- Singapore

- /

- Gas Utilities

- /

- SGX:I11

Shareholders Shouldn’t Be Too Comfortable With Renaissance United's (SGX:I11) Strong Earnings

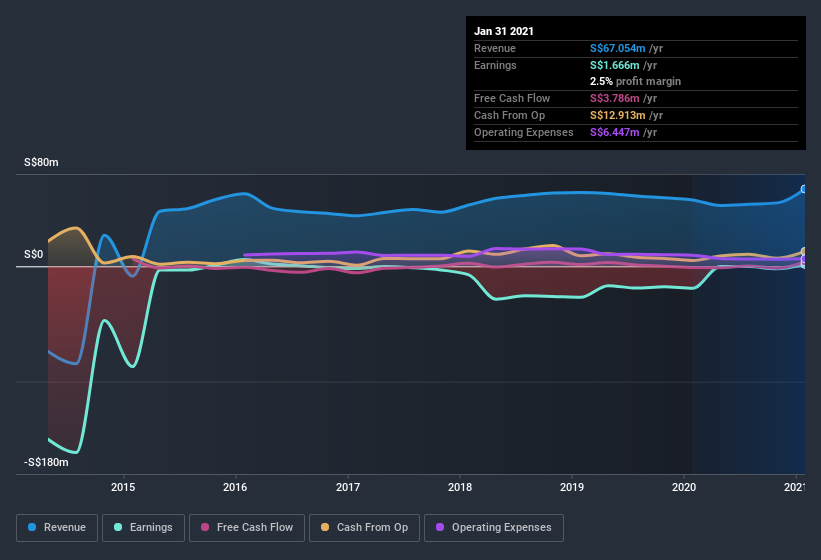

We didn't see Renaissance United Limited's (SGX:I11) stock surge when it reported robust earnings recently. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

View our latest analysis for Renaissance United

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Renaissance United's profit received a boost of S$309k in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Renaissance United had a rather significant contribution from unusual items relative to its profit to January 2021. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Renaissance United.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Renaissance United received a tax benefit of S$300k. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Renaissance United's Profit Performance

In the last year Renaissance United received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. Considering all this we'd argue Renaissance United's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. When we did our research, we found 3 warning signs for Renaissance United (1 doesn't sit too well with us!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Renaissance United or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:I11

Renaissance United

An investment holding company, engages in the distribution of gas to household, commercial, and industrial users.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026