The Strong Earnings Posted By Willas-Array Electronics (Holdings) (SGX:BDR) Are A Good Indication Of The Strength Of The Business

Willas-Array Electronics (Holdings) Limited (SGX:BDR) just reported healthy earnings but the stock price didn't move much. Investors are probably missing some underlying factors which are encouraging for the future of the company.

Check out our latest analysis for Willas-Array Electronics (Holdings)

Zooming In On Willas-Array Electronics (Holdings)'s Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

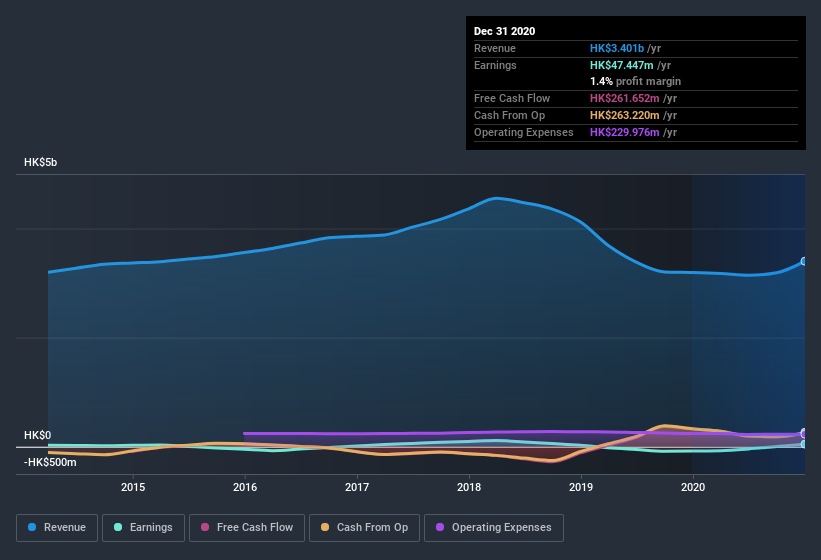

Over the twelve months to December 2020, Willas-Array Electronics (Holdings) recorded an accrual ratio of -0.22. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of HK$262m during the period, dwarfing its reported profit of HK$47.4m. Willas-Array Electronics (Holdings)'s free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Willas-Array Electronics (Holdings).

The Impact Of Unusual Items On Profit

Surprisingly, given Willas-Array Electronics (Holdings)'s accrual ratio implied strong cash conversion, its paper profit was actually boosted by HK$7.9m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Willas-Array Electronics (Holdings)'s Profit Performance

In conclusion, Willas-Array Electronics (Holdings)'s accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Based on these factors, we think that Willas-Array Electronics (Holdings)'s profits are a reasonably conservative guide to its underlying profitability. If you want to do dive deeper into Willas-Array Electronics (Holdings), you'd also look into what risks it is currently facing. Case in point: We've spotted 3 warning signs for Willas-Array Electronics (Holdings) you should be mindful of and 2 of them make us uncomfortable.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Willas-Array Electronics (Holdings), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion