- Singapore

- /

- Marine and Shipping

- /

- SGX:5LY

If You Had Bought Marco Polo Marine's (SGX:5LY) Shares Five Years Ago You Would Be Down 89%

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We don't wish catastrophic capital loss on anyone. Imagine if you held Marco Polo Marine Ltd. (SGX:5LY) for half a decade as the share price tanked 89%. It's up 31% in the last seven days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Marco Polo Marine

Marco Polo Marine isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Marco Polo Marine reduced its trailing twelve month revenue by 23% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

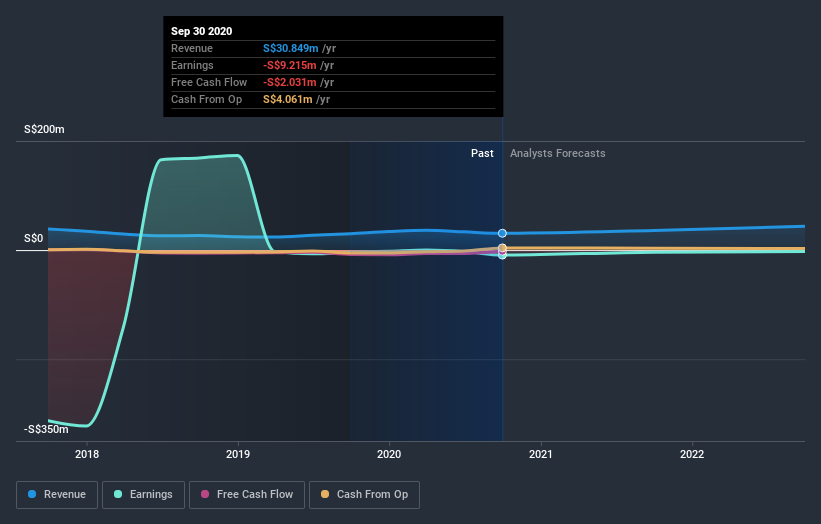

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Marco Polo Marine will earn in the future (free profit forecasts).

A Different Perspective

While the broader market lost about 5.1% in the twelve months, Marco Polo Marine shareholders did even worse, losing 8.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 14% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Marco Polo Marine you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you’re looking to trade Marco Polo Marine, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:5LY

Marco Polo Marine

Operates as an integrated marine logistic company in Singapore, Indonesia, Taiwan, Thailand, Malaysia, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives