Does Singapore Airlines (SGX:C6L) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Singapore Airlines Limited (SGX:C6L) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Singapore Airlines

How Much Debt Does Singapore Airlines Carry?

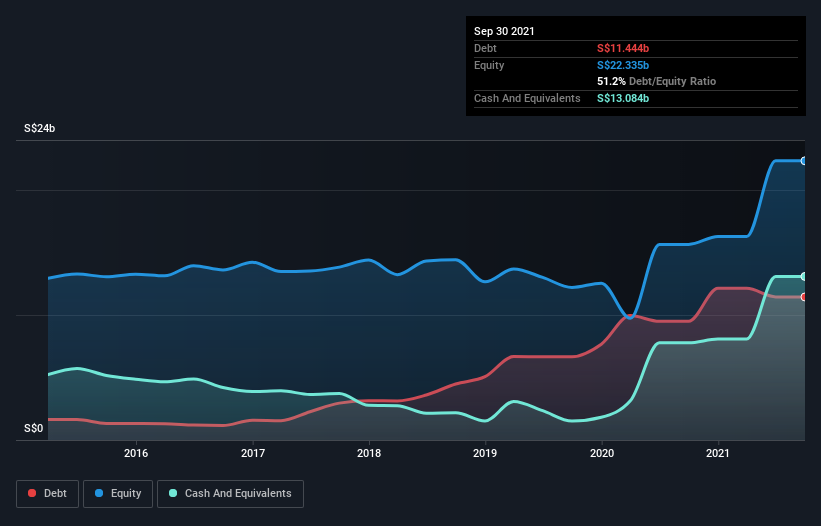

As you can see below, at the end of September 2021, Singapore Airlines had S$11.4b of debt, up from S$9.49b a year ago. Click the image for more detail. But on the other hand it also has S$13.1b in cash, leading to a S$1.64b net cash position.

How Healthy Is Singapore Airlines' Balance Sheet?

According to the last reported balance sheet, Singapore Airlines had liabilities of S$5.67b due within 12 months, and liabilities of S$16.4b due beyond 12 months. Offsetting these obligations, it had cash of S$13.1b as well as receivables valued at S$1.19b due within 12 months. So its liabilities total S$7.76b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Singapore Airlines is worth a massive S$14.7b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Singapore Airlines also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Singapore Airlines's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Singapore Airlines had a loss before interest and tax, and actually shrunk its revenue by 46%, to S$5.0b. To be frank that doesn't bode well.

So How Risky Is Singapore Airlines?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Singapore Airlines had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through S$3.5b of cash and made a loss of S$1.6b. With only S$1.64b on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. For riskier companies like Singapore Airlines I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking to trade Singapore Airlines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:C6L

Singapore Airlines

Together with subsidiaries, provides passenger and cargo air transportation services under the Singapore Airlines and Scoot brands in East Asia, the Americas, Europe, Southwest Pacific, West Asia, and Africa.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives