- Singapore

- /

- Marine and Shipping

- /

- SGX:S56

Is Now The Time To Put Samudera Shipping Line (SGX:S56) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Samudera Shipping Line (SGX:S56). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out the opportunities and risks within the SG Shipping industry.

How Fast Is Samudera Shipping Line Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Samudera Shipping Line's EPS went from US$0.068 to US$0.49 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

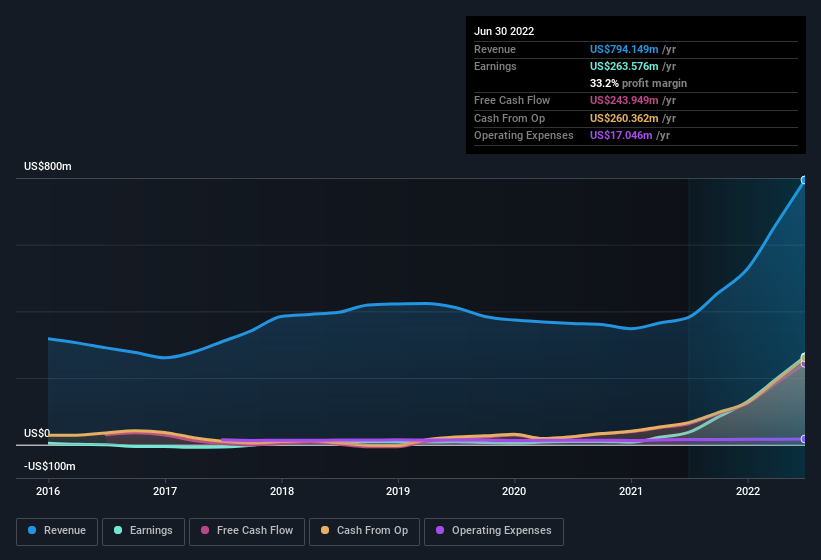

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Samudera Shipping Line is growing revenues, and EBIT margins improved by 21.6 percentage points to 34%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Samudera Shipping Line's balance sheet strength, before getting too excited.

Are Samudera Shipping Line Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Samudera Shipping Line insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the US$225k that Group CEO & Executive Director Bani Mulia spent buying shares (at an average price of about US$0.97). Strong buying like that could be a sign of opportunity.

The good news, alongside the insider buying, for Samudera Shipping Line bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$53m worth of its stock. This considerable investment should help drive long-term value in the business. That amounts to 9.8% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Samudera Shipping Line Deserve A Spot On Your Watchlist?

Samudera Shipping Line's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Samudera Shipping Line deserves timely attention. Still, you should learn about the 1 warning sign we've spotted with Samudera Shipping Line.

Keen growth investors love to see insider buying. Thankfully, Samudera Shipping Line isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S56

Samudera Shipping Line

Engages in the transportation of containerized and non-containerized cargo to various ports in Southeast Asia, the Indian Sub-continent, the Far East, and the Middle East, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success