Subdued Growth No Barrier To Vibrant Group Limited (SGX:BIP) With Shares Advancing 27%

Vibrant Group Limited (SGX:BIP) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

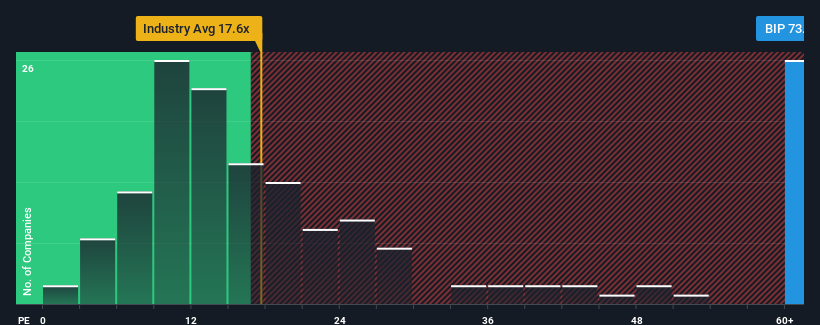

Following the firm bounce in price, Vibrant Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 73.9x, since almost half of all companies in Singapore have P/E ratios under 11x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Vibrant Group certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Vibrant Group

Is There Enough Growth For Vibrant Group?

In order to justify its P/E ratio, Vibrant Group would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 246%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 81% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 7.5% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Vibrant Group's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Shares in Vibrant Group have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Vibrant Group currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 5 warning signs we've spotted with Vibrant Group (including 2 which can't be ignored).

If you're unsure about the strength of Vibrant Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BIP

Vibrant Group

An investment holding company, engages in the integrated logistics business in Singapore, Malaysia, China, Rest of Asia, the United States, Oceania, Europe, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026