Will Be Increasing Its Dividend To S$0.012

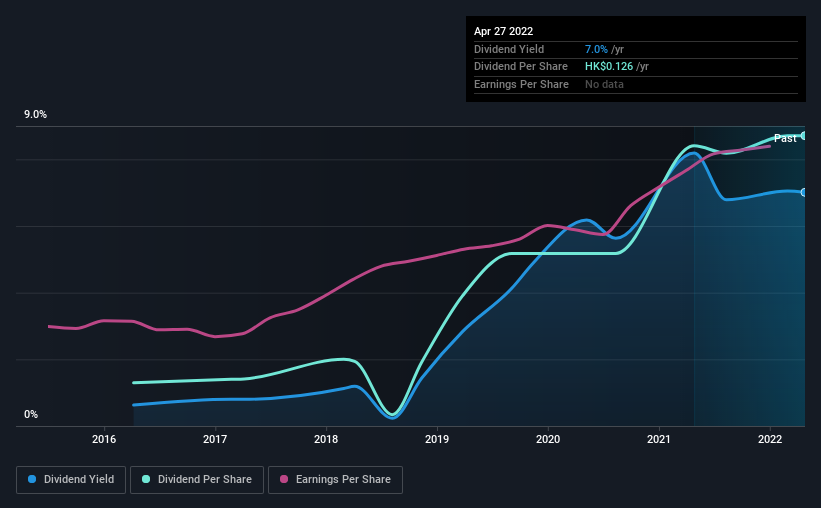

China Everbright Water Limited (SGX:U9E) has announced that it will be increasing its dividend on the 18th of May to S$0.012. This takes the dividend yield to 7.0%, which shareholders will be pleased with.

View our latest analysis for China Everbright Water

China Everbright Water's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, China Everbright Water's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share could rise by 25.6% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 5.6% by next year, which we think can be pretty sustainable going forward.

China Everbright Water Doesn't Have A Long Payment History

It is great to see that China Everbright Water has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2016, the first annual payment was HK$0.019, compared to the most recent full-year payment of HK$0.13. This means that it has been growing its distributions at 37% per annum over that time. China Everbright Water has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see China Everbright Water has been growing its earnings per share at 26% a year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Our Thoughts On China Everbright Water's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We don't think China Everbright Water is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for China Everbright Water (1 is potentially serious!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:U9E

China Everbright Water

Engages in the water environment management business in Mainland China and Germany.

Good value average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026