Singapore Post (SGX:S08) Has Announced That Its Dividend Will Be Reduced To S$0.006

Singapore Post Limited (SGX:S08) is reducing its dividend to S$0.006 on the 11th of August. This means that the annual payment will be 1.5% of the current stock price, which is in line with the average for the industry.

See our latest analysis for Singapore Post

Singapore Post's Earnings Easily Cover the Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. The last payment made up 76% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 79.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 34%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Dividend Volatility

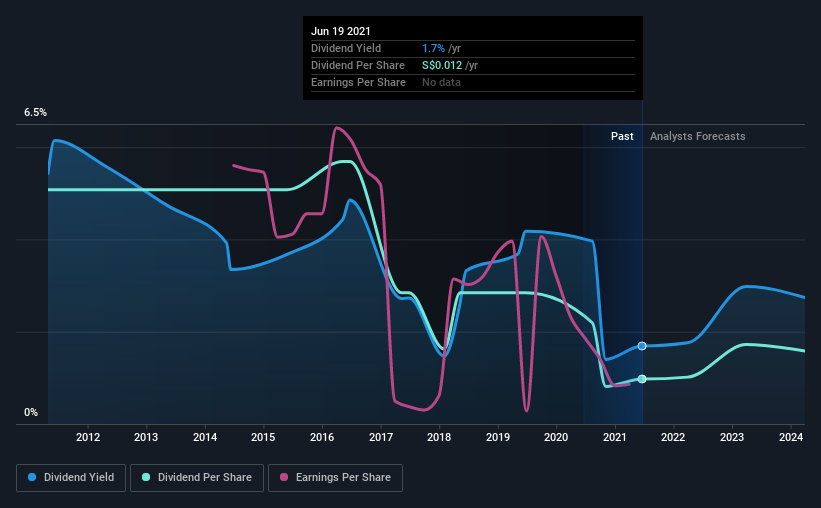

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the dividend has gone from S$0.063 to S$0.012. Dividend payments have fallen sharply, down 81% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Over the past five years, it looks as though Singapore Post's EPS has declined at around 33% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Our Thoughts On Singapore Post's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Singapore Post that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

If you decide to trade Singapore Post, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:S08

Singapore Post

Engages in the post and parcel, eCommerce logistics, and property businesses in Singapore and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.