Willas-Array Electronics (Holdings) (SGX:BDR) Has Some Way To Go To Become A Multi-Bagger

There are a few key trends to look for if we want to identify the next multi-bagger. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. In light of that, when we looked at Willas-Array Electronics (Holdings) (SGX:BDR) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Willas-Array Electronics (Holdings):

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = HK$118m ÷ (HK$2.1b - HK$1.3b) (Based on the trailing twelve months to September 2022).

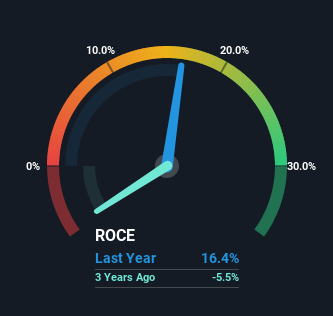

Thus, Willas-Array Electronics (Holdings) has an ROCE of 16%. That's a relatively normal return on capital, and it's around the 15% generated by the Electronic industry.

View our latest analysis for Willas-Array Electronics (Holdings)

Historical performance is a great place to start when researching a stock so above you can see the gauge for Willas-Array Electronics (Holdings)'s ROCE against it's prior returns. If you'd like to look at how Willas-Array Electronics (Holdings) has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

Over the past five years, Willas-Array Electronics (Holdings)'s ROCE and capital employed have both remained mostly flat. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So unless we see a substantial change at Willas-Array Electronics (Holdings) in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

On a separate but related note, it's important to know that Willas-Array Electronics (Holdings) has a current liabilities to total assets ratio of 65%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Key Takeaway

We can conclude that in regards to Willas-Array Electronics (Holdings)'s returns on capital employed and the trends, there isn't much change to report on. And investors appear hesitant that the trends will pick up because the stock has fallen 16% in the last five years. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

If you'd like to know more about Willas-Array Electronics (Holdings), we've spotted 7 warning signs, and 3 of them are a bit unpleasant.

While Willas-Array Electronics (Holdings) isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Good value with slight risk.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

Tesla, Inc. (TSLA): The Autonomy Transition – From "Car Maker" to "AI Utility" in 2026.

Comfort Systems USA Inc. (FIX): The Data Center Vanguard – Powering the AI Physical Layer in 2026.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks